- United States

- /

- Hospitality

- /

- NasdaqCM:LIND

Undervalued Small Caps With Insider Action In July 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, though it has experienced a 13% increase over the past year with earnings forecasted to grow by 15% annually. In this context, identifying small-cap stocks with insider activity can provide insights into potentially undervalued opportunities that align with current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | NA | 0.5x | 39.37% | ★★★★★☆ |

| Lindblad Expeditions Holdings | NA | 1.1x | 25.88% | ★★★★★☆ |

| Citizens & Northern | 11.7x | 2.9x | 44.35% | ★★★★☆☆ |

| Southside Bancshares | 10.6x | 3.7x | 38.49% | ★★★★☆☆ |

| S&T Bancorp | 11.4x | 3.9x | 39.45% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 30.78% | ★★★★☆☆ |

| Montrose Environmental Group | NA | 1.1x | 31.13% | ★★★★☆☆ |

| Standard Motor Products | 12.8x | 0.5x | -2392.16% | ★★★☆☆☆ |

| Farmland Partners | 9.1x | 9.2x | -10.46% | ★★★☆☆☆ |

| Vital Energy | NA | 0.3x | -48.48% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Lindblad Expeditions Holdings (LIND)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lindblad Expeditions Holdings operates as an expedition travel company, specializing in ship-based voyages and land experiences, with a market cap of approximately $0.49 billion.

Operations: Lindblad Expeditions Holdings generates revenue primarily from its Lindblad and Land Experiences segments, with the former contributing $436.11 million and the latter $234.72 million. The company's gross profit margin has shown a notable trend, reaching 47.52% as of March 2025, indicating an improvement in profitability relative to earlier periods where it was significantly lower. Operating expenses have been substantial, with general and administrative expenses being a major component at $139.51 million by March 2025.

PE: -23.2x

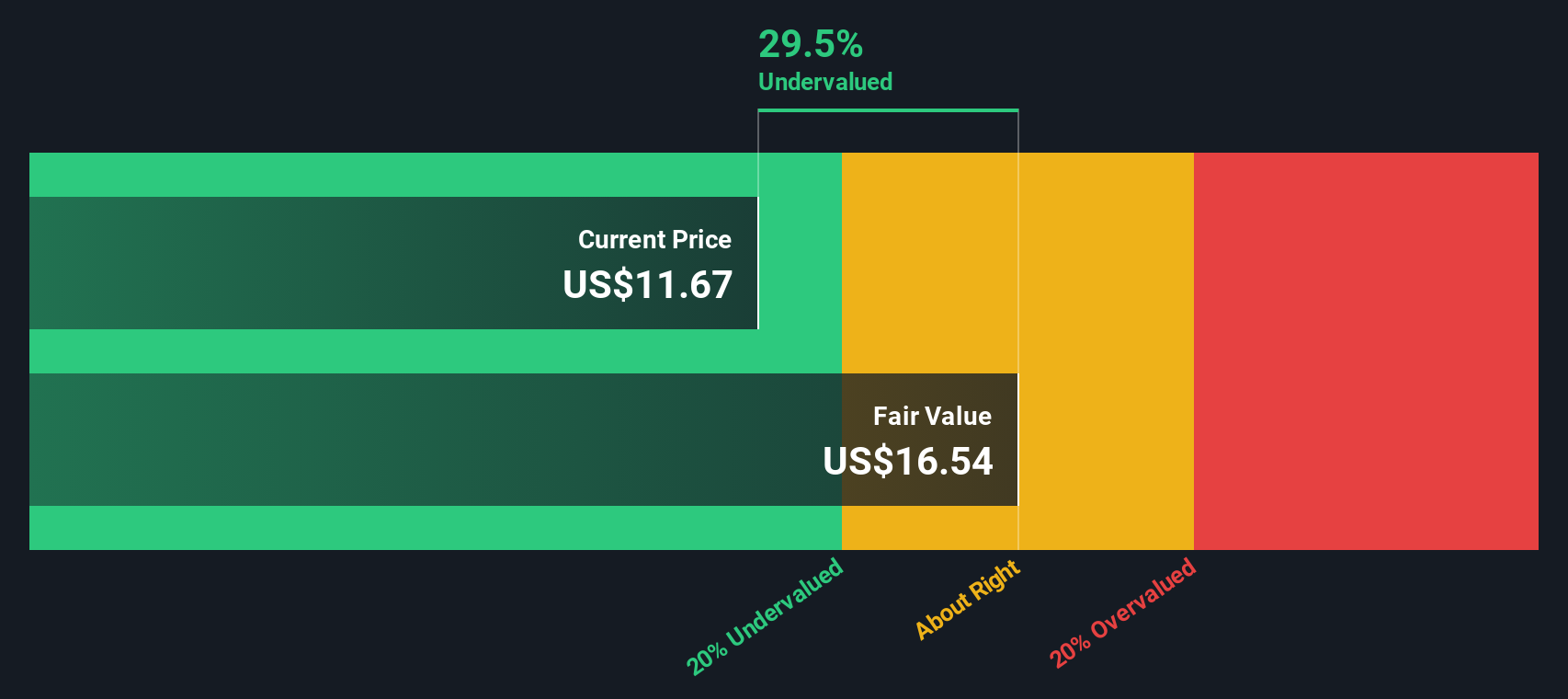

Lindblad Expeditions Holdings, a small-cap company, has recently been dropped from several Russell indices as of June 2025. Despite this, the company reported first-quarter sales of US$179.72 million, up from US$153.61 million the previous year, and achieved a net income of US$1.16 million compared to a loss previously. Insider confidence is evident with recent purchases by executives in early 2025. The company's strategic alliance with Transcend Cruises aims to expand its European river cruising offerings through 2028, potentially enhancing future revenue streams amidst forecasts for significant earnings growth annually at over 100%.

Columbus McKinnon (CMCO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Columbus McKinnon is a company specializing in machinery and industrial equipment, with a market capitalization of $1.82 billion.

Operations: The company's revenue primarily stems from Machinery & Industrial Equipment, amounting to $963.03 million. The gross profit margin has shown variability, reaching 37.10% in December 2024 before declining to 35.48% by March 2025. Operating expenses have consistently been a significant portion of costs, with sales and marketing and general & administrative expenses being notable components.

PE: -89.2x

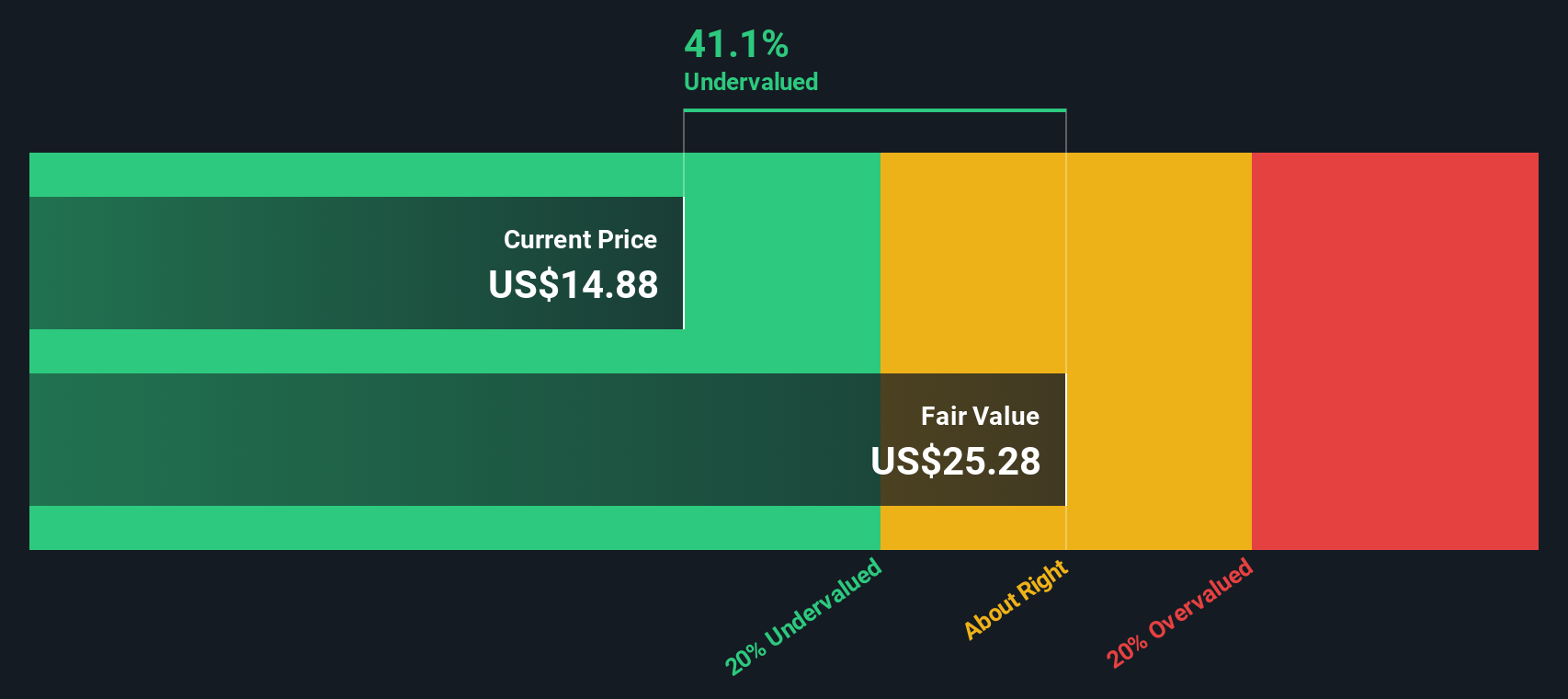

Columbus McKinnon, a smaller company in the industrial sector, has seen recent insider confidence with David Wilson purchasing 31,300 shares for US$1.00 million. Despite being dropped from several Russell indexes and facing a net loss of US$5.14 million for fiscal year 2025 compared to last year's profit of US$46.63 million, they remain optimistic about future growth with earnings projected to grow annually by over 90%. The company's financial structure relies heavily on external borrowing without customer deposits.

Colony Bankcorp (CBAN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Colony Bankcorp operates as a financial services company with divisions in banking, mortgage banking, and small business specialty lending, with a market capitalization of approximately $0.14 billion.

Operations: Colony Bankcorp generates revenue primarily from its Banking Division, with additional contributions from Mortgage Banking and Small Business Specialty Lending. The company has seen a consistent gross profit margin of 100% over the observed periods, indicating that all reported revenue translates directly into gross profit. Operating expenses are a significant component of costs, with General & Administrative Expenses being the largest category within operating expenses. Net income margin has varied over time but reached 22.11% in early 2025, reflecting an increase in profitability relative to revenue.

PE: 12.4x

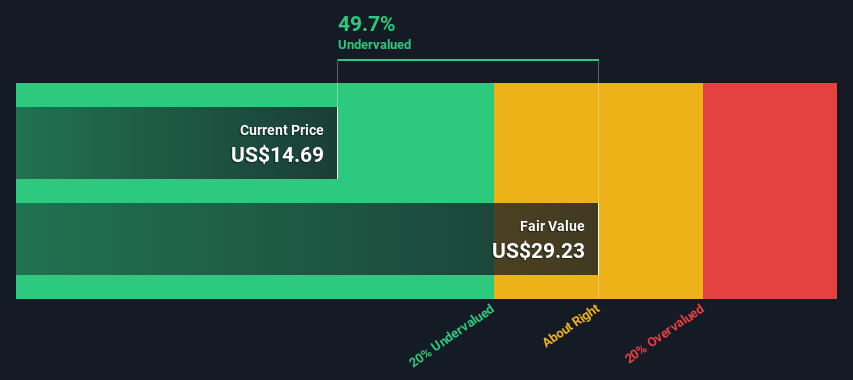

Colony Bankcorp, a small company in the banking sector, shows potential as an undervalued investment. Insider confidence is evident with recent share purchases by key stakeholders. In Q1 2025, net interest income rose to US$20.95 million from US$18.65 million the previous year, while net income increased to US$6.61 million from US$5.33 million. The company also repurchased 38,307 shares for US$0.63 million between January and March 2025, reflecting strategic capital management efforts amidst a forecasted annual earnings growth of 14%.

Where To Now?

- Click this link to deep-dive into the 78 companies within our Undervalued US Small Caps With Insider Buying screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LIND

Lindblad Expeditions Holdings

Provides marine expedition adventures and travel experience worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives