- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

July 2025's Noteworthy Stocks Trading Below Estimated Fair Value

Reviewed by Simply Wall St

The United States market has shown a robust performance, with a 1.3% increase over the last week and a 15% rise over the past year, while earnings are projected to grow by 15% annually in the coming years. In this environment, identifying stocks that are trading below their estimated fair value can present opportunities for investors seeking to capitalize on potential growth at an attractive price point.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Semrush Holdings (SEMR) | $9.80 | $19.08 | 48.6% |

| Roku (ROKU) | $89.55 | $174.24 | 48.6% |

| Pennant Group (PNTG) | $22.46 | $44.18 | 49.2% |

| Hesai Group (HSAI) | $21.10 | $41.10 | 48.7% |

| Carter Bankshares (CARE) | $18.00 | $35.50 | 49.3% |

| Camden National (CAC) | $42.17 | $83.88 | 49.7% |

| BioLife Solutions (BLFS) | $21.41 | $42.60 | 49.7% |

| Atlantic Union Bankshares (AUB) | $33.17 | $65.45 | 49.3% |

| ACNB (ACNB) | $43.04 | $85.24 | 49.5% |

| Acadia Realty Trust (AKR) | $18.89 | $36.69 | 48.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Rocket Lab (RKLB)

Overview: Rocket Lab Corporation is a space company offering launch services and space systems solutions globally, with a market cap of $22.62 billion.

Operations: The company's revenue is derived from two main segments: Space Systems, which generated $337.77 million, and Launch Services, which brought in $128.25 million.

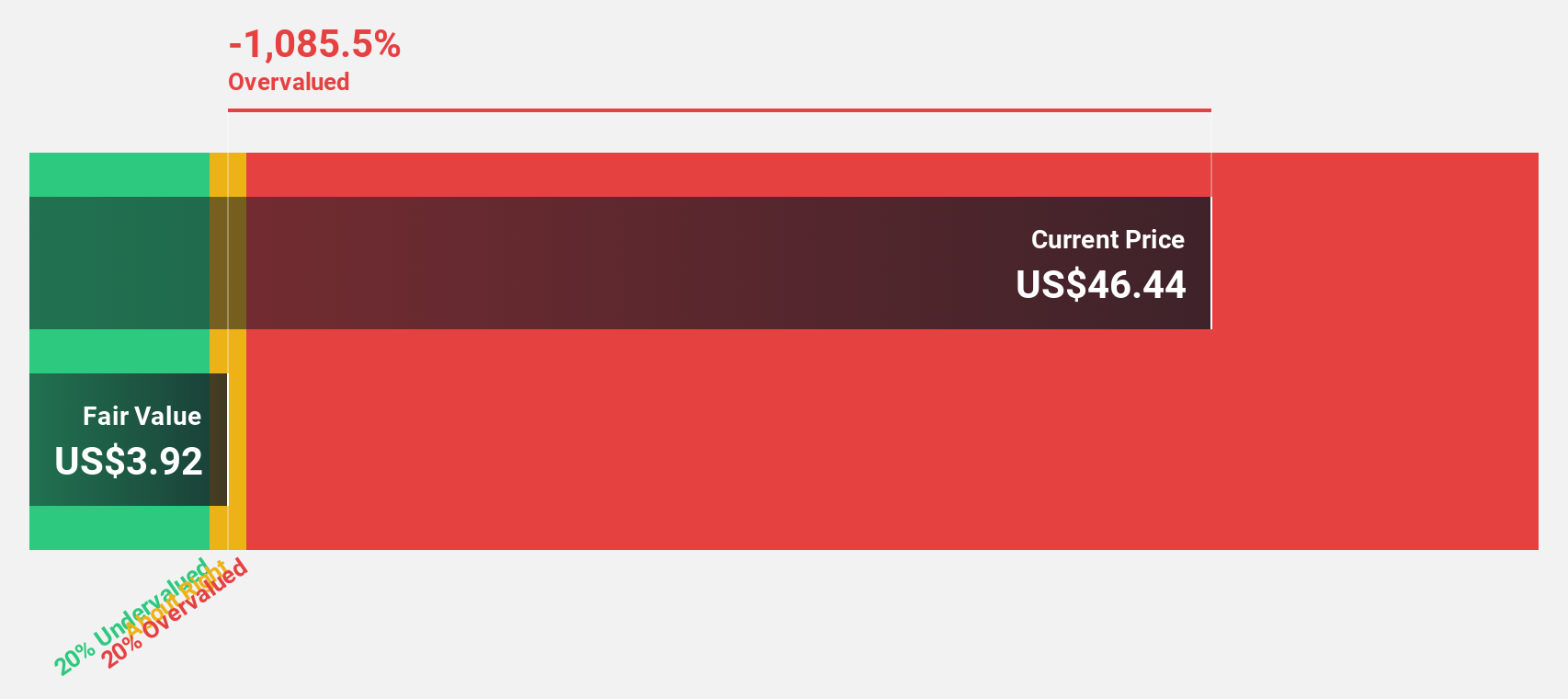

Estimated Discount To Fair Value: 33.1%

Rocket Lab is trading at US$46.88, significantly below its estimated fair value of US$70.07, highlighting potential undervaluation based on cash flows. Despite a volatile share price and recent insider selling, the company is poised for robust revenue growth at 28.1% annually, outpacing the broader U.S. market's 9%. Recent successful launches and inclusion in major indices like Russell Midcap Growth underscore operational strength amid high demand for its launch services.

- Our comprehensive growth report raises the possibility that Rocket Lab is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Rocket Lab.

DoorDash (DASH)

Overview: DoorDash, Inc. operates a commerce platform linking merchants, consumers, and independent contractors both in the United States and internationally, with a market cap of $101.92 billion.

Operations: The company's revenue primarily comes from its Internet Information Providers segment, generating $11.24 billion.

Estimated Discount To Fair Value: 30.9%

DoorDash, priced at US$239.82, is trading significantly below its estimated fair value of US$347.22, suggesting potential undervaluation based on cash flows. Its earnings are expected to grow substantially over the next three years, outpacing the U.S. market's growth rate. Despite recent index exclusions and insider selling, DoorDash's strategic partnerships and innovations in delivery technology and advertising platforms indicate strong operational momentum that could support future revenue expansion.

- In light of our recent growth report, it seems possible that DoorDash's financial performance will exceed current levels.

- Navigate through the intricacies of DoorDash with our comprehensive financial health report here.

Oracle (ORCL)

Overview: Oracle Corporation provides products and services for enterprise information technology environments globally, with a market cap of approximately $684.06 billion.

Operations: Oracle's revenue is primarily derived from three segments: Cloud and License at $49.23 billion, Services at $5.23 billion, and Hardware at $2.94 billion.

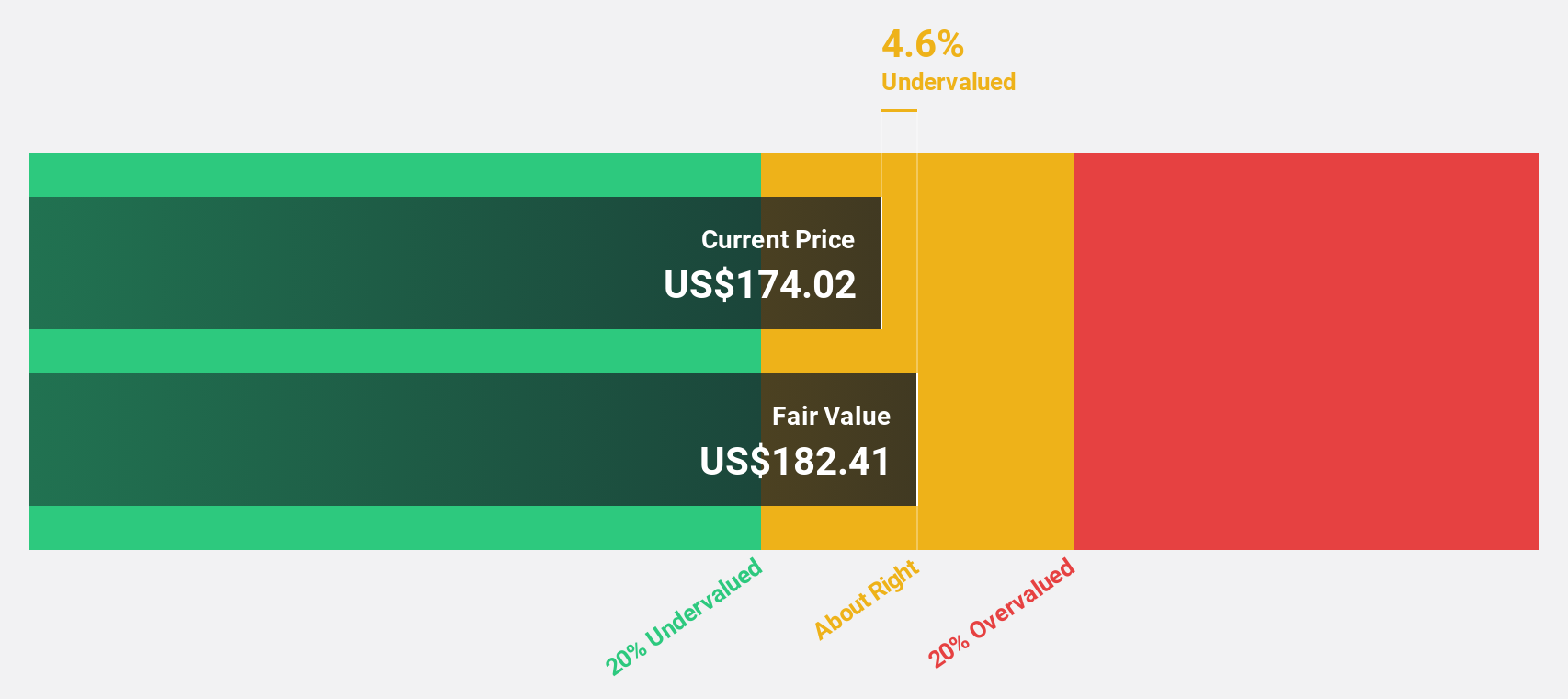

Estimated Discount To Fair Value: 10.4%

Oracle, with a current price of US$238.11, is trading below its estimated fair value of US$265.65, presenting potential undervaluation based on cash flows. Recent collaborations in AI and cloud services enhance Oracle's strategic positioning and operational capabilities. While the company carries a high level of debt, its earnings are projected to grow at 16.7% annually, surpassing the U.S. market average growth rate and reinforcing its financial robustness amidst ongoing legal resolutions and client expansions.

- The analysis detailed in our Oracle growth report hints at robust future financial performance.

- Click here to discover the nuances of Oracle with our detailed financial health report.

Next Steps

- Explore the 180 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives