- United States

- /

- Hospitality

- /

- NasdaqGS:BLMN

Little Excitement Around Bloomin' Brands, Inc.'s (NASDAQ:BLMN) Revenues As Shares Take 26% Pounding

Bloomin' Brands, Inc. (NASDAQ:BLMN) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

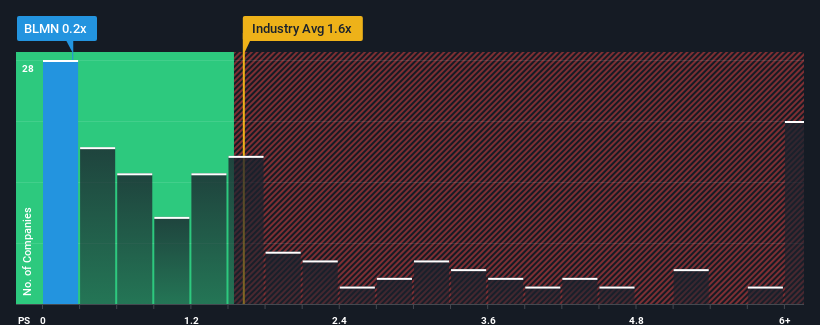

Since its price has dipped substantially, Bloomin' Brands' price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Hospitality industry in the United States, where around half of the companies have P/S ratios above 1.6x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Bloomin' Brands

How Bloomin' Brands Has Been Performing

Bloomin' Brands could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Bloomin' Brands will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Bloomin' Brands would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 17% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue growth is heading into negative territory, declining 1.8% per year over the next three years. With the industry predicted to deliver 12% growth per year, that's a disappointing outcome.

With this in consideration, we find it intriguing that Bloomin' Brands' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Bloomin' Brands' recently weak share price has pulled its P/S back below other Hospitality companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's clear to see that Bloomin' Brands maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Bloomin' Brands you should be aware of, and 1 of them is a bit concerning.

If these risks are making you reconsider your opinion on Bloomin' Brands, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bloomin' Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BLMN

Bloomin' Brands

Through its subsidiaries, owns and operates casual, polished casual, and fine dining restaurants in the United States and internationally.

Proven track record slight.

Market Insights

Community Narratives