- United States

- /

- Consumer Services

- /

- NYSE:TAL

3 US Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As major U.S. stock indices like the S&P 500 and Nasdaq Composite reach record highs, investor optimism is buoyed by strong technology earnings and anticipation of Federal Reserve policy signals. In this environment, identifying stocks that may be trading below their estimated value can present opportunities for investors seeking to capitalize on market dynamics while maintaining a focus on fundamentals.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | $126.05 | $242.81 | 48.1% |

| First Solar (NasdaqGS:FSLR) | $207.51 | $406.03 | 48.9% |

| West Bancorporation (NasdaqGS:WTBA) | $23.33 | $46.41 | 49.7% |

| Business First Bancshares (NasdaqGS:BFST) | $28.05 | $54.94 | 48.9% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.82 | $63.31 | 48.2% |

| Privia Health Group (NasdaqGS:PRVA) | $21.66 | $43.17 | 49.8% |

| First Advantage (NasdaqGS:FA) | $19.89 | $38.88 | 48.8% |

| Vasta Platform (NasdaqGS:VSTA) | $2.28 | $4.43 | 48.5% |

| Marcus & Millichap (NYSE:MMI) | $41.33 | $81.27 | 49.1% |

| Hesai Group (NasdaqGS:HSAI) | $8.00 | $15.68 | 49% |

Let's dive into some prime choices out of the screener.

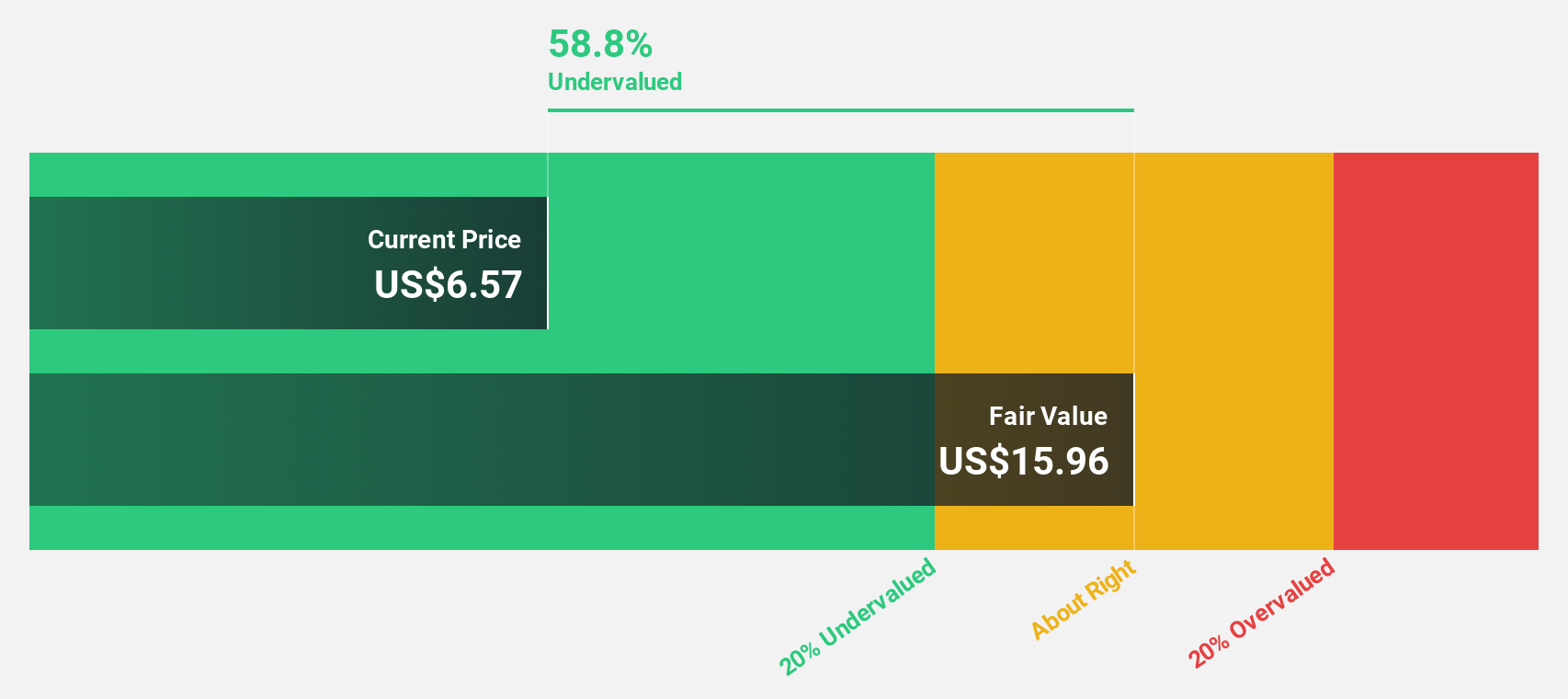

Atour Lifestyle Holdings (NasdaqGS:ATAT)

Overview: Atour Lifestyle Holdings Limited, with a market cap of $3.47 billion, operates through its subsidiaries to develop lifestyle brands centered around hotel offerings in the People's Republic of China.

Operations: Atour Lifestyle Holdings Limited generates revenue primarily from its Atour Group segment, which reported CN¥6.67 billion.

Estimated Discount To Fair Value: 37.6%

Atour Lifestyle Holdings is trading at US$25.96, significantly below its estimated fair value of US$41.61, suggesting it may be undervalued based on cash flows. Despite shareholder dilution last year, the company has shown strong earnings growth of 168% and forecasts indicate continued robust revenue and profit expansion exceeding market averages. Recent earnings reports reveal substantial revenue and net income increases year-over-year, reinforcing its potential as an undervalued investment opportunity.

- Our comprehensive growth report raises the possibility that Atour Lifestyle Holdings is poised for substantial financial growth.

- Get an in-depth perspective on Atour Lifestyle Holdings' balance sheet by reading our health report here.

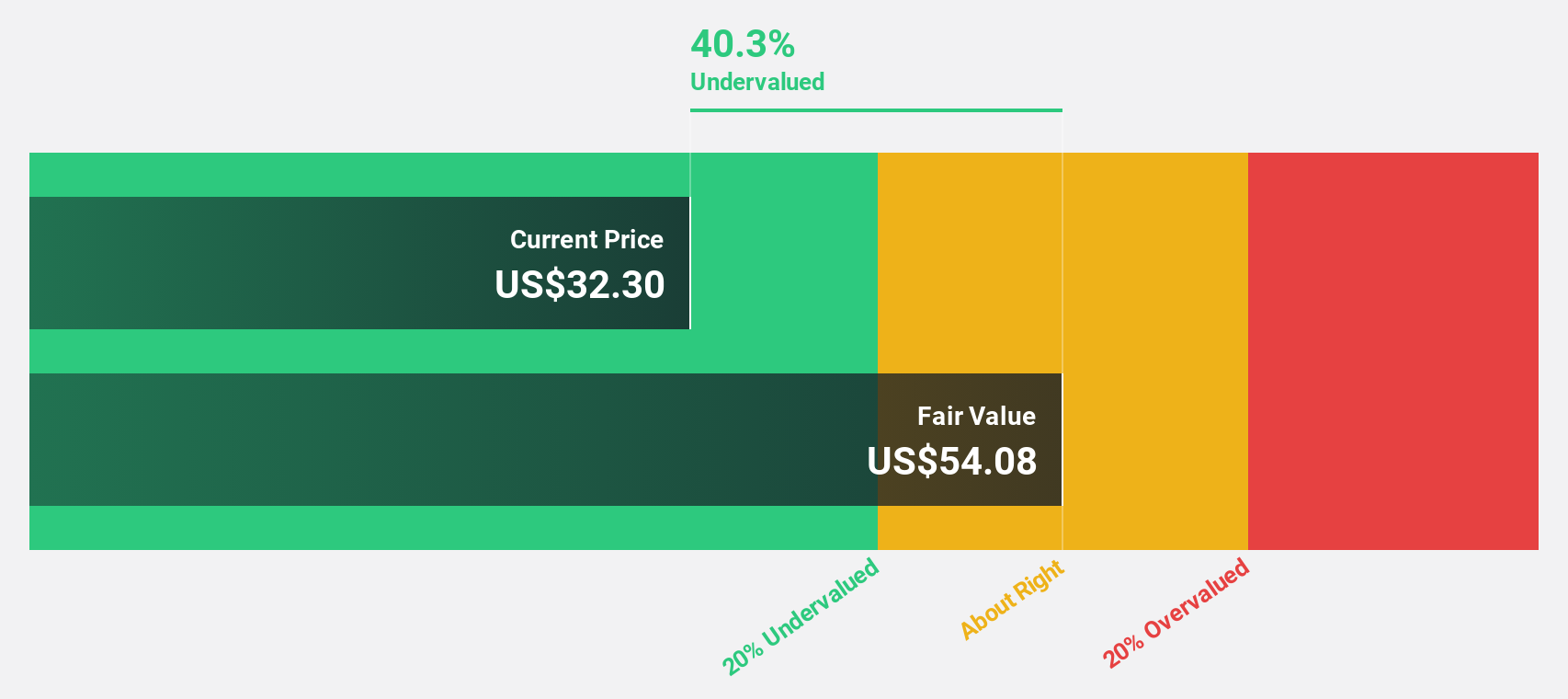

Compass (NYSE:COMP)

Overview: Compass, Inc. operates as a real estate brokerage service provider in the United States with a market cap of approximately $3.64 billion.

Operations: The company generates revenue from its Internet Information Providers segment, totaling $5.35 billion.

Estimated Discount To Fair Value: 26.5%

Compass is trading at US$7.33, below its estimated fair value of US$9.98, indicating potential undervaluation based on cash flows. Earnings are projected to grow 78.12% annually as the company aims for profitability within three years, surpassing market averages. Recent strategic alliances with Christie's International Real Estate and @properties aim to boost growth domestically and internationally, potentially enhancing revenue streams and supporting Compass's long-term strategy of integrating high-margin services into its portfolio.

- Our earnings growth report unveils the potential for significant increases in Compass' future results.

- Take a closer look at Compass' balance sheet health here in our report.

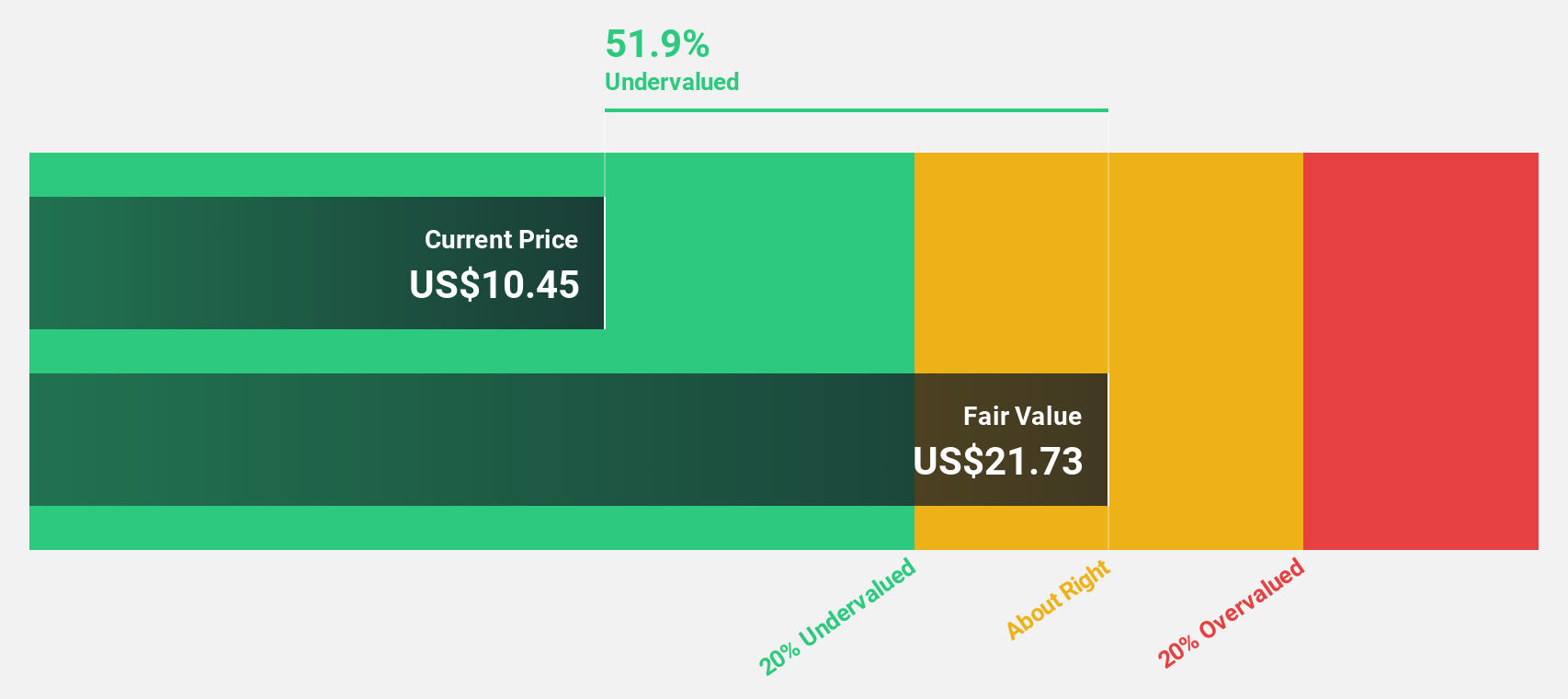

TAL Education Group (NYSE:TAL)

Overview: TAL Education Group offers K-12 after-school tutoring services in the People’s Republic of China and has a market cap of approximately $6.23 billion.

Operations: The company's revenue segment is primarily comprised of after-school tutoring services, generating approximately $1.84 billion.

Estimated Discount To Fair Value: 30.2%

TAL Education Group is trading at US$10.69, below its estimated fair value of US$15.32, highlighting potential undervaluation based on cash flows. The company has recently become profitable, with earnings projected to grow significantly at 36.1% annually, outpacing the US market average. Recent earnings reported a net income of US$57.43 million for Q2 2024 compared to US$37.9 million the previous year, alongside a strategic buyback of shares worth over $509 million since 2021.

- Our expertly prepared growth report on TAL Education Group implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of TAL Education Group.

Summing It All Up

- Embark on your investment journey to our 183 Undervalued US Stocks Based On Cash Flows selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TAL Education Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TAL

TAL Education Group

Provides K-12 after-school tutoring services in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives