- United States

- /

- Consumer Services

- /

- NasdaqGS:AFYA

Insider Favorites For Growth In March 2025

Reviewed by Simply Wall St

As of March 2025, the U.S. stock market has been experiencing a mixed performance, with major indices like the S&P 500 and Nasdaq posting their third straight weekly declines despite a recent rebound following positive comments from Federal Reserve Chair Jerome Powell. Amidst this backdrop of volatility and economic uncertainty, growth companies with high insider ownership can offer unique insights into potential investment opportunities, as insiders often have a deeper understanding of their company's prospects and are more likely to invest in businesses they believe will succeed.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.9% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.7% | 36.7% |

| Kingstone Companies (NasdaqCM:KINS) | 17.9% | 24.2% |

| Astera Labs (NasdaqGS:ALAB) | 15.9% | 61.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Clene (NasdaqCM:CLNN) | 20.7% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.6% |

Underneath we present a selection of stocks filtered out by our screen.

Astrana Health (NasdaqCM:ASTH)

Simply Wall St Growth Rating: ★★★★☆☆

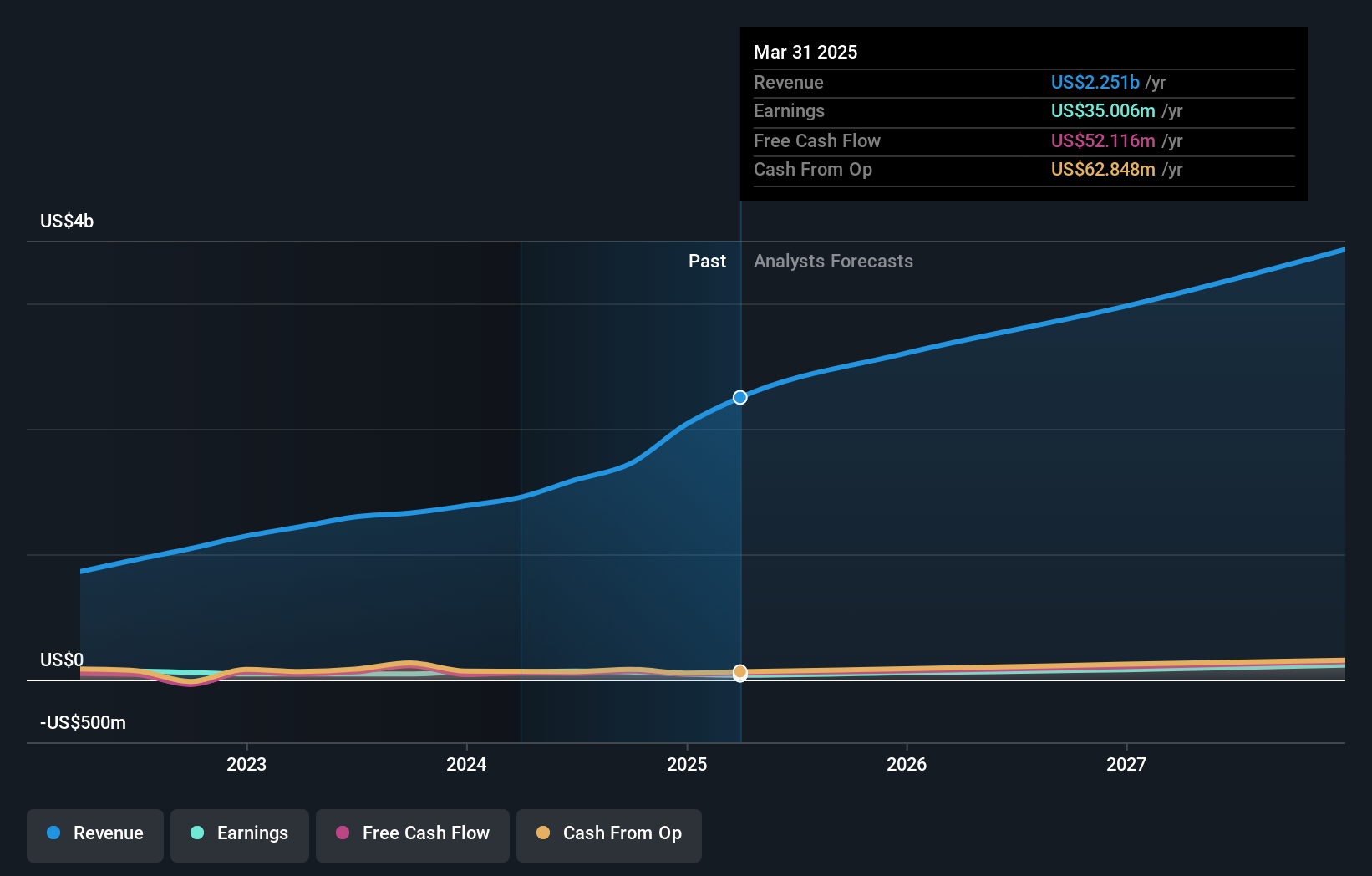

Overview: Astrana Health, Inc. is a physician-centric technology-powered healthcare management company providing medical care services in the United States, with a market cap of approximately $1.41 billion.

Operations: Astrana Health generates revenue through its segments: Care Delivery ($136.67 million), Care Partners ($1.95 billion), and Care Enablement ($155.45 million).

Insider Ownership: 13.2%

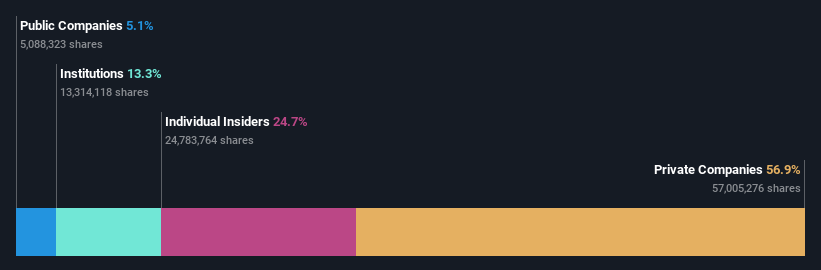

Astrana Health's revenue is forecast to grow at 18% annually, outpacing the US market. Despite a recent net loss in Q4 2024, annual earnings are expected to increase significantly over the next three years. The company trades below its estimated fair value and anticipates revenue up to US$2.7 billion in 2025. Recent financial activities include a substantial credit agreement for acquisitions and a share repurchase program, although insider trading data is unavailable.

- Unlock comprehensive insights into our analysis of Astrana Health stock in this growth report.

- In light of our recent valuation report, it seems possible that Astrana Health is trading behind its estimated value.

Afya (NasdaqGS:AFYA)

Simply Wall St Growth Rating: ★★★★☆☆

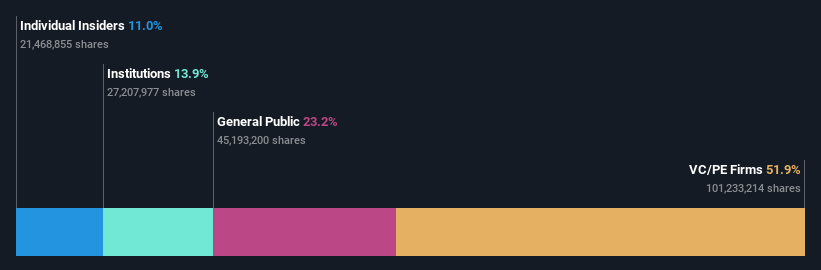

Overview: Afya Limited is a medical education group operating in Brazil with a market cap of approximately $1.55 billion.

Operations: The company's revenue is primarily derived from its Undergrad segment, which generated R$2.78 billion, and its Continuing Education segment, contributing R$164.55 million.

Insider Ownership: 15.3%

Afya is forecast to experience robust revenue growth at 9.6% annually, surpassing the US market average. Its earnings are expected to increase by 18.87% per year, outpacing the broader market's growth rate of 13.9%. The stock trades at a significant discount to its estimated fair value and shows high return on equity projections (20.2%). No recent insider trading activity is reported, and the company concluded its buyback plan in December 2024.

- Get an in-depth perspective on Afya's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Afya's current price could be quite moderate.

loanDepot (NYSE:LDI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: loanDepot, Inc. operates in the United States by originating, financing, selling, and servicing residential mortgage loans with a market cap of approximately $588.60 million.

Operations: The company's revenue primarily comes from originating, financing, and selling mortgage loans, generating approximately $1.01 billion.

Insider Ownership: 11%

loanDepot is experiencing significant executive transitions, with founder Anthony Hsieh rejoining as Executive Chairman amid a CEO search. Despite high insider ownership, recent months have seen substantial insider selling. The company is forecast to become profitable within three years and projects earnings growth of 110.16% annually. Revenue growth is expected at 18.4% per year, outpacing the US market average but below the 20% threshold for high growth companies, while maintaining competitive value relative to peers.

- Take a closer look at loanDepot's potential here in our earnings growth report.

- The analysis detailed in our loanDepot valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Dive into all 205 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFYA

Undervalued with solid track record.