- United States

- /

- Banks

- /

- NasdaqCM:CIVB

Undervalued Small Caps In US With Insider Action For January 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.8%, yet it remains up by 24% over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying small-cap stocks that are potentially undervalued and exhibit insider activity can be an intriguing strategy for investors looking to navigate these fluctuating conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Quanex Building Products | 33.5x | 0.9x | 39.76% | ★★★★☆☆ |

| ProPetro Holding | NA | 0.7x | 33.60% | ★★★★☆☆ |

| Douglas Dynamics | 10.1x | 1.0x | -10.62% | ★★★☆☆☆ |

| First United | 13.4x | 3.0x | 48.38% | ★★★☆☆☆ |

| Limbach Holdings | 38.1x | 1.9x | 41.30% | ★★★☆☆☆ |

| RGC Resources | 17.5x | 2.4x | 20.58% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Tilray Brands | NA | 1.6x | -97.20% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -73.25% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -74.15% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

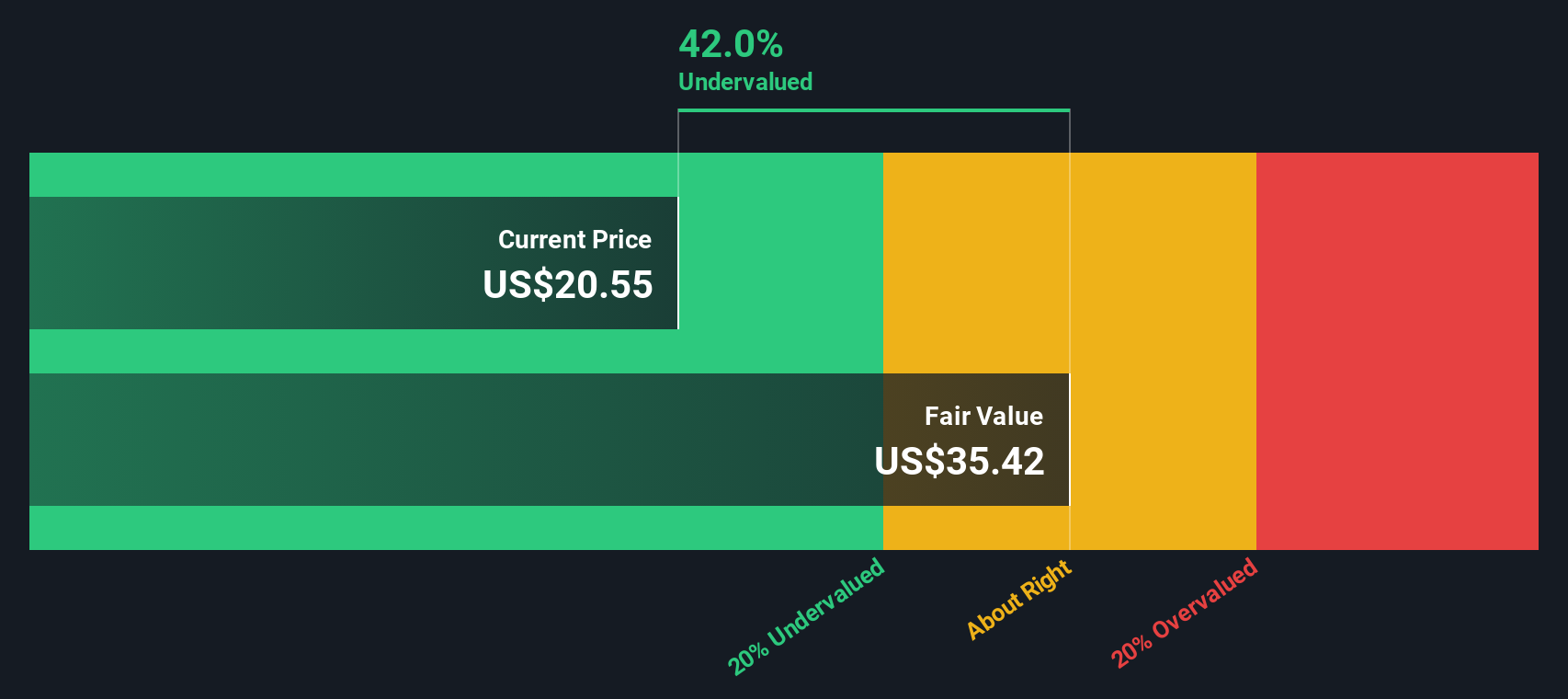

Civista Bancshares (NasdaqCM:CIVB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Civista Bancshares is a financial institution primarily engaged in banking operations, with a market capitalization of approximately $0.27 billion.

Operations: The primary revenue stream is from banking, with total revenue reaching $146.57 million in the latest period. Operating expenses are a significant component of the cost structure, totaling $106.87 million for the same period. The net income margin has shown variability over time, currently at 20.90%.

PE: 10.5x

Civista Bancshares, a smaller U.S. financial entity, is drawing attention due to its potential for growth, with earnings projected to rise 7.73% annually. Despite recent dips in net income and earnings per share—US$8.37 million and US$0.53 respectively for Q3 2024—the company maintains insider confidence through consistent dividend payouts of US$0.16 per share as of November 2024. Their recent US$200 million shelf registration hints at strategic financial maneuvers ahead, suggesting possible expansion or capital restructuring opportunities in the future.

- Navigate through the intricacies of Civista Bancshares with our comprehensive valuation report here.

Evaluate Civista Bancshares' historical performance by accessing our past performance report.

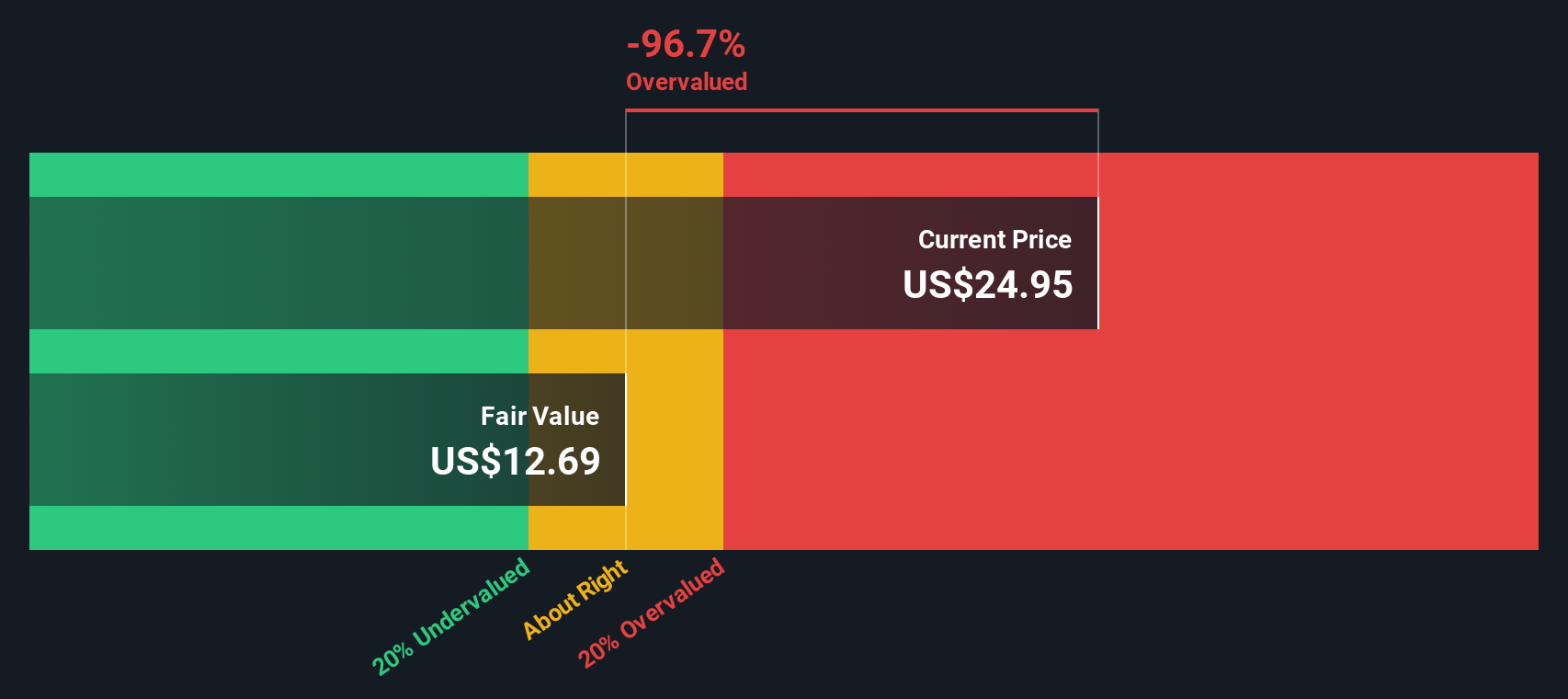

Guardian Pharmacy Services (NYSE:GRDN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Guardian Pharmacy Services operates in the pharmacy services industry, providing a range of pharmaceutical care solutions with a focus on personalized service, and has a market capitalization of $1.75 billion.

Operations: Pharmacy Services generated $1.17 billion in revenue, with a gross profit margin of 19.80%. Operating expenses were significant, including general and administrative costs of $292.61 million, contributing to a net income loss of -$98.09 million and a net income margin of -8.38%.

PE: -12.8x

Guardian Pharmacy Services, a small company in the U.S., has shown potential for growth despite recent financial challenges. Their third-quarter sales rose to US$314 million from US$263 million last year, although they reported a net loss of US$113 million. Recently added to the S&P TMI Index, Guardian expanded its reach by partnering with Freedom Pharmacy in New Jersey. Insider confidence is evident as insiders have been purchasing shares throughout 2024, signaling belief in future prospects.

PennyMac Mortgage Investment Trust (NYSE:PMT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: PennyMac Mortgage Investment Trust operates as a specialty finance company focusing on mortgage-related assets, with a market capitalization of approximately $1.02 billion.

Operations: The company's revenue is primarily derived from Credit Sensitive Strategies, with significant contributions from Correspondent Production and Interest Rate Sensitive Strategies. Over recent periods, the gross profit margin has seen fluctuations, reaching as high as 85.03% in the latest quarter. Operating expenses are a notable component of costs, with general and administrative expenses consistently contributing to this category.

PE: 8.7x

PennyMac Mortgage Investment Trust, a smaller player in the U.S. market, is navigating challenges with its reliance on higher-risk external borrowing for funding. Despite this, there's insider confidence as insiders have been purchasing shares recently. The company's financial position shows room for improvement; however, earnings are projected to grow by 6.63% annually. Recent dividend affirmations and strategic leadership changes aim to enhance value creation within the mortgage sector while maintaining shareholder returns through consistent dividends like the upcoming US$0.40 per share payout in January 2025.

Summing It All Up

- Get an in-depth perspective on all 44 Undervalued US Small Caps With Insider Buying by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CIVB

Civista Bancshares

Operates as the financial holding company for Civista Bank that provides community banking services.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives