- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

Undervalued Small Caps In US With Insider Action

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.2% and is up 24% over the past year, with earnings projected to grow by 15% annually. In this context of robust market performance, identifying small-cap stocks that are currently undervalued can present unique opportunities for investors looking to capitalize on insider actions that may signal potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First United | 13.0x | 3.5x | 30.65% | ★★★★☆☆ |

| Eagle Financial Services | 7.5x | 1.6x | 35.84% | ★★★★☆☆ |

| S&T Bancorp | 11.8x | 4.0x | 37.40% | ★★★★☆☆ |

| Arrow Financial | 15.3x | 3.4x | 37.95% | ★★★☆☆☆ |

| Limbach Holdings | 36.7x | 1.9x | 46.74% | ★★★☆☆☆ |

| Columbus McKinnon | 62.6x | 0.6x | 41.61% | ★★★☆☆☆ |

| ChromaDex | 304.7x | 4.9x | 25.98% | ★★★☆☆☆ |

| Franklin Financial Services | 15.1x | 2.4x | 21.23% | ★★★☆☆☆ |

| Guardian Pharmacy Services | NA | 1.1x | 32.03% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -77.13% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

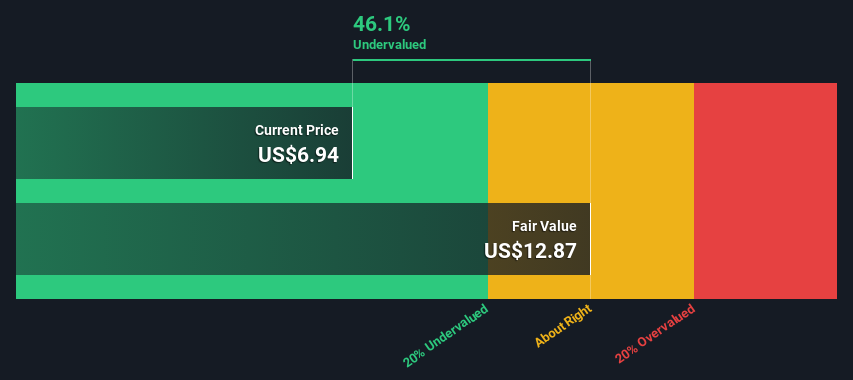

Fluence Energy (NasdaqGS:FLNC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fluence Energy is a company focused on providing energy storage solutions, primarily through its batteries and battery systems segment, with a market capitalization of approximately $4.63 billion.

Operations: Fluence Energy's revenue is primarily derived from its battery systems, with the latest reported figure at $2.52 billion. The company has experienced fluctuations in its gross profit margin, reaching 12.93% in the most recent period after a series of variations over time. Operating expenses are significant and include costs such as sales & marketing, R&D, and general & administrative expenses.

PE: -455.5x

Fluence Energy, a company in the energy storage sector, recently launched Smartstack™, a high-density platform addressing grid-scale applications. Despite experiencing volatile share prices and reporting a Q1 2025 net loss of US$41.47 million, Fluence's earnings are projected to grow significantly by 42% annually. Insider confidence is reflected through recent executive changes but no insider buying activity was reported. The company's fiscal year 2025 revenue guidance was lowered to US$3.1 billion - US$3.7 billion due to contract timing issues in Australia, yet it remains largely covered by existing backlog and recognized revenue.

- Click here to discover the nuances of Fluence Energy with our detailed analytical valuation report.

Assess Fluence Energy's past performance with our detailed historical performance reports.

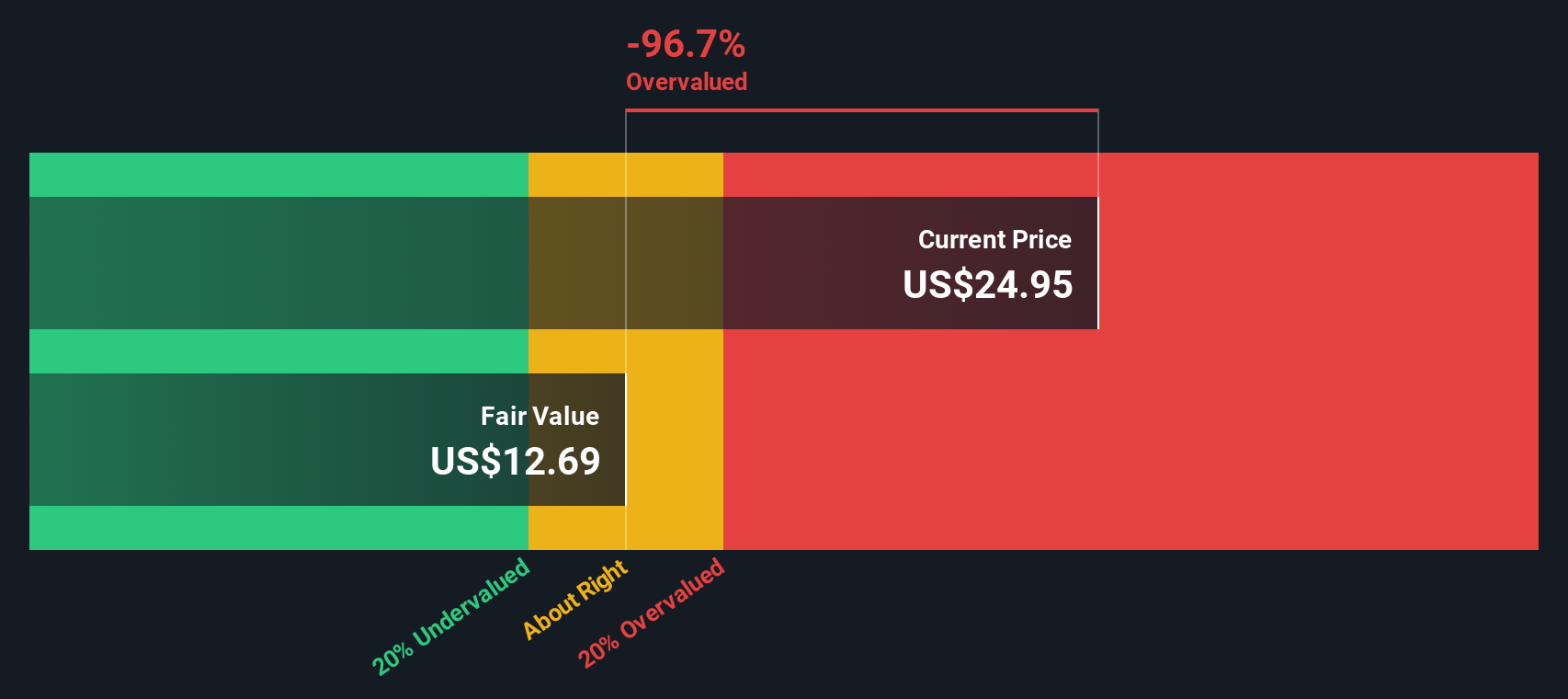

Guardian Pharmacy Services (NYSE:GRDN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Guardian Pharmacy Services operates in the healthcare sector, providing pharmacy services with a focus on personalized care, and has a market capitalization of $3.25 billion.

Operations: Pharmacy Services generated $1.17 billion in revenue, with a gross profit margin of 19.80%. Operating expenses, primarily driven by general and administrative costs at $292.61 million, significantly impacted the net income margin, resulting in -8.38%.

PE: -12.9x

Guardian Pharmacy Services, a dynamic player in the healthcare sector, has recently expanded its footprint by integrating Freedom Pharmacy into its operations, enhancing its presence in New Jersey. The company was added to the S&P TMI Index on December 23, 2024. Insider confidence is evident as they acquired shares between October and December 2024. Despite relying entirely on external borrowing for funding, earnings are projected to grow at an impressive rate of 88% annually.

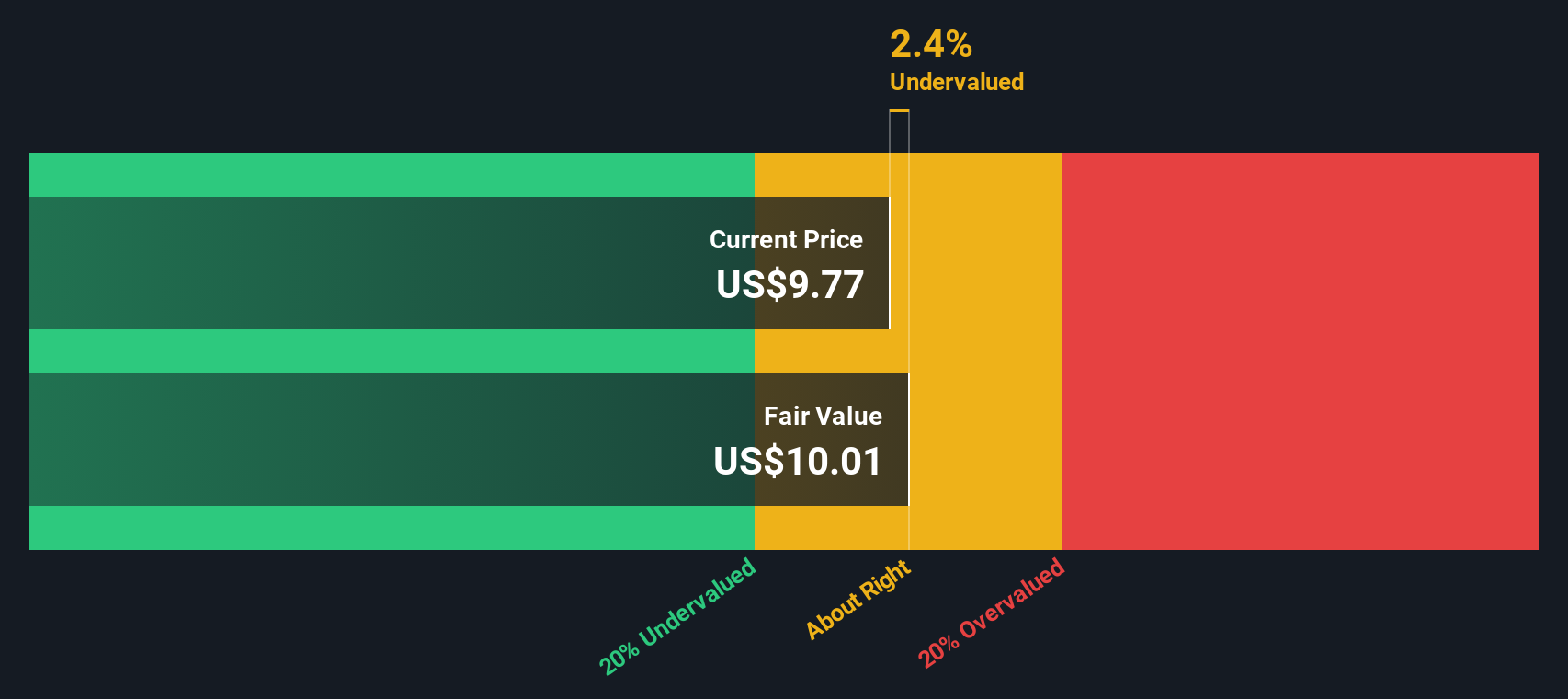

Pebblebrook Hotel Trust (NYSE:PEB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pebblebrook Hotel Trust operates as a real estate investment trust focusing on the acquisition and management of upscale, full-service hotels and resorts, with a market capitalization of approximately $2.12 billion.

Operations: The company generates revenue primarily from its hotels and motels segment, with the most recent revenue reported at $1.45 billion. The gross profit margin has shown fluctuations, recently recorded at 25.67%. Operating expenses and non-operating expenses are significant cost components impacting profitability.

PE: -49.3x

Pebblebrook Hotel Trust, a player in the hospitality sector, is drawing attention for its potential value. With earnings projected to grow 31% annually, there's a promising outlook despite the reliance on external borrowing for funding. Insider confidence is evident with recent share purchases between January and February 2025. The company declared dividends on preferred and common shares in December 2024, indicating stable cash flow management. These factors could position Pebblebrook well for future growth within its industry.

Seize The Opportunity

- Click through to start exploring the rest of the 49 Undervalued US Small Caps With Insider Buying now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives