- United States

- /

- Banks

- /

- NasdaqGS:CCB

3 US Growth Stocks With Up To 32% Insider Ownership

Reviewed by Simply Wall St

As the U.S. markets experience a downturn with major indexes like the Nasdaq snapping their winning streaks, investors are closely monitoring sectors that offer resilience amid volatility. In this environment, growth companies with substantial insider ownership can be appealing, as high insider stakes often signal confidence in long-term prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.6% | 26% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.4% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 33.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.7% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.4% |

| Coastal Financial (NasdaqGS:CCB) | 18.4% | 40.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Underneath we present a selection of stocks filtered out by our screen.

EHang Holdings (NasdaqGM:EH)

Simply Wall St Growth Rating: ★★★★★★

Overview: EHang Holdings Limited is an autonomous aerial vehicle technology platform company operating in China and internationally, with a market cap of approximately $1.05 billion.

Operations: The company's revenue primarily comes from its Aerospace & Defense segment, which generated CN¥248.97 million.

Insider Ownership: 32.8%

EHang Holdings, with substantial insider ownership, is poised for significant growth as its revenue is forecast to increase by 38% annually, outpacing the US market. Despite past shareholder dilution and a volatile share price, EHang's strategic advancements in eVTOL technology, including recent regulatory approvals in Brazil and China, bolster its potential. The company reported robust sales growth recently and expects continued strong performance with projected revenues of RMB 123 million for Q3 2024.

- Unlock comprehensive insights into our analysis of EHang Holdings stock in this growth report.

- According our valuation report, there's an indication that EHang Holdings' share price might be on the expensive side.

Coastal Financial (NasdaqGS:CCB)

Simply Wall St Growth Rating: ★★★★★★

Overview: Coastal Financial Corporation is the bank holding company for Coastal Community Bank, offering a range of banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington, with a market cap of $797.56 million.

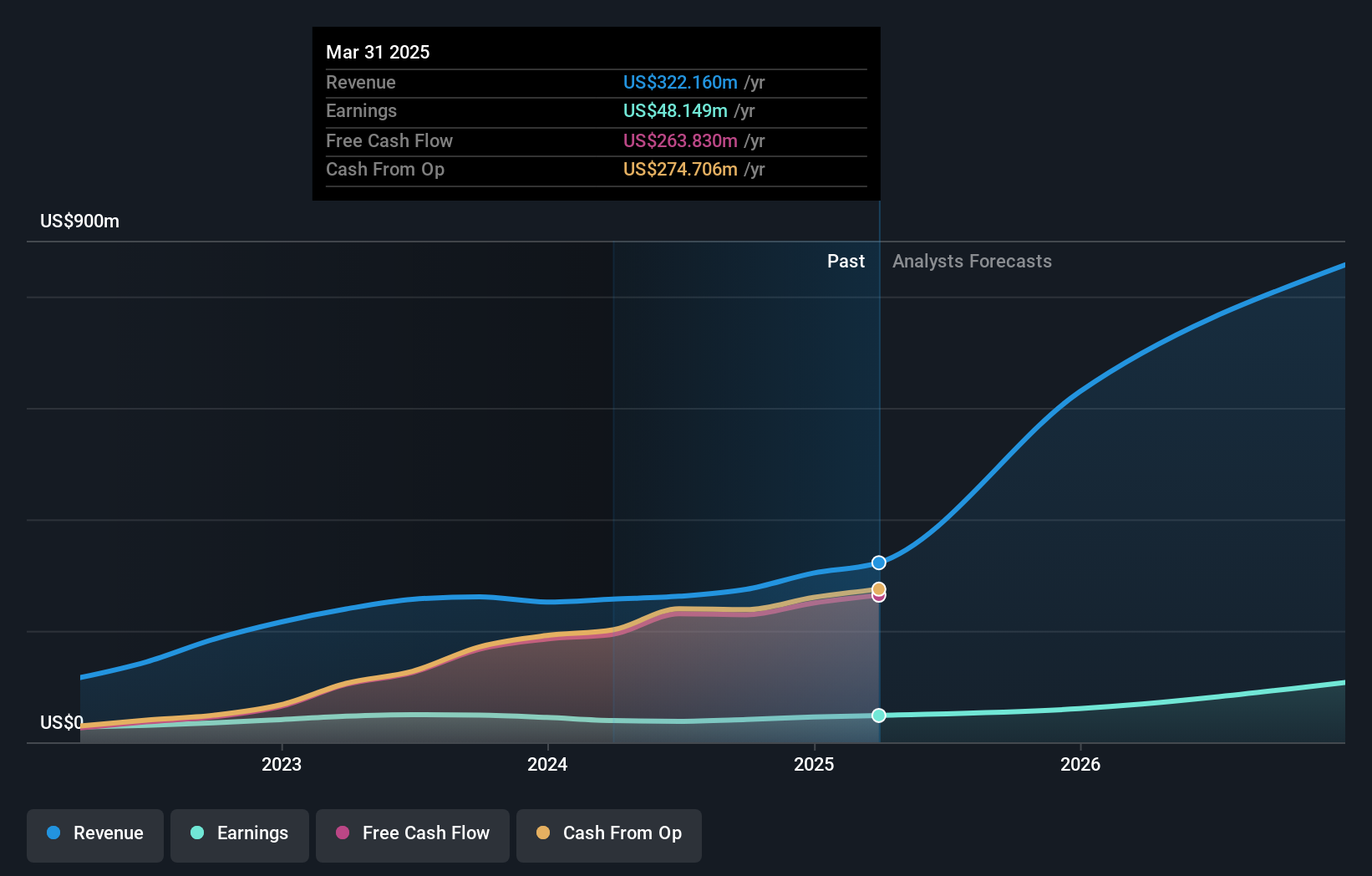

Operations: The company's revenue is derived from three segments: CCBX ($184.17 million), Community Bank ($76.75 million), and Treasury & Administration ($10.76 million).

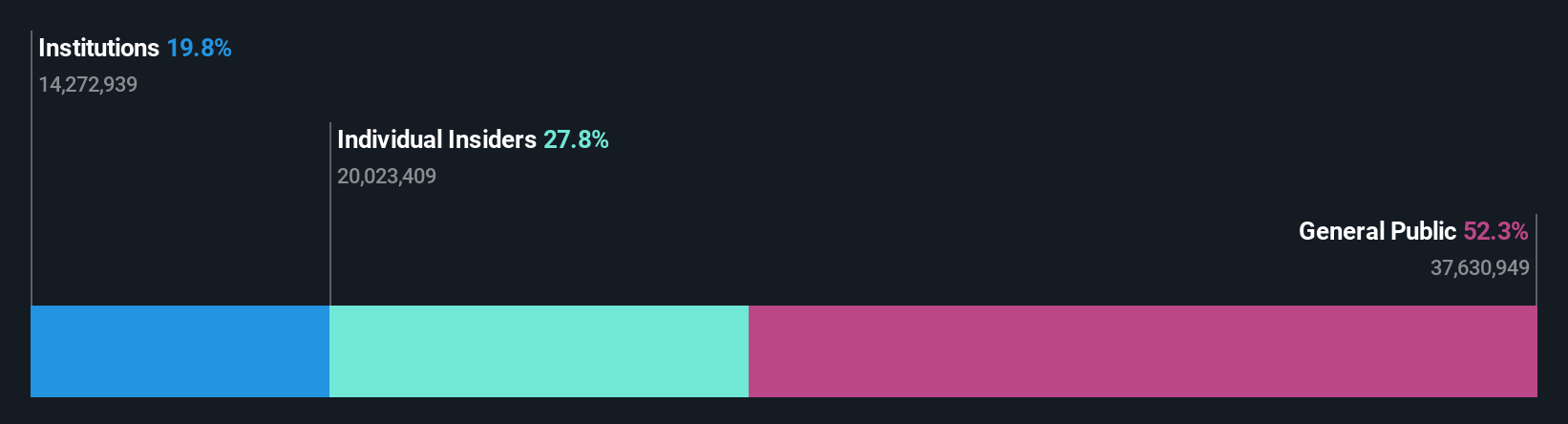

Insider Ownership: 18.4%

Coastal Financial Corporation, with high insider ownership, is positioned for robust growth, as earnings and revenue are forecast to grow substantially faster than the US market. The recent appointment of Brian Hamilton to lead its CCBX division highlights a strategic focus on fintech and banking-as-a-service. However, recent financial results show a decline in net income despite increased net interest income. Significant insider selling has been observed over the past three months.

- Click to explore a detailed breakdown of our findings in Coastal Financial's earnings growth report.

- The analysis detailed in our Coastal Financial valuation report hints at an inflated share price compared to its estimated value.

Dingdong (Cayman) (NYSE:DDL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dingdong (Cayman) Limited is an e-commerce company operating in China with a market cap of approximately $717.16 million.

Operations: The company generates revenue primarily through its online retail operations, amounting to CN¥20.76 billion.

Insider Ownership: 28.2%

Dingdong (Cayman) Limited, with significant insider ownership, has recently turned profitable, reporting a net income of CNY 67.13 million for Q2 2024. The company anticipates substantial earnings growth of 49.4% per year, outpacing the US market's forecasted growth rate. Despite slower revenue growth expectations at 5.9% annually compared to the market average, its shares trade significantly below estimated fair value. Recent leadership changes include appointing Ed Chan Yiu Cheong as director and chair of key committees.

- Click here to discover the nuances of Dingdong (Cayman) with our detailed analytical future growth report.

- Our expertly prepared valuation report Dingdong (Cayman) implies its share price may be too high.

Next Steps

- Gain an insight into the universe of 181 Fast Growing US Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCB

Coastal Financial

Operates as the bank holding company for Coastal Community Bank that provides various banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Flawless balance sheet with high growth potential.