- United States

- /

- Consumer Durables

- /

- NYSE:TOL

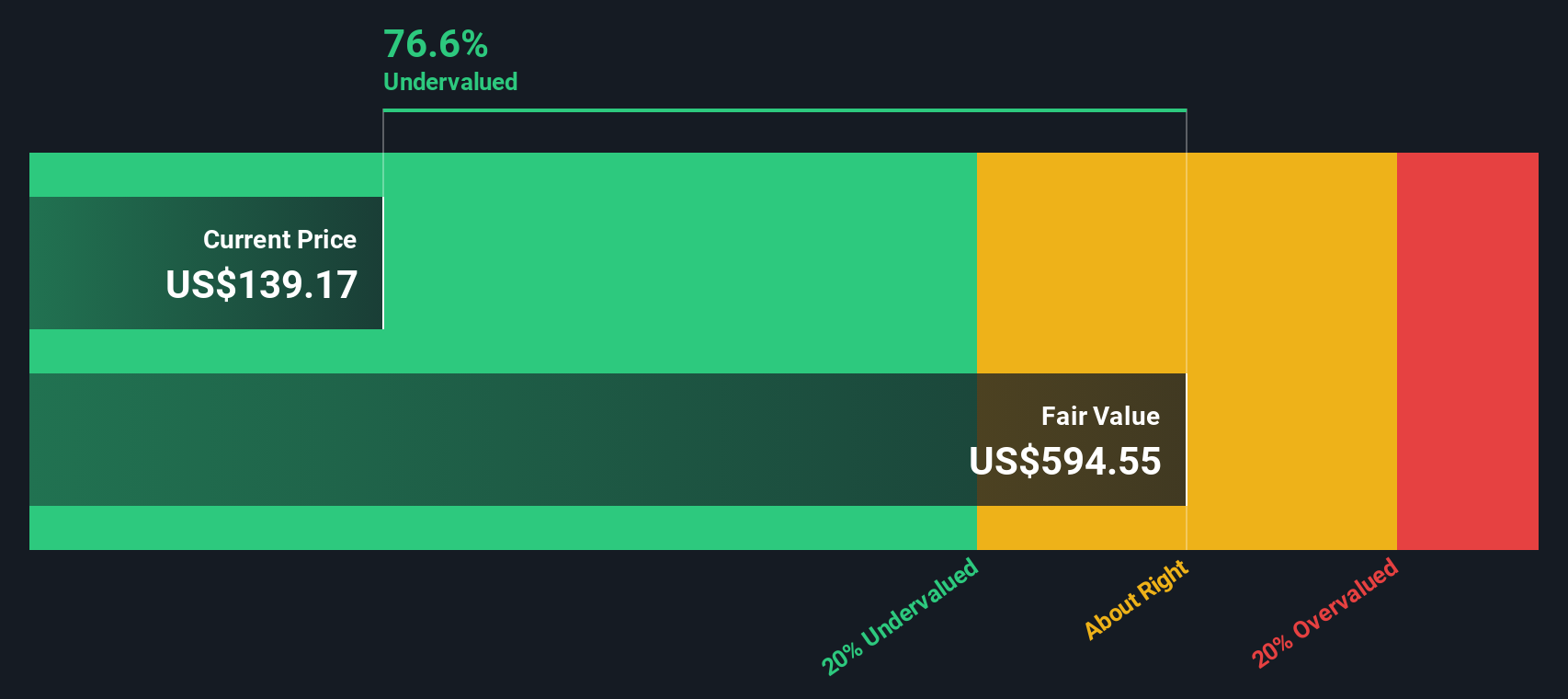

Toll Brothers (TOL): How Does Its Recent Outperformance Shape the Stock’s Valuation Today?

Reviewed by Simply Wall St

Toll Brothers (TOL) has quietly outpaced the broader homebuilder group this month, with the stock up roughly 6% while the past 3 months have been more sideways for investors.

See our latest analysis for Toll Brothers.

That move fits into a steadier backdrop, with an 11.33% year to date share price return and a powerful 3 year total shareholder return of 185.17% suggesting underlying confidence rather than speculative froth.

If Toll Brothers has you rethinking the housing cycle, it could be a good moment to broaden your view and explore fast growing stocks with high insider ownership.

But with revenue and profit growth slowing, a modest discount to analyst targets, and shares already more than doubling over three years, is there still a compelling entry point here, or is the market fully pricing in future gains?

Most Popular Narrative Narrative: 9% Undervalued

With Toll Brothers last closing at $138.67 against a narrative fair value of $152.40, the story leans toward upside, hinging on steady growth and richer future multiples.

Analysts expect earnings to reach $1.7 billion (and earnings per share of $18.36) by about September 2028, up from $1.4 billion today.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.6x on those 2028 earnings, down from 10.2x today. This future PE is lower than the current PE for the US Consumer Durables industry at 11.5x.

Want to see the engine under this valuation, from modest revenue assumptions to expanding margins and a richer future multiple, all working together, or against each other, in one tight model? Read on to unpick the full narrative and the numbers behind it.

Result: Fair Value of $152.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising reliance on speculative builds and mounting incentives could quickly pressure margins if luxury buyer demand softens from today’s robust levels.

Find out about the key risks to this Toll Brothers narrative.

Another Angle on Value

Our SWS DCF model is less generous than the narrative fair value, with Toll Brothers' shares trading above an estimated fair value of $129.55. That implies the stock may be mildly overvalued on cash flow terms and raises the question: which story do you trust more, the model or the market?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toll Brothers for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toll Brothers Narrative

If you see the outlook differently or prefer to dig into the numbers yourself, you can build a complete view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Toll Brothers.

Ready for more investment ideas?

Do not stop with one great story, use the Simply Wall Street Screener today to uncover fresh opportunities before other investors even start looking.

- Boost your income potential by scanning these 13 dividend stocks with yields > 3% that combine solid yields with the balance sheets needed to sustain payouts through the cycle.

- Position ahead of the next AI surge by targeting these 25 AI penny stocks where real revenue traction and adoption trends back up the hype.

- Strengthen your long term returns by focusing on these 909 undervalued stocks based on cash flows that markets may be mispricing based on their cash flow power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Toll Brothers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOL

Toll Brothers

Designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)