- United States

- /

- Software

- /

- NasdaqGS:APP

US Growth Companies With High Insider Ownership In January 2025

Reviewed by Simply Wall St

As the U.S. stock market approaches record highs, driven by a surge in AI-related stocks and robust earnings reports, investors are keenly observing growth companies with significant insider ownership. In this thriving environment, such companies often attract attention due to their potential for strong alignment between management interests and shareholder value, offering a compelling proposition for those looking to capitalize on the current tech rally.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| MoneyLion (NYSE:ML) | 20.3% | 92.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.1% | 66.2% |

| Similarweb (NYSE:SMWB) | 25.4% | 126.3% |

Let's dive into some prime choices out of the screener.

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation develops a software-based platform to improve marketing and monetization for advertisers globally, with a market cap of approximately $113.56 billion.

Operations: The company's revenue is primarily derived from its Software Platform segment, generating $2.80 billion, and its Apps segment, contributing $1.49 billion.

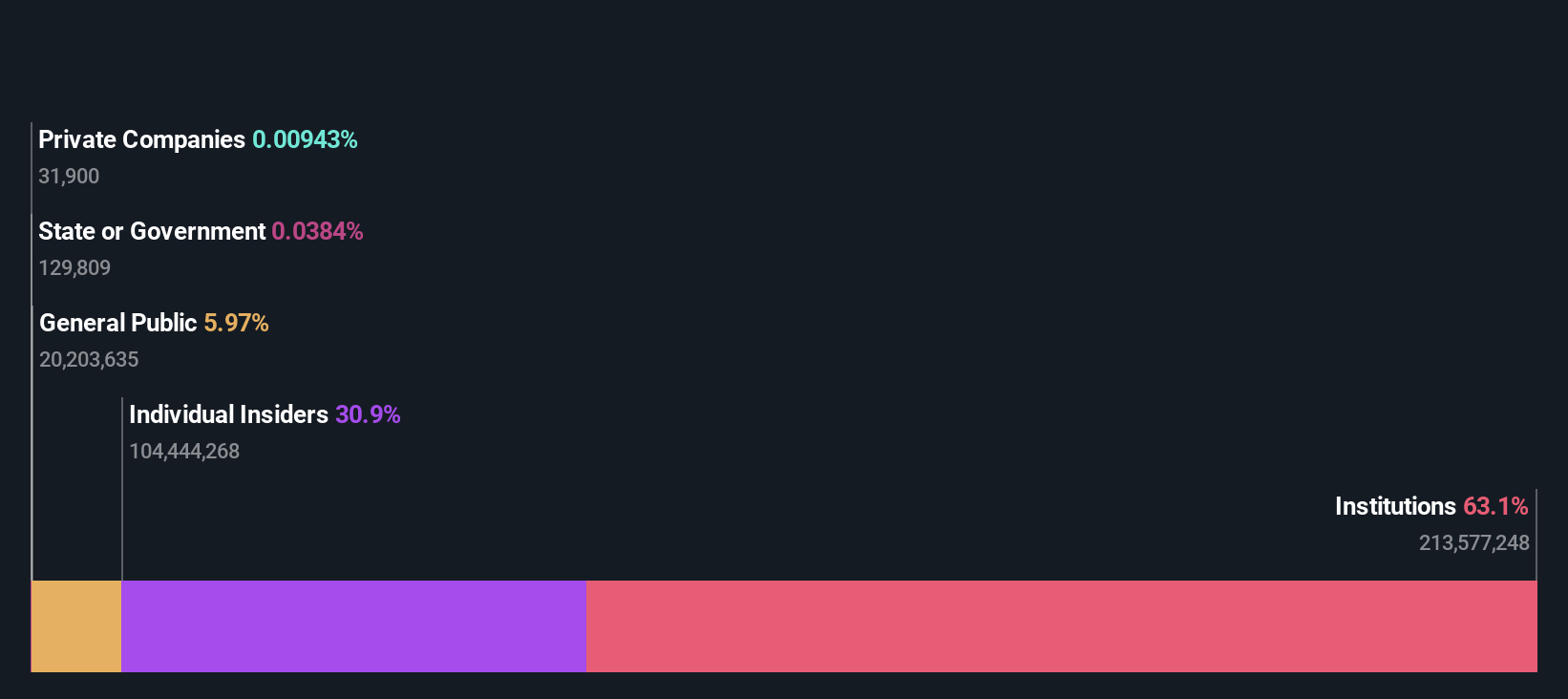

Insider Ownership: 35.5%

Revenue Growth Forecast: 18% p.a.

AppLovin has demonstrated significant earnings growth, with profits up very large over the past year. Despite a volatile share price recently, its revenue is forecast to grow faster than the US market at 18% annually. The company has issued substantial fixed-income offerings totaling billions, indicating a strategic focus on capital management amid high debt levels. Recent inclusion in the NASDAQ-100 Index reflects its growing prominence, though insider activity shows more selling than buying in recent months.

- Get an in-depth perspective on AppLovin's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility AppLovin's shares may be trading at a premium.

Super Micro Computer (NasdaqGS:SMCI)

Simply Wall St Growth Rating: ★★★★★★

Overview: Super Micro Computer, Inc. develops and manufactures high-performance server and storage solutions based on modular and open architecture globally, with a market cap of approximately $19.00 billion.

Operations: The company generates revenue of approximately $14.94 billion from its high-performance server solutions segment.

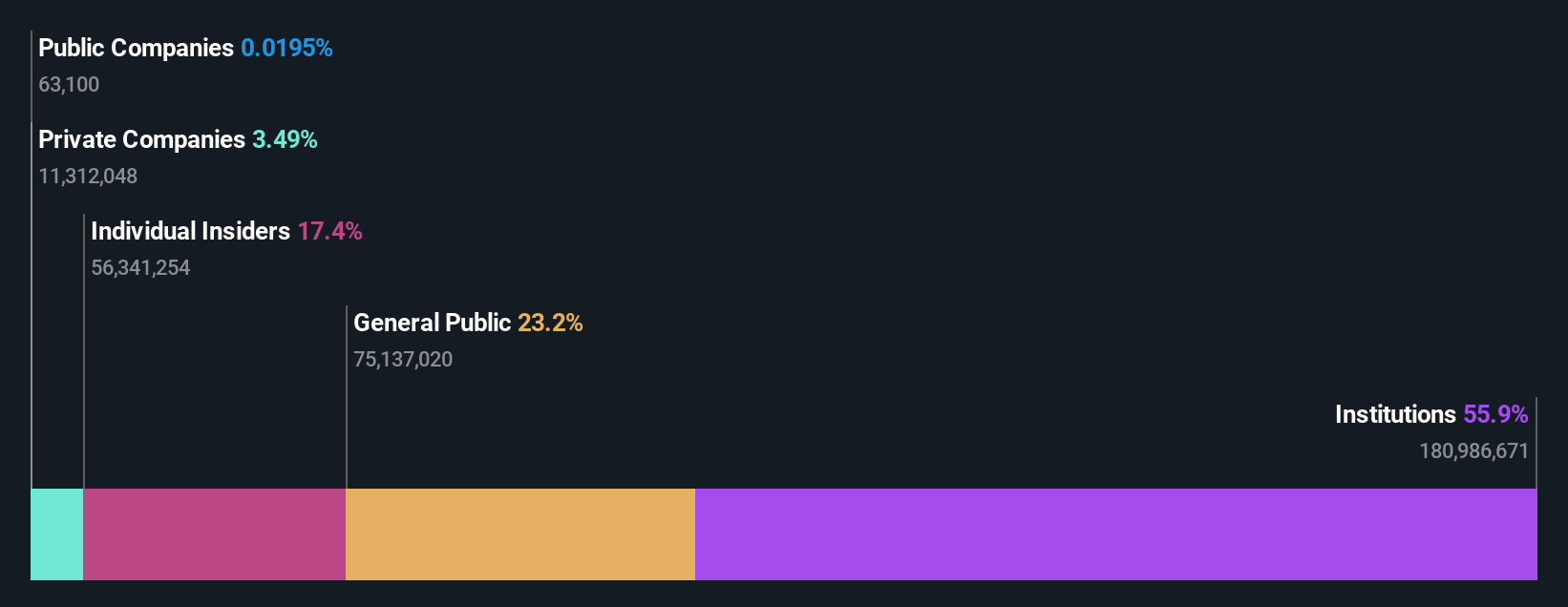

Insider Ownership: 14.4%

Revenue Growth Forecast: 24.1% p.a.

Super Micro Computer is experiencing rapid earnings growth, forecasted at 24.3% annually, outpacing the US market. Despite trading well below estimated fair value and offering good relative value compared to peers, it faces challenges with delayed SEC filings and compliance issues affecting its NASDAQ listing status. The company is addressing these through a compliance plan while also dealing with supply chain constraints impacting revenue growth. Recent unaudited results missed Wall Street expectations due to these delays and supply issues.

- Dive into the specifics of Super Micro Computer here with our thorough growth forecast report.

- The analysis detailed in our Super Micro Computer valuation report hints at an deflated share price compared to its estimated value.

On Holding (NYSE:ONON)

Simply Wall St Growth Rating: ★★★★★★

Overview: On Holding AG is involved in the development and distribution of sports products globally, with a market cap of approximately $19.19 billion.

Operations: The company's revenue segment includes Athletic Footwear, generating CHF 2.16 billion.

Insider Ownership: 19.1%

Revenue Growth Forecast: 20.1% p.a.

On Holding is experiencing robust growth, with revenue projected to increase over 20% annually, outpacing the US market. Earnings are expected to grow significantly at nearly 30% per year. Recent financial guidance was raised due to strong third-quarter results, forecasting net sales of at least CHF 2.29 billion for 2024. Despite a decline in quarterly net income compared to last year, overall sales have risen substantially, reflecting continued brand momentum and market expansion efforts.

- Take a closer look at On Holding's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that On Holding is priced higher than what may be justified by its financials.

Where To Now?

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 201 more companies for you to explore.Click here to unveil our expertly curated list of 204 Fast Growing US Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

High growth potential with solid track record.