- United States

- /

- Consumer Durables

- /

- NYSE:NVR

Shareholder Proposal Sparks Debate At NVR (NYSE:NVR) Annual Meeting

Reviewed by Simply Wall St

NVR (NYSE:NVR) recently faced shareholder activism with John Chevedden's proposal to amend governance documents, allowing shareholders with a combined 10% of stock to call special meetings. NVR advised voting against this, influencing the focus during its upcoming annual meeting. Over the past week, NVR's share price declined by 2% amid these developments. This drop is notable, as the broader market, including indices like the Dow Jones, saw gains with a surge ahead of the Federal Reserve's interest rate decision. Major companies like Tesla and Boeing experienced significant upside movements. Despite the market's positive momentum, NVR's price action appeared isolated, possibly impacted by the ongoing shareholder proposal discussions. The upcoming annual meeting scheduled for May 6, 2025, continues to draw investor focus, potentially influencing shareholder sentiment in this period of market anticipation and broader economic forecasts.

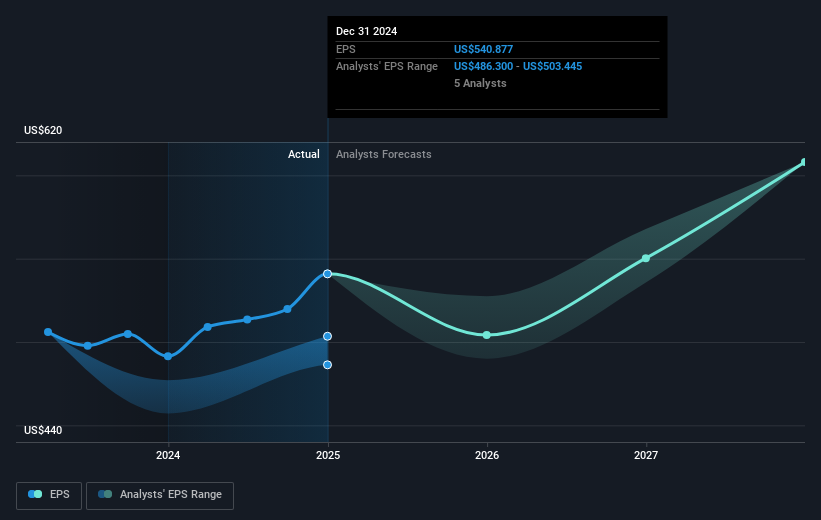

The last five years have been quite impactful for NVR, with the company's total shareholder returns, including share price and dividends, reaching 172.74%. This performance is notable against some challenges, including recent underperformance compared to the broader US market and Consumer Durables industry over the past year. NVR has expanded its profitability over this period, achieving a 15% annual growth in earnings, reflecting its strong operational execution.

Throughout this period, NVR has engaged in notable buyback programs, such as repurchasing approximately 64,216 shares for US$564.31 million from October to December 2024. These efforts, along with consistent earnings growth, contributed significantly to shareholder returns. However, NVR faces ongoing investor activism issues, with prominent proposals about governance changes potentially impacting future investor sentiment. As the market continues to anticipate the outcomes of these proposals and broader economic conditions, NVR's future trajectory remains under keen investor scrutiny.

Review our growth performance report to gain insights into NVR's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVR

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives