- United States

- /

- Luxury

- /

- NYSE:OXM

Ethan Allen Interiors And 2 Other Excellent Dividend Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences significant volatility due to escalating trade tensions and a steep decline in major indices, investors are increasingly looking for stability and reliable income sources. In such uncertain times, dividend stocks can offer a measure of resilience, providing regular income through dividends while potentially weathering market downturns better than non-dividend-paying counterparts.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.93% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.57% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 5.27% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 8.20% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 7.64% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.87% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.35% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.61% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 5.21% | ★★★★★★ |

Click here to see the full list of 176 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Ethan Allen Interiors (NYSE:ETD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ethan Allen Interiors Inc. is an interior design company that manufactures and retails home furnishings both in the United States and internationally, with a market cap of approximately $676.95 million.

Operations: Ethan Allen Interiors Inc. generates revenue through its Retail segment, which accounts for $534.78 million, and its Wholesale segment, contributing $353.90 million.

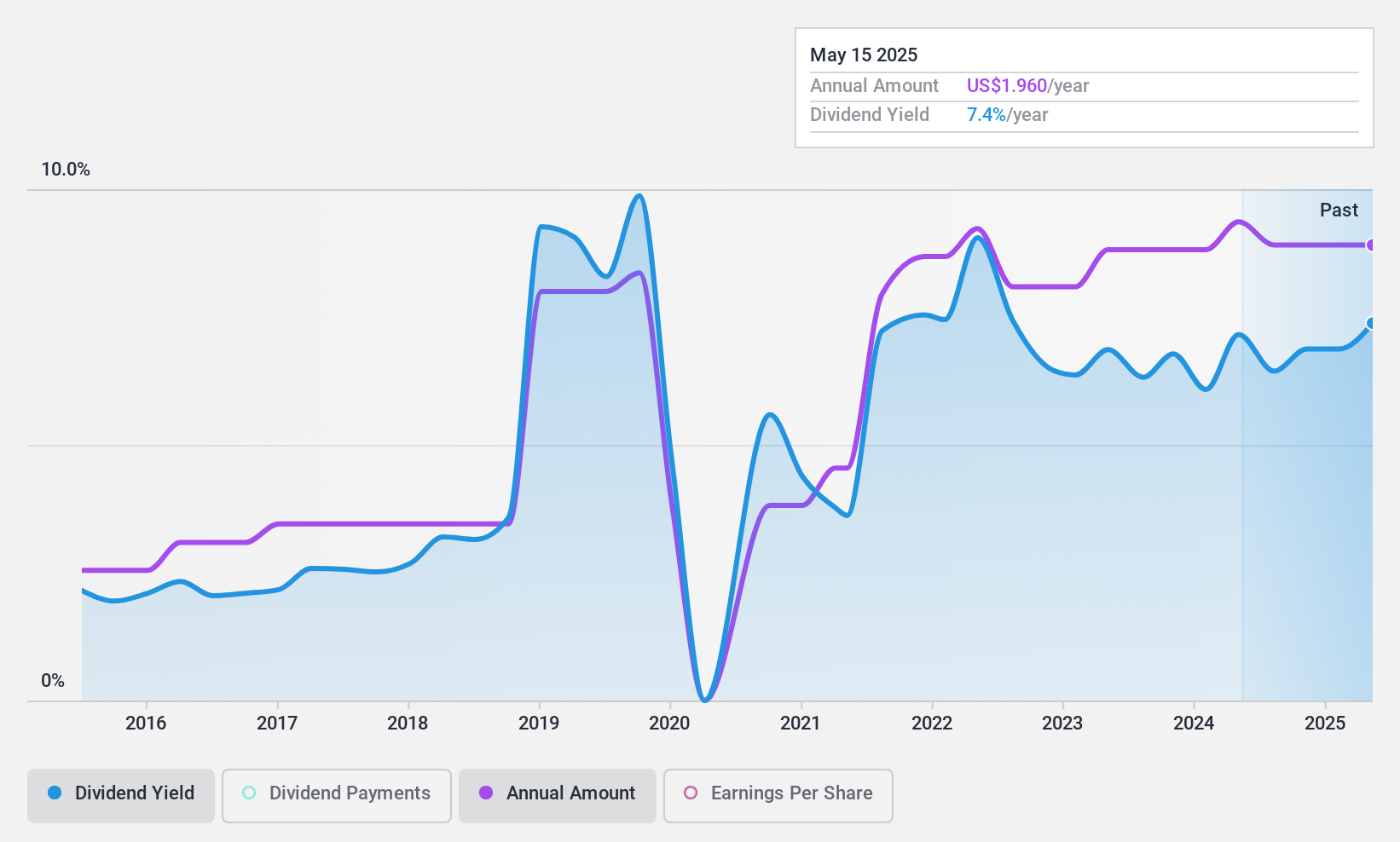

Dividend Yield: 7.4%

Ethan Allen Interiors offers a dividend yield in the top 25% of US payers, supported by earnings and cash flows with payout ratios of 63.9% and 76.8%, respectively. However, its dividend history is unstable with past volatility. Recent expansions include a new Toronto Design Studio, potentially enhancing revenue streams. Despite a slight decline in recent earnings, dividends remain consistent at $0.39 per share quarterly as affirmed by the board in January 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Ethan Allen Interiors.

- Our comprehensive valuation report raises the possibility that Ethan Allen Interiors is priced lower than what may be justified by its financials.

Oxford Industries (NYSE:OXM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oxford Industries, Inc. is an apparel company that designs, sources, markets, and distributes lifestyle and other brand products globally with a market cap of approximately $849.84 million.

Operations: Oxford Industries' revenue is generated from several segments, including Johnny Was at $194.98 million, Tommy Bahama at $869.60 million, Lilly Pulitzer at $323.92 million, and Emerging Brands contributing $128.43 million.

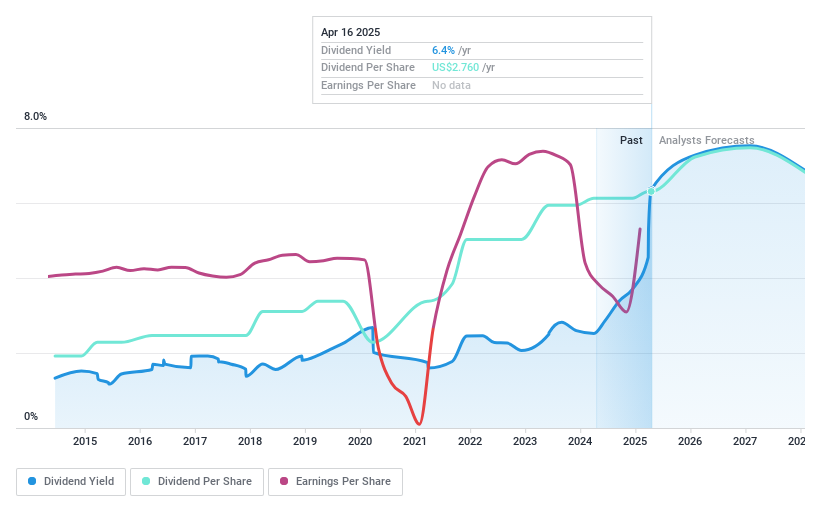

Dividend Yield: 4.8%

Oxford Industries recently increased its quarterly dividend by 3% to $0.69 per share, though its yield remains slightly below the top US payers. Despite a volatile dividend history, current payouts are well-supported by earnings and cash flows with payout ratios of 45.2% and 68.6%, respectively. The company reported improved net income for fiscal year-end February 2025 and announced a $100 million share repurchase program, indicating confidence in financial stability despite projected lower sales and EPS for fiscal 2025 due to tariffs and tax adjustments.

- Unlock comprehensive insights into our analysis of Oxford Industries stock in this dividend report.

- Our expertly prepared valuation report Oxford Industries implies its share price may be lower than expected.

Universal Insurance Holdings (NYSE:UVE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Universal Insurance Holdings, Inc., with a market cap of approximately $626.26 million, operates as an integrated insurance holding company in the United States through its subsidiaries.

Operations: Universal Insurance Holdings generates revenue primarily from its Property & Casualty insurance segment, totaling approximately $1.52 billion.

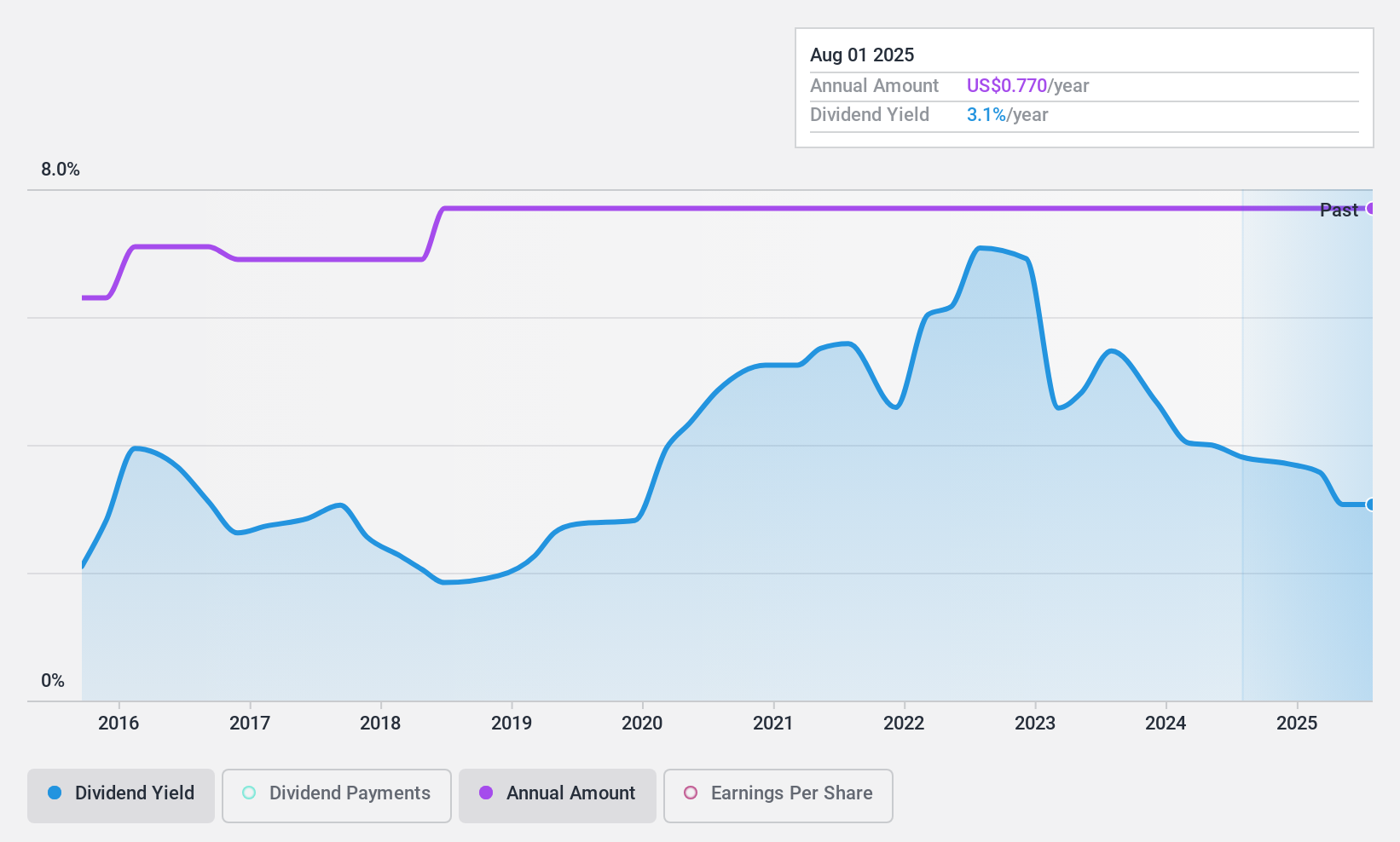

Dividend Yield: 3.5%

Universal Insurance Holdings maintains a stable dividend, currently yielding 3.45%, supported by low payout ratios of 31% for earnings and 16.6% for cash flows. Although dividends have grown steadily over the past decade, recent financial results show a decline in net income to US$58.93 million for 2024 from US$66.82 million in the previous year. The company has also completed share buybacks worth US$17.42 million, reflecting strategic capital management amidst insider selling concerns.

- Dive into the specifics of Universal Insurance Holdings here with our thorough dividend report.

- Our valuation report here indicates Universal Insurance Holdings may be undervalued.

Where To Now?

- Click here to access our complete index of 176 Top US Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OXM

Oxford Industries

An apparel company, designs, sources, markets, and distributes products of lifestyle and other brands worldwide.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives