- United States

- /

- Banks

- /

- NasdaqCM:CIVB

Top Dividend Stocks To Consider In September 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility with the S&P 500 and Nasdaq reaching new highs before pulling back, investors are keenly watching the Federal Reserve's anticipated decision to cut interest rates. In this dynamic environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.51% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.56% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.86% | ★★★★★★ |

| Ennis (EBF) | 5.50% | ★★★★★★ |

| Employers Holdings (EIG) | 3.09% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.64% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.68% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.65% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.32% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.27% | ★★★★★☆ |

Click here to see the full list of 125 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Civista Bancshares (CIVB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Civista Bancshares, Inc. is the financial holding company for Civista Bank, offering community banking services in the United States with a market cap of $402.67 million.

Operations: Civista Bancshares, Inc. generates its revenue primarily from its banking segment, which accounts for $157.43 million.

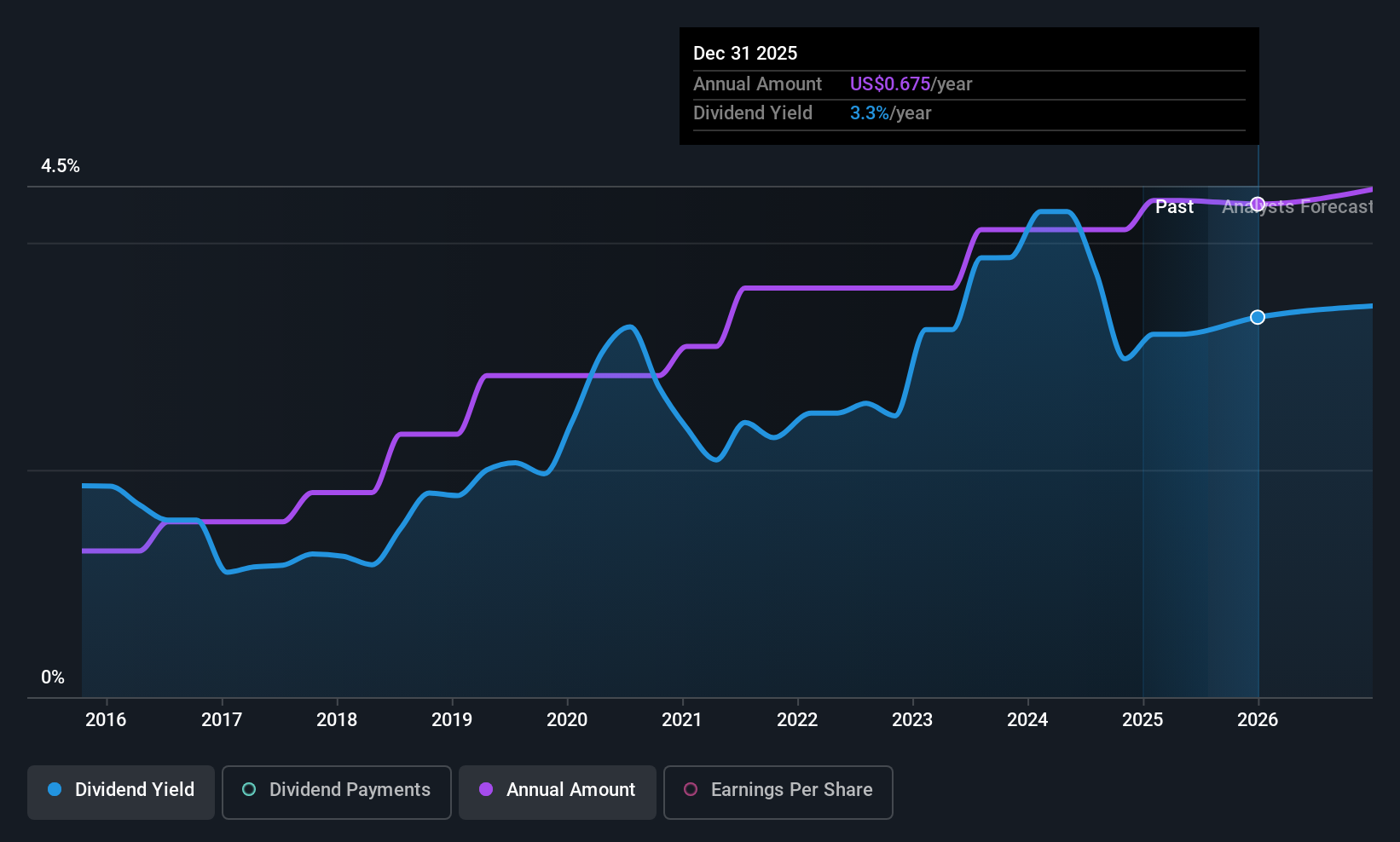

Dividend Yield: 3.3%

Civista Bancshares offers a stable dividend history with consistent growth over the past decade, though its 3.3% yield is below the top quartile of U.S. dividend payers. Despite recent shareholder dilution from a $70 million equity offering, dividends remain well-covered by earnings due to a low payout ratio of 26.2%. Recent executive changes and strong earnings growth underscore operational stability, yet future dividend coverage remains uncertain without sufficient forward-looking data.

- Dive into the specifics of Civista Bancshares here with our thorough dividend report.

- The analysis detailed in our Civista Bancshares valuation report hints at an deflated share price compared to its estimated value.

JAKKS Pacific (JAKK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JAKKS Pacific, Inc. is a company that designs, produces, markets, sells, and distributes toys and related consumer products globally, with a market cap of approximately $201.42 million.

Operations: JAKKS Pacific's revenue primarily comes from its Toys/Consumer Products segment, which generated $706.62 million, while the Costumes segment reported a loss of $21.93 million.

Dividend Yield: 5.6%

JAKKS Pacific's recent dividend initiation offers a compelling yield of 5.55%, placing it among the top 25% of U.S. dividend payers, supported by a low payout ratio of 14.4%. Despite a forecasted earnings decline, dividends are well-covered by cash flows, with a cash payout ratio at 28.2%. The company continues to innovate through collaborations like Disney Darlings and strategic product launches, though its short dividend history limits reliability assessments for consistent payouts over time.

- Navigate through the intricacies of JAKKS Pacific with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that JAKKS Pacific is trading behind its estimated value.

Paychex (PAYX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Paychex, Inc., along with its subsidiaries, offers human capital management solutions including payroll, employee benefits, HR, and insurance services for small to medium-sized businesses across the United States, Europe, and India; it has a market cap of approximately $47.46 billion.

Operations: Paychex's revenue from its Staffing & Outsourcing Services segment is approximately $5.57 billion.

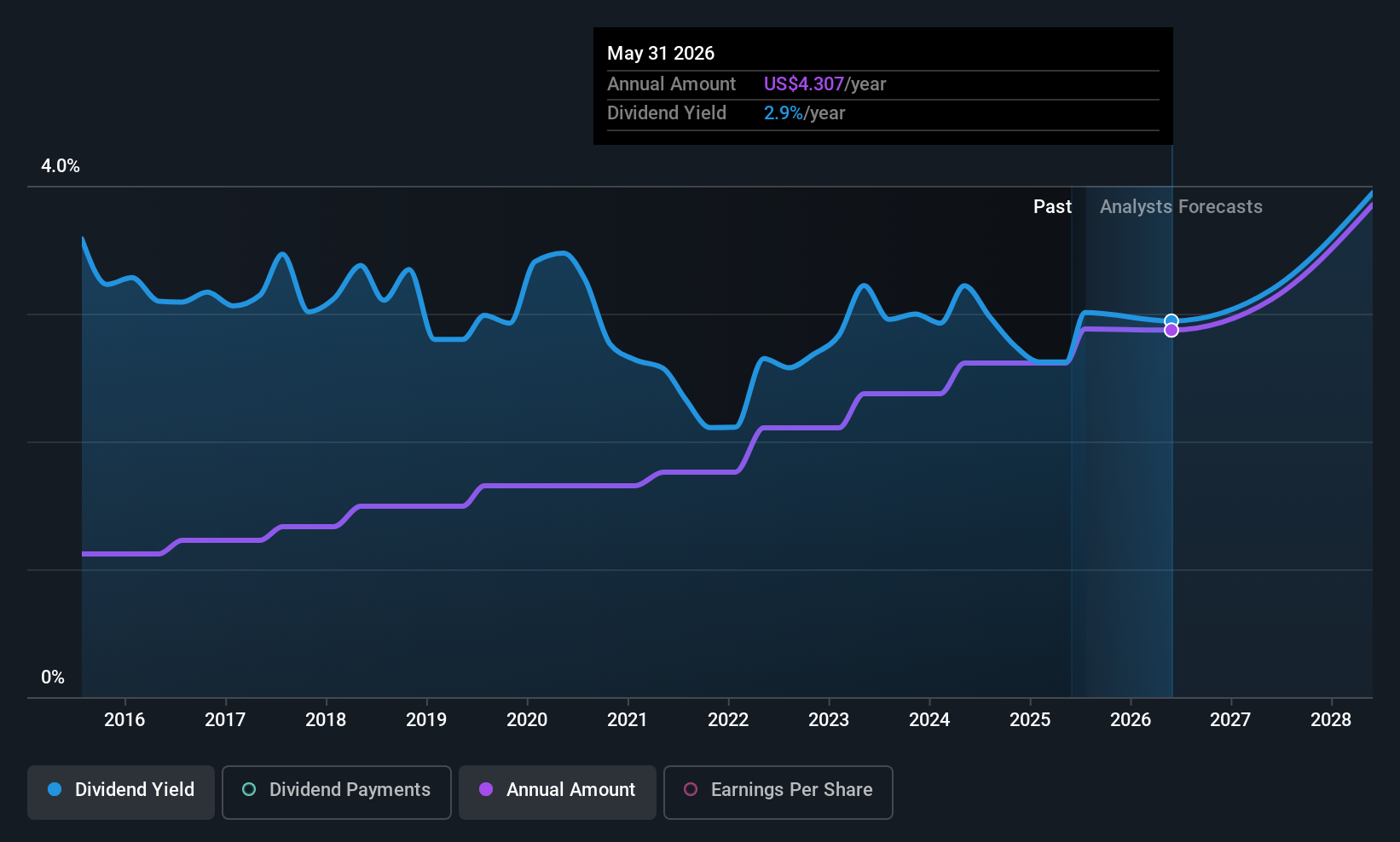

Dividend Yield: 3.3%

Paychex's dividend yield of 3.28% is relatively low compared to top U.S. dividend payers, with a high payout ratio of 87.4%. Recent earnings growth and stable dividends over the past decade are positive, but the cash payout ratio of 90.9% raises concerns about sustainability from cash flows alone. The integration of Bill Pay into Paychex Flex aims to enhance operational efficiency for SMBs, potentially supporting future financial stability despite current high debt levels.

- Click here and access our complete dividend analysis report to understand the dynamics of Paychex.

- Our valuation report here indicates Paychex may be undervalued.

Seize The Opportunity

- Navigate through the entire inventory of 125 Top US Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CIVB

Civista Bancshares

Operates as the financial holding company for Civista Bank that provides community banking services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives