- United States

- /

- Metals and Mining

- /

- NYSE:SXC

3 Reliable Dividend Stocks To Consider Yielding Up To 8%

Reviewed by Simply Wall St

As the U.S. markets face turbulence with stocks plunging due to tariff concerns and economic uncertainties, investors are seeking stability amid the volatility. In such an environment, dividend stocks can offer a reliable income stream, providing potential cushioning against market fluctuations while contributing to long-term investment goals.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.75% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.68% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.00% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.46% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.24% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.86% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.50% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.48% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.82% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.63% | ★★★★★★ |

Click here to see the full list of 154 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

CompX International (NYSEAM:CIX)

Simply Wall St Dividend Rating: ★★★★★★

Overview: CompX International Inc. manufactures and sells security products and recreational marine components primarily in North America, with a market cap of approximately $279.26 million.

Operations: CompX International generates revenue from two main segments: Security Products, which accounts for $115.24 million, and Marine Components, contributing $30.70 million.

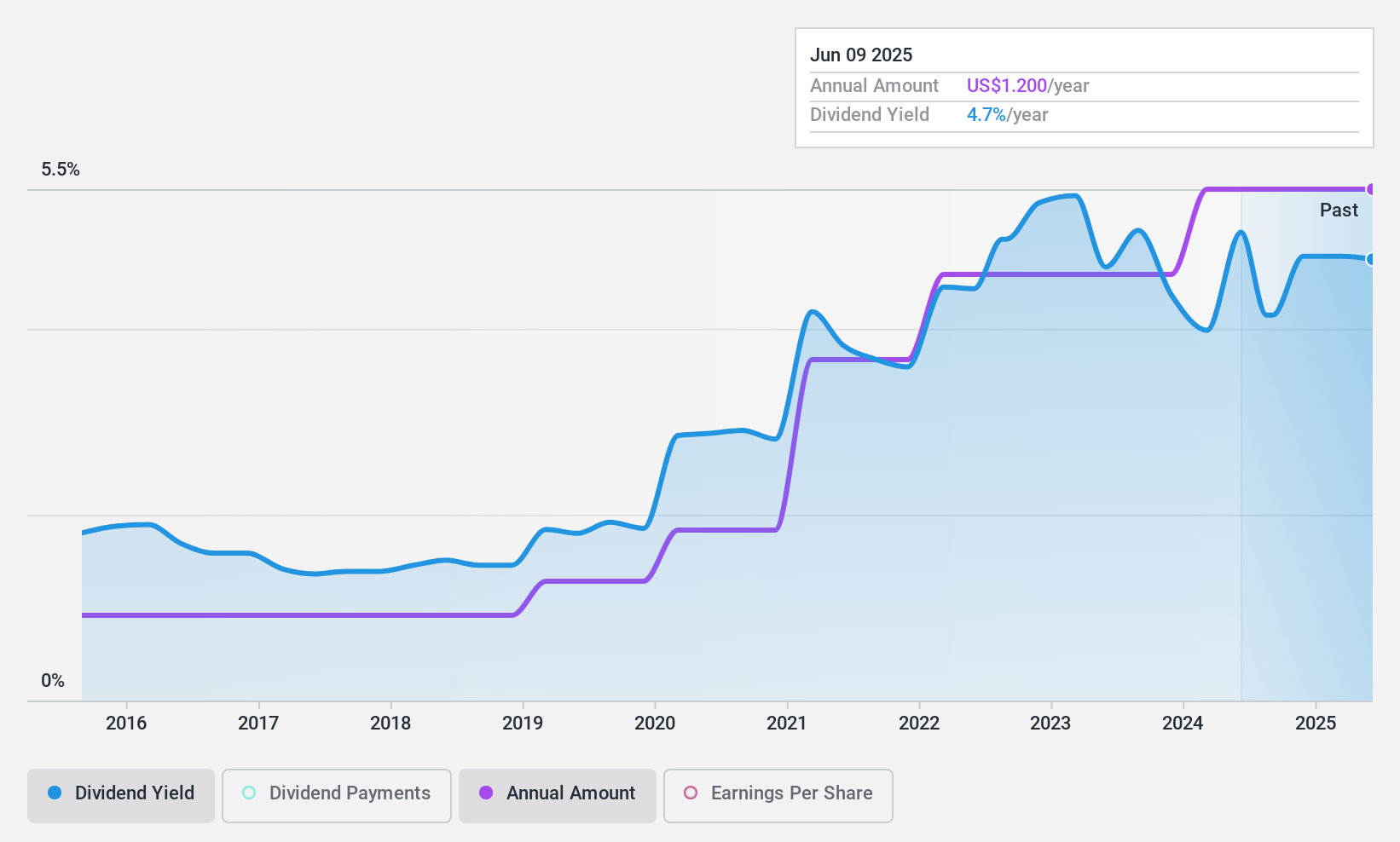

Dividend Yield: 5.3%

CompX International maintains a strong dividend profile, offering a high yield of 5.29%, placing it in the top quartile of US dividend payers. Despite recent declines in sales and net income, dividends remain stable and have grown over the past decade. The company's payout ratios—89.1% for earnings and 68.7% for cash flow—suggest sustainable distributions, supported by consistent free cash flow coverage. Recent affirmations confirm continued quarterly payouts of $0.30 per share.

- Click here to discover the nuances of CompX International with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that CompX International is trading behind its estimated value.

Artisan Partners Asset Management (NYSE:APAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Artisan Partners Asset Management Inc. is a publicly owned investment manager with a market cap of $3.46 billion.

Operations: Artisan Partners Asset Management Inc. generates revenue primarily from its Investment Management Industry segment, which accounts for $1.11 billion.

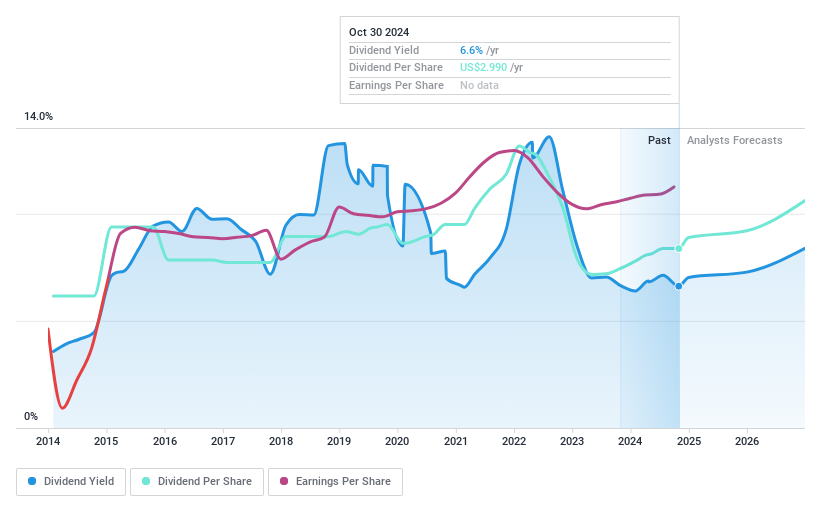

Dividend Yield: 8.1%

Artisan Partners Asset Management offers an attractive dividend yield, ranking in the top 25% of US payers. Despite a history of volatility and unreliability in dividend payments, recent increases reflect strong earnings growth and cash flow coverage with payout ratios at 81.5% for earnings and 75.9% for cash flow. Trading below estimated fair value enhances its appeal, though investors should note upcoming leadership changes with Jason Gottlieb set to become CEO after the June 2025 meeting.

- Click to explore a detailed breakdown of our findings in Artisan Partners Asset Management's dividend report.

- Our valuation report here indicates Artisan Partners Asset Management may be undervalued.

SunCoke Energy (NYSE:SXC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SunCoke Energy, Inc. is an independent producer of coke operating in the Americas and Brazil, with a market cap of $763.39 million.

Operations: SunCoke Energy's revenue segments are comprised of $105.90 million from Logistics, $35.10 million from Brazil Coke, and $1.82 billion from Domestic Coke.

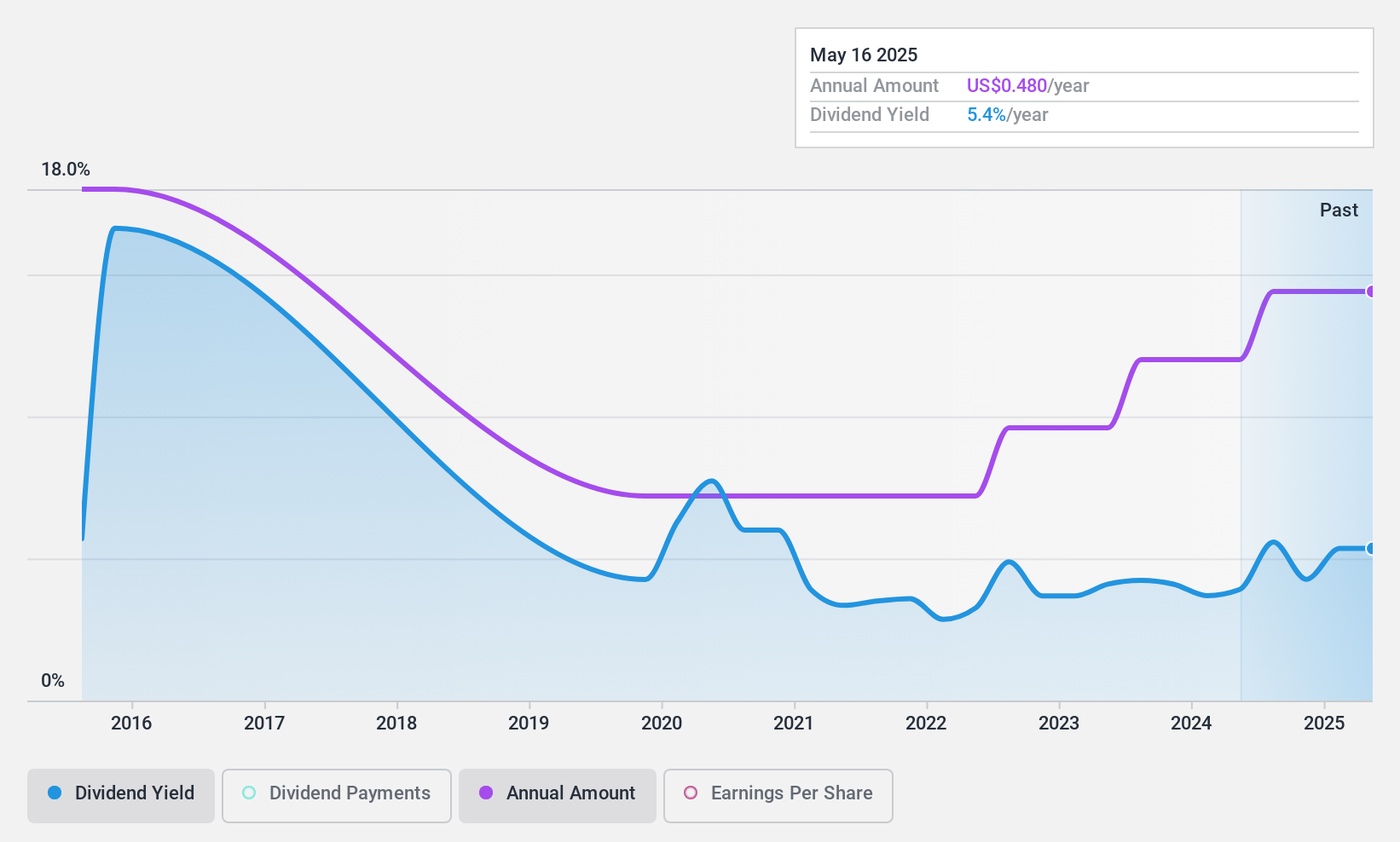

Dividend Yield: 5.3%

SunCoke Energy's dividend yield is among the top 25% in the US market, supported by a low payout ratio of 39%, indicating strong earnings coverage. Despite past volatility and an unstable track record, recent earnings growth of 66.8% enhances its current dividend reliability. The company's dividends are well-covered by both earnings and cash flows, with a cash payout ratio of 42.2%. Trading below fair value adds potential appeal for investors seeking value in dividend stocks.

- Click here and access our complete dividend analysis report to understand the dynamics of SunCoke Energy.

- The valuation report we've compiled suggests that SunCoke Energy's current price could be quite moderate.

Where To Now?

- Embark on your investment journey to our 154 Top US Dividend Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SXC

SunCoke Energy

Operates as an independent producer of coke in the Americas and Brazil.

Undervalued with solid track record and pays a dividend.