- United States

- /

- Professional Services

- /

- NYSE:TRU

TransUnion (NYSE:TRU) Expands Truework Partnership Enhancing Mortgage Lenders' Access To Verification Solutions

Reviewed by Simply Wall St

Over the last week, TransUnion (NYSE:TRU) saw its share price decrease by 3.62%. This period coincided with the advancement of its partnership with Truework, aimed at enhancing income and employment verifications for mortgage lenders through the TruVision solution. While this collaboration marks a significant step in service offering, market conditions appear to have had a more substantial impact on the company's stock performance. The broader market experienced a 2.5% decline, heavily influenced by investor reactions to new U.S. tariffs against key trade partners, which led to a broad-based sell-off in financial services and other sectors. Despite the promising developments within TransUnion's operations, the market downturn, propelled by the tariffs and its cascading effects, likely played a dominant role in the company's recent share price performance.

Click to explore a detailed breakdown of our findings on TransUnion.

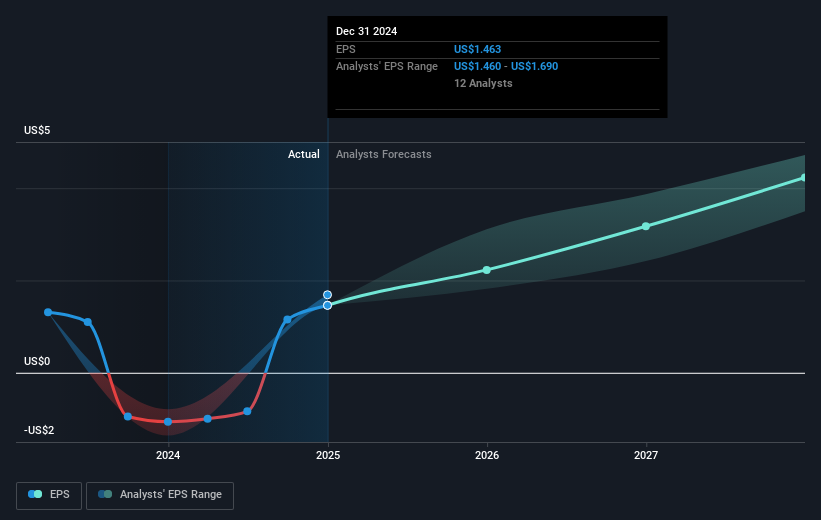

Over the past year, TransUnion (NYSE:TRU) achieved a total shareholder return of 14.43%. While this demonstrates solid performance, it marginally underperformed the broader US market return of 15.3%. Despite this, TransUnion has surpassed the Professional Services industry, which saw a slight decline. Several key developments likely supported this performance. March 2024 saw the announcement of enhancements to the TruVision solution, expanding capabilities for mortgage lenders, and this was complemented by solid financial results throughout the year, especially notable in Q2 2024, with revenue of US$1.04 billion and net income of US$85 million.

TransUnion's strategic initiatives, including share buybacks with a program announced in February 2025 to repurchase up to US$500 million in shares, have further bolstered investor confidence. Additionally, executive leadership changes, such as the February 2025 appointment of Tiffani Chambers as Executive Vice President and COO to oversee global operations, may have created optimistic sentiment about the company’s operational and growth trajectory. These factors collectively contributed to its overall return performance.

- Analyze TransUnion's fair value against its market price in our detailed valuation report—access it here.

- Assess the potential risks impacting TransUnion's growth trajectory—explore our risk evaluation report.

- Have a stake in TransUnion? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransUnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRU

TransUnion

Operates as a global consumer credit reporting agency that provides risk and information solutions.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives