- United States

- /

- Professional Services

- /

- NYSE:TRU

How TransUnion's (TRU) Enhanced Mortgage Scoring Could Shape Its Financial Inclusion and Growth Strategy

Reviewed by Sasha Jovanovic

- In October 2025, TransUnion unveiled significant mortgage credit scoring and pricing enhancements, including discounted access to VantageScore 4.0 and free simulators for industry participants, aiming to improve financial inclusion and address steep FICO price increases.

- This initiative leverages trended and alternative data to expand mortgage access for 33 million credit-invisible consumers while providing lenders with cost certainty in a changing regulatory environment.

- We'll now look at how TransUnion's expanded mortgage scoring offerings may impact its investment case and growth narrative going forward.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

TransUnion Investment Narrative Recap

To believe in TransUnion as a shareholder today, you need to have conviction in the rising long-term demand for consumer credit data and risk analytics, particularly as financial services digitize and new credit models gain traction. The recent announcement about discounted VantageScore 4.0 access is potentially significant for expanding addressable markets and supporting pricing power, but it does not immediately overshadow the biggest current risk: regulatory scrutiny and data privacy rules, which remain a key uncertainty for near-term results.

Among recent news, TransUnion’s expanded partnership with RPM Living stands out as a practical example of how alternative data and specialized analytics are being adopted at scale within property management. This adoption supports the broader catalyst of increasing demand for advanced, industry-specific credit and risk solutions, possibly enhancing margin resilience as traditional bureau services face pricing pressure. In contrast, investors should be mindful of how increased regulatory attention on data practices could...

Read the full narrative on TransUnion (it's free!)

TransUnion's narrative projects $5.6 billion in revenue and $869.9 million in earnings by 2028. This requires 8.4% yearly revenue growth and a $477.9 million earnings increase from the current $392.0 million.

Uncover how TransUnion's forecasts yield a $107.00 fair value, a 32% upside to its current price.

Exploring Other Perspectives

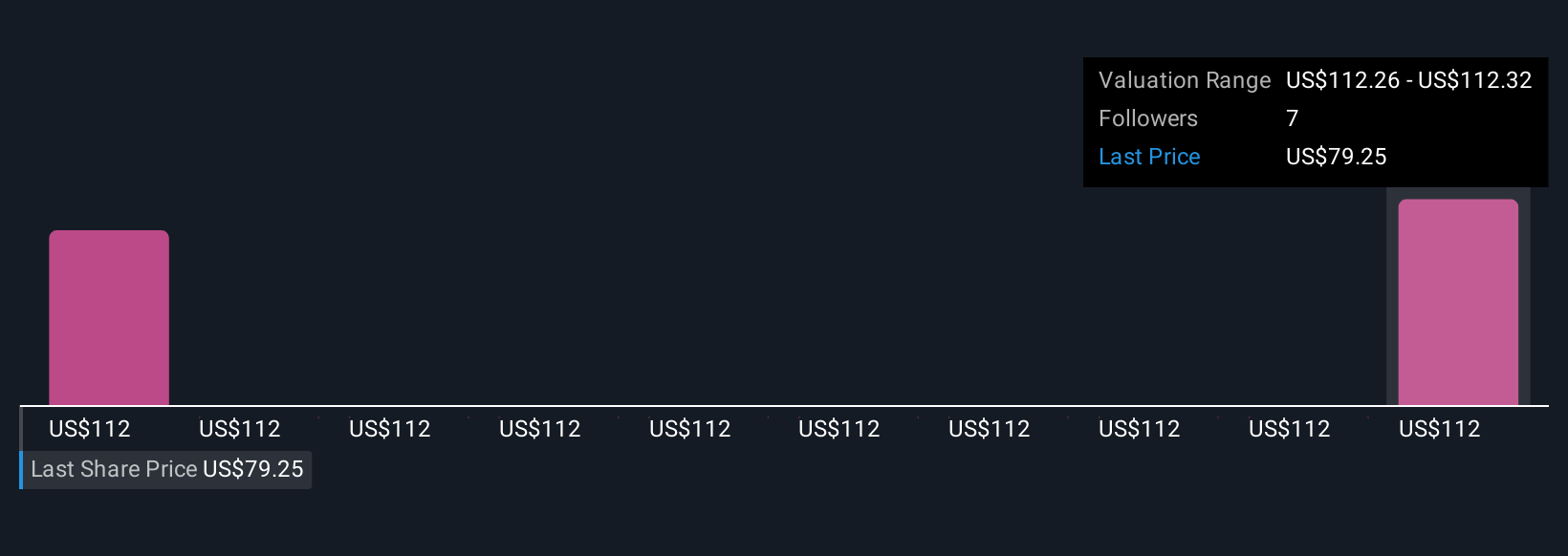

Simply Wall St Community members have offered two fair value estimates for TransUnion, ranging from US$107.00 to US$107.83 per share. While opinions differ, many are weighing the implications of regulatory risk for future earnings potential, reminding you to consider several viewpoints before making decisions.

Explore 2 other fair value estimates on TransUnion - why the stock might be worth just $107.00!

Build Your Own TransUnion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TransUnion research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TransUnion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TransUnion's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransUnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRU

TransUnion

Operates as a global consumer credit reporting agency that provides risk and information solutions.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives