- United States

- /

- Commercial Services

- /

- NYSE:ROL

Rollins (ROL) Board Declares Regular US$0.17 Dividend for September Payout

Reviewed by Simply Wall St

Rollins (ROL) affirmed a quarterly dividend of $0.165 per share, reflecting its dedication to shareholder value. Despite a modest 1% price increase in the last quarter, this was in line with broader market trends, which rose by 1% over the same period, suggesting the dividend affirmation had a neutral effect. Upcoming Q2 earnings results could potentially impact future performance. Meanwhile, the market continues to hit record highs due to trade optimism and anticipated earnings from major tech companies, highlighting a more optimistic sentiment across sectors that's been shared by Rollins' price stability.

Buy, Hold or Sell Rollins? View our complete analysis and fair value estimate and you decide.

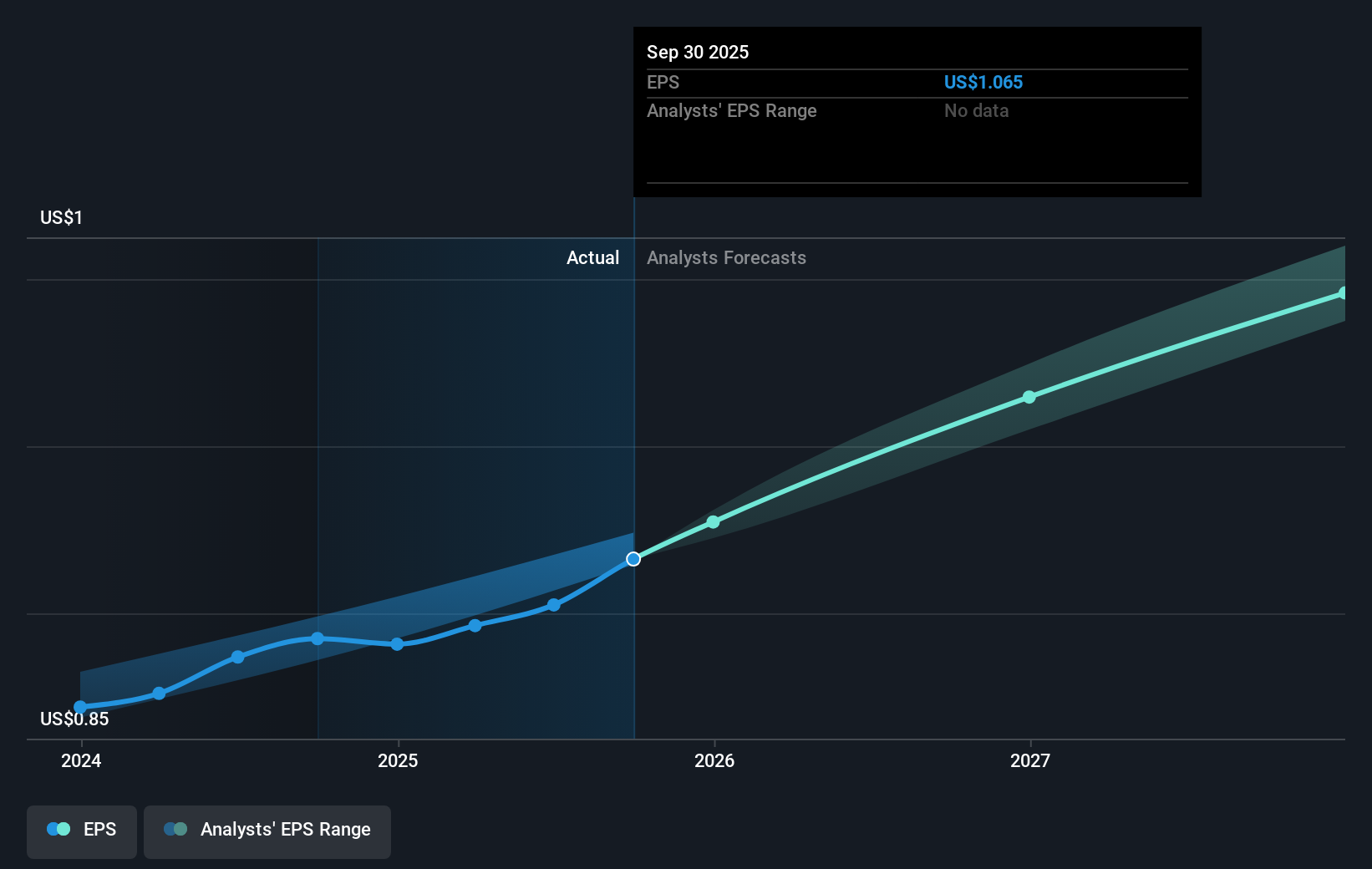

The affirmation of Rollins' dividend underlines its commitment to delivering shareholder value, but the neutral market reaction suggests limited immediate impact on the company's prevailing narrative. While the market is experiencing record highs, Rollins' share price movement remains largely stable, pointing towards investor confidence in its consistent business model over flash responses to short-term market changes. As Rollins continues its strategic acquisitions, such as Saela Pest Control, and investment in operational efficiencies, these moves are likely to bolster revenue and earnings projections. However, market uncertainties and cost pressures could still pose challenges to these forecasts.

Over the past five years, Rollins' total return, including dividends, was 81.29%, showing strong long-term performance and the company's capability to generate returns despite recent modest gains. Compared to the broader market, Rollins underperformed the US market return of 13.7% over the past year, but it did exceed the US Commercial Services industry return of 4.7% during the same period. This indicates Rollins' robust standing within its industry, although broader market conditions were more favorable.

In the context of the current share price of US$55.51 and an analyst price target of US$56.18, the price movement offers a slight discount, suggesting limited upside according to market consensus. Rollins' performance against this target will be crucial to watch, especially as future earnings releases and external economic factors may influence its trajectory. As ongoing investments aim to enhance both revenue and operational efficiency, the alignment of these moves with such forecasts will determine whether Rollins meets, exceeds, or falls short of these expectations.

Examine Rollins' past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROL

Rollins

Through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)