- United States

- /

- Professional Services

- /

- NYSE:NSP

3 US Dividend Stocks Yielding At Least 3% For Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market continues to hover near record highs, buoyed by a surge in AI-related stocks and robust earnings across various sectors, investors are keenly observing opportunities for stable returns amidst this dynamic environment. In such a climate, dividend stocks yielding at least 3% can offer an attractive blend of income and potential capital appreciation, making them a compelling choice for those looking to balance growth with steady cash flow in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.66% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.68% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.45% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.97% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.01% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.51% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.81% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.91% | ★★★★★★ |

Click here to see the full list of 143 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Ituran Location and Control (NasdaqGS:ITRN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ituran Location and Control Ltd., along with its subsidiaries, offers location-based telematics services and machine-to-machine telematics products, with a market cap of approximately $659.87 million.

Operations: The company's revenue is derived from two main segments: Telematics Products, which contribute $90.81 million, and Telematics Services, which account for $240.37 million.

Dividend Yield: 4.6%

Ituran Location and Control offers a dividend yield in the top 25% of US payers, supported by both earnings and cash flow coverage. Despite this, its dividend history has been volatile over the past decade. Recent strategic expansion into India's telematics sector and a new agreement with Nissan Chile highlight growth potential, while earnings have shown consistent improvement. The company recently affirmed a US$0.39 per share dividend, reflecting ongoing shareholder returns amidst strategic developments.

- Take a closer look at Ituran Location and Control's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Ituran Location and Control is trading behind its estimated value.

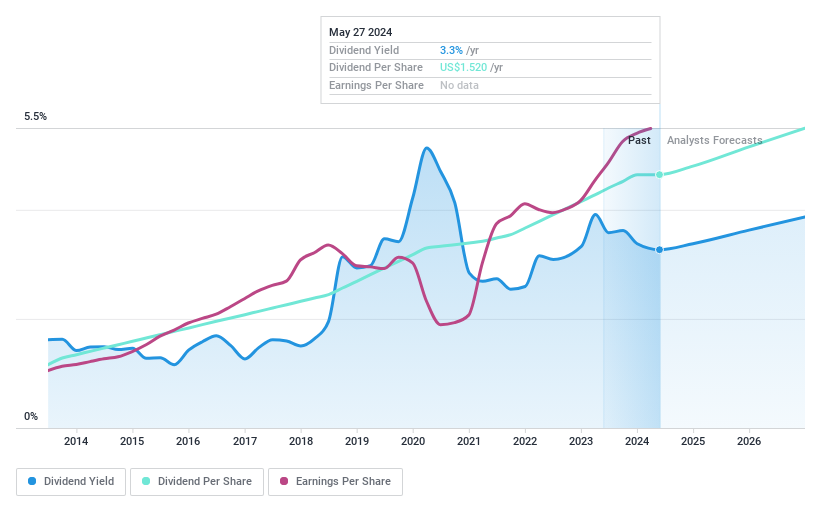

Bank OZK (NasdaqGS:OZK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank OZK offers a range of retail and commercial banking services to individuals and businesses in the United States, with a market cap of approximately $5.73 billion.

Operations: Bank OZK generates revenue primarily from its Community Banking segment, which accounts for $1.48 billion.

Dividend Yield: 3.3%

Bank OZK offers a stable dividend history with consistent increases over 58 quarters, currently yielding 3.3%, though below the top US payers. Its dividends are well covered by a low payout ratio of 25.6%, ensuring sustainability and reliability. Recent earnings showed growth, with net income reaching US$716.46 million for the year, reflecting solid financial performance despite insider selling concerns in recent months.

- Click to explore a detailed breakdown of our findings in Bank OZK's dividend report.

- The valuation report we've compiled suggests that Bank OZK's current price could be quite moderate.

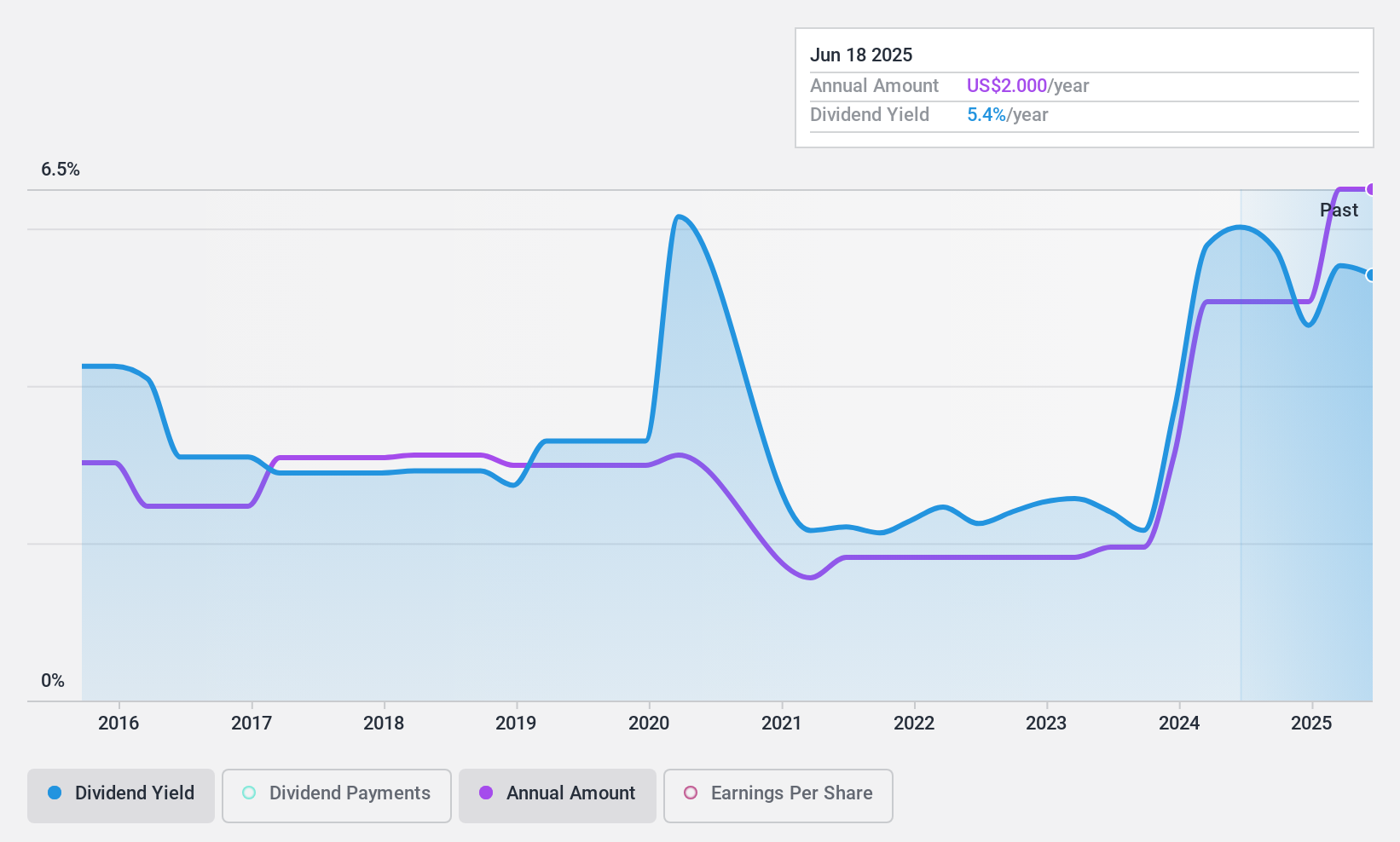

Insperity (NYSE:NSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Insperity, Inc. provides human resources and business solutions aimed at enhancing the performance of small and medium-sized businesses in the United States, with a market cap of approximately $3.01 billion.

Operations: Insperity, Inc.'s revenue is primarily derived from its Staffing & Outsourcing Services segment, which generated approximately $6.55 billion.

Dividend Yield: 3%

Insperity declared a quarterly dividend of US$0.60 per share, continuing a decade-long trend of stable and growing dividends despite a low yield of 3.03%. However, the dividend is not covered by free cash flows and is only partially supported by earnings, raising sustainability concerns. Recent financials showed declining profitability with net income dropping to US$3 million in Q3 2024 from US$45 million the previous year, alongside significant insider selling activity.

- Click here and access our complete dividend analysis report to understand the dynamics of Insperity.

- Our comprehensive valuation report raises the possibility that Insperity is priced lower than what may be justified by its financials.

Summing It All Up

- Click through to start exploring the rest of the 140 Top US Dividend Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Insperity, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSP

Insperity

Engages in the provision of human resources (HR) and business solutions to improve business performance for small and medium-sized businesses primarily in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives