- United States

- /

- Professional Services

- /

- NYSE:EFX

Evaluating Equifax After Share Price Drop and 2025 Revenue Outlook Upgrade

Reviewed by Bailey Pemberton

Thinking about what to do with your Equifax shares or considering a new position? You are definitely not alone. With a recent close of $239.68, Equifax’s stock has had investors turning their heads, both for the short-term bumps and the long-term possibilities. Over the past week, the share price slipped 5.6%, extending a slow slide that has the 1-year return hovering at -15.1%. But here is the twist: take a longer view and you will see gains of 48.6% over three years and 51.3% across five years. That rollercoaster performance has come alongside shifting market sentiment about data security and economic trends that influence all the major credit bureaus.

So, is Equifax on sale, or are these price movements justified given the risks? When I crunch the numbers, Equifax clocks a valuation score of 2 out of 6. In other words, the stock looks undervalued in a couple key areas but not across the board. We will dig into what that means, breaking down the main valuation yardsticks that investors use, and I will share a more insightful way to frame value toward the end.

Equifax scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Equifax Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future free cash flows and discounting them back to their present value. This approach gives investors a way to judge whether today's price reflects what the company's future earnings are worth in today's dollars.

For Equifax, the analysis begins with current Free Cash Flow of $800 million. According to projections, annual free cash flow is expected to grow substantially, reaching around $2.08 billion by 2029. These estimates are drawn from a mix of analyst forecasts for the next few years and extended projections provided by Simply Wall St. This indicates a strong trajectory, with cash flows consistently rising over the next decade.

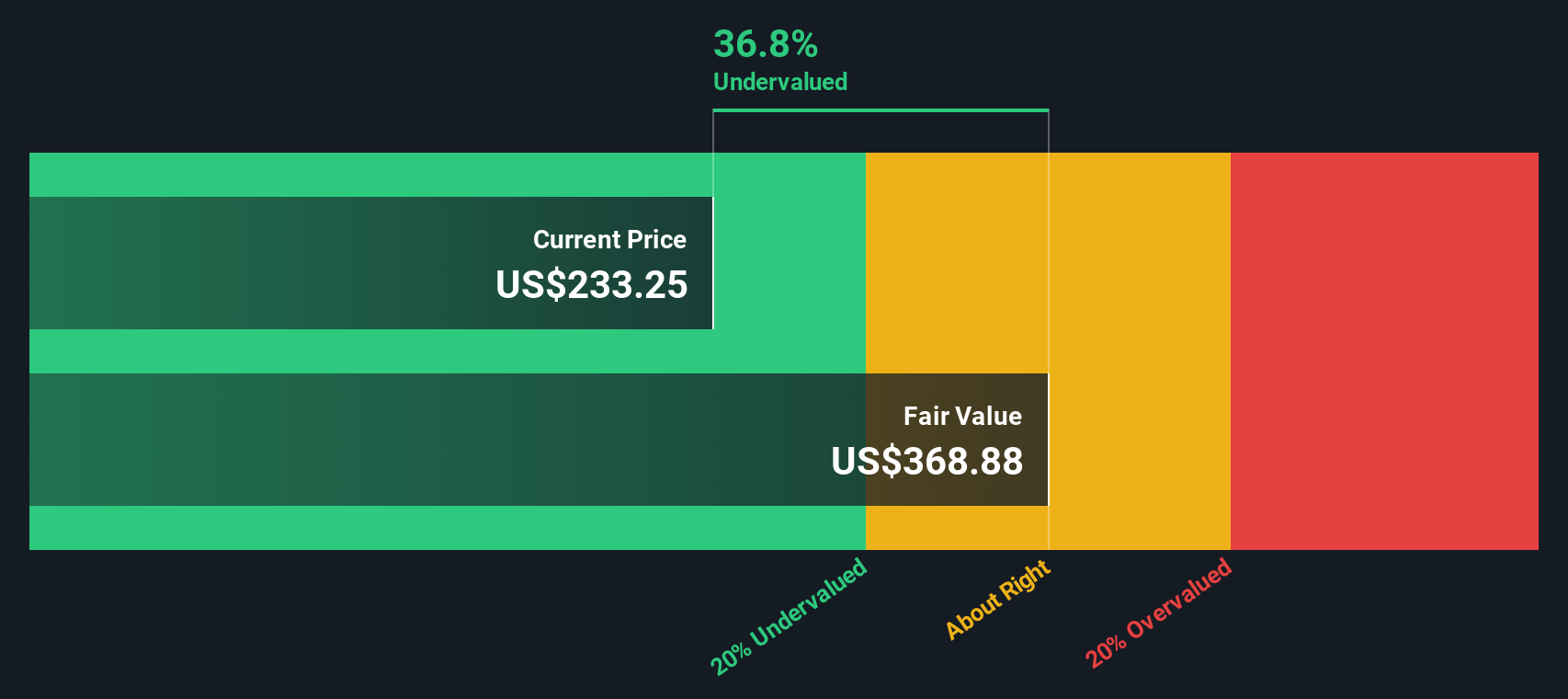

Based on this two-stage Free Cash Flow to Equity model, the estimated intrinsic value for Equifax is $369.11 per share. At its recent price of $239.68, this suggests the stock trades at a 35.1% discount compared to its calculated fair value. According to the DCF, Equifax shares currently appear significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Equifax is undervalued by 35.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Equifax Price vs Earnings (P/E)

The Price-to-Earnings (P/E) ratio is a common metric for valuing profitable companies, as it connects what investors are paying with the company’s actual bottom-line results. For companies like Equifax that consistently generate earnings, the P/E ratio helps compare how much you are paying for each dollar of profits versus other stocks and its own growth outlook.

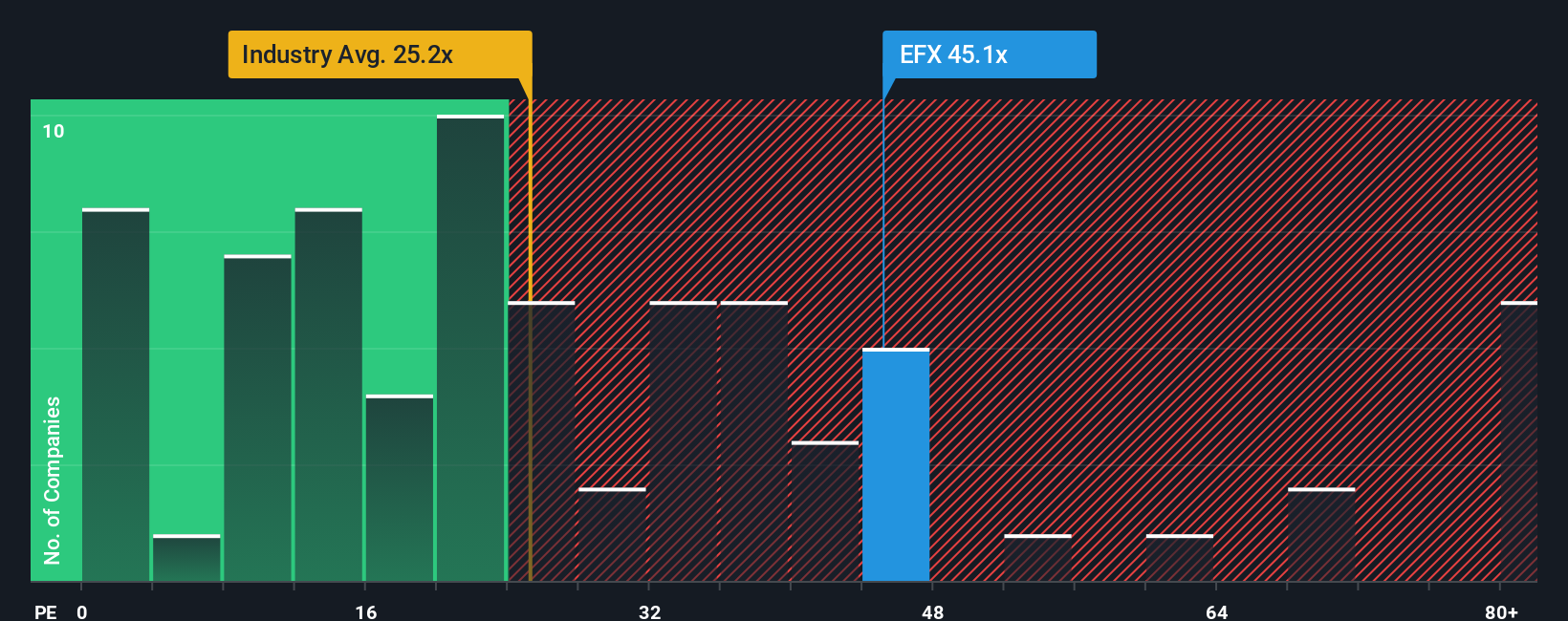

Growth expectations and risk levels play a major role in what a “fair” P/E ratio should be. Companies with higher growth prospects or more stable earnings can command a higher P/E, while slower or riskier businesses usually come at a discount. In Equifax’s case, the current P/E ratio stands at 46.4x. That is higher than both the Professional Services industry average of 26.2x and the average for its peers, which sits at 35.3x. On face value, Equifax looks expensive.

This is where Simply Wall St’s “Fair Ratio” comes in. It calculates an ideal P/E ratio by factoring in not just industry averages, but also company-specific elements like growth, profit margins, market cap, and risk. For Equifax, the calculated Fair Ratio is 35.6x. This approach goes deeper than a simple comparison with peers or the industry and provides a more tailored benchmark for whether Equifax is priced reasonably.

With a current P/E of 46.4x compared to the Fair Ratio of 35.6x, Equifax appears overvalued based on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Equifax Narrative

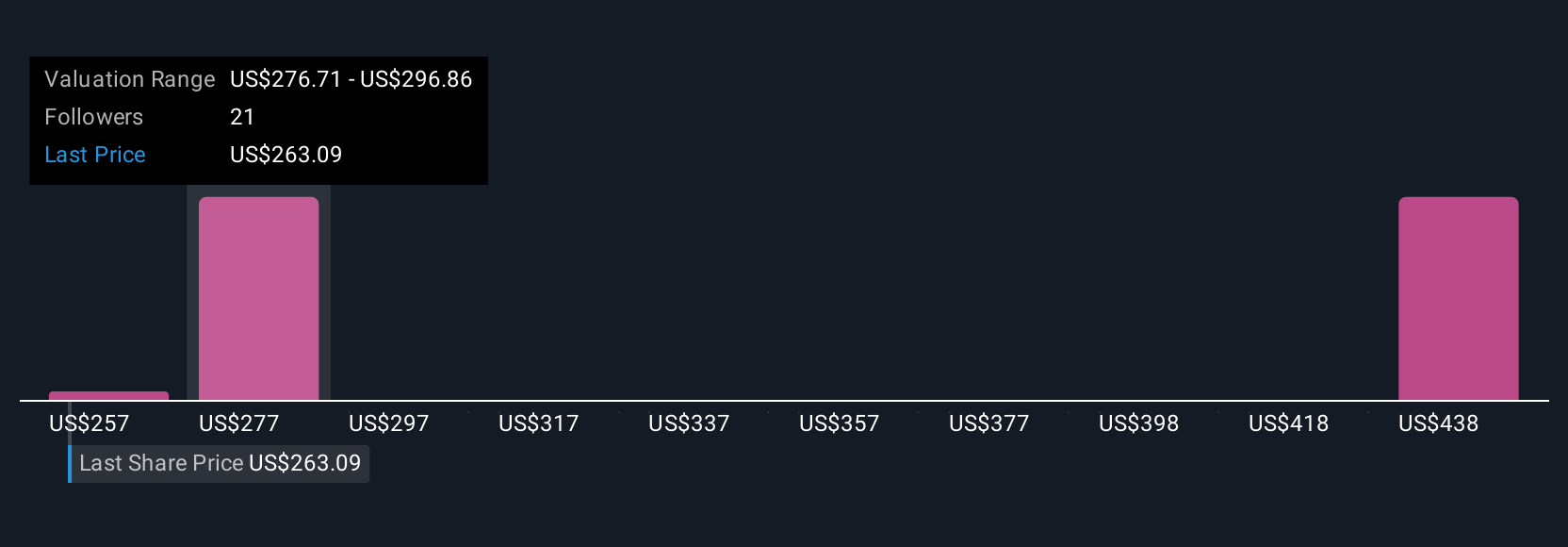

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your personalized story about a company’s future; it is how you connect your unique perspective on Equifax’s potential with concrete financial assumptions, such as what you expect future revenues, profit margins, or fair value to be. Narratives link together the key elements of investing: the story behind the business, a forecast of its financial future, and a resulting estimate of what the stock is actually worth today.

Narratives are easy to create and update directly on Simply Wall St’s Community page, where millions of investors share their views. By capturing both the numbers and the reasons behind them, Narratives make it much simpler to decide if now is the time to buy, hold, or sell. You can compare the Fair Value from your own Narrative with the current Price. What is truly powerful is that Narratives are dynamic, automatically updating as new data, news, or earnings are released, so your investment outlook can keep pace with real world events.

For example, one user’s Narrative for Equifax might forecast robust revenue growth and margin expansion and set a Fair Value close to $300; another might worry about regulatory and competitive risks, projecting a fair value of just $240.

Do you think there's more to the story for Equifax? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equifax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EFX

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives