- United States

- /

- Professional Services

- /

- NYSE:EFX

Equifax (NYSE:EFX) Calls for Rejection of Shareholder Proposal on Voting Requirements

Reviewed by Simply Wall St

Equifax (NYSE:EFX) recently urged shareholders to oppose a proposal by John Chevedden aiming to alter its voting requirements, aligning the company’s governance more closely with standard practices. This shareholder activism and resistance to proposed governance changes could be influencing investor sentiment. The company's stock moved down by 1.6% over the last week. This price decline comes despite broader market gains, where major U.S. stock indexes, including the Dow Jones and S&P 500, were up as investors awaited updates from the Federal Reserve on interest rates and economic forecasts. The broader market's positive performance was driven by gains in significant tech companies, such as Tesla and Boeing, and largely ignored Intel's sharp decline. In contrast, Equifax's situation, marked by internal governance issues, might be less appealing, thereby affecting its shareholder returns. Such developments highlight potential differences in investor priorities between the company and broader market trends.

Buy, Hold or Sell Equifax? View our complete analysis and fair value estimate and you decide.

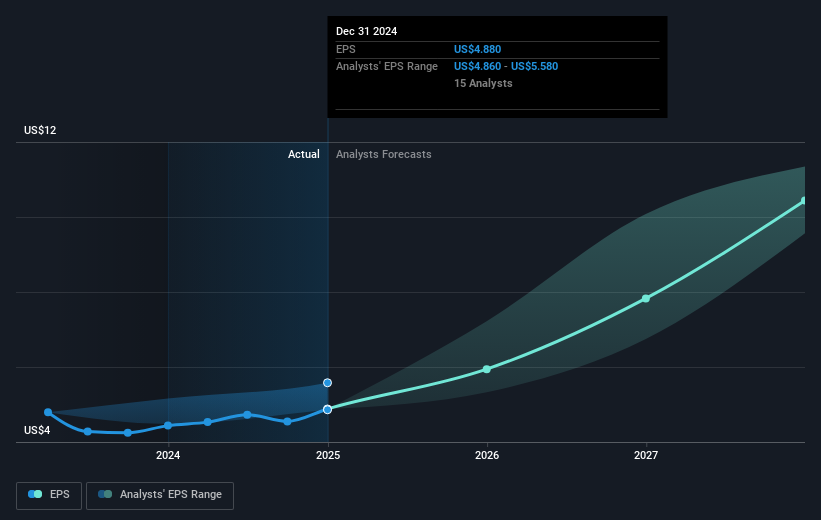

The last five years have seen Equifax achieve a total shareholder return of 115.09%, a notable period of growth contributed by several strategic maneuvers. A significant factor has been the company's commitment to increasing earnings, which grew significantly on an annual basis, reaching a net income of US$604.1 million in 2024. Additionally, the company maintained consistent dividend payouts, including the most recent announcement of a US$0.39 per share dividend, reaffirming its dedication to returning capital to shareholders.

During this time, Equifax pursued partnerships and technological expansions, such as the collaboration with Google Cloud to enhance data delivery and client service capabilities. However, governance challenges emerged, including internal disputes regarding voting requirements, potentially impacting investor sentiment. While Equifax faces some competitive hurdles, evidenced by its underperformance against both the US Professional Services industry and the broader market over the past year, its forward-looking strategies, like potential acquisitions, suggest a focus on strengthening its market position.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equifax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EFX

Reasonable growth potential with acceptable track record.