- United States

- /

- Professional Services

- /

- NYSE:CLVT

Clarivate Shares Plunge 29% in 2025 Is the Market Missing Something?

Reviewed by Bailey Pemberton

If you own Clarivate or are considering a move, you are probably wondering this: does the market know something you don’t, or is the stock simply misunderstood? Clarivate’s share price has seen quite a tumble lately, sliding 1.9% in the last 7 days and 12.2% over the past month. In fact, stepping back further reveals an even steeper drop. The stock is down nearly 29% year-to-date and a staggering 87.8% over five years. That kind of performance has reset expectations and, for some, dialed up the fear factor. But for valuation-focused investors, steep pullbacks like these sometimes hint at opportunity just below the surface.

There have been shifts in market sentiment surrounding the information services industry, especially as investors reconsider longer-term growth prospects and risk premiums. This backdrop might be exaggerating Clarivate’s challenges, giving us a stock price that underestimates its potential. To help cut through the noise, let’s focus on the numbers: on a scale that checks for six key signs of undervaluation, Clarivate passes five out of six. This is not something you see every day, especially at a low share price.

In the next section, we will roll up our sleeves for a deeper dive into exactly how that valuation score stacks up. We will break down each approach, and keep an eye out for a smarter way to piece it all together at the end.

Why Clarivate is lagging behind its peers

Approach 1: Clarivate Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating a company’s future cash flows and then discounting them back to today’s value, giving us a sense of what the business is really worth now based on those future expectations. For Clarivate, analysts estimate the company generated Free Cash Flow (FCF) of $381 million over the last twelve months. Fast-forward ten years and projections suggest Clarivate’s annual FCF could reach around $456 million, with growth extrapolated by industry analysts and further extended using reliable methodologies.

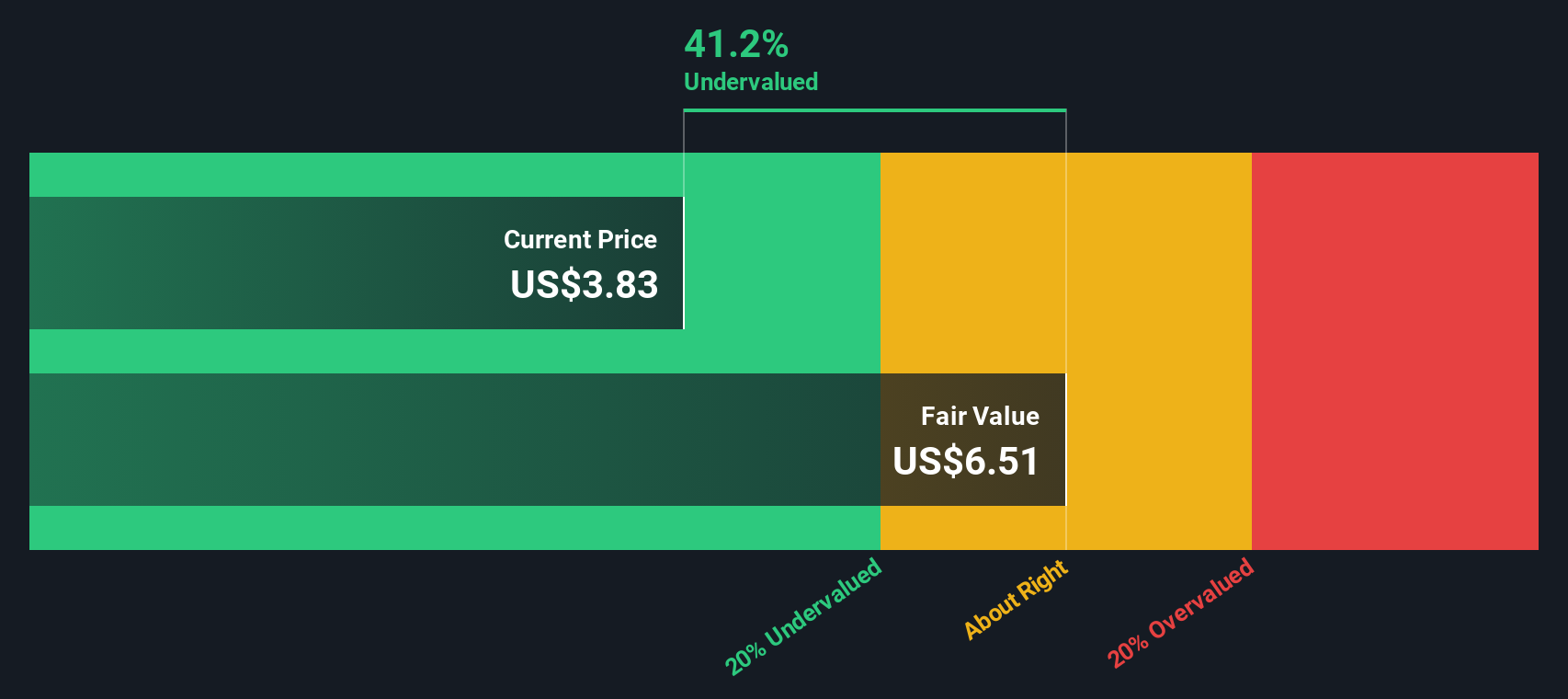

Each year’s projected FCF, all in $ millions, is discounted back to present value to account for the risks and time value of money, using a two-stage approach. This calculation results in an intrinsic value per share of $6.31 compared to the current market price. The DCF valuation model implies that Clarivate stock is trading at a 42.0% discount, suggesting investors may be overlooking its long-term cash-generating potential, even as industry sentiment wavers.

In summary, the DCF approach points to a solid margin of safety at the current price, making Clarivate look attractively undervalued at this stage.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Clarivate is undervalued by 42.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Clarivate Price vs Sales

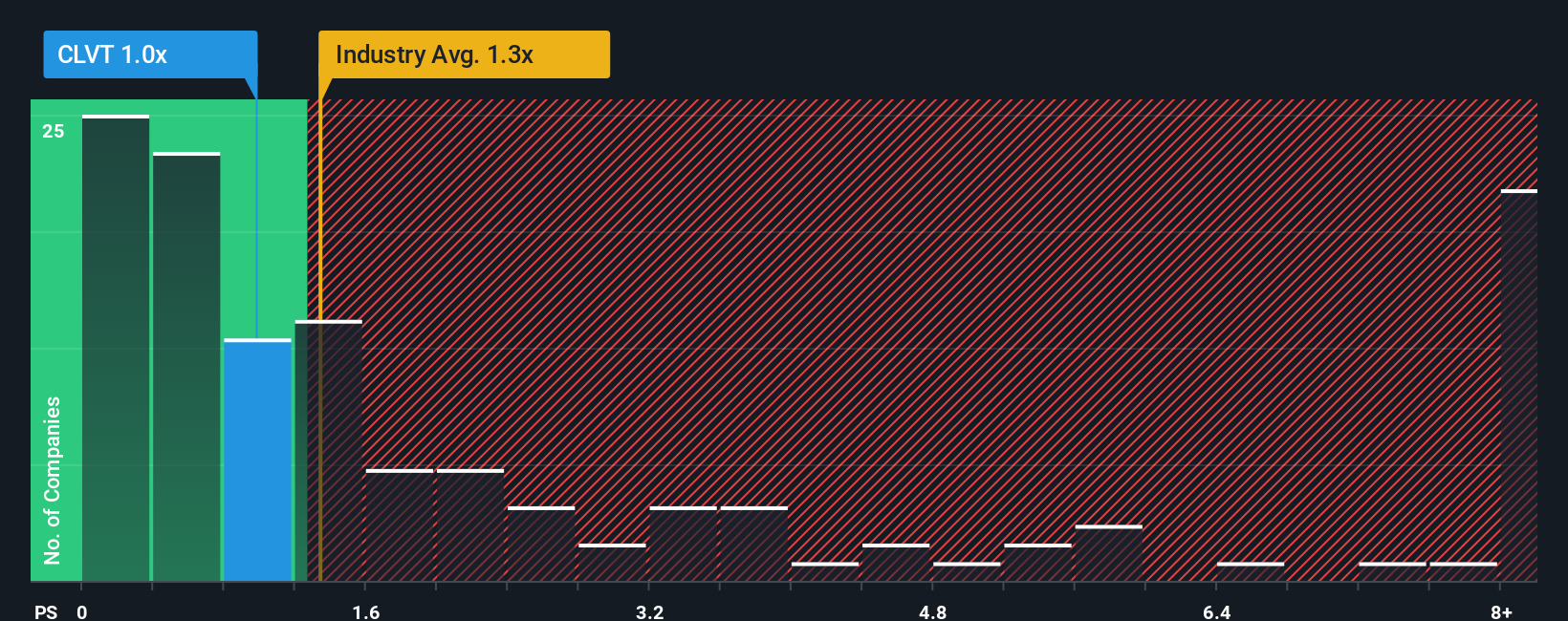

The Price-to-Sales (P/S) ratio is a favored tool for valuing companies like Clarivate, which are still building profitability but have stable revenue streams. The P/S ratio is useful for stocks in the information services or professional services sector, where profits might fluctuate but consistent sales are a reliable business indicator.

What counts as a “normal” or “fair” P/S multiple depends on factors such as growth expectations and risk profile. Rapidly growing companies or those with lower risk typically deserve a higher multiple, while slower-growing or riskier businesses trade on the lower end of the scale.

Currently, Clarivate trades at a P/S ratio of 0.98x. This is notably lower than both the industry average of 1.32x and the peer group average of 3.34x. However, these benchmarks do not factor in Clarivate's particular mix of growth rates, margin profile, or company-specific risks. This is where Simply Wall St’s proprietary “Fair Ratio” comes in, set at 2.06x for Clarivate. The Fair Ratio reflects a more nuanced view by considering the company’s growth outlook, risk factors, profit margin, industry group, and market capitalization, providing a personalized estimate of what multiple the stock deserves in today’s market.

Comparing Clarivate’s actual P/S of 0.98x against its Fair Ratio of 2.06x suggests the shares are trading well below the level that would typically be justified, making the stock look undervalued by this approach.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Clarivate Narrative

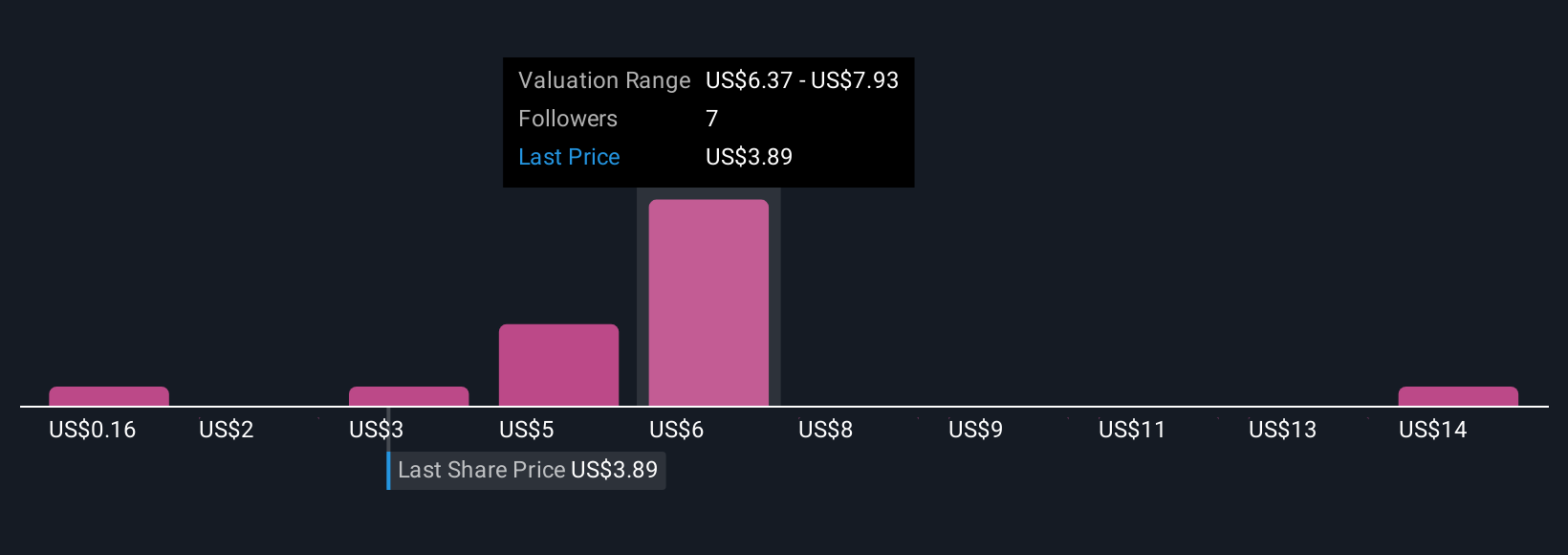

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful tool that allows you to pair your view of a company’s story with your assumptions about its financial future, letting you see exactly how your expectations translate into a fair value.

Rather than relying solely on rigid ratios or analyst consensus, Narratives help you connect the dots from the business’s prospects, such as revenue growth, margins, or AI-driven innovation, to a forecast and a fair valuation, all in one place. Available right on Simply Wall St’s Community page, Narratives make it easy for everyone, from new investors to experienced pros, to document their reasoning and watch it play out with real data. By showing how your own Fair Value compares with today’s share price, Narratives support more personalized buy or sell decisions that evolve as new information, including earnings reports or industry news, is released.

For example, some investors might build a positive Clarivate Narrative focusing on AI-powered product growth and rising margins, resulting in a price target as high as $7.00, while others may remain cautious about industry disruption and set a target closer to $3.75.

Do you think there's more to the story for Clarivate? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLVT

Clarivate

Operates as an information services provider in the Americas, the Middle East, Africa, Europe, and the Asia Pacific.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives