- United States

- /

- Professional Services

- /

- NYSE:CLVT

Clarivate (NYSE:CLVT) Valuation: Weighing the Shift to AI and Recurring Revenue

Reviewed by Kshitija Bhandaru

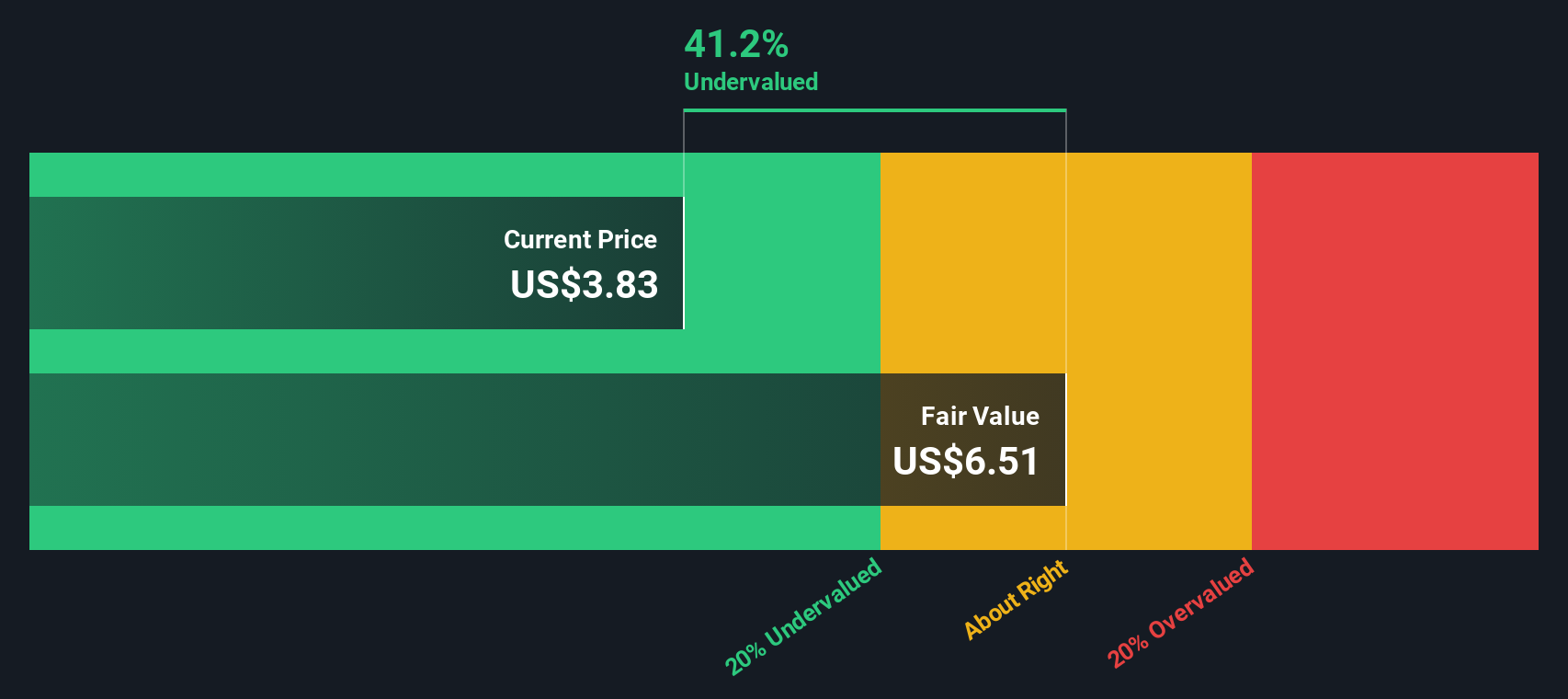

Most Popular Narrative: 21% Undervalued

According to the most widely followed narrative, Clarivate is presently undervalued by 21% compared to its estimated fair value. This outlook is based on analysts’ expectations for future growth in revenue, margins, and recurring subscription income as the company pivots toward AI-powered solutions.

"Rapid expansion and adoption of AI-driven product innovation across all segments (including new AI-powered analytics in Web of Science, Derwent, and Cortellis) enhances product differentiation and workflow integration, driving higher pricing, customer retention, and potentially expanding gross margins."

Curious about what’s fueling this bullish projection? The narrative relies on a rigorous set of data-driven assumptions that could redefine how investors see Clarivate. Bold profit margin improvements, unexpected growth levers, and a price multiple that breaks norms for the sector are all factors. Wondering what numbers lie behind this striking valuation? Keep reading to uncover the key ingredients of this forward-looking story.

Result: Fair Value of $5.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent funding cuts in higher education and intensifying competition from free research platforms could quickly undermine Clarivate’s bullish turnaround outlook.

Find out about the key risks to this Clarivate narrative.Another View: Discounted Cash Flow Perspective

Taking a different approach, our DCF model also points to Clarivate being undervalued based on projected future cash flows. However, as with any model, results depend on key assumptions. Is this a clearer signal for potential buyers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Clarivate Narrative

If you find yourself questioning these conclusions or enjoy digging into the numbers firsthand, you can build your own valuation in just minutes by using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Clarivate.

Looking for More Investment Ideas?

Expand your investing playbook and seize opportunities that others might overlook. Make your next smart move by getting ahead of the trends shaping tomorrow’s winners right now.

- Uncover value opportunities by zeroing in on companies trading below their true worth with our undervalued stocks based on cash flows.

- Tap into technology’s next wave by finding trailblazers making breakthroughs in artificial intelligence through our AI penny stocks.

- Capture reliable income streams by targeting businesses offering impressive yields above 3% using our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLVT

Clarivate

Operates as an information services provider in the Americas, the Middle East, Africa, Europe, and the Asia Pacific.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives