- United States

- /

- Software

- /

- NasdaqGS:AVPT

US Growth Stocks With High Insider Ownership To Watch

Reviewed by Simply Wall St

As the U.S. stock market continues to rally post-election, with indices like the Dow Jones and S&P 500 reaching new record highs, investor optimism is palpable. In this buoyant environment, growth companies with high insider ownership can present unique opportunities, as such ownership often indicates confidence in a company's long-term potential by those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 31% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.5% |

| Coastal Financial (NasdaqGS:CCB) | 18% | 46.1% |

| New Fortress Energy (NasdaqGS:NFE) | 32.6% | 83% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 39.6% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

AvePoint (NasdaqGS:AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

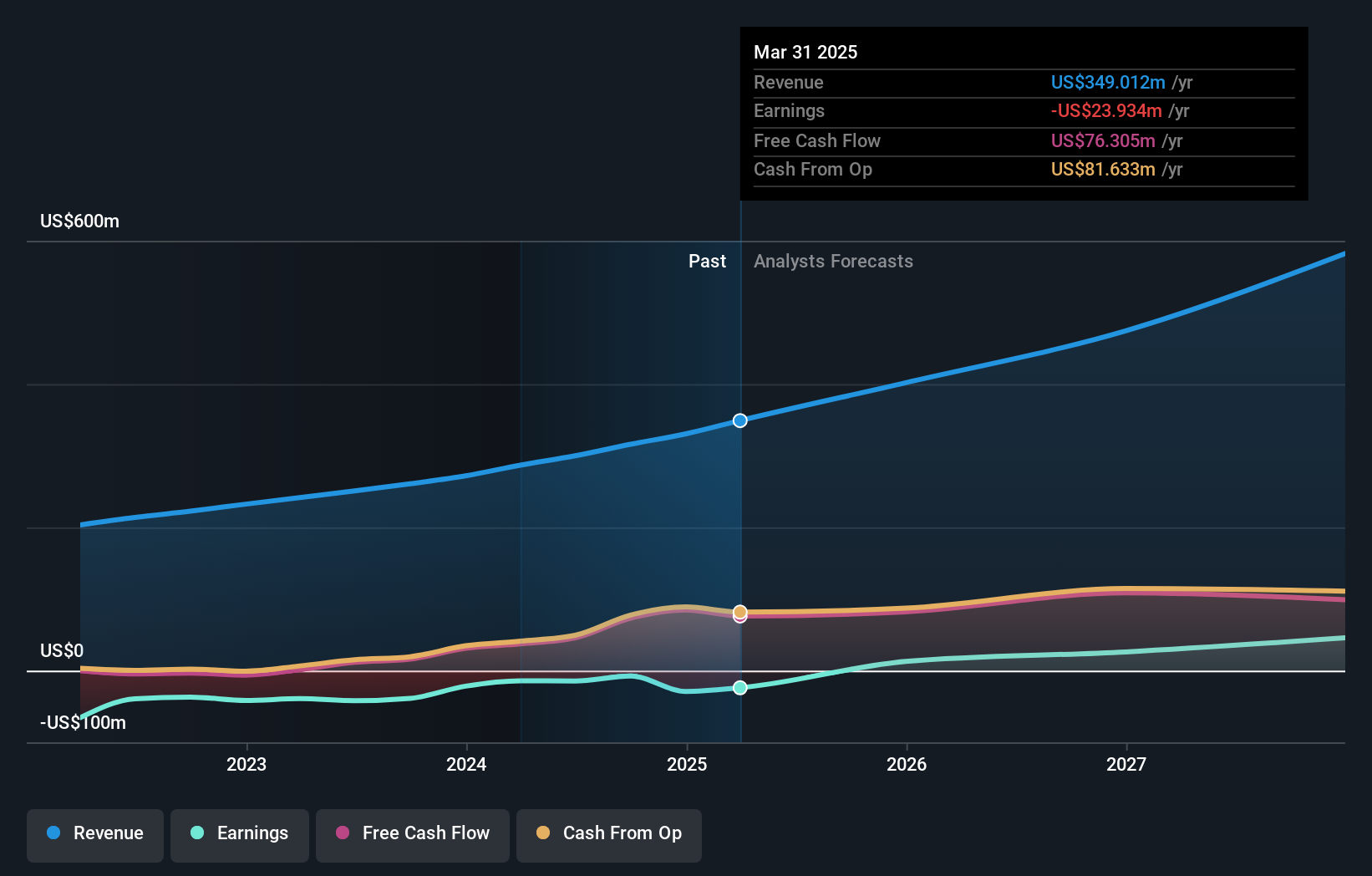

Overview: AvePoint, Inc. offers a cloud-native data management software platform across various regions including North America, Europe, the Middle East, Africa, and Asia Pacific with a market cap of approximately $2.78 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $315.92 million.

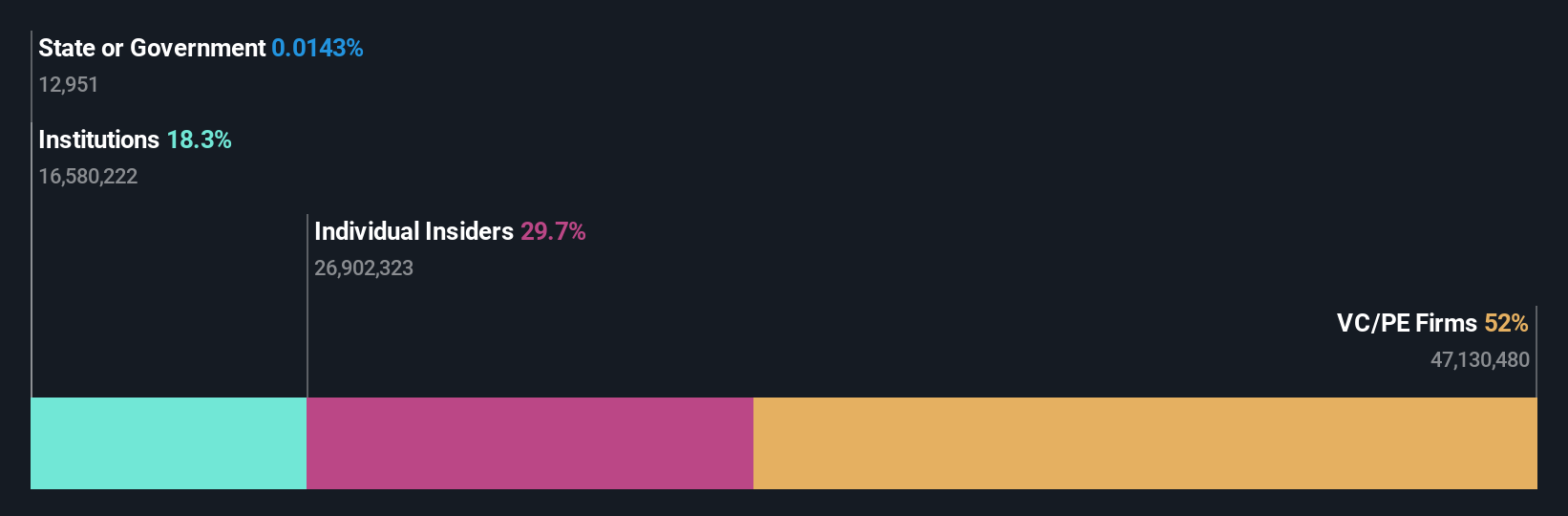

Insider Ownership: 36.8%

AvePoint's recent earnings report shows a positive shift with a net income of US$2.62 million for Q3 2024, contrasting last year's loss. The company forecasts revenue growth of 21% for the full year, indicating robust expansion potential. Despite insider selling in the past quarter, AvePoint's strategic initiatives like the AI Lab aim to enhance its SaaS offerings and global market presence. Trading below its estimated fair value suggests potential upside as profitability is expected within three years.

- Navigate through the intricacies of AvePoint with our comprehensive analyst estimates report here.

- The analysis detailed in our AvePoint valuation report hints at an inflated share price compared to its estimated value.

TaskUs (NasdaqGS:TASK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TaskUs, Inc. offers digital outsourcing services to companies across the Philippines, the United States, India, and internationally with a market cap of approximately $1.68 billion.

Operations: TaskUs generates revenue through its provision of digital outsourcing services across various international markets, including the Philippines, the United States, and India.

Insider Ownership: 28.1%

TaskUs, Inc. demonstrates strong growth potential with earnings expected to grow significantly above the US market average at 29.1% annually. Recent Q3 results show a net income increase to US$12.7 million from US$9.77 million, and revenue guidance for the full year between $988 million and $990 million suggests steady expansion. Trading at 64.2% below estimated fair value highlights possible investment appeal despite slower projected revenue growth than some high-growth benchmarks.

- Take a closer look at TaskUs' potential here in our earnings growth report.

- Upon reviewing our latest valuation report, TaskUs' share price might be too optimistic.

BBB Foods (NYSE:TBBB)

Simply Wall St Growth Rating: ★★★★★★

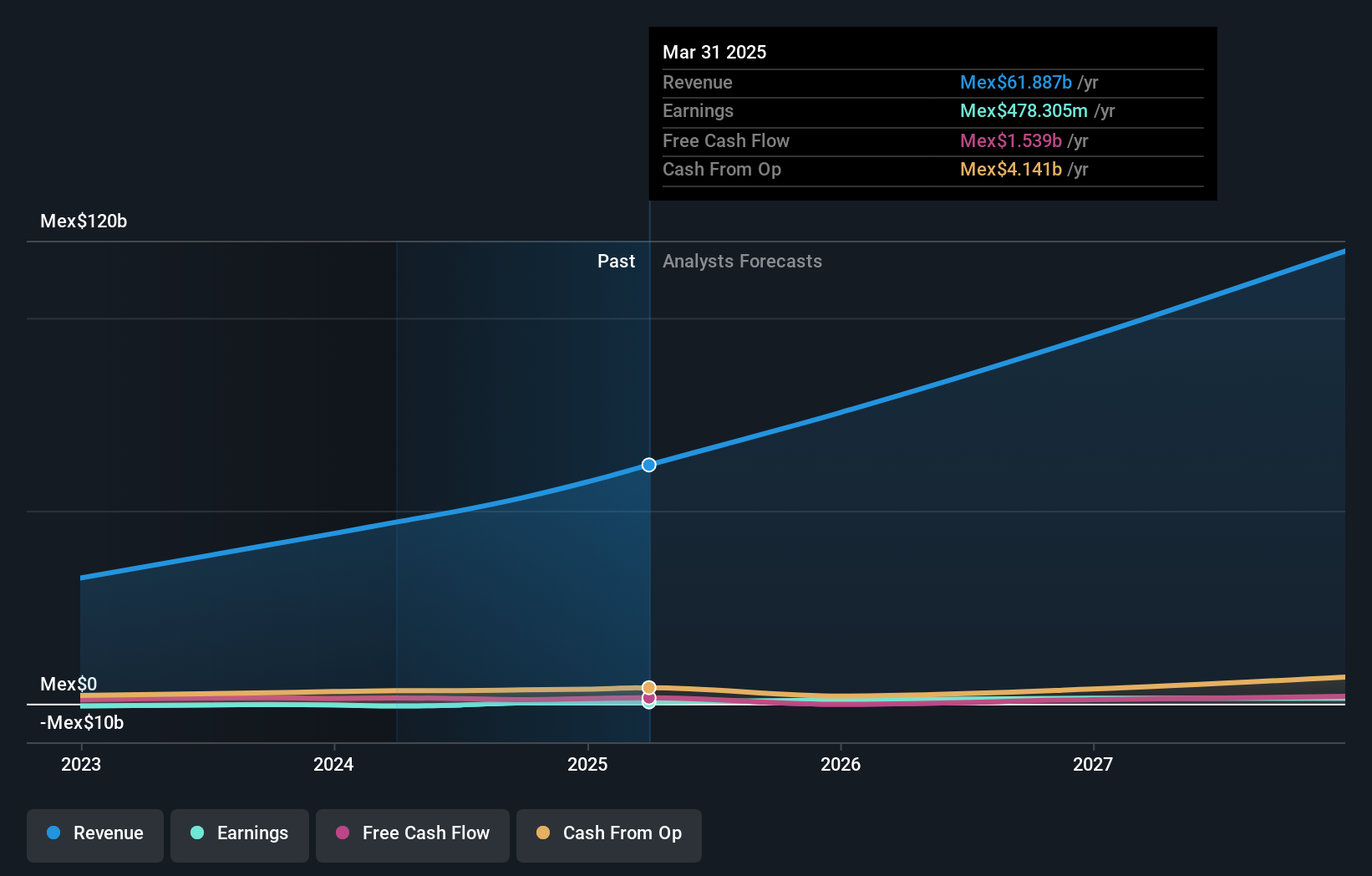

Overview: BBB Foods Inc. operates a chain of grocery retail stores in Mexico and has a market cap of $3.75 billion.

Operations: The company's revenue segment primarily involves the sale, acquisition, and distribution of various products and consumer goods, generating MX$49.99 billion.

Insider Ownership: 22.9%

BBB Foods shows promising growth prospects, with revenue expected to increase by 20.3% annually, surpassing the US market average of 8.9%. Earnings are projected to grow at a robust rate of 51.22% per year, and profitability is anticipated within three years, outperforming market averages. Recent earnings reveal substantial revenue growth from MXN 10.65 billion to MXN 13.57 billion year-over-year for Q2, though net income declined for the six-month period ending June 2024.

- Delve into the full analysis future growth report here for a deeper understanding of BBB Foods.

- Our comprehensive valuation report raises the possibility that BBB Foods is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Delve into our full catalog of 198 Fast Growing US Companies With High Insider Ownership here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, Middle East, Africa, and Asia Pacific.

Flawless balance sheet with reasonable growth potential.