- United States

- /

- Banks

- /

- NYSEAM:TMP

Undiscovered Gems in the United States to Watch This October 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 39% over the past year with earnings forecasted to grow by 15% annually. In this context of steady growth and promising forecasts, identifying undiscovered gems becomes crucial for investors seeking opportunities beyond well-trodden paths.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

CRA International (NasdaqGS:CRAI)

Simply Wall St Value Rating: ★★★★★☆

Overview: CRA International, Inc. offers economic, financial, and management consulting services globally with a market capitalization of approximately $1.30 billion.

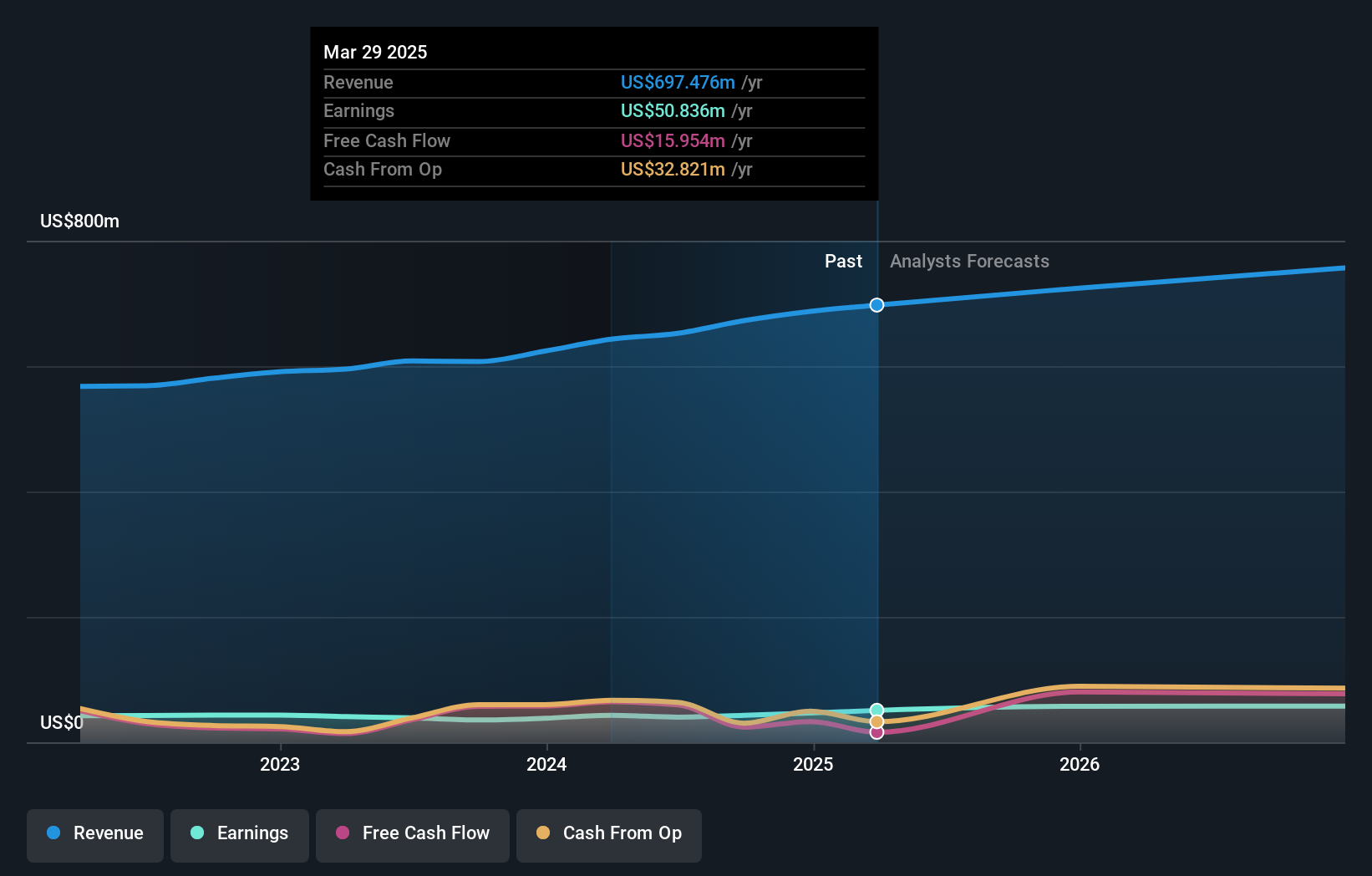

Operations: CRA International generates revenue primarily from consulting services, totaling $652.40 million.

CRA International, a notable player in the professional services sector, has seen its debt to equity ratio rise from 21% to 45.4% over five years, yet maintains a satisfactory net debt to equity at 32.5%. The company is trading at 41.8% below its estimated fair value and boasts high-quality earnings with robust EBIT coverage of interest payments at 16.2 times. Despite not outpacing industry growth last year, CRA's earnings have grown annually by 14.4%, supported by strategic expansions in intellectual property and cybersecurity practices likely enhancing future revenue streams and profit margins amidst ongoing financial pressures.

Photronics (NasdaqGS:PLAB)

Simply Wall St Value Rating: ★★★★★★

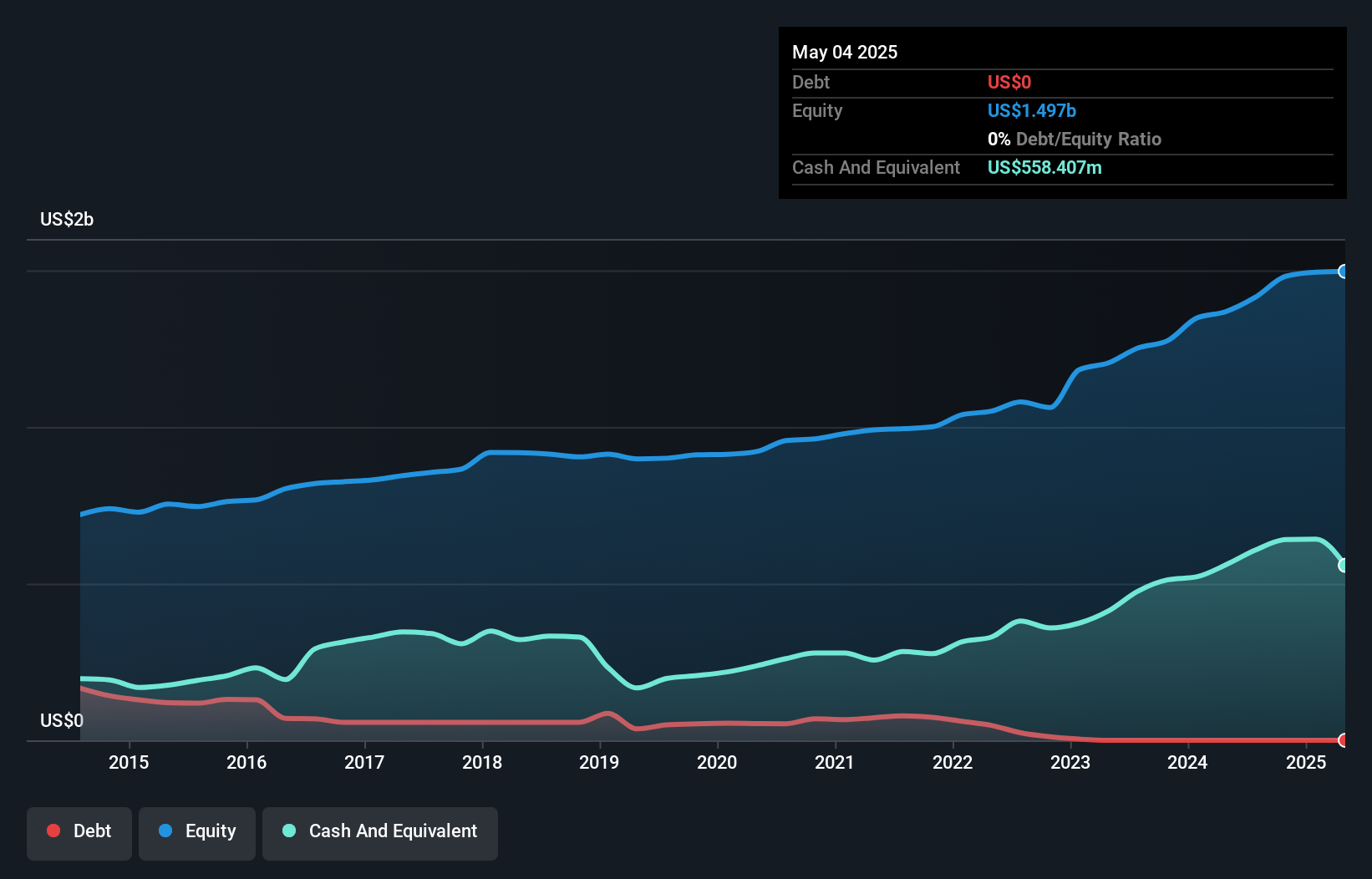

Overview: Photronics, Inc. is a company that manufactures and sells photomask products and services across various regions including the United States, Taiwan, China, Korea, Europe, and other international markets with a market cap of approximately $1.52 billion.

Operations: Photronics generates its revenue primarily from the manufacture of photomasks, with reported sales amounting to $871.79 million. The company's financial performance can be analyzed through its net profit margin, which reflects how effectively it converts revenue into profit after accounting for all expenses.

Photronics, a player in the semiconductor industry, shows promising financial health with earnings growth of 19.8% over the past year, outpacing the industry's -2.1%. The company is debt-free and trades at 63.6% below its estimated fair value, suggesting potential undervaluation. Recent earnings revealed a net income increase to US$34 million for Q3 2024 from US$27 million last year, with basic earnings per share rising to US$0.56 from US$0.44. Despite these gains, sales dipped slightly to US$211 million from US$224 million previously, reflecting market challenges but also highlighting resilience in profitability amidst fluctuating demand and costs.

Tompkins Financial (NYSEAM:TMP)

Simply Wall St Value Rating: ★★★★★☆

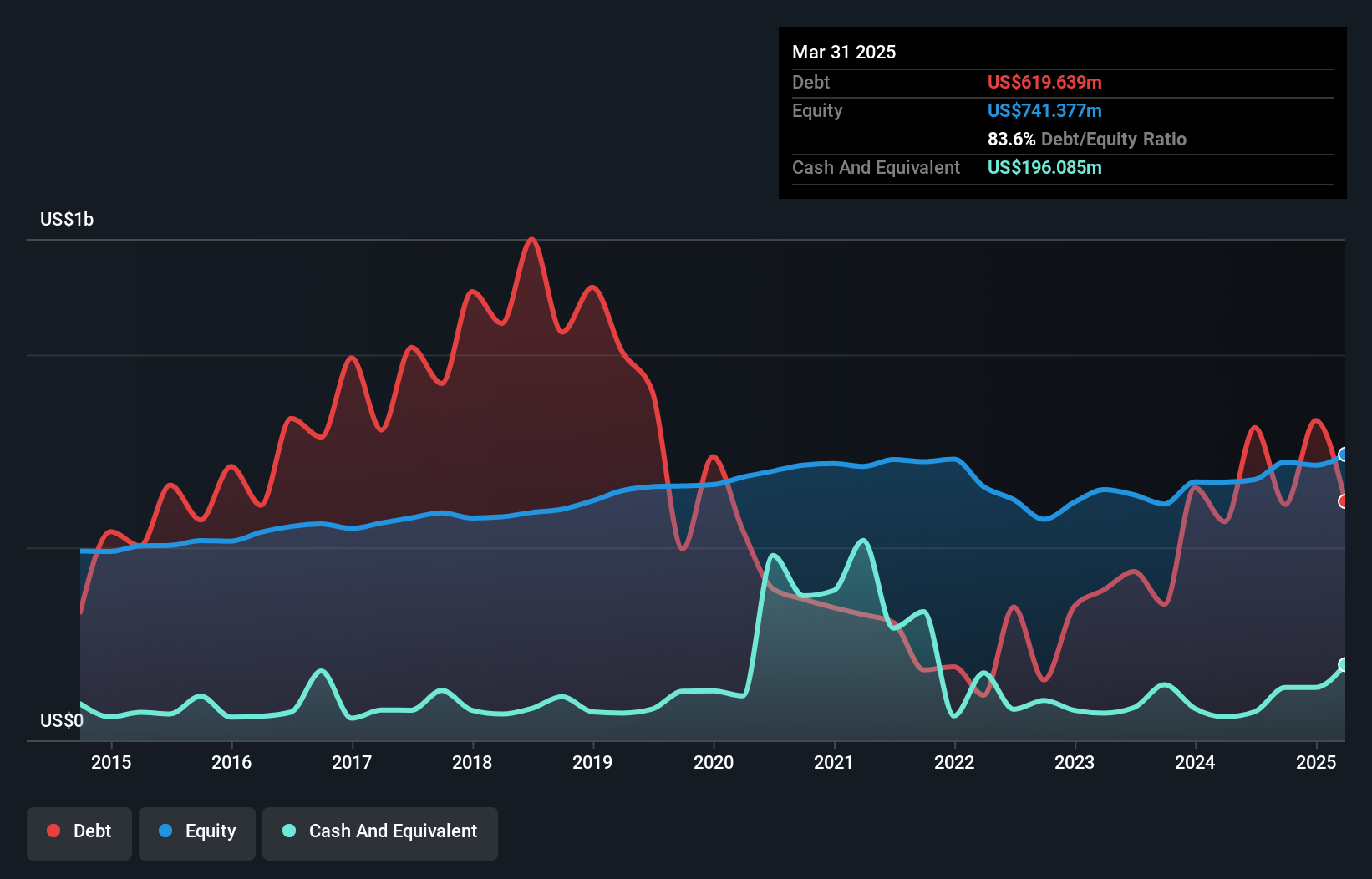

Overview: Tompkins Financial Corporation is a financial holding company offering commercial and consumer banking, leasing, trust and investment management, financial planning and wealth management, and insurance services with a market cap of $954.37 million.

Operations: Tompkins Financial generates revenue primarily through its diverse financial services, including banking, investment management, and insurance. The company's cost structure is influenced by interest expenses and operational costs associated with providing these services. Its net profit margin reflects the overall profitability after accounting for all expenses related to its operations.

Tompkins Financial, with assets totaling US$8 billion and equity of US$721.3 million, stands out for its robust performance in the financial sector. The company boasts a solid deposit base of US$6.6 billion against loans of US$5.8 billion, reflecting a net interest margin of 2.8%. Its earnings surged by 373% over the past year, significantly outpacing the industry average decline of 14%. Despite having an appropriate level of bad loans at 1.1%, it maintains a low allowance for these at 89%. Trading below estimated fair value by about 46%, Tompkins offers potential for value seekers.

- Click to explore a detailed breakdown of our findings in Tompkins Financial's health report.

Evaluate Tompkins Financial's historical performance by accessing our past performance report.

Key Takeaways

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 223 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tompkins Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:TMP

Tompkins Financial

A financial holding company, provides commercial and consumer banking, leasing, trust and investment management, financial planning and wealth management, and insurance services.

Flawless balance sheet established dividend payer.