- United States

- /

- Food and Staples Retail

- /

- NYSE:NGVC

Undiscovered Gems Three Promising Small Cap Stocks in the United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.2% drop, yet it remains up by 24% over the past year with earnings projected to grow by 15% annually in the coming years. In this dynamic environment, identifying promising small-cap stocks can be key to uncovering potential growth opportunities that align well with these market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Merchants Bancorp (NasdaqCM:MBIN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Merchants Bancorp is a diversified bank holding company in the United States with a market capitalization of approximately $1.65 billion.

Operations: Merchants Bancorp generates revenue primarily from its Banking segment, contributing $320.88 million, followed by Multi-Family Mortgage Banking at $154.17 million and Mortgage Warehousing at $129.91 million.

Merchants Bancorp, with total assets of US$18.7 billion and equity of US$1.9 billion, showcases a robust financial structure. Its deposits stand at US$12.9 billion while loans total US$10.3 billion, reflecting a net interest margin of 3.1%. However, the allowance for bad loans is insufficient at 2% of total loans, indicating potential risk management challenges despite high-quality earnings and low-risk funding sources comprising 77% customer deposits. Recent activities include declaring dividends on various preferred stocks and announcing the redemption of Series B preferred stock by January 2025, highlighting active capital management strategies amidst trading below estimated fair value by nearly 70%.

- Navigate through the intricacies of Merchants Bancorp with our comprehensive health report here.

Explore historical data to track Merchants Bancorp's performance over time in our Past section.

Hyster-Yale (NYSE:HY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hyster-Yale, Inc. operates globally through its subsidiaries, focusing on the design, engineering, manufacturing, sales, and servicing of lift trucks and related products, with a market capitalization of approximately $882.49 million.

Operations: Hyster-Yale generates revenue primarily from its Lift Truck business across three regions: Americas ($3.13 billion), EMEA ($753.30 million), and JAPIC ($189.70 million). The company also earns from Bolzoni, contributing $383.50 million, and Nuvera at $1.20 million, with eliminations amounting to -$190.50 million in the financials.

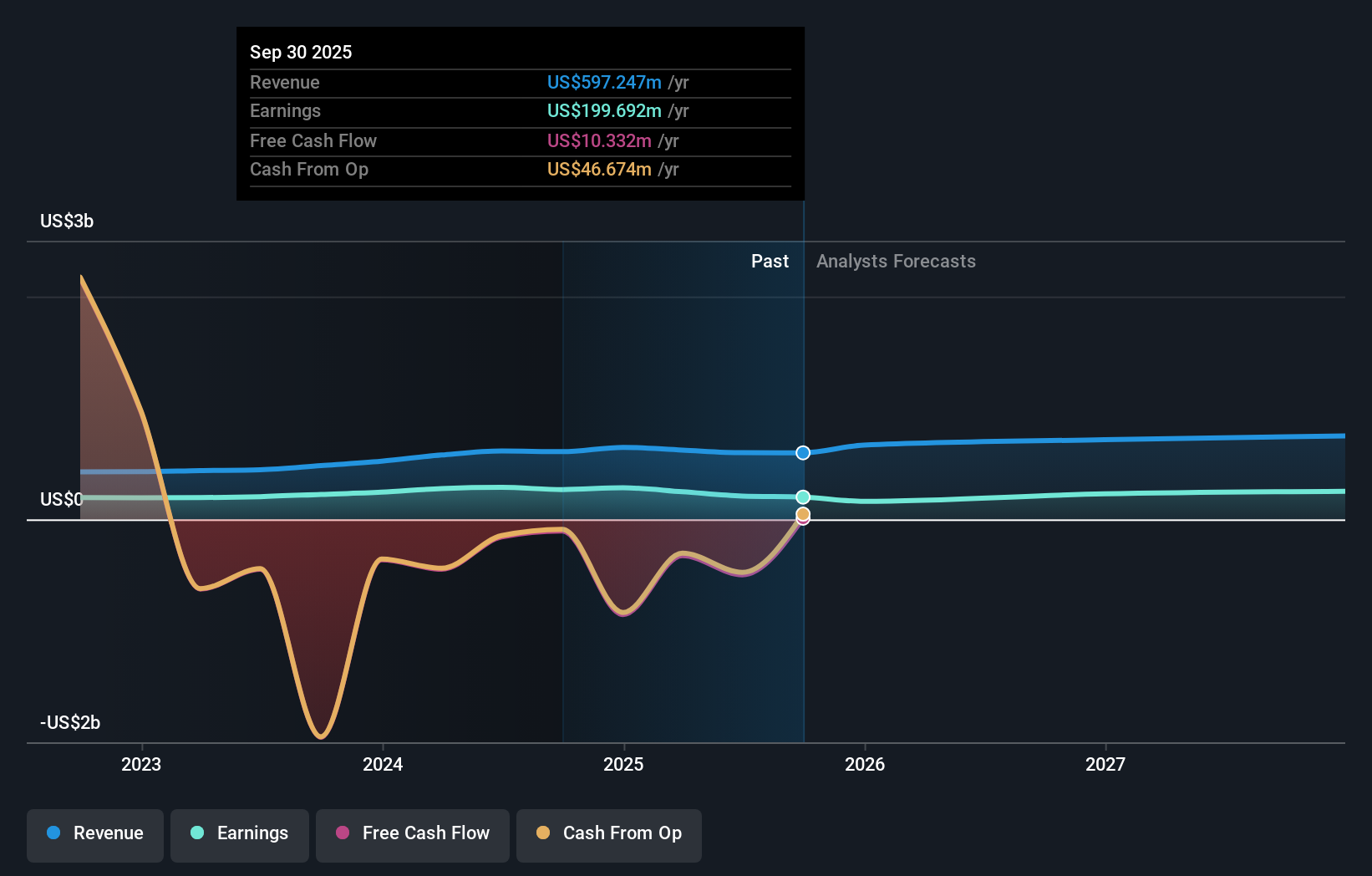

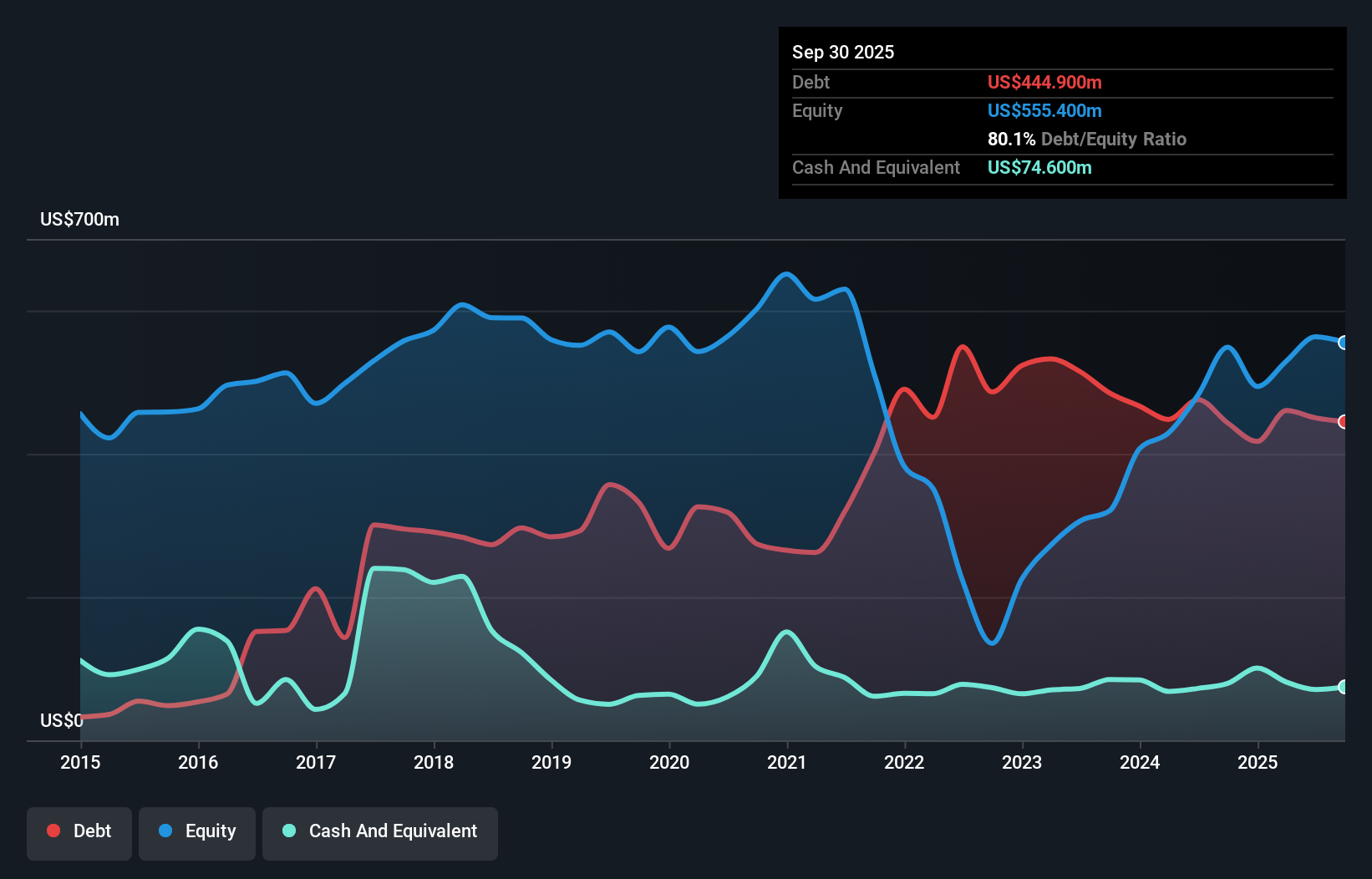

Hyster-Yale, a notable player in the machinery sector, has demonstrated impressive earnings growth of 45% over the past year, outpacing the industry average of 15%. Despite its high net debt to equity ratio of 66%, interest payments are well covered with EBIT at 7.3 times. The company is trading at nearly 69% below estimated fair value and remains free cash flow positive. Recent strategic moves include expanding domestic manufacturing to comply with the Build America, Buy America Act and launching a share repurchase program worth $50 million for up to 1.5 million shares by November 2027.

Natural Grocers by Vitamin Cottage (NYSE:NGVC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Natural Grocers by Vitamin Cottage, Inc. operates retail stores offering natural and organic groceries and dietary supplements across the United States, with a market cap of approximately $897.91 million.

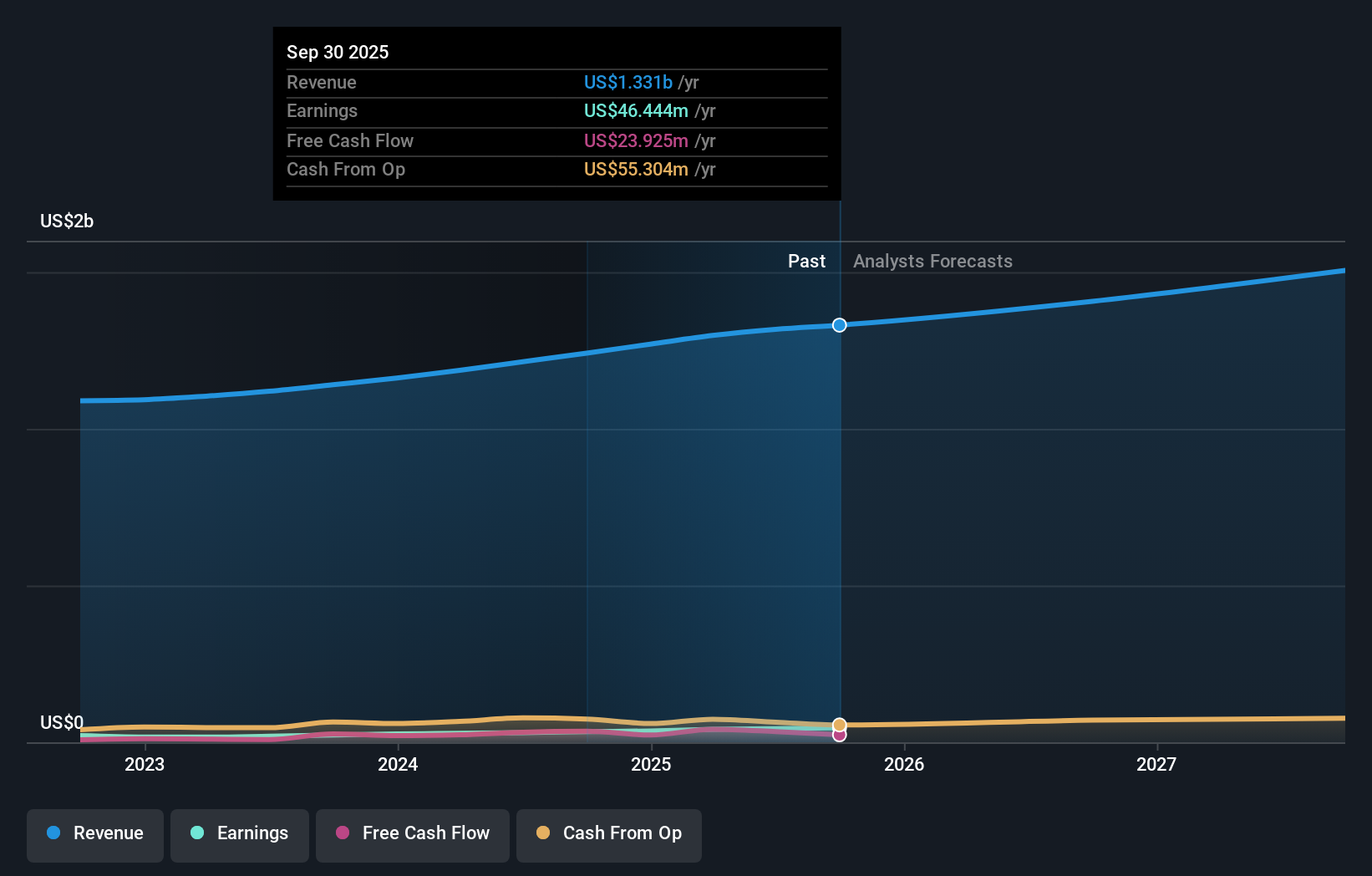

Operations: Natural Grocers generates revenue primarily from its natural and organic retail stores, amounting to $1.24 billion. The company's market cap stands at approximately $897.91 million.

Natural Grocers, a nimble player in the organic retail scene, has shown impressive growth with earnings rising 46% over the past year, outpacing its industry peers. The company boasts high-quality earnings and operates debt-free, enhancing its financial stability. Trading at roughly 33% below estimated fair value suggests potential upside for investors. Recent quarterly results highlighted a net income of US$9 million on sales of US$322.66 million, reflecting strong operational performance. However, significant insider selling and store closures indicate some internal challenges that may need addressing to sustain momentum in the coming years.

Taking Advantage

- Discover the full array of 239 US Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natural Grocers by Vitamin Cottage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NGVC

Natural Grocers by Vitamin Cottage

Natural Grocers by Vitamin Cottage, Inc., together with its subsidiaries, retails natural and organic groceries, and dietary supplements in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives