Key Takeaways

- Streamlining manufacturing and optimizing production enhance efficiency, reduce costs, and improve net margins long term.

- New product innovations and sector collaborations align with market trends, capturing market share and boosting revenues and margins.

- Anticipated revenue declines and cost challenges in 2025, compounded by competitive pressures and economic uncertainties, may adversely impact profitability and margins.

Catalysts

About Hyster-Yale- Through its subsidiaries, designs, engineers, manufactures, sells, and services a line of lift trucks, attachments, and aftermarket parts worldwide.

- Streamlining of manufacturing network and footprint optimization programs are expected to lower costs, reduce inventory, and improve product lead times, which would positively impact net margins in the long term.

- Expansion of modular and scalable models, combining internal combustion and electric trucks on the same production lines, aims to enhance manufacturing efficiency and reduce operational costs, subsequently improving net margins and earnings.

- New product introductions, including automated lift trucks and advanced electric powertrains, are expected to boost revenues by meeting evolving customer demands and potentially capturing more market share in 2025 and beyond.

- Bolzoni's focus on AGV sector collaborations and enhanced technologies to improve product safety and efficiency may increase volumes and margins, positively impacting revenue and net margins in the attachment business.

- Nuvera's expansion into mobile power generation with its HydroCharge product targets new commercial applications, potentially leading to increased revenue in 2025 and beyond as it capitalizes on the shift towards clean energy solutions.

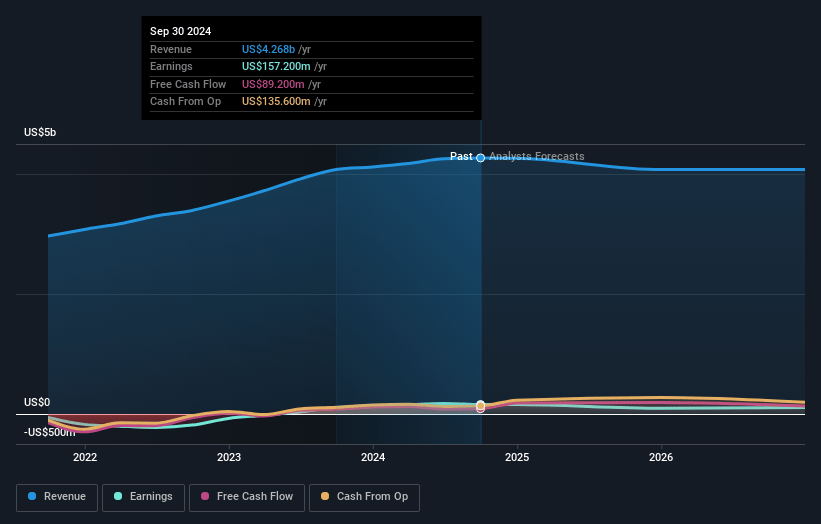

Hyster-Yale Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hyster-Yale's revenue will decrease by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 3.3% today to 1.7% in 3 years time.

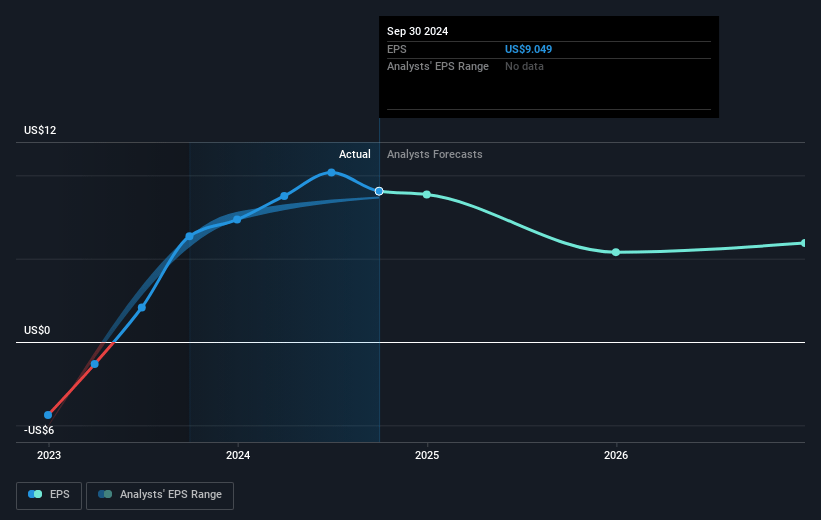

- Analysts expect earnings to reach $69.0 million (and earnings per share of $3.79) by about May 2028, down from $142.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.4x on those 2028 earnings, up from 4.9x today. This future PE is greater than the current PE for the US Machinery industry at 21.3x.

- Analysts expect the number of shares outstanding to grow by 2.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.83%, as per the Simply Wall St company report.

Hyster-Yale Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reported a significant year-over-year revenue improvement in 2024, but anticipates a significant decline in revenues and profits for the full year 2025 due to decreased global lift truck bookings and lower production levels, which will likely impact revenue and earnings.

- Competitive intensity in the market is expected to continue, potentially leading to a decline in product margins in 2025, despite maintaining margins above target levels in 2024, thereby impacting net margins.

- Economic uncertainty, including potential tariffs and trade wars, poses a risk to global demand and could disrupt financial performance if these materialize unfavorably, affecting revenue and net margins.

- The new product introductions, while providing potential revenue per unit increases, have resulted in increased initial warranty claims, which could adversely impact net margins until product reliability improves.

- Ongoing high freight and operational costs, despite some proactive mitigation efforts, are challenges that may constrain the company's ability to leverage profitability improvements, potentially impacting earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $72.5 for Hyster-Yale based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $69.0 million, and it would be trading on a PE ratio of 24.4x, assuming you use a discount rate of 8.8%.

- Given the current share price of $39.17, the analyst price target of $72.5 is 46.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.