- United States

- /

- Trade Distributors

- /

- NYSE:GIC

Exploring Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

The United States market has experienced a robust performance, climbing 2.4% in the last 7 days and 25% over the past year, with earnings projected to grow by 15% annually in the coming years. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can offer intriguing opportunities for investors seeking to capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Lifeway Foods (NasdaqGM:LWAY)

Simply Wall St Value Rating: ★★★★★★

Overview: Lifeway Foods, Inc. is engaged in the production and marketing of probiotic-based products both in the United States and internationally, with a market capitalization of approximately $339.89 million.

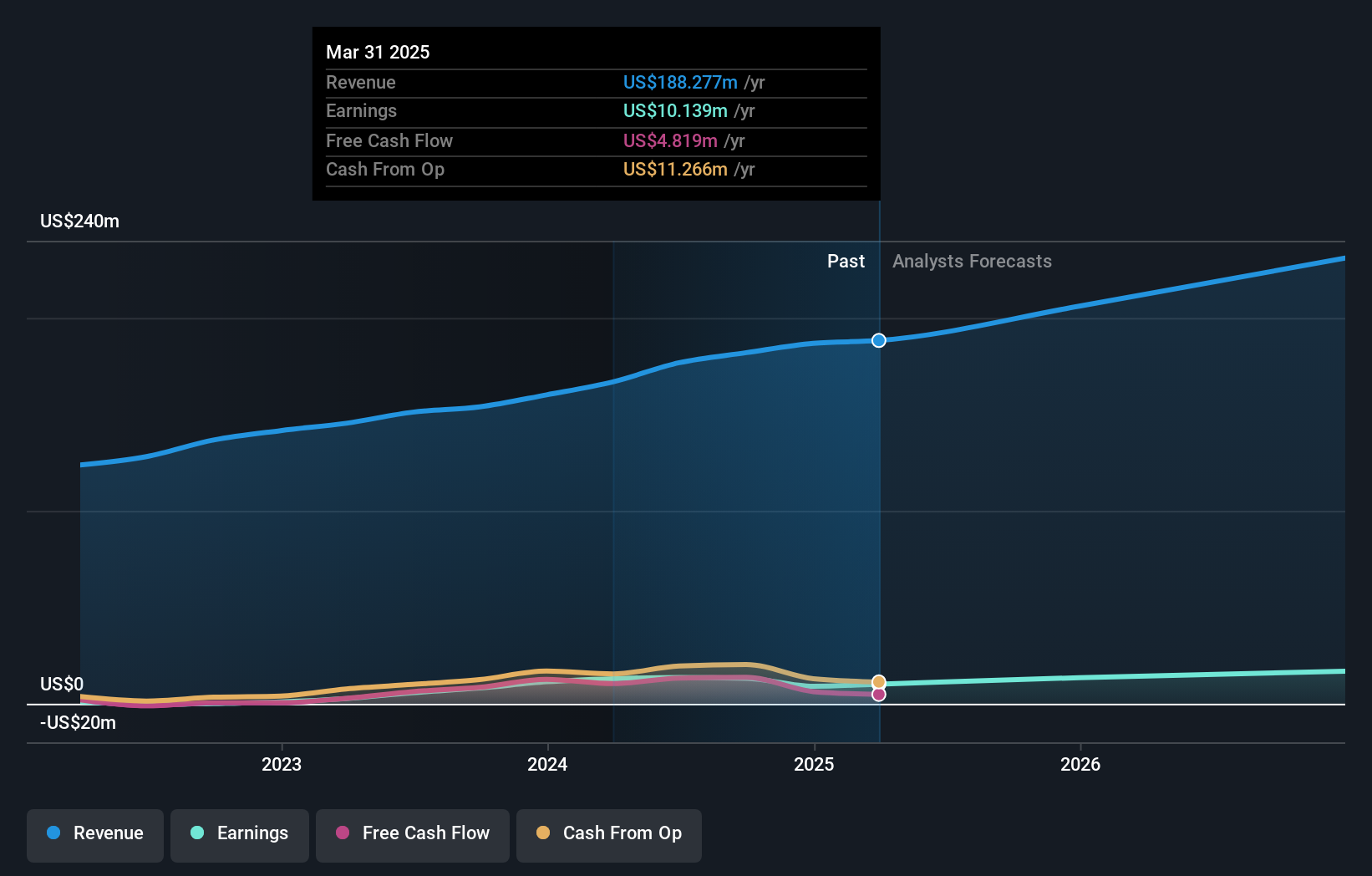

Operations: Lifeway Foods generates revenue primarily from its cultured dairy products segment, amounting to $181.98 million.

Lifeway Foods, a prominent player in the probiotic foods market, has seen robust earnings growth of 62.1% over the past year, outpacing its industry peers. The company is debt-free now, a significant improvement from five years ago when its debt-to-equity ratio was 10%. Despite trading at 73.5% below estimated fair value and facing notable insider selling recently, Lifeway remains focused on expanding globally with new product lines like Probiotic Smoothie + Collagen. Recent sales figures highlight continued momentum with Q3 sales reaching US$46 million compared to US$41 million the previous year, while net income slightly decreased to US$2.98 million from US$3.41 million.

Kelly Services (NasdaqGS:KELY.A)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kelly Services, Inc. offers workforce solutions across multiple industries and has a market capitalization of approximately $513.39 million.

Operations: Kelly Services generates revenue primarily from its Professional & Industrial segment ($1.40 billion) and Science, Engineering & Technology segment ($1.31 billion), with significant contributions from Education ($941.10 million) and Outsourcing & Consulting ($458.30 million).

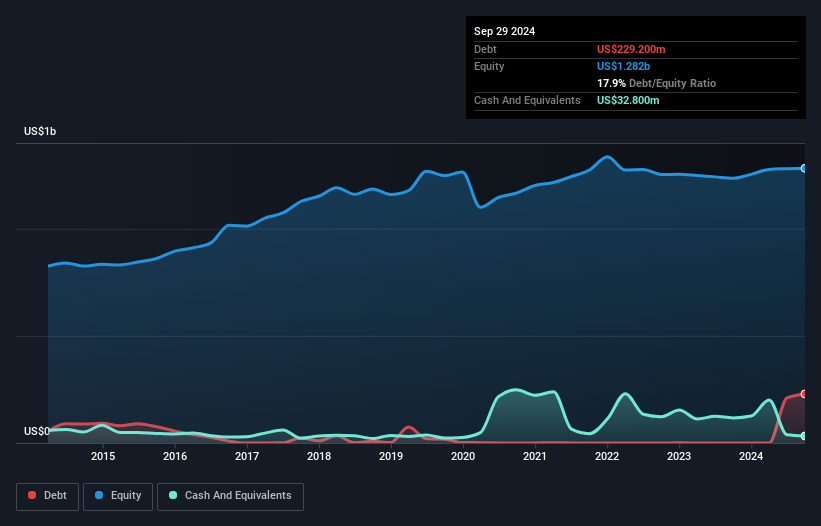

Kelly Services, a nimble player in the staffing industry, has seen its earnings grow by 80% over the past year, outpacing the sector's 9.8% growth. Despite a notable $15.9M one-off loss recently impacting results, it trades at an attractive value—88% below estimated fair value. The debt to equity ratio has risen from 1.4% to 17.9%, yet remains satisfactory at 15%. With a share buyback program of up to $50M announced and strategic moves into specialized staffing and AI technology through its Helix platform, Kelly aims for improved margins amidst market challenges and potential growth opportunities.

Global Industrial (NYSE:GIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Global Industrial Company operates as an industrial distributor of various industrial and MRO products in North America with a market capitalization of $969.15 million.

Operations: Global Industrial's revenue primarily comes from its Industrial Products Group, which generated $1.33 billion. The company's financial performance is reflected in its market capitalization of $969.15 million.

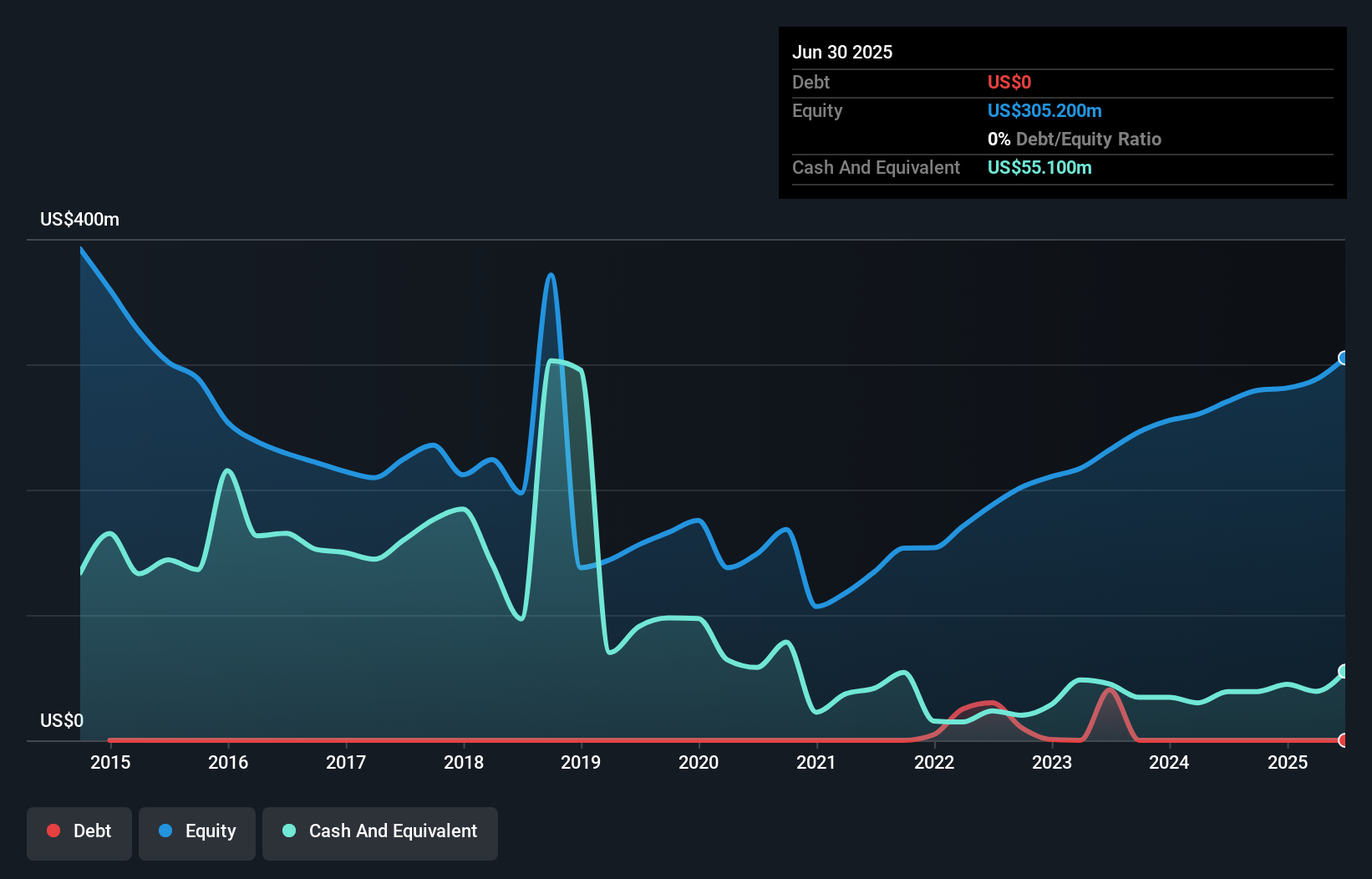

Global Industrial, a nimble player in the industrial sector, is leveraging strategic initiatives to boost growth and efficiency. The company's focus on high-value accounts and exclusive offerings, alongside tools like Salesforce, aims to enhance customer engagement. Despite a dip in third-quarter sales to US$342 million from US$355 million last year and net income of US$16.8 million down from US$20.7 million, Global Industrial remains debt-free with positive free cash flow of US$39.4 million as of September 2024. While earnings are projected to grow at 13% annually, challenges such as rising costs could impact future performance.

Where To Now?

- Reveal the 253 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GIC

Global Industrial

Operates as an industrial distributor of various industrial and maintenance, repair, and operation (MRO) products in North America.

Flawless balance sheet and undervalued.