Key Takeaways

- A new CEO with expertise in B2B and e-commerce is likely to enhance operations, driving growth and boosting revenue and margins.

- Strategic integration of Salesforce and expanded digital platforms aim to unify customer insights, deepen engagement, and increase order volumes, enhancing future earnings.

- Revenue risks persist due to declining sales in core SMB markets and rising transportation and CPC costs, impacting margins and profitability.

Catalysts

About Global Industrial- Through its subsidiaries, operates as an industrial distributor of various industrial and maintenance, repair, and operation (MRO) products in the United States and Canada.

- The appointment of a new CEO with a strong background in B2B, industrial distribution, marketing, and e-commerce is expected to enhance Global Industrial’s operating performance and drive long-term growth, potentially boosting future revenue and net margins.

- Strategic initiatives such as the recent rollout of Salesforce for the sales team and upcoming integration of marketing and customer service modules are anticipated to improve operational efficiencies and contribute to higher revenue and earnings by providing a unified perspective of customers across business functions.

- Targeted account-based marketing programs and alignment of marketing and sales teams to strengthen managed account relationships can deepen customer engagement and drive revenue growth, especially from high-value accounts, thereby positively impacting future earnings.

- Investments in e-procurement and e-enabled sales platforms are aimed at meeting the expectations of digital B2B buyers, which could lead to increased order volumes and higher revenue through improved digital sales channels.

- Continued focus on pricing analytics and intelligence, and enhancements to customer experience, freight, and web performance is expected to optimize cost efficiencies, reduce customer dissatisfaction, and improve price capture, which could bolster net margins and overall earnings.

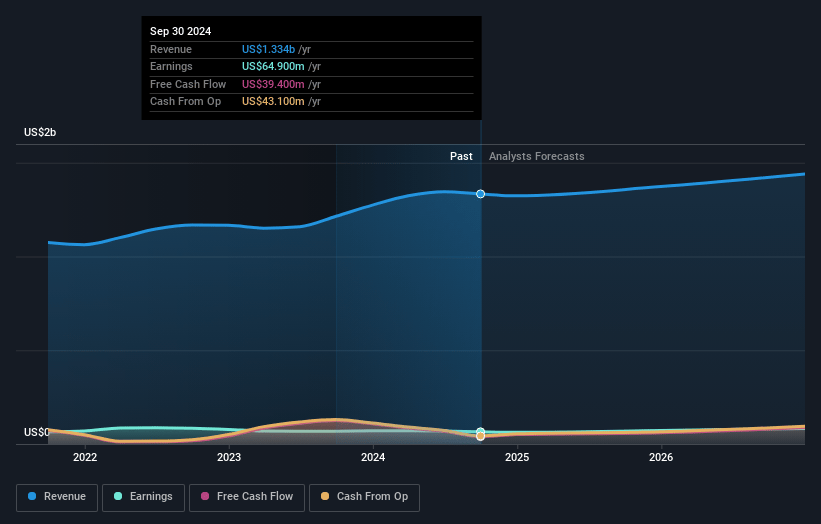

Global Industrial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Global Industrial's revenue will grow by 2.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.6% today to 6.6% in 3 years time.

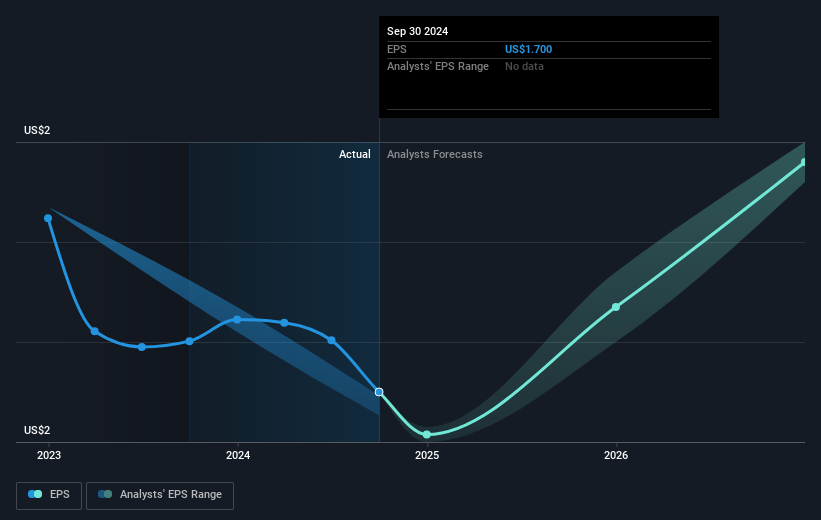

- Analysts expect earnings to reach $94.4 million (and earnings per share of $2.4) by about March 2028, up from $60.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.0x on those 2028 earnings, up from 14.5x today. This future PE is about the same as the current PE for the US Trade Distributors industry at 19.0x.

- Analysts expect the number of shares outstanding to grow by 0.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.42%, as per the Simply Wall St company report.

Global Industrial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The revenue decline of 5.6% in the fourth quarter, particularly with underperformance in the core SMB customer base, indicates a potential risk to overall revenue stability and growth prospects.

- Increased transportation costs continue to impact gross margins, which could strain profitability if not effectively managed, potentially affecting net margins.

- Inflation in cost-per-click (CPC) within paid search advertising has led to reduced web traffic among unmanaged small customer accounts, which may further impact sales and marketing efficiency, affecting revenue growth.

- The potential impact of new tariffs and ongoing volatility in ocean freight costs could pressure cost management strategies, influencing gross margins and overall earnings.

- Selling, general, and administrative (SG&A) expenses increased as a percentage of net sales due to negative leverage from soft top-line performance and CPC inflation, posing a risk to operating margins and overall operating income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $38.0 for Global Industrial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $94.4 million, and it would be trading on a PE ratio of 19.0x, assuming you use a discount rate of 7.4%.

- Given the current share price of $22.9, the analyst price target of $38.0 is 39.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.