- United States

- /

- Aerospace & Defense

- /

- NYSE:CDRE

3 US Stocks That May Be Trading At Discounts Up To 45.9%

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with mixed futures following a strong rally, investors are keenly observing corporate earnings and economic indicators that could influence future trends. In this environment, identifying stocks that may be undervalued provides an opportunity for investors to consider potential discounts, especially when these equities show promise despite broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Flushing Financial (NasdaqGS:FFIC) | $14.51 | $28.35 | 48.8% |

| Atlantic Union Bankshares (NYSE:AUB) | $37.87 | $75.40 | 49.8% |

| Heartland Financial USA (NasdaqGS:HTLF) | $66.23 | $129.87 | 49% |

| Afya (NasdaqGS:AFYA) | $15.74 | $30.63 | 48.6% |

| CI&T (NYSE:CINT) | $6.47 | $12.57 | 48.5% |

| Privia Health Group (NasdaqGS:PRVA) | $22.68 | $44.59 | 49.1% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | $38.48 | $75.05 | 48.7% |

| BeiGene (NasdaqGS:ONC) | $222.22 | $437.98 | 49.3% |

| Equifax (NYSE:EFX) | $271.88 | $535.10 | 49.2% |

| Coeur Mining (NYSE:CDE) | $6.36 | $12.67 | 49.8% |

Underneath we present a selection of stocks filtered out by our screen.

HealthEquity (NasdaqGS:HQY)

Overview: HealthEquity, Inc. offers technology-enabled services platforms for consumers and employers in the United States, with a market cap of approximately $9.08 billion.

Operations: HealthEquity's revenue segment includes Pharmacy Services, generating $1.15 billion.

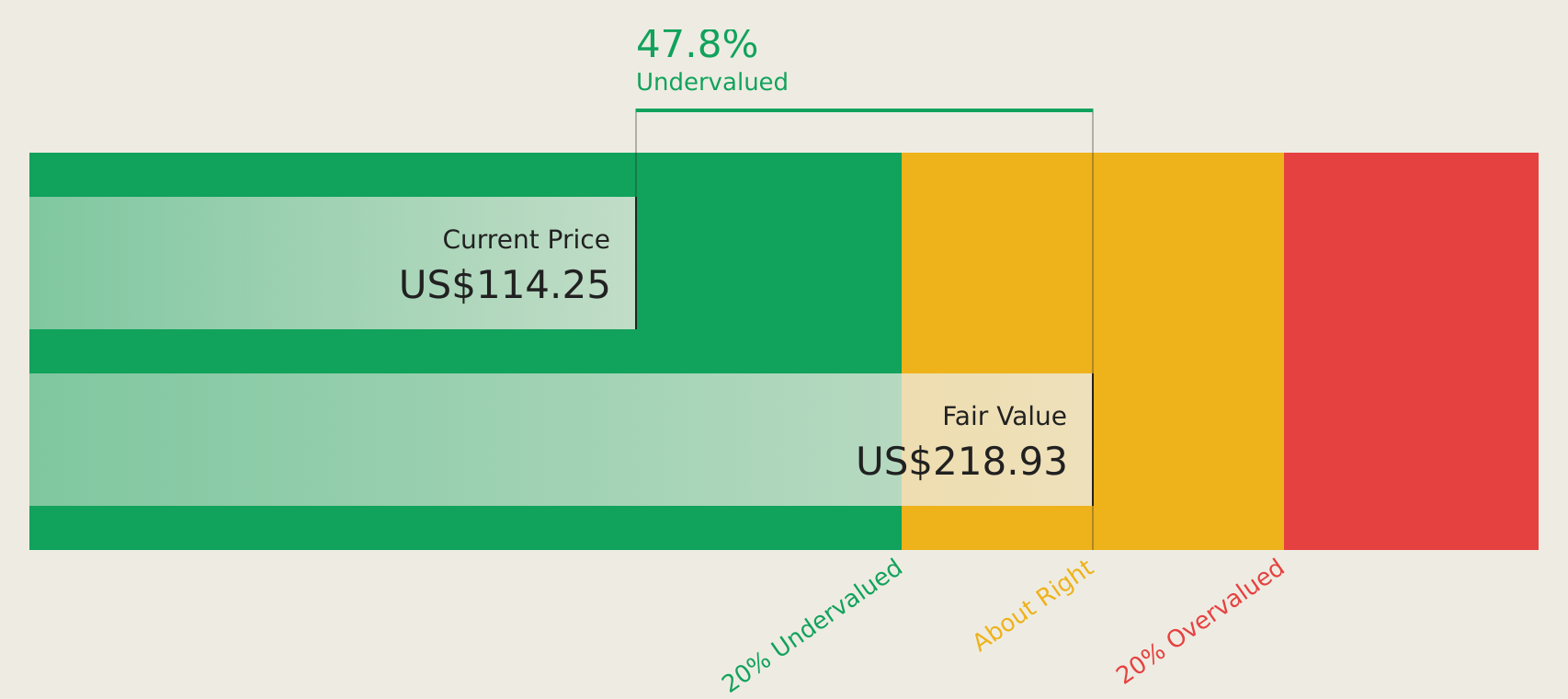

Estimated Discount To Fair Value: 44.1%

HealthEquity is trading at US$105.77, significantly below its estimated fair value of US$189.22, indicating potential undervaluation based on cash flows. Despite recent insider selling and a settlement expense impacting earnings, the company has shown strong revenue growth, with earnings rising by 231.9% over the past year. Forecasts suggest annual profit growth of 41%, outpacing the broader US market, while revenue is expected to grow at 10% annually.

- According our earnings growth report, there's an indication that HealthEquity might be ready to expand.

- Navigate through the intricacies of HealthEquity with our comprehensive financial health report here.

AngloGold Ashanti (NYSE:AU)

Overview: AngloGold Ashanti plc is a gold mining company with operations in Africa, Australia, and the Americas, and it has a market cap of approximately $14.08 billion.

Operations: The company's revenue segment is primarily derived from Metals & Mining - Gold & Other Precious Metals, amounting to $5.30 billion.

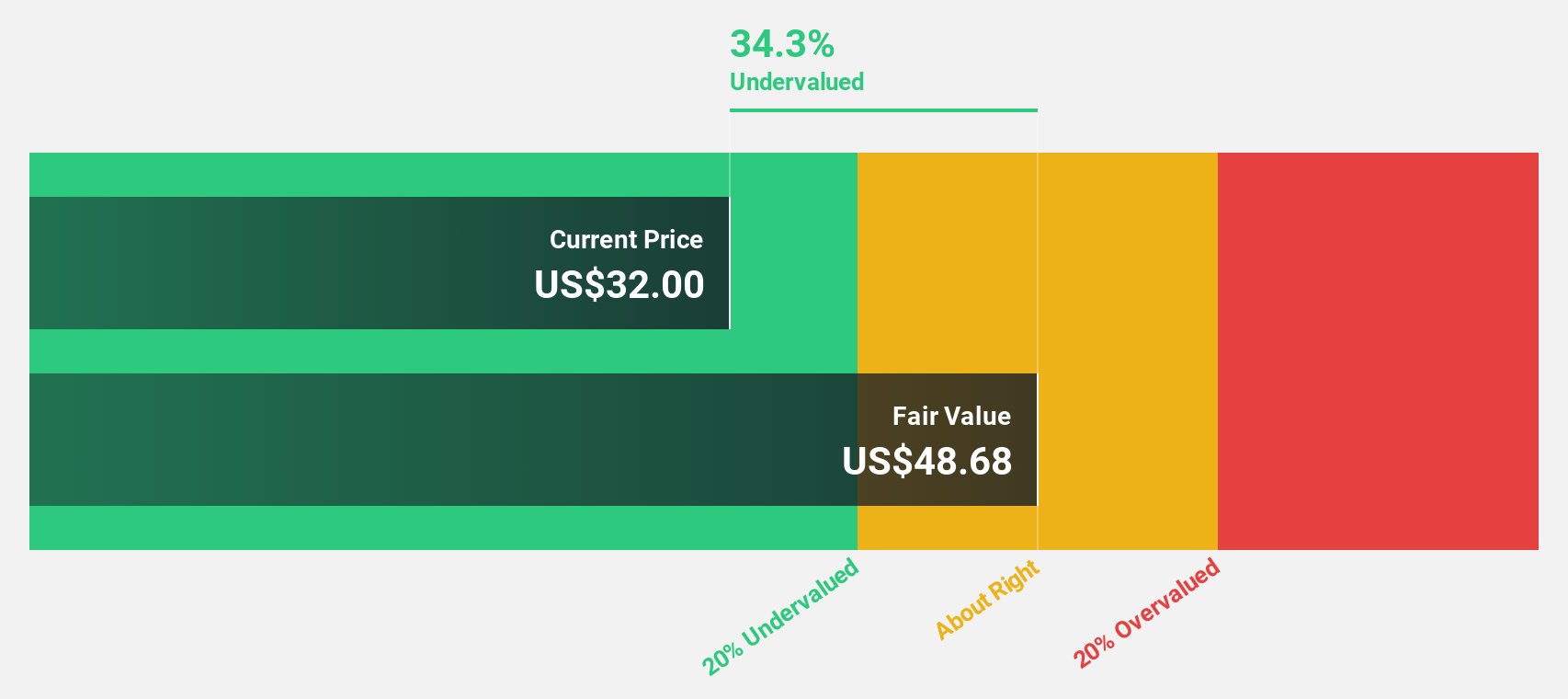

Estimated Discount To Fair Value: 45.9%

AngloGold Ashanti, trading at US$27.95, is significantly undervalued against its estimated fair value of US$51.70, reflecting potential based on cash flows. Despite recent insider selling and large one-off items affecting results, the company turned profitable this year with net income reaching US$534 million for the first nine months of 2024. Earnings are forecast to grow substantially by 52.7% annually over the next three years, surpassing market growth expectations.

- Our expertly prepared growth report on AngloGold Ashanti implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of AngloGold Ashanti.

Cadre Holdings (NYSE:CDRE)

Overview: Cadre Holdings, Inc. manufactures and distributes safety equipment for protection in hazardous situations both in the United States and internationally, with a market cap of $1.58 billion.

Operations: The company's revenue segments consist of $449.48 million from Product and $99.39 million from Distribution.

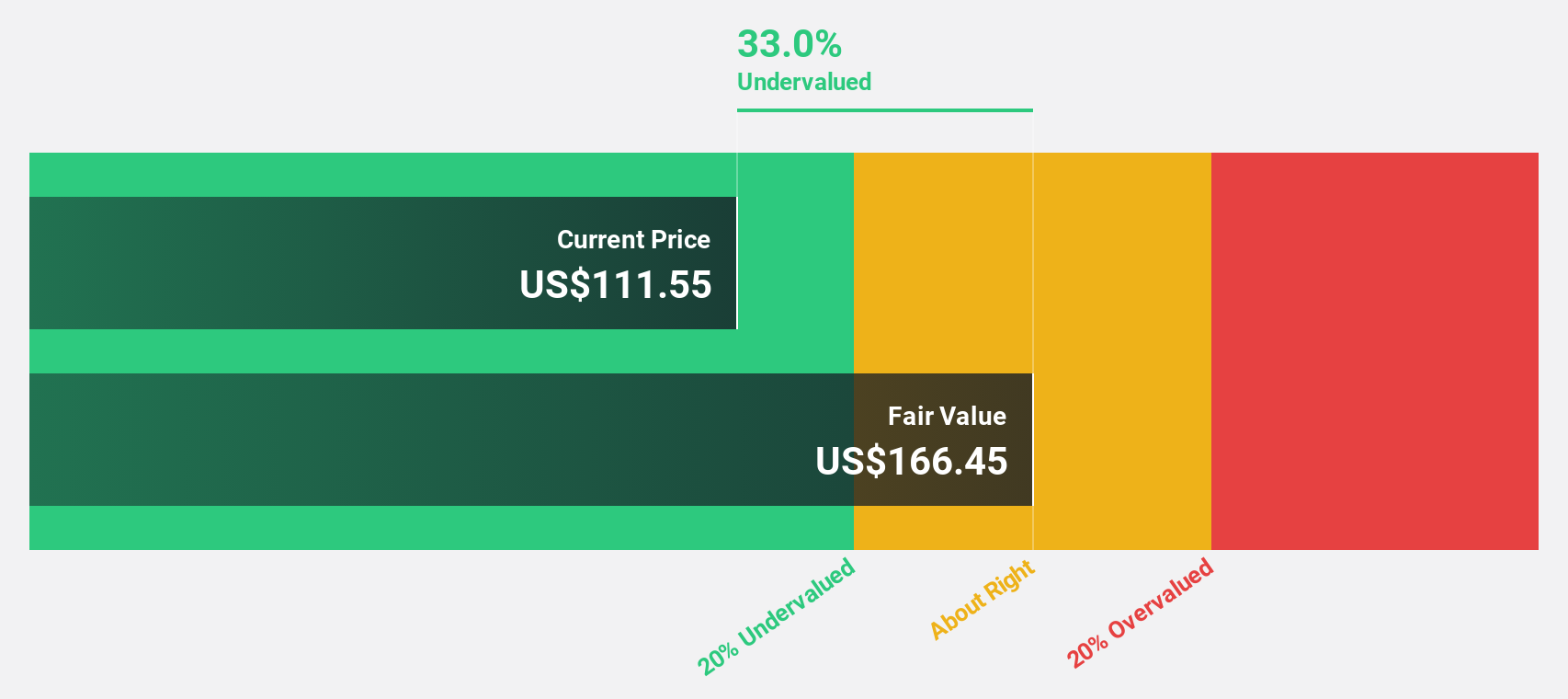

Estimated Discount To Fair Value: 43.8%

Cadre Holdings, trading at US$39.39, is significantly undervalued compared to its estimated fair value of US$70.15, offering potential based on cash flows. Despite insider selling and large one-off items impacting results, the company forecasts robust annual earnings growth of 30.1% over the next three years, outpacing market expectations. Recent strategic moves include a new credit facility totaling US$590 million to support acquisitions and growth initiatives, enhancing its financial flexibility.

- Our earnings growth report unveils the potential for significant increases in Cadre Holdings' future results.

- Get an in-depth perspective on Cadre Holdings' balance sheet by reading our health report here.

Make It Happen

- Unlock our comprehensive list of 162 Undervalued US Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDRE

Cadre Holdings

Manufactures and distributes safety equipment and other related products that provides protection to users in hazardous or life-threatening situations in the United States and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives