- United States

- /

- Banks

- /

- NasdaqGS:ZION

US Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a wave of earnings reports, with major indices experiencing slight declines, investors are closely watching economic indicators that could influence Federal Reserve decisions on interest rates. In this environment, dividend stocks can offer stability and income potential, making them an attractive consideration for those seeking resilient investment options amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.67% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.73% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.12% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 5.13% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.77% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.78% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

Click here to see the full list of 147 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

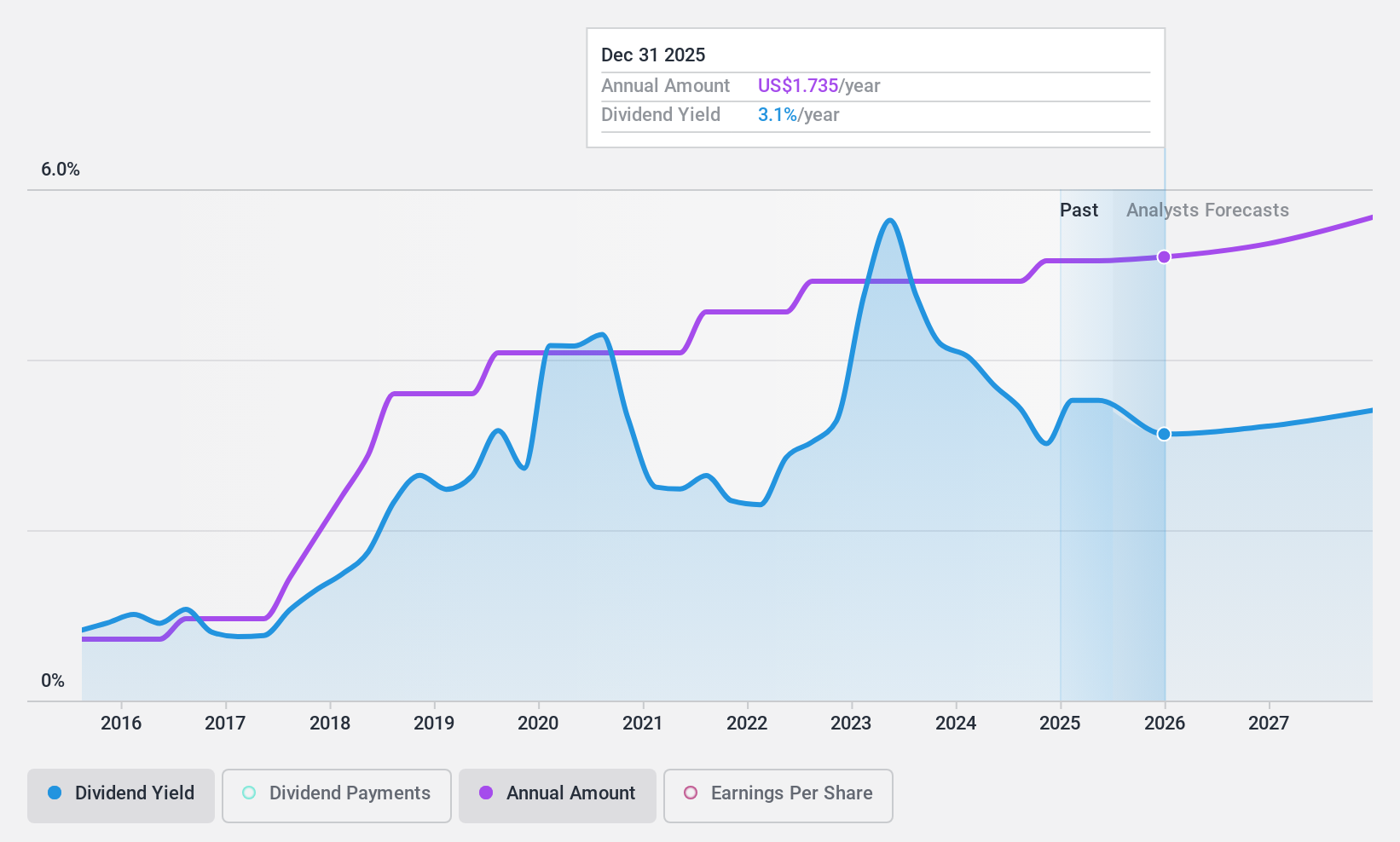

Zions Bancorporation National Association (NasdaqGS:ZION)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zions Bancorporation National Association offers a range of banking products and services across several Western and Southwestern U.S. states, with a market cap of approximately $8.46 billion.

Operations: Zions Bancorporation National Association's revenue segments include Nevada State Bank with $232 million, Amegy Corporation at $631 million, Vectra Bank Colorado contributing $174 million, California Bank & Trust at $672 million, National Bank of Arizona with $279 million, The Commerce Bank of Washington providing $64 million, and Zions First National Bank generating $879 million.

Dividend Yield: 3%

Zions Bancorporation, National Association has demonstrated reliable and stable dividend payments over the past decade, with a recent quarterly dividend of US$0.43 per share. The company's dividends are well covered by earnings with a payout ratio of 37.4%, ensuring sustainability. Although the dividend yield of 3% is lower than top-tier payers in the US market, Zions' dividends have shown consistent growth and remain attractive for income-focused investors seeking stability.

- Unlock comprehensive insights into our analysis of Zions Bancorporation National Association stock in this dividend report.

- The analysis detailed in our Zions Bancorporation National Association valuation report hints at an deflated share price compared to its estimated value.

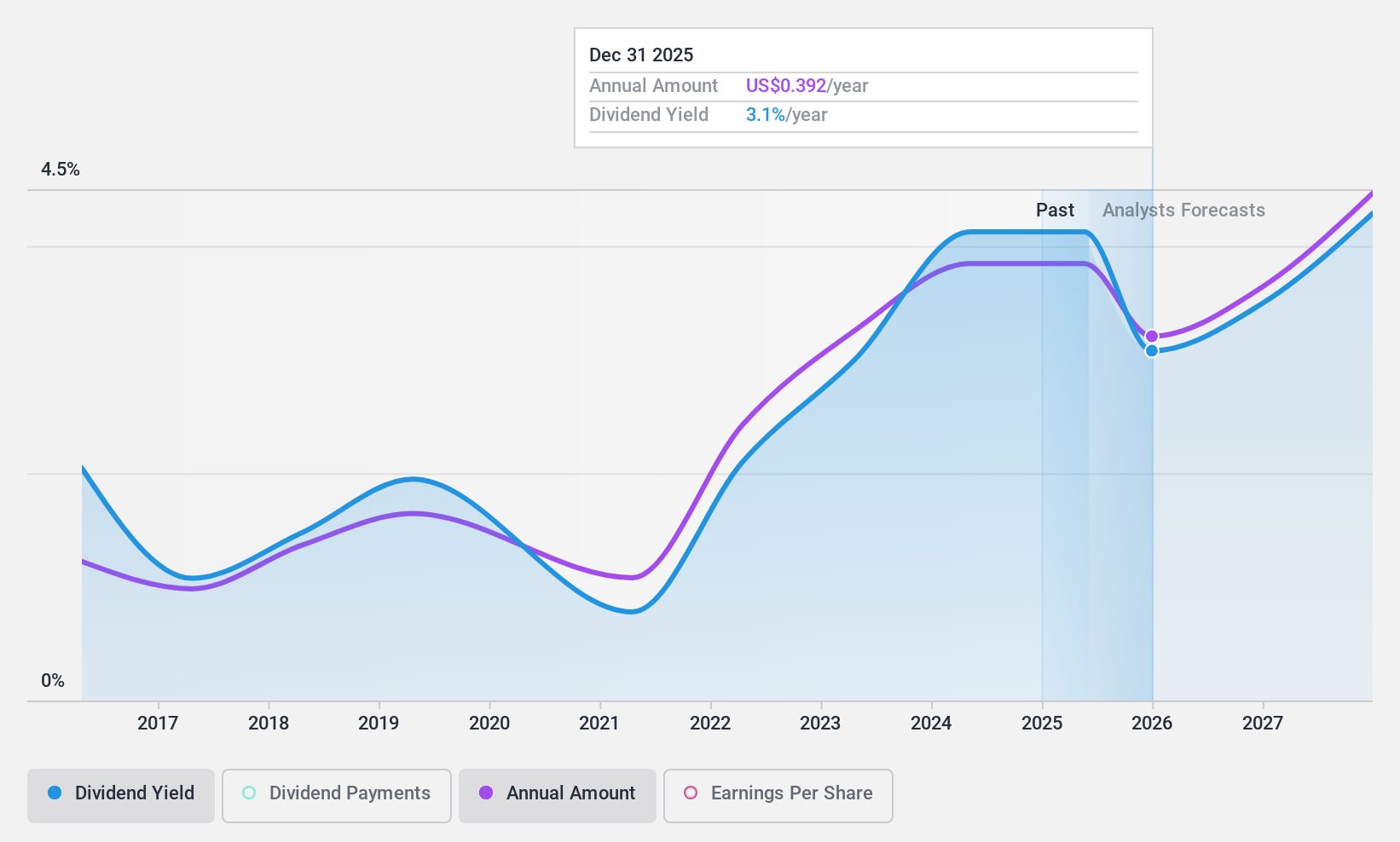

CNH Industrial (NYSE:CNH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNH Industrial N.V. is an equipment and services company involved in the design, production, marketing, sale, and financing of agricultural and construction equipment across various regions including North America, Europe, the Middle East, Africa, South America, and the Asia Pacific with a market cap of approximately $14.54 billion.

Operations: CNH Industrial's revenue segments include $15.54 billion from Industrial Activities - Agriculture, $3.41 billion from Industrial Activities - Construction, and $2.80 billion from Financial Services.

Dividend Yield: 3.9%

CNH Industrial's dividend yield of 3.9% is below the top 25% of US dividend payers, and its dividends have been volatile over the past decade. Despite this, dividends are well covered by earnings with a payout ratio of 34.1%, though cash flow coverage is tighter at 87.6%. Recent share buybacks totaling $143.62 million may support stock value, but declining earnings and revenue highlight potential challenges for future dividend stability and growth.

- Navigate through the intricacies of CNH Industrial with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that CNH Industrial is trading behind its estimated value.

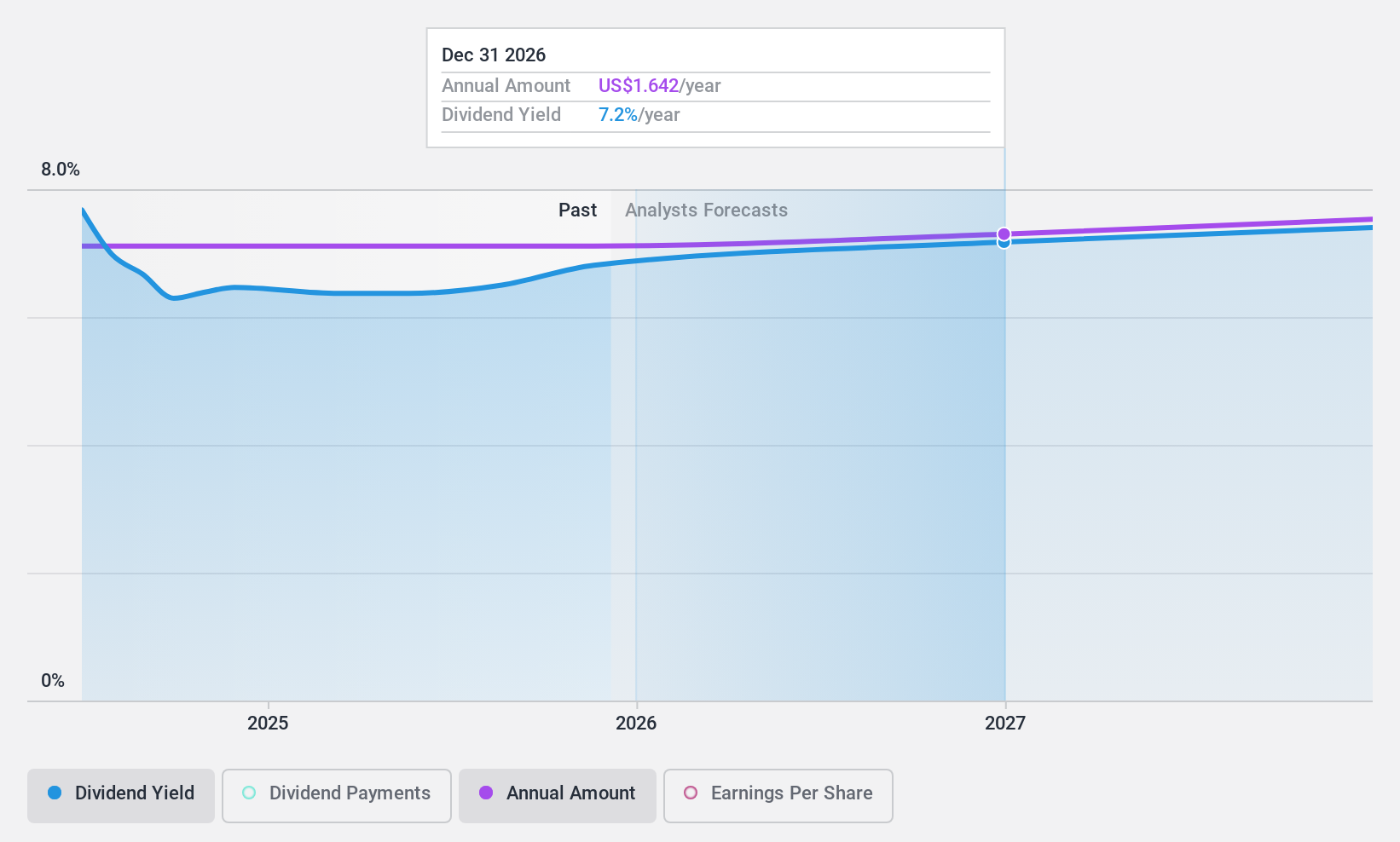

Sila Realty Trust (NYSE:SILA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sila Realty Trust, Inc. is a net lease real estate investment trust based in Tampa, Florida, concentrating on investments in the U.S. healthcare sector, with a market cap of $1.32 billion.

Operations: Revenue Segments: Sila Realty Trust generates $186.23 million from its commercial real estate investments in the healthcare sector.

Dividend Yield: 6.6%

Sila Realty Trust's dividend yield ranks in the top 25% of US payers, though its four-year track record reveals volatility and unreliable growth. Dividends are covered by earnings and cash flows, with payout ratios at 64.9% and 68.6%, respectively. Recent index inclusion may enhance visibility, but fluctuating earnings and sales could impact future payouts. The company is exploring acquisitions focused on outpatient medical facilities, potentially influencing its financial dynamics moving forward into 2025.

- Click here to discover the nuances of Sila Realty Trust with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Sila Realty Trust's current price could be inflated.

Key Takeaways

- Take a closer look at our Top US Dividend Stocks list of 147 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zions Bancorporation National Association might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZION

Zions Bancorporation National Association

Provides various banking products and related services primarily in the states of Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives