- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Intuitive Machines (LUNR) Sees US$38 Million Net Loss In Recent Quarterly Performance

Reviewed by Simply Wall St

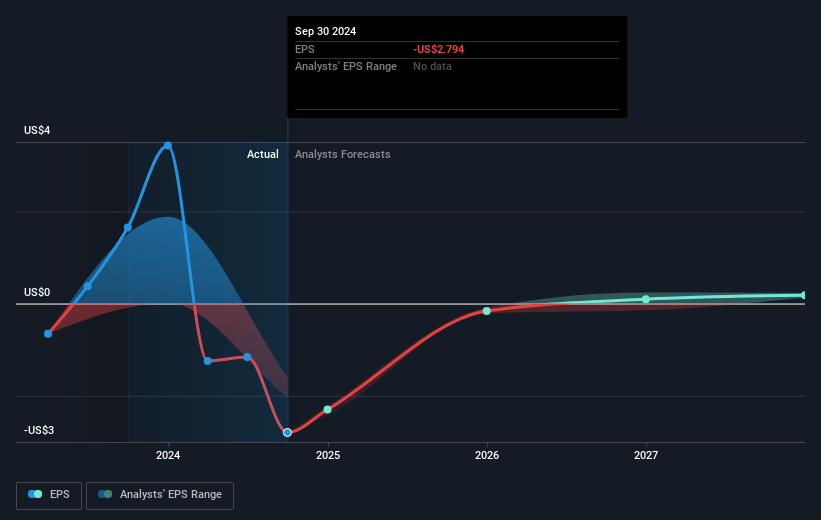

Intuitive Machines (LUNR) reported a notable quarterly performance on August 7, 2025, with sales increasing to $50.31 million, but a net loss of $38.59 million contrasted sharply with last year's profit. Despite securing a $9.8 million government contract and pursuing strategic mergers and acquisitions, the company's share price dropped 10.49% last week. This decline occurred as major indexes like the Dow and S&P 500 hovered near record highs, closing with slight gains over the same period. The broader uptick helped counterbalance negative market sentiment influenced by worrisome inflation data, further highlighting the diversity of investor reactions.

The recent performance of Intuitive Machines, marked by a 10.49% share price decline despite securing a US$9.8 million government contract, casts a spotlight on the volatility surrounding the company's operations. This movement could influence the narrative by suggesting that investor concerns about net losses and execution risks have overshadowed positive contract news. The market's reaction might imply skepticism about the company's capacity to convert contracts into tangible revenue and earnings amid intense competition and operational challenges.

Over the past year, the company's total return including share price and dividends was 113.76%. This compares favorably to the broader market and US Aerospace & Defense industry, which saw returns of 16.1% and 30.9% respectively. This indicates significant investor optimism surrounding Intuitive Machines' prospects prior to recent short-term declines.

The recent financial updates might prompt analysts to reassess their revenue and earnings forecasts, considering the heightened execution risks and existing losses detailed in the latest report. With revenue at US$225.98 million and earnings at a loss of US$241.76 million, the current outlook appears cautious despite ambitious future growth assumptions.

Given the current share price of US$9.08 and the analyst price target of US$14.83, the recent drop reflects a discount of approximately 37% from the target. This considerable gap highlights persistent uncertainties around the company’s valuation and future profitability outlook, indicating that the path to achieving analyst targets remains challenging in light of recent developments.

Review our growth performance report to gain insights into Intuitive Machines' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)