- United States

- /

- Machinery

- /

- NasdaqGS:CMCO

Top Undervalued Small Caps With Insider Action In April 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 7.1%, contributing to a 12-month increase of 7.7%, with earnings projected to grow by 14% annually in the coming years. In this favorable environment, identifying small-cap stocks that are perceived as undervalued and exhibit insider activity can offer intriguing opportunities for investors seeking potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MVB Financial | 10.7x | 1.4x | 37.06% | ★★★★★★ |

| Shore Bancshares | 10.0x | 2.2x | 11.65% | ★★★★★☆ |

| S&T Bancorp | 10.6x | 3.6x | 45.52% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 20.65% | ★★★★☆☆ |

| Forestar Group | 5.9x | 0.7x | -396.90% | ★★★★☆☆ |

| West Bancorporation | 12.7x | 4.0x | 39.30% | ★★★☆☆☆ |

| Franklin Financial Services | 15.7x | 2.5x | 35.01% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -18.26% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.2x | -3384.45% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.1x | -336.19% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

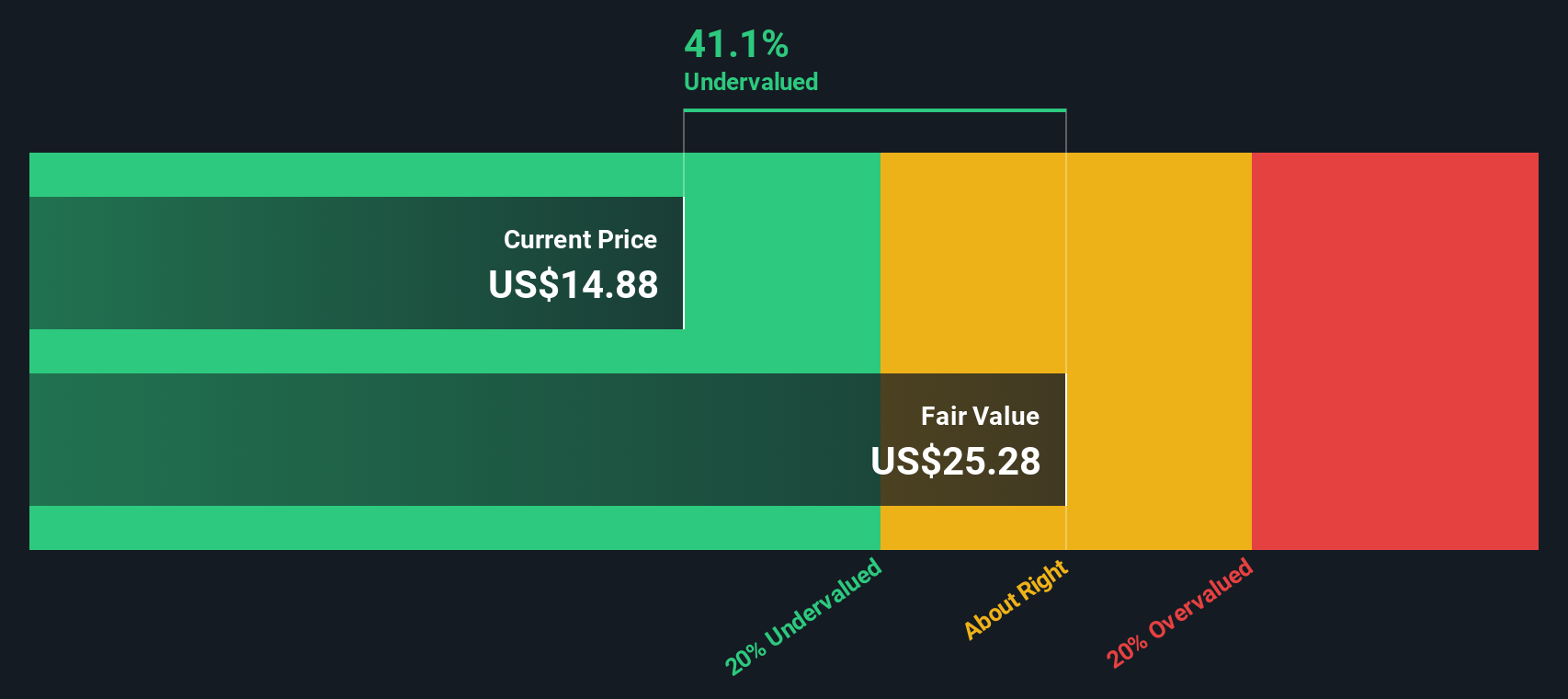

Columbus McKinnon (NasdaqGS:CMCO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Columbus McKinnon is a company specializing in the design, manufacture, and distribution of machinery and industrial equipment with a market capitalization of approximately $1.27 billion.

Operations: The primary revenue stream for the company comes from Machinery & Industrial Equipment, with recent quarterly revenue of $981.64 million. The gross profit margin has shown fluctuations, reaching 37.10% in the quarter ending December 2024 before declining to 36.26% by April 2025. Operating expenses are a significant cost component, consistently exceeding $280 million in recent periods, impacting net income figures which have varied notably over time.

PE: 45.9x

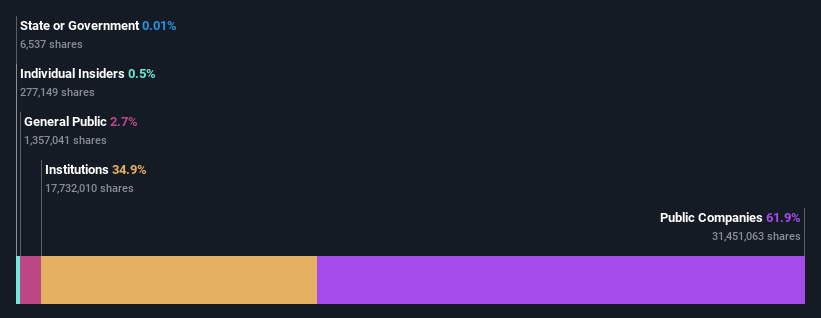

Columbus McKinnon has been navigating a challenging period with fluctuating earnings and volatile share prices. Despite these hurdles, insider confidence remains strong, as evidenced by David Wilson's recent purchase of 31,300 shares for US$1 million between October and December 2024. The company is addressing its financial position through strategic moves like a US$800 million private placement with Clayton, Dubilier & Rice. While profit margins have dipped to 1%, future growth prospects are promising with an expected annual earnings increase of nearly 83%.

- Click here and access our complete valuation analysis report to understand the dynamics of Columbus McKinnon.

Understand Columbus McKinnon's track record by examining our Past report.

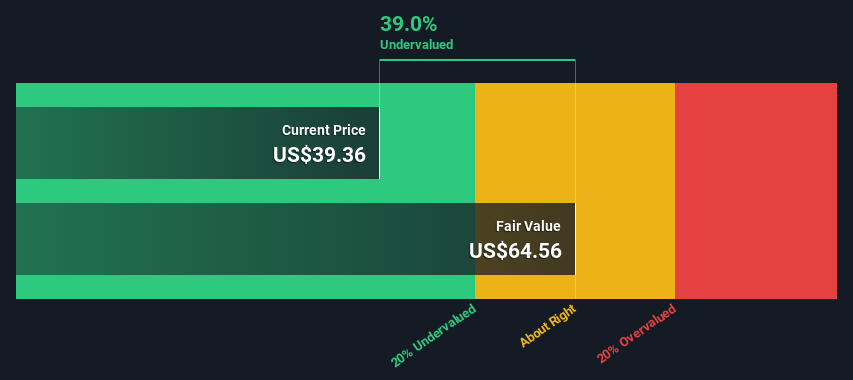

S&T Bancorp (NasdaqGS:STBA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: S&T Bancorp is a financial holding company that provides community banking services, with a market capitalization of approximately $1.23 billion.

Operations: The company generates revenue primarily from community banking, with recent figures showing $386.87 million in revenue. Operating expenses are significant, totaling $215.32 million, with general and administrative expenses being the largest component at $175.96 million. The net income margin shows a notable trend, reaching 34.49% as of the latest period analyzed.

PE: 10.6x

S&T Bancorp, a smaller financial institution, reported a solid Q1 2025 performance with net income rising to US$33.4 million from US$31.24 million the previous year, and diluted earnings per share increasing to US$0.87 from US$0.81. Despite no recent share repurchases, insider confidence is evident through stock purchases over the past year, suggesting belief in its potential value despite forecasted earnings declines of 2.2% annually over three years.

- Take a closer look at S&T Bancorp's potential here in our valuation report.

Gain insights into S&T Bancorp's past trends and performance with our Past report.

Forestar Group (NYSE:FOR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Forestar Group is a residential lot development company focused on delivering real estate solutions, with operations primarily in the United States and a market capitalization of approximately $1.09 billion.

Operations: Forestar Group's revenue primarily stems from its real estate operations, with a recent figure of $1.47 billion. The company has experienced fluctuations in its gross profit margin, which reached 23.93% as of September 2024, indicating variability in cost management and pricing strategies over time. Operating expenses have also varied, impacting net income margins that have shown both positive and negative trends across different periods.

PE: 5.9x

Forestar Group, a smaller player in the U.S. market, has shown insider confidence with recent share purchases. Despite a dip in net income to US$31.6 million for Q2 2025 from US$45 million the previous year, revenue increased to US$351 million from US$333.8 million. The company's growth potential is underscored by a forecasted annual revenue increase of 10.7%. However, reliance on higher-risk external borrowing remains a concern as they recently issued US$500 million in senior notes due 2033 at 6.5% interest for refinancing and general purposes.

- Delve into the full analysis valuation report here for a deeper understanding of Forestar Group.

Evaluate Forestar Group's historical performance by accessing our past performance report.

Where To Now?

- Unlock more gems! Our Undervalued US Small Caps With Insider Buying screener has unearthed 87 more companies for you to explore.Click here to unveil our expertly curated list of 90 Undervalued US Small Caps With Insider Buying.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Columbus McKinnon, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCO

Columbus McKinnon

Designs, manufactures, and markets motion solutions for moving, lifting, positioning, and securing materials worldwide.

Established dividend payer slight.

Similar Companies

Market Insights

Community Narratives