- United States

- /

- Beverage

- /

- NasdaqGS:COCO

US Growth Stocks With High Insider Ownership January 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a complex landscape marked by fluctuating tech stocks and rising bond yields, investors are keeping a close eye on economic indicators like inflation data and job reports that could influence Federal Reserve policies. In this environment, growth companies with high insider ownership can offer unique insights into potential resilience and long-term value, as insiders' vested interests may align closely with shareholder goals amidst market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.2% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.7% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| Capital Bancorp (NasdaqGS:CBNK) | 31.1% | 30.1% |

| ARS Pharmaceuticals (NasdaqGM:SPRY) | 19.1% | 60.5% |

| Myomo (NYSEAM:MYO) | 13.7% | 56.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

AerSale (NasdaqCM:ASLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AerSale Corporation supplies aftermarket commercial aircraft, engines, and parts to various sectors including airlines and defense contractors, while also offering MRO services globally, with a market cap of $335.23 million.

Operations: The company's revenue segments include Tech Ops - MRO Services at $107.24 million, Tech Ops - Product Sales at $21.42 million, Asset Management Solutions - Engine at $158.66 million, and Asset Management Solutions - Aircraft at $57.43 million.

Insider Ownership: 24.1%

AerSale Corporation shows potential as a growth company with high insider ownership, despite some challenges. Recent earnings reports indicate improved net income of US$3.15 million for the first nine months of 2024, reversing a previous loss. Although revenue growth is moderate at 11.4% annually, it surpasses the US market average of 9%. Earnings are projected to grow significantly by 86.1% per year, though profit margins have declined slightly from last year.

- Dive into the specifics of AerSale here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, AerSale's share price might be too optimistic.

Vita Coco Company (NasdaqGS:COCO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Vita Coco Company, Inc. develops, markets, and distributes coconut water products under the Vita Coco brand across various regions including the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of approximately $1.91 billion.

Operations: The company's revenue is primarily derived from the Americas segment, which accounts for $424.40 million, while the International segment contributes $70.46 million.

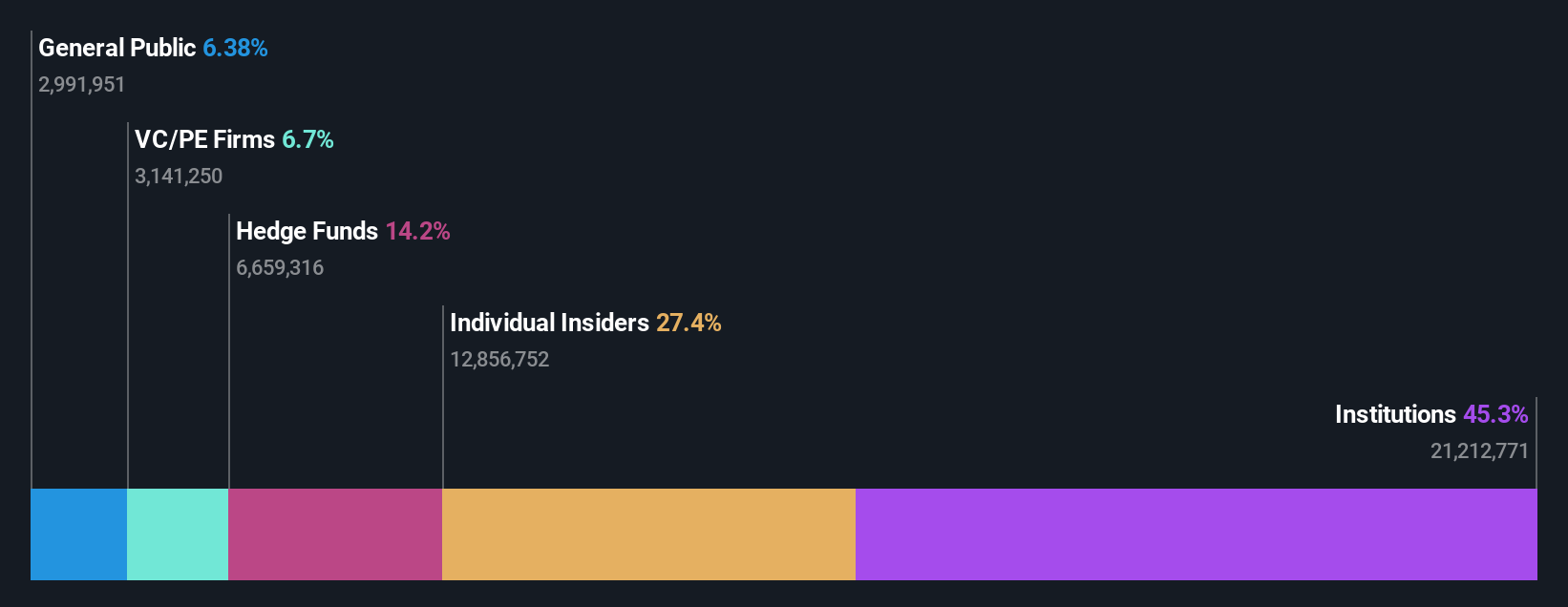

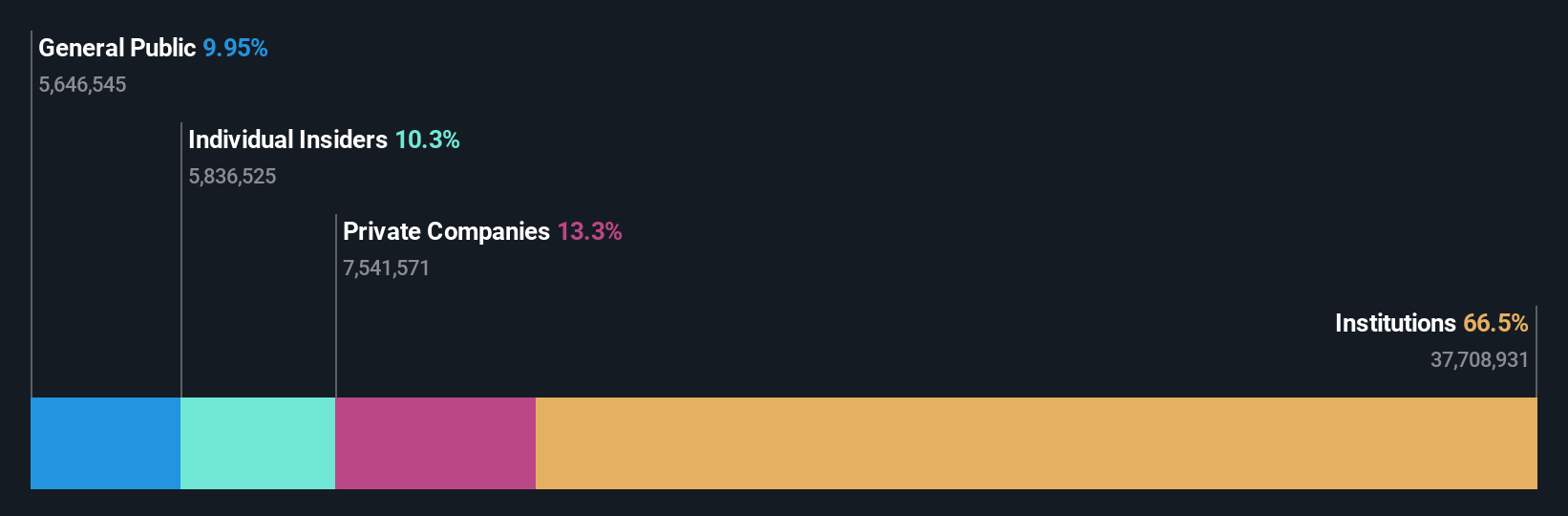

Insider Ownership: 10.9%

Vita Coco Company demonstrates growth potential, with earnings forecasted to increase significantly by 20.3% annually, surpassing US market averages. Despite a slight decline in third-quarter sales to US$132.91 million from the previous year, net income rose to US$19.25 million. The company raised its financial guidance for 2024, reflecting confidence in its core coconut water business despite challenges in other segments. Insider activity shows more buying than selling recently, indicating insider confidence.

- Unlock comprehensive insights into our analysis of Vita Coco Company stock in this growth report.

- Our comprehensive valuation report raises the possibility that Vita Coco Company is priced lower than what may be justified by its financials.

TXO Partners (NYSE:TXO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TXO Partners, L.P. is an oil and natural gas company that specializes in acquiring, developing, optimizing, and exploiting conventional reserves in North America, with a market cap of $709.03 million.

Operations: The company's revenue is primarily derived from the exploration and production of oil, natural gas, and natural gas liquids, totaling $285.45 million.

Insider Ownership: 24.5%

TXO Partners shows potential with insiders buying more shares recently, indicating confidence despite a challenging financial year. The company reported third-quarter revenue of US$68.73 million, down from the previous year, and net income dropped significantly to US$0.203 million. While its dividend yield is high at 11.76%, it's not well covered by earnings or cash flows. TXO is expected to achieve above-market profit growth over the next three years while trading below estimated fair value.

- Click to explore a detailed breakdown of our findings in TXO Partners' earnings growth report.

- The analysis detailed in our TXO Partners valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Click this link to deep-dive into the 204 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COCO

Vita Coco Company

Develops, markets, and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific.

Outstanding track record with high growth potential.