- United States

- /

- Banks

- /

- NYSE:WAL

Here's Why We Think Western Alliance Bancorporation (NYSE:WAL) Is Well Worth Watching

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Western Alliance Bancorporation (NYSE:WAL). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Western Alliance Bancorporation

How Fast Is Western Alliance Bancorporation Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. It certainly is nice to see that Western Alliance Bancorporation has managed to grow EPS by 27% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

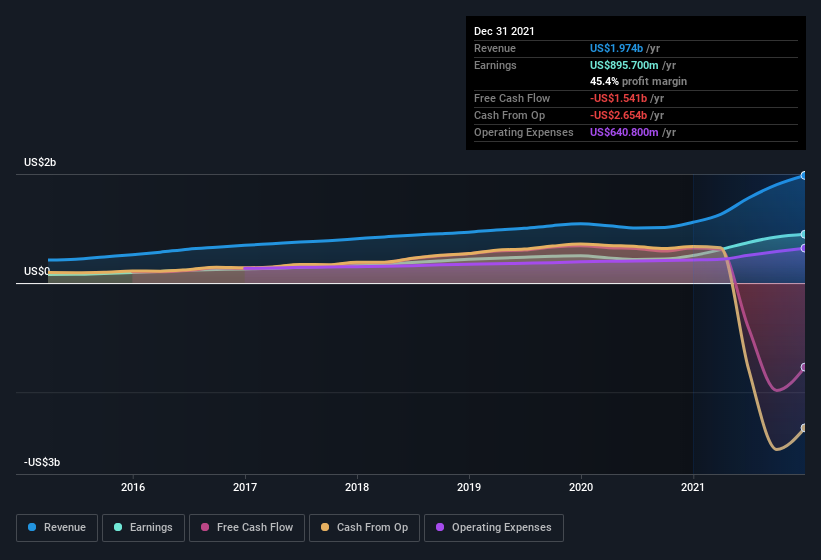

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Western Alliance Bancorporation's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Western Alliance Bancorporation's EBIT margins were flat over the last year, revenue grew by a solid 77% to US$2.0b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Western Alliance Bancorporation.

Are Western Alliance Bancorporation Insiders Aligned With All Shareholders?

Since Western Alliance Bancorporation has a market capitalization of US$8.7b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$264m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

Is Western Alliance Bancorporation Worth Keeping An Eye On?

You can't deny that Western Alliance Bancorporation has grown its earnings per share at a very impressive rate. That's attractive. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. You should always think about risks though. Case in point, we've spotted 4 warning signs for Western Alliance Bancorporation you should be aware of, and 1 of them is a bit unpleasant.

Although Western Alliance Bancorporation certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Western Alliance Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WAL

Western Alliance Bancorporation

Operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives