- United States

- /

- Life Sciences

- /

- NasdaqGS:RGEN

3 US Stocks Estimated To Be Trading At Discounts Up To 49.1%

Reviewed by Simply Wall St

As the U.S. stock market reaches new heights, with the Dow Jones Industrial Average closing at a record high and major indices posting weekly gains, investors are increasingly on the lookout for opportunities that may be trading below their intrinsic value. In this environment of rising markets and economic optimism, identifying undervalued stocks can offer potential entry points for those seeking to capitalize on discrepancies between current prices and perceived true worth.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | $50.45 | $99.93 | 49.5% |

| UMB Financial (NasdaqGS:UMBF) | $125.00 | $243.19 | 48.6% |

| Business First Bancshares (NasdaqGS:BFST) | $28.38 | $54.91 | 48.3% |

| West Bancorporation (NasdaqGS:WTBA) | $24.28 | $46.85 | 48.2% |

| Five Star Bancorp (NasdaqGS:FSBC) | $33.39 | $63.91 | 47.8% |

| Pinterest (NYSE:PINS) | $30.02 | $59.51 | 49.6% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $115.19 | $219.35 | 47.5% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.35 | $30.27 | 49.3% |

| Nutanix (NasdaqGS:NTNX) | $73.18 | $143.80 | 49.1% |

| Snap (NYSE:SNAP) | $11.42 | $22.72 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

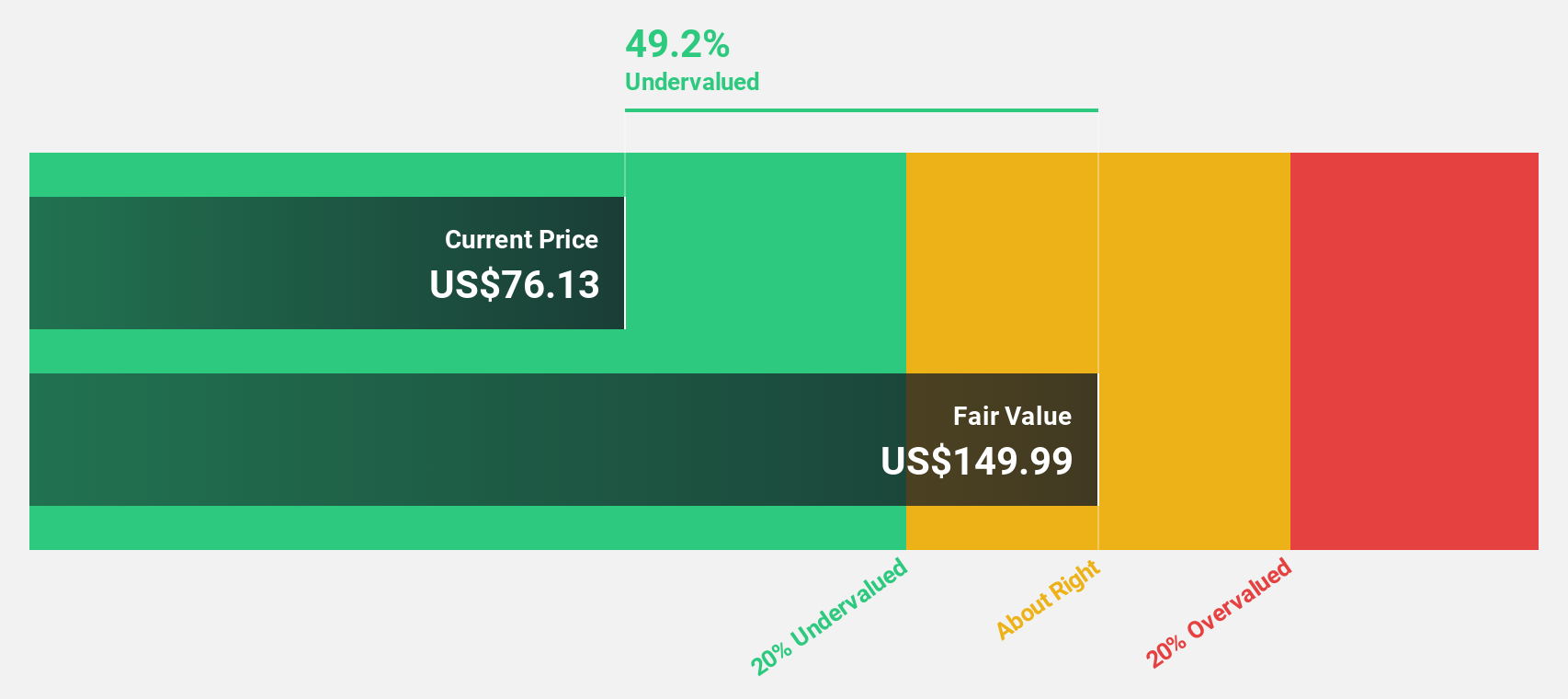

Nutanix (NasdaqGS:NTNX)

Overview: Nutanix, Inc. offers an enterprise cloud platform across various global regions and has a market cap of approximately $19.60 billion.

Operations: The company's revenue segment is primarily from Internet Software & Services, generating $2.15 billion.

Estimated Discount To Fair Value: 49.1%

Nutanix, trading at US$73.18, appears undervalued with a fair value estimate of US$143.8 based on discounted cash flow analysis. Despite negative equity and past shareholder dilution, its projected revenue growth of 13% annually surpasses the broader U.S. market's 8.9%. Recent initiatives like Nutanix Enterprise AI enhance its cloud-native offerings and strategic collaboration with AWS could boost operational efficiency and return on investment for customers transitioning to hybrid cloud solutions.

- Upon reviewing our latest growth report, Nutanix's projected financial performance appears quite optimistic.

- Dive into the specifics of Nutanix here with our thorough financial health report.

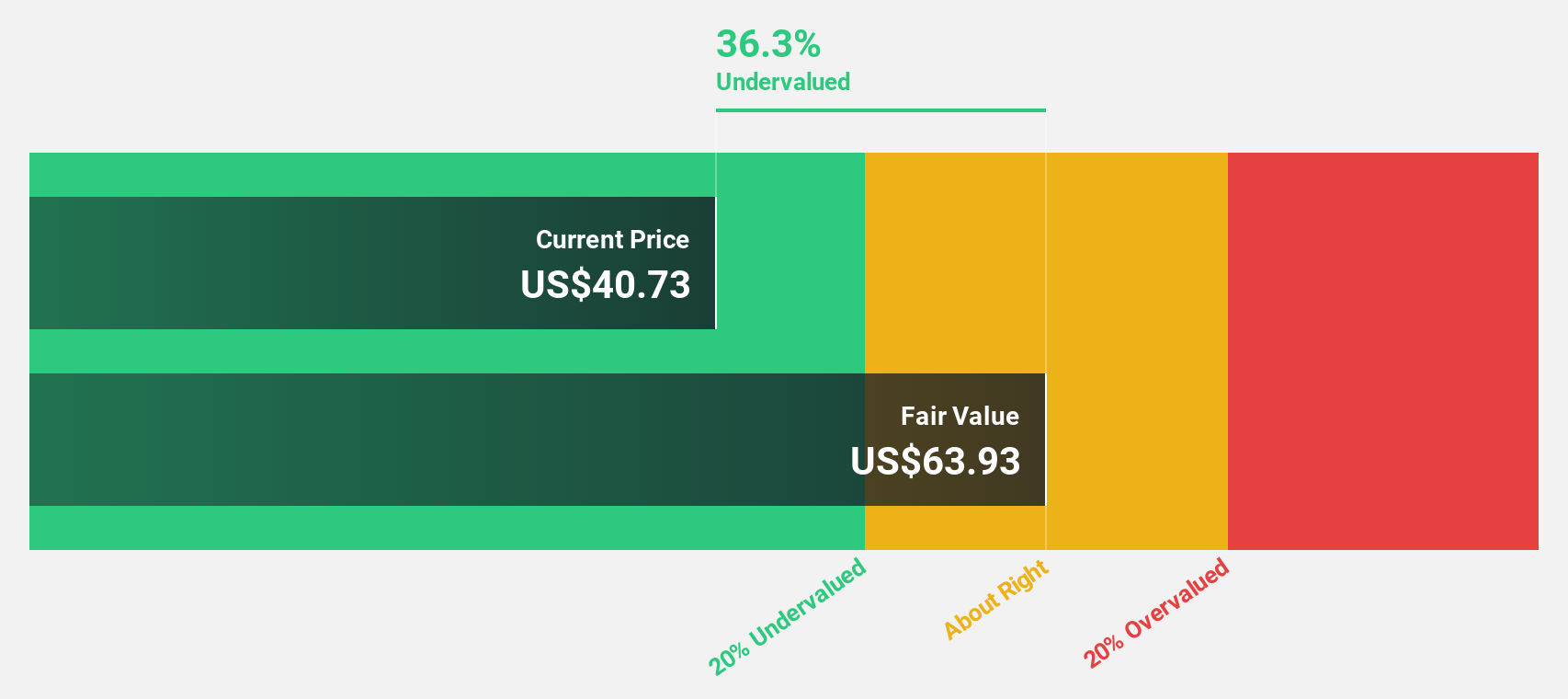

Repligen (NasdaqGS:RGEN)

Overview: Repligen Corporation develops and commercializes bioprocessing technologies and systems for biological drug manufacturing across North America, Europe, the Asia Pacific, and internationally, with a market cap of approximately $7.99 billion.

Operations: The company's revenue segment includes Medical Products, generating approximately $633.51 million.

Estimated Discount To Fair Value: 24.2%

Repligen, trading at US$142.58, is significantly undervalued with a fair value estimate of US$188.07 based on discounted cash flow analysis. Despite recent earnings challenges and insider selling, its expected annual profit growth exceeds market averages as it aims for profitability within three years. The company continues to seek bolt-on acquisitions to enhance its portfolio, although revenue growth projections of 12.9% annually are below the 20% benchmark yet above the U.S. market average.

- Our comprehensive growth report raises the possibility that Repligen is poised for substantial financial growth.

- Get an in-depth perspective on Repligen's balance sheet by reading our health report here.

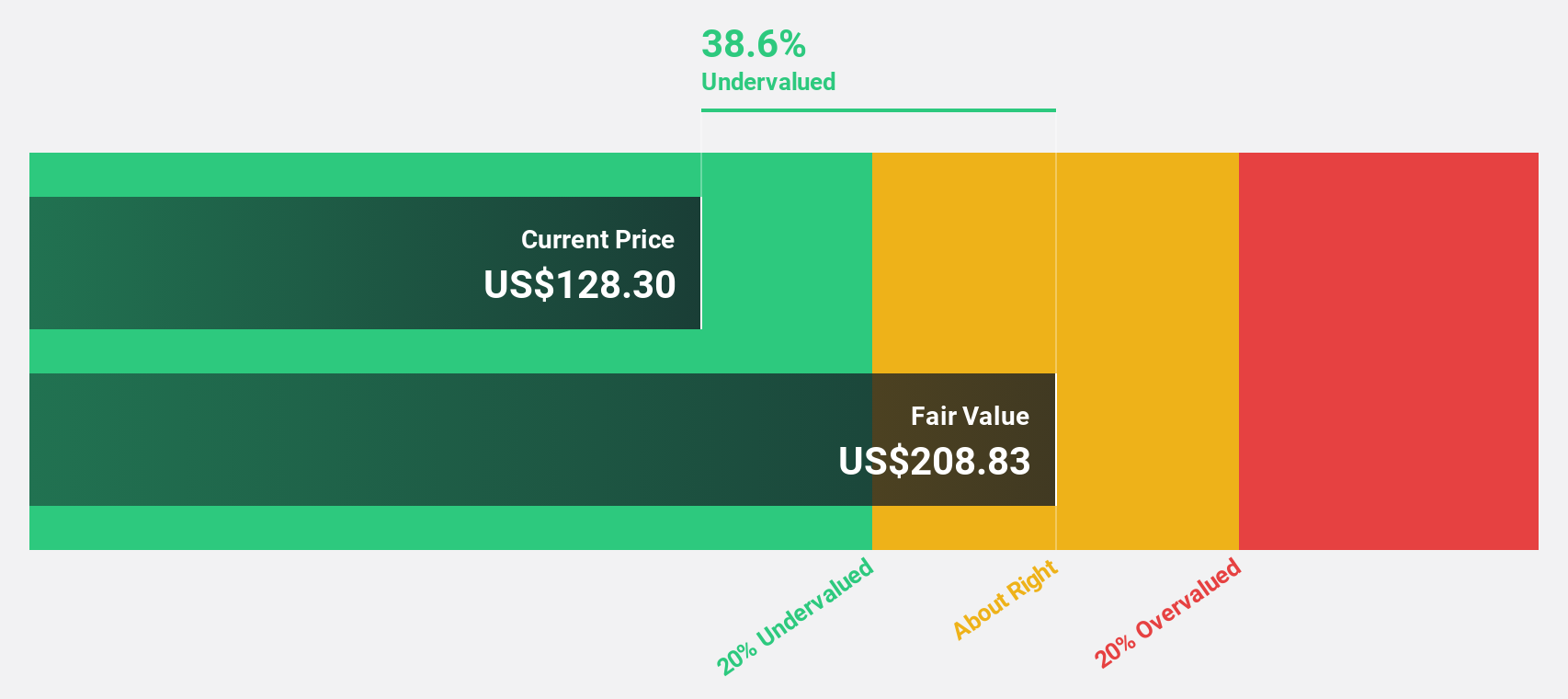

Truist Financial (NYSE:TFC)

Overview: Truist Financial Corporation is a financial services company offering banking and trust services in the Southeastern and Mid-Atlantic United States, with a market cap of approximately $63.67 billion.

Operations: The company's revenue segments include Segment Adjustment at $24.37 million and Treasury & Corporate (Ot&C) at -$9.87 million.

Estimated Discount To Fair Value: 27.3%

Truist Financial, priced at US$47.96, is undervalued with a fair value estimate of US$65.93 according to discounted cash flow analysis. Despite a forecasted low return on equity of 9.2% in three years and revenue growth projections of 11.9% annually, which are below the 20% benchmark but above the U.S. market average, Truist's earnings are expected to grow significantly at 57.49% per year, supporting its undervaluation status based on cash flows.

- Insights from our recent growth report point to a promising forecast for Truist Financial's business outlook.

- Click to explore a detailed breakdown of our findings in Truist Financial's balance sheet health report.

Next Steps

- Reveal the 186 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGEN

Repligen

Develops and commercializes bioprocessing technologies and systems for use in biological drug manufacturing process in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives