- United States

- /

- Banks

- /

- NYSE:SBSI

February 2025 US Dividend Stocks To Consider

Reviewed by Simply Wall St

As the U.S. stock market shows resilience, shaking off recent tariff threats with notable gains in major indices like the Dow Jones and Nasdaq Composite, investors are keenly observing how these economic dynamics might influence dividend stocks. In such a climate, identifying robust dividend stocks becomes crucial as they offer potential income stability amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.18% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.80% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.72% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.49% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.83% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.72% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.19% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.76% | ★★★★★★ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

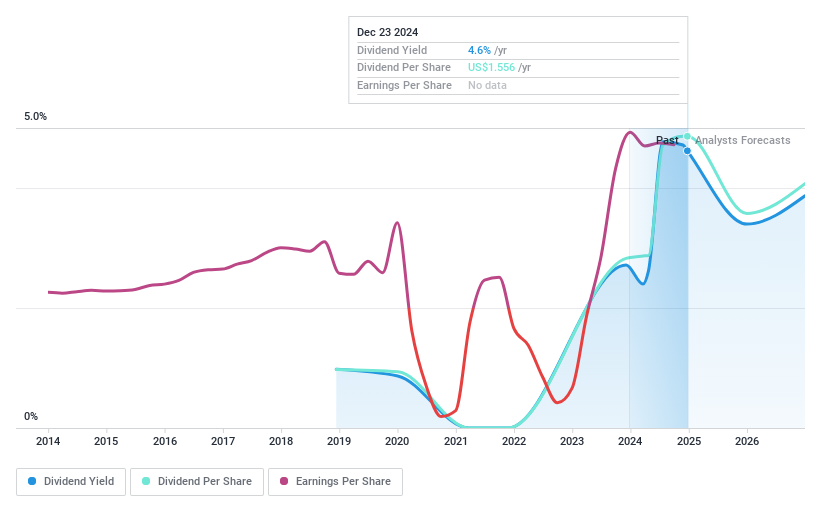

H World Group (NasdaqGS:HTHT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: H World Group Limited operates leased and owned, manachised, and franchised hotels in the People's Republic of China with a market cap of approximately $10.21 billion.

Operations: H World Group Limited's revenue is segmented into Legacy DH at CN¥4.86 billion and Legacy-Huazhu at CN¥18.63 billion.

Dividend Yield: 4.8%

H World Group's dividend yield is in the top 25% of US market payers, but its track record is unstable, with less than a decade of payments and volatility over 20%. Despite this, dividends are well-covered by earnings and cash flows with payout ratios at 74.4% and 57.2%, respectively. The company trades at a favorable P/E ratio compared to industry peers, though recent revenue guidance suggests modest growth between 1% to 5%.

- Unlock comprehensive insights into our analysis of H World Group stock in this dividend report.

- Our comprehensive valuation report raises the possibility that H World Group is priced lower than what may be justified by its financials.

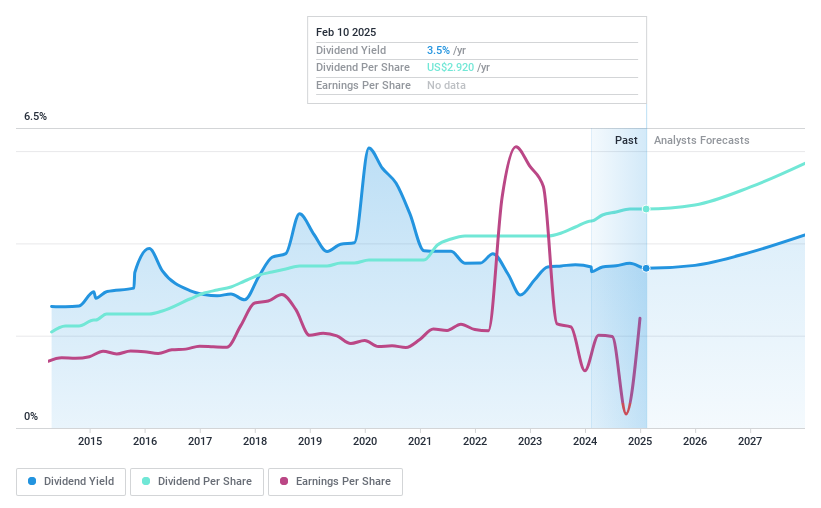

Principal Financial Group (NasdaqGS:PFG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Principal Financial Group, Inc. offers retirement, asset management, and insurance products and services globally to businesses, individuals, and institutional clients with a market cap of approximately $18.62 billion.

Operations: Principal Financial Group's revenue segments include Retirement and Income Solutions ($7.98 billion), Benefits and Protection - Life Insurance ($1.34 billion), Benefits and Protection - Specialty Benefits ($3.45 billion), Principal Asset Management - Investment Management ($1.82 billion), and Principal Asset Management - Principal International ($986 million).

Dividend Yield: 3.5%

Principal Financial Group recently increased its quarterly dividend to $0.75 per share, showing a 9% rise from the previous year, reflecting a consistent growth trend over the past decade. The company's dividends are well-supported by earnings and cash flows with payout ratios of 42.1% and 16.5%, respectively, ensuring sustainability. While its dividend yield of 3.55% is below top-tier US payers, Principal's stable financial performance and ongoing share repurchase program enhance shareholder value.

- Click to explore a detailed breakdown of our findings in Principal Financial Group's dividend report.

- Our valuation report here indicates Principal Financial Group may be undervalued.

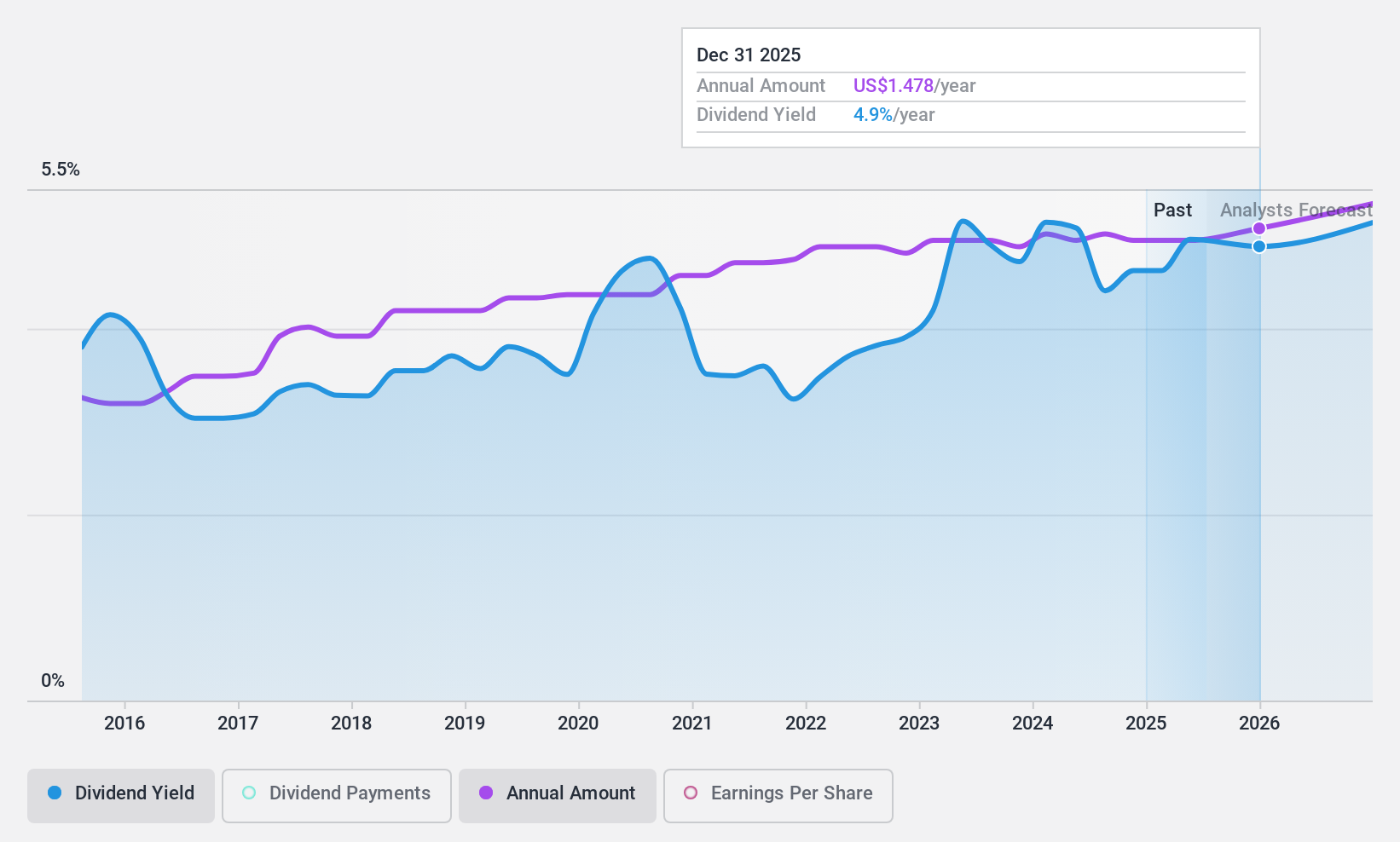

Southside Bancshares (NYSE:SBSI)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Southside Bancshares, Inc. is the bank holding company for Southside Bank, offering a variety of financial services to individuals, businesses, municipal entities, and nonprofit organizations with a market cap of $963.62 million.

Operations: Southside Bancshares, Inc. generates its revenue primarily from its banking segment, which amounts to $254.51 million.

Dividend Yield: 4.5%

Southside Bancshares declared a quarterly dividend of $0.36 per share, maintaining stable and reliable payments over the past decade. With a payout ratio of 49.3%, dividends are well-covered by earnings and forecasted to remain sustainable with a future payout ratio of 52.7%. The stock's dividend yield is in the top 25% among US payers, offering attractive value as it trades at 41.2% below estimated fair value compared to peers and industry standards.

- Navigate through the intricacies of Southside Bancshares with our comprehensive dividend report here.

- The analysis detailed in our Southside Bancshares valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Investigate our full lineup of 135 Top US Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SBSI

Southside Bancshares

Operates as the bank holding company for Southside Bank that provides various financial services to individuals, businesses, municipal entities, and nonprofit organizations.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives