- United States

- /

- Banks

- /

- NYSE:RF

Regions Financial (NYSE:RF) Slides 11% in a Week as Dow Jones Enters Correction Territory

Reviewed by Simply Wall St

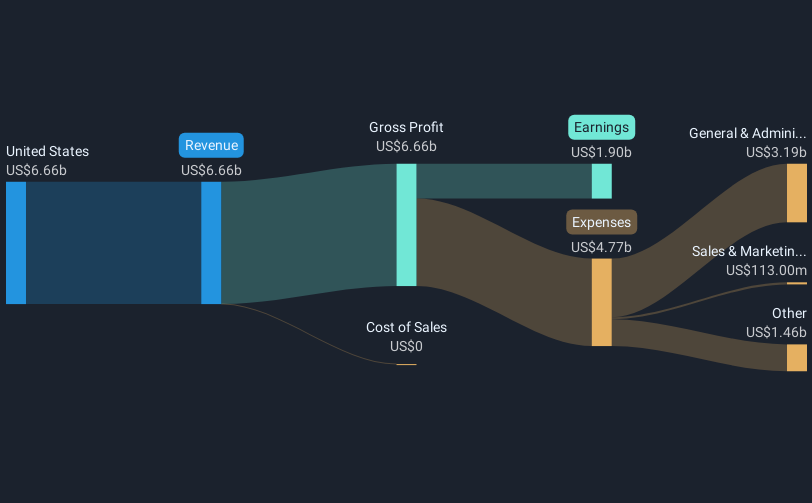

In recent market developments, Regions Financial (NYSE:RF) experienced a 11% decline last week. This movement coincided with a broader market downturn driven by escalating trade tensions, as evidenced by the Dow Jones tumbling into correction territory and the Nasdaq slipping into a bear market following the U.S. administration's implementation of new tariffs and China's retaliatory measures. As financial institutions such as Bank of America, JPMorgan Chase, and Citigroup saw significant share price drops, Regions Financial was likely impacted by the sector-wide sentiment, reflecting broader concerns over potential economic slowdowns and increased uncertainty.

Regions Financial's shares have delivered a total return of 118.41% over the past five years, reflecting resilience amidst fluctuating economic conditions. Although recent performances reflect some challenges, several initiatives previously set the stage for this longer-term return. Key investments in mobile capabilities and the expansion of fee-generating businesses have been pivotal in enhancing revenue growth and efficiency. The launch of digital solutions such as CashFlowIQ underscored efforts to streamline services for commercial clients, contributing positively over time.

Concurrent buyback programs, with significant repurchases, have supported share valuations by reducing the number of outstanding shares. Meanwhile, strong dividend payouts have provided steady income streams for investors, further underpinning total shareholder returns. Despite recent downturns highlighted in full-year results for 2024, which showed declines in net interest income to US$4.82 billion, these foundational efforts have largely contributed to the impressive five-year return.

Learn about Regions Financial's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RF

Regions Financial

A financial holding company, provides various banking and related products and services to individual and corporate customers.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives