- United States

- /

- Banks

- /

- NYSE:RF

Could Dividend Growth and Valuation Make Regions Financial (RF) a Standout for Income Investors?

Reviewed by Sasha Jovanovic

- In the past week, analysts projected that Regions Financial would report higher earnings and revenues for the September 2025 quarter, supported by a consistent record of dividend increases and recent payout hikes.

- One interesting insight is that valuation metrics identified Regions Financial as undervalued, with continued dividend growth making it appealing to income-focused investors during a period of broader sector optimism.

- We'll explore how these positive analyst expectations for earnings growth and dividend increases could influence Regions Financial's long-term investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Regions Financial Investment Narrative Recap

To own Regions Financial, an investor should be confident in the bank’s ability to capitalize on Southeastern economic growth, strengthen its deposit base, and generate shareholder value from disciplined credit management and consistent dividends. While analysts’ projections for improved September 2025 earnings and revenues are encouraging, the outcome of the October 17 earnings release represents the key short-term catalyst; near-term price moves will likely be influenced more by sector sentiment and rates than company-specific performance. The principal risk remains heightened competition in core Sun Belt markets, particularly from fintechs and non-traditional lenders, but the new information does not materially alter the threat level at this time.

One recent announcement that stands out is the 6% increase in Regions’ common dividend, declared in July 2025. This continues a 12-year track record of dividend growth and supports the income thesis that attracts many shareholders, especially as reliable payouts may offset sector volatility and provide an anchor for long-term returns.

However, investors should also keep in mind the possibility of shifting deposit costs and competitive pressures that could...

Read the full narrative on Regions Financial (it's free!)

Regions Financial's outlook calls for $8.6 billion in revenue and $2.2 billion in earnings by 2028. This is based on analysts forecasting an 8.2% annual revenue growth and a $0.2 billion increase in earnings from the current $2.0 billion.

Uncover how Regions Financial's forecasts yield a $29.14 fair value, a 19% upside to its current price.

Exploring Other Perspectives

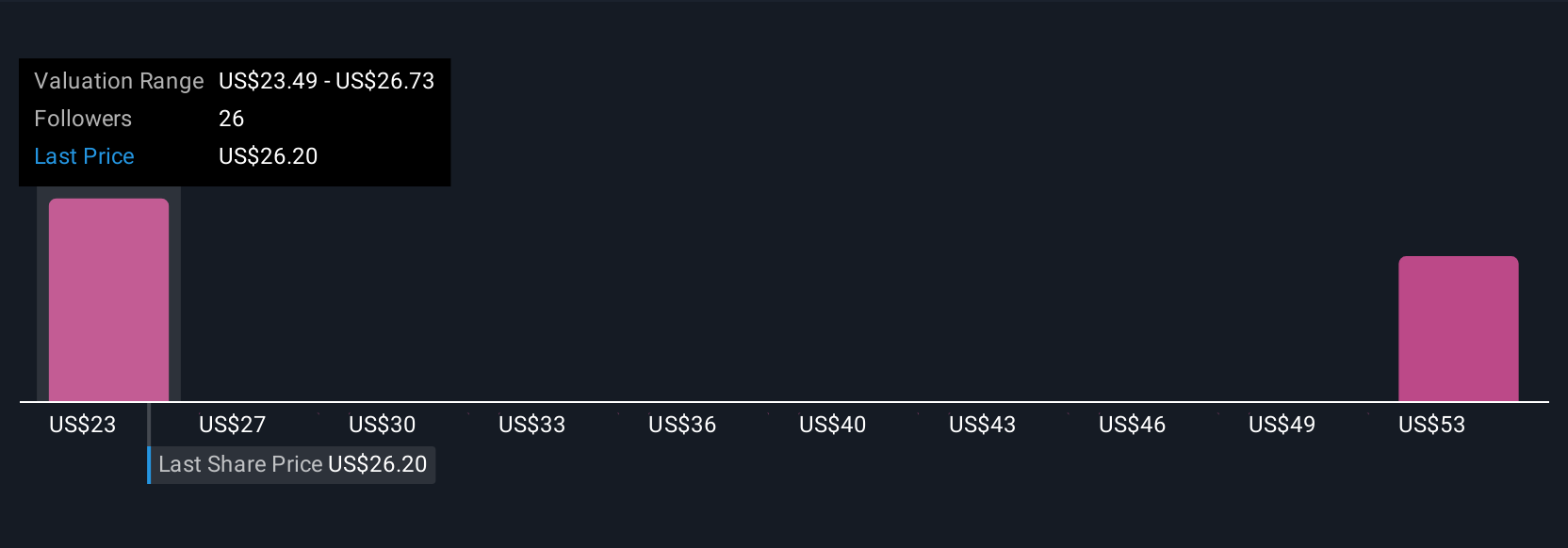

Three recent fair value estimates from the Simply Wall St Community ranged from US$29.14 to an ambitious US$52.75 per share. As you weigh these diverse views, consider how rising competition in the Southeast may complicate Regions’ long-term earnings outlook.

Explore 3 other fair value estimates on Regions Financial - why the stock might be worth over 2x more than the current price!

Build Your Own Regions Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regions Financial research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Regions Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regions Financial's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RF

Regions Financial

A financial holding company, provides various banking and related products and services to individual and corporate customers.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives