- United States

- /

- Banks

- /

- NasdaqCM:COFS

3 Leading Dividend Stocks Offering Yields Up To 3.7%

Reviewed by Simply Wall St

As the U.S. equities market seeks to extend its rebound rally amid fluctuating consumer confidence and tariff-related uncertainties, investors are keenly observing dividend stocks for their potential stability and income generation. In this environment, a good dividend stock is often characterized by a strong track record of payouts and resilience in the face of economic challenges, making them an attractive option for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Douglas Dynamics (NYSE:PLOW) | 4.87% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.61% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.09% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.95% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.27% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.85% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.40% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.39% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.40% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.79% | ★★★★★★ |

Click here to see the full list of 154 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

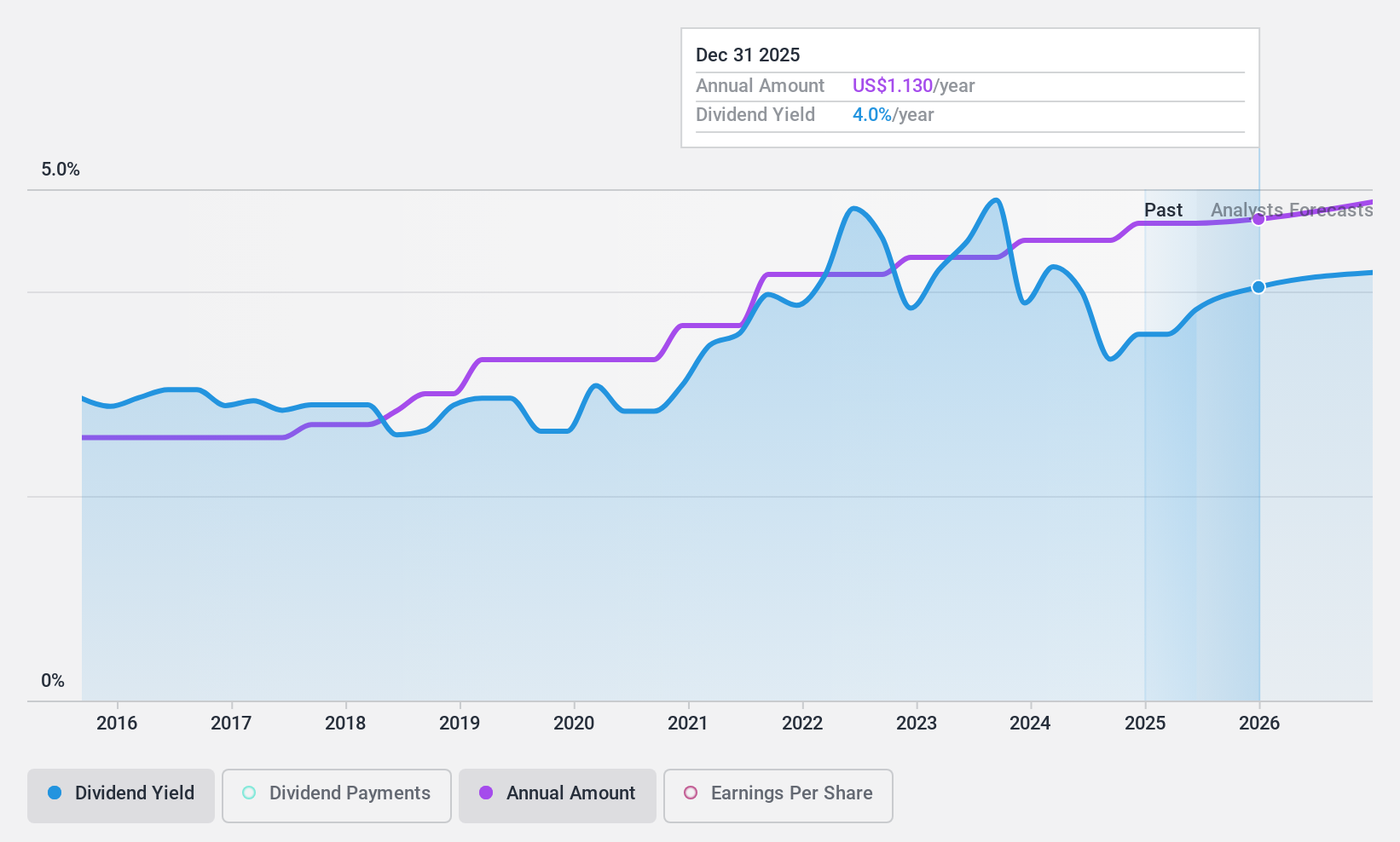

ChoiceOne Financial Services (NasdaqCM:COFS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ChoiceOne Financial Services, Inc. is the bank holding company for ChoiceOne Bank, offering banking services in Michigan with a market cap of $255.70 million.

Operations: ChoiceOne Financial Services, Inc. generates its revenue primarily from its banking segment, which amounts to $91.11 million.

Dividend Yield: 3.8%

ChoiceOne Financial Services offers a stable dividend yield of 3.78%, supported by a low payout ratio of 33.3%, ensuring dividends are well covered by earnings. The company has consistently increased its dividends over the past decade, maintaining reliability and stability. Recent financial performance shows strong growth, with net income rising to US$26.73 million in 2024 from US$21.26 million the previous year, reinforcing its capacity to sustain dividend payments amidst industry challenges and board changes following a merger agreement.

- Take a closer look at ChoiceOne Financial Services' potential here in our dividend report.

- The analysis detailed in our ChoiceOne Financial Services valuation report hints at an deflated share price compared to its estimated value.

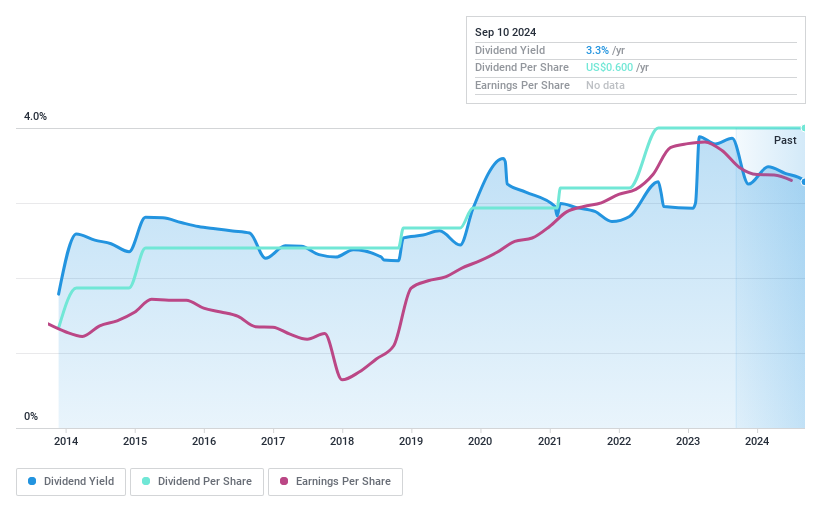

ESSA Bancorp (NasdaqGS:ESSA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ESSA Bancorp, Inc. is a bank holding company for ESSA Bank & Trust, offering various financial services to individuals, families, and businesses in Pennsylvania, with a market cap of approximately $190.68 million.

Operations: ESSA Bancorp, Inc. generates revenue primarily from its Thrift/Savings and Loan Institutions segment, amounting to $67.43 million.

Dividend Yield: 3.1%

ESSA Bancorp's dividend yield of 3.09% is reliable and stable, with a low payout ratio of 34.4%, indicating dividends are well covered by earnings. The company has consistently increased its dividends over the past decade. However, its yield is lower than top-tier US dividend payers. Recent developments include a merger agreement with CNB Financial Corporation valued at approximately $210 million, potentially impacting future dividend policies as the transaction progresses towards completion in Q3 2025.

- Delve into the full analysis dividend report here for a deeper understanding of ESSA Bancorp.

- Our valuation report unveils the possibility ESSA Bancorp's shares may be trading at a discount.

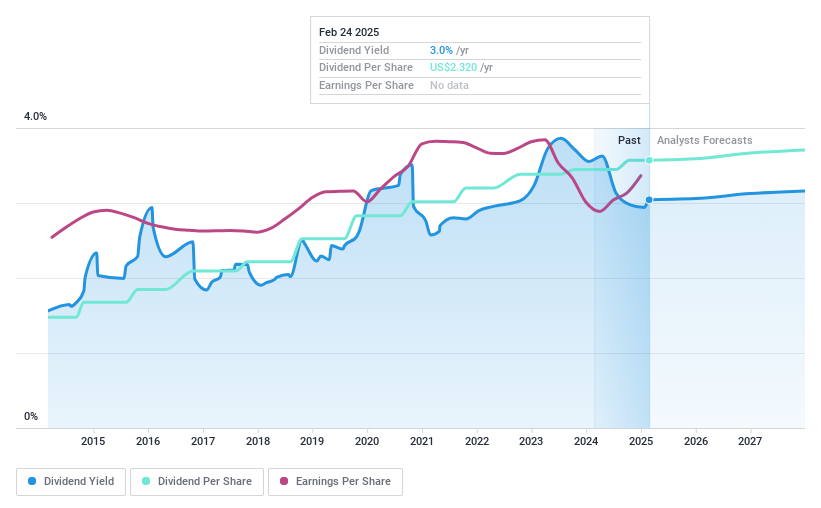

Prosperity Bancshares (NYSE:PB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Prosperity Bancshares, Inc. is a bank holding company for Prosperity Bank, offering financial products and services to businesses and consumers, with a market cap of approximately $6.72 billion.

Operations: Prosperity Bancshares, Inc. generates revenue primarily through its banking segment, which accounted for $1.18 billion.

Dividend Yield: 3.2%

Prosperity Bancshares offers a stable dividend yield of 3.22%, supported by a low payout ratio of 44.8%, ensuring dividends are well covered by earnings. The company's dividend has been consistently reliable and growing over the past decade, though it remains below the top tier in the US market. Recent financials show net income growth to US$479.39 million in 2024, with ongoing share repurchases enhancing shareholder value alongside declared quarterly dividends of $0.58 per share for Q1 2025.

- Click to explore a detailed breakdown of our findings in Prosperity Bancshares' dividend report.

- The valuation report we've compiled suggests that Prosperity Bancshares' current price could be quite moderate.

Where To Now?

- Navigate through the entire inventory of 154 Top US Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:COFS

ChoiceOne Financial Services

Operates as the bank holding company for ChoiceOne Bank that provides banking services in Michigan.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives