- United States

- /

- Banks

- /

- NasdaqCM:COFS

3 Dividend Stocks Yielding Between 3% And 5.8% For Steady Income

Reviewed by Simply Wall St

As the major U.S. stock indexes continue to rise, with the Dow Jones Industrial Average nearing a record high despite recent concerns over private employment declines, investors are seeking stable opportunities amidst fluctuating economic signals. In this environment, dividend stocks offering yields between 3% and 5.8% can provide a reliable source of income, appealing to those looking for steady returns in an unpredictable market landscape.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| United Bankshares (UBSI) | 3.88% | ★★★★★☆ |

| Provident Financial Services (PFS) | 4.81% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.39% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.82% | ★★★★★★ |

| Heritage Commerce (HTBK) | 4.58% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.64% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.87% | ★★★★★★ |

| Ennis (EBF) | 5.59% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.11% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.46% | ★★★★★★ |

Click here to see the full list of 122 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

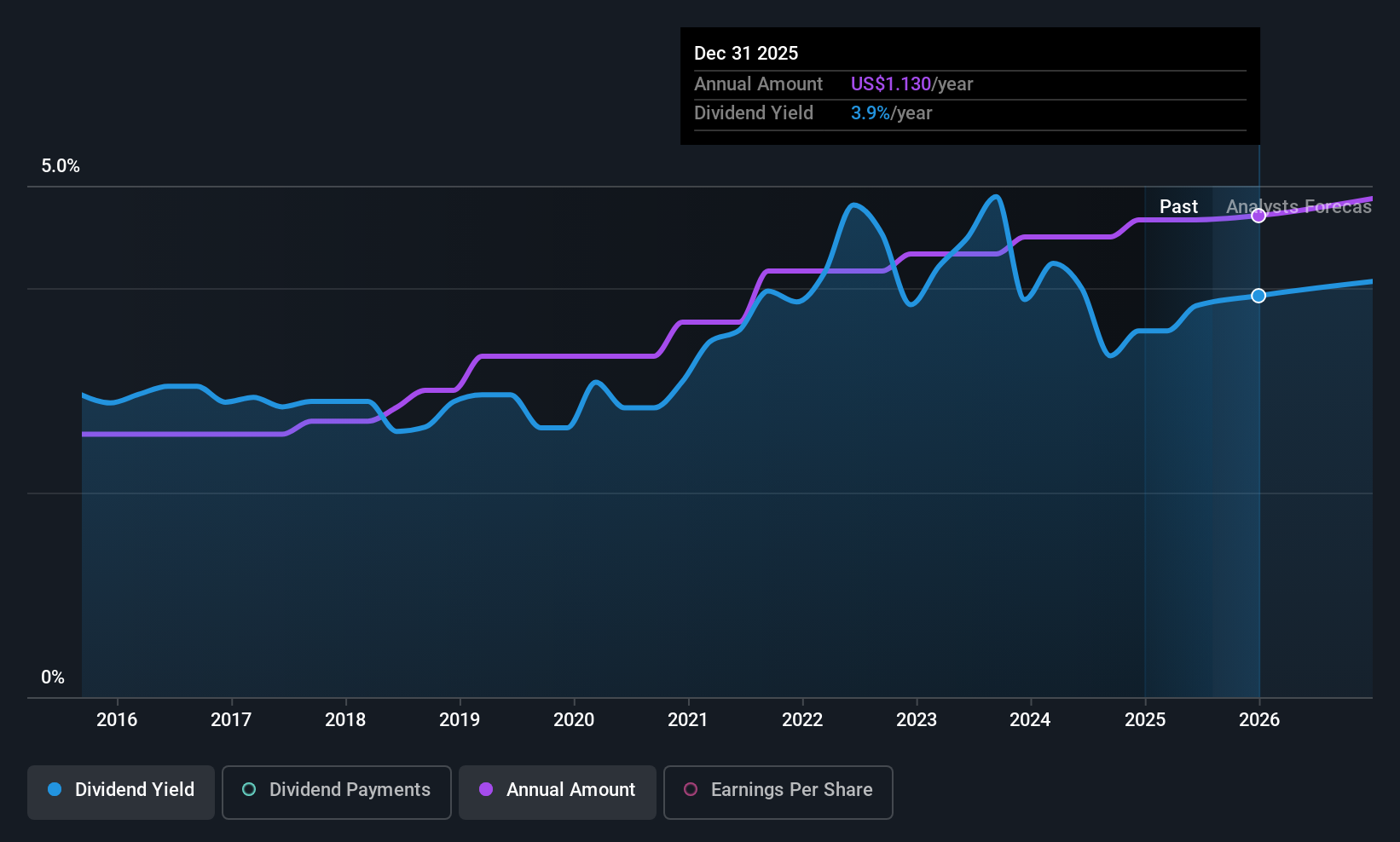

ChoiceOne Financial Services (COFS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ChoiceOne Financial Services, Inc. is the bank holding company for ChoiceOne Bank, offering banking services in Michigan with a market cap of $457.77 million.

Operations: ChoiceOne Financial Services, Inc. generates revenue primarily through its banking segment, which accounts for $127.93 million.

Dividend Yield: 3.5%

ChoiceOne Financial Services offers a dividend yield of 3.53%, below the top quartile in the US market, but maintains reliable and stable payments over the past decade. Recent increases in dividends, now at $0.29 per share, reflect growth and stability despite shareholder dilution last year. The payout ratio is sustainable at 64.8%, with future forecasts suggesting even stronger coverage at 33.6%. Earnings are expected to grow significantly by 46.17% annually, supporting continued dividend reliability.

- Click here to discover the nuances of ChoiceOne Financial Services with our detailed analytical dividend report.

- The valuation report we've compiled suggests that ChoiceOne Financial Services' current price could be inflated.

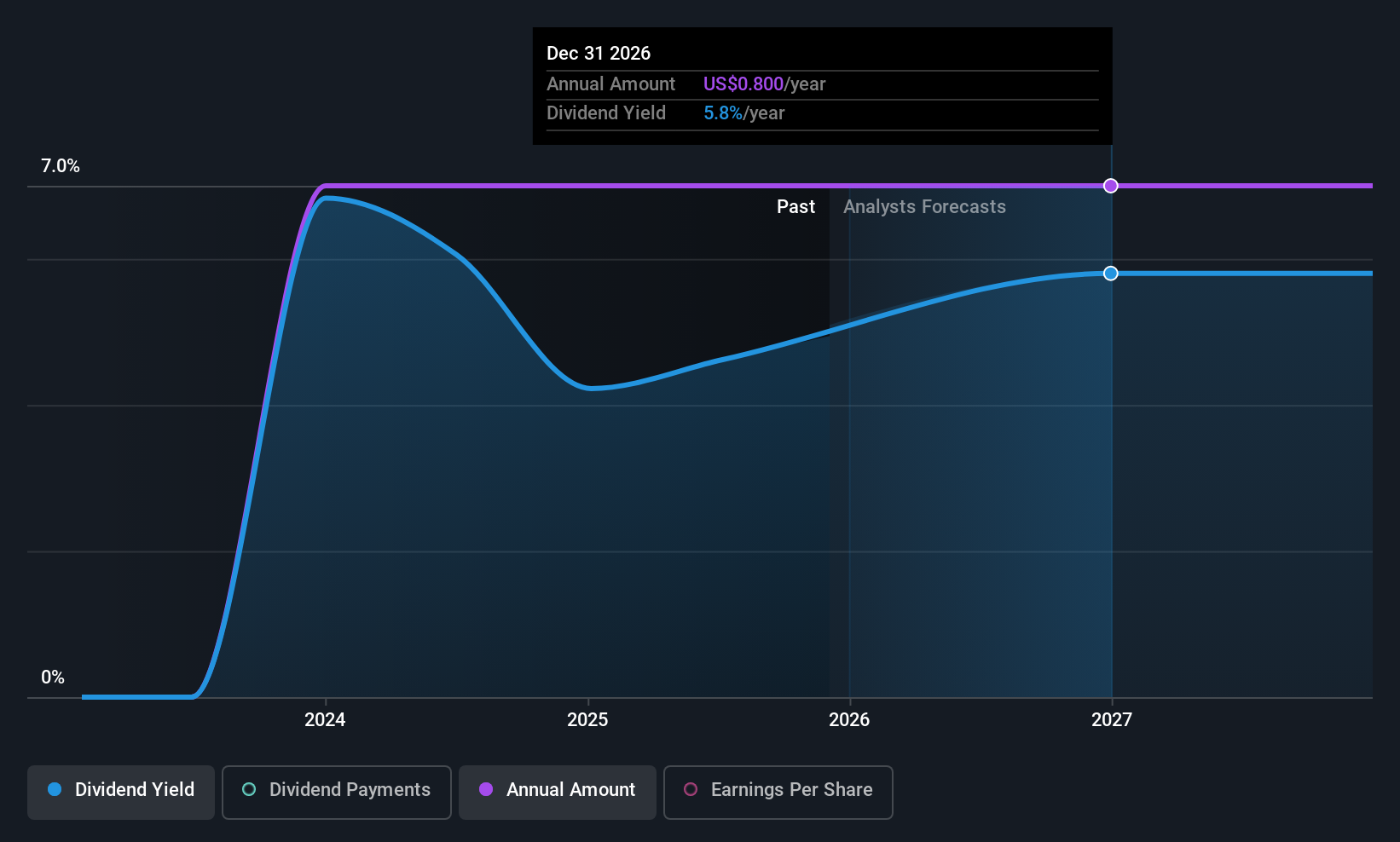

Opera (OPRA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Opera Limited, along with its subsidiaries, offers mobile and PC web browsers and related products and services both in Norway and internationally, with a market cap of approximately $1.24 billion.

Operations: Opera Limited generates revenue primarily through its mobile and PC web browsers, as well as related products and services, serving both domestic and international markets.

Dividend Yield: 5.8%

Opera's dividend yield of 5.8% places it among the top 25% of US dividend payers, with coverage by both earnings and cash flow at payout ratios of 87.9% and 83.8%, respectively, ensuring sustainability despite a short two-year history without increases. Recent AI advancements and partnerships have bolstered revenue growth, though profit margins have decreased from last year. Trading significantly below estimated fair value suggests potential for capital appreciation alongside its attractive dividend profile.

- Click here and access our complete dividend analysis report to understand the dynamics of Opera.

- According our valuation report, there's an indication that Opera's share price might be on the cheaper side.

M&T Bank (MTB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: M&T Bank Corporation is a bank holding company offering retail and commercial banking services through its subsidiaries, Manufacturers and Traders Trust Company and Wilmington Trust, National Association, with a market cap of approximately $29.35 billion.

Operations: M&T Bank's revenue segments consist of $2.69 billion from the Commercial Bank, $4.59 billion from the Retail Bank, and $1.56 billion from Institutional Services and Wealth Management.

Dividend Yield: 3.1%

M&T Bank's recent affirmation of a US$1.50 quarterly dividend underscores its commitment to stable payouts, supported by a low payout ratio of 34.1%, indicating strong coverage by earnings. Despite trading at 42.5% below estimated fair value, its dividend yield of 3.07% is modest compared to top-tier US payers but remains reliable with consistent growth over the past decade. The bank's strategic focus on acquisitions may further enhance shareholder value and dividend sustainability in the long term.

- Click to explore a detailed breakdown of our findings in M&T Bank's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of M&T Bank shares in the market.

Where To Now?

- Explore the 122 names from our Top US Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:COFS

ChoiceOne Financial Services

Operates as the bank holding company for ChoiceOne Bank that provides banking services in Michigan.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026