- United States

- /

- Banks

- /

- NYSE:LOB

3 Undervalued Small Caps With Insider Activity In Your Region

Reviewed by Simply Wall St

As the U.S. stock market continues its upward trajectory, with major indexes poised for their best week since June, investors are increasingly eyeing opportunities in small-cap stocks. In this vibrant landscape, identifying small-cap companies with significant insider activity can be a promising strategy, as it may signal confidence from those closest to the business.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Merchants Bancorp | 7.5x | 2.5x | 49.74% | ★★★★★★ |

| Shore Bancshares | 10.4x | 2.8x | 41.24% | ★★★★★☆ |

| Business First Bancshares | 10.2x | 2.6x | 49.35% | ★★★★★☆ |

| Peoples Bancorp | 10.3x | 1.9x | 44.96% | ★★★★★☆ |

| First United | 9.9x | 3.0x | 45.12% | ★★★★★☆ |

| Embassy Bancorp | 10.5x | 3.0x | 46.72% | ★★★★☆☆ |

| S&T Bancorp | 11.3x | 3.9x | 37.94% | ★★★★☆☆ |

| Farmland Partners | 6.4x | 7.9x | -86.08% | ★★★★☆☆ |

| CNB Financial | 17.8x | 3.4x | 46.35% | ★★★☆☆☆ |

| Omega Flex | 17.0x | 2.7x | 7.38% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Arbor Realty Trust (ABR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Arbor Realty Trust operates as a real estate investment trust focusing on the origination and servicing of loans for multifamily, single-family rental portfolios, and other commercial real estate assets, with a market capitalization of approximately $2.85 billion.

Operations: The company generates revenue primarily through its Agency Business and Structured Business segments, with recent figures showing $259.44 million and $220.39 million, respectively. Notably, the gross profit margin has seen a decline from 93.43% in early 2021 to 85.55% by late 2025, indicating changes in cost management or pricing strategies over time.

PE: 11.6x

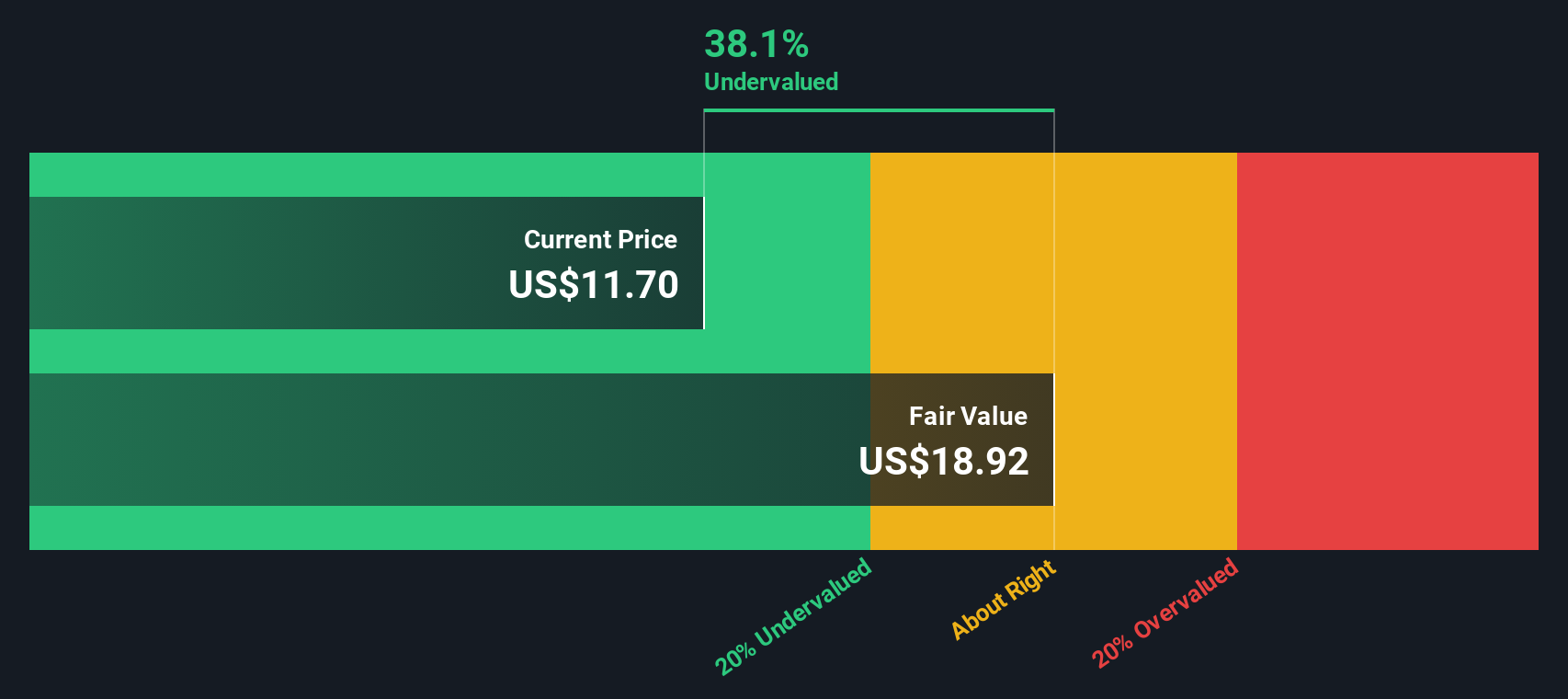

Arbor Realty Trust, a smaller player in the U.S. market, has shown insider confidence with Ivan Kaufman purchasing 210,000 shares for US$1.94 million between July and September 2025. Despite challenges like earnings per share dropping to US$0.20 from US$0.31 year-over-year for Q3 2025, sales increased significantly to US$4.19 million from US$1.51 million in the same period last year. The company declared a quarterly dividend of $0.30 per share for common stockholders and has completed a share repurchase program worth $48.84 million since March 2023, reflecting strategic financial maneuvers amid its external borrowing reliance.

- Unlock comprehensive insights into our analysis of Arbor Realty Trust stock in this valuation report.

Evaluate Arbor Realty Trust's historical performance by accessing our past performance report.

Live Oak Bancshares (LOB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Live Oak Bancshares operates as a banking platform primarily focused on providing financial services to small businesses, with a market capitalization of approximately $1.50 billion.

Operations: The primary revenue stream for the company comes from its banking platform for small businesses, generating $434.21 million in revenue. Operating expenses are a significant cost component, with general and administrative expenses consistently being the largest portion. The net income margin has shown variability over time, reaching 15.80% most recently.

PE: 21.5x

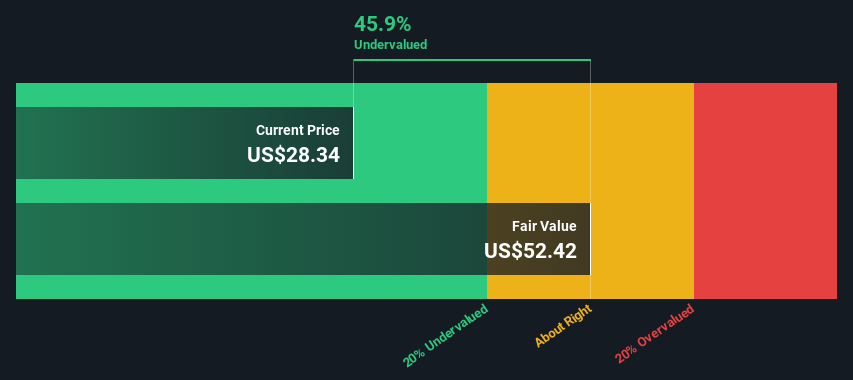

Live Oak Bancshares, a small player in the financial sector, shows potential despite some challenges. Their net interest income rose to US$115.49 million for Q3 2025 from US$97 million the previous year, highlighting growth. However, high bad loans at 4.5% and low allowance for these loans at 36% present risks. Insider confidence is evident with recent stock purchases by insiders, signaling belief in future prospects despite delayed SEC filings announced on November 12, 2025.

- Click here to discover the nuances of Live Oak Bancshares with our detailed analytical valuation report.

Understand Live Oak Bancshares' track record by examining our Past report.

SmartStop Self Storage REIT (SMA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SmartStop Self Storage REIT operates a self-storage business with additional revenue from a managed REIT platform, and has a market cap of $1.4 billion.

Operations: SmartStop Self Storage REIT generates its revenue primarily from the self-storage segment, contributing $240.62 million, with additional income from a managed REIT platform at $13.97 million. The company has experienced fluctuations in its net income margin, which stood at -0.0622% as of September 2025, reflecting ongoing challenges in managing costs and expenses relative to revenue growth.

PE: -114.2x

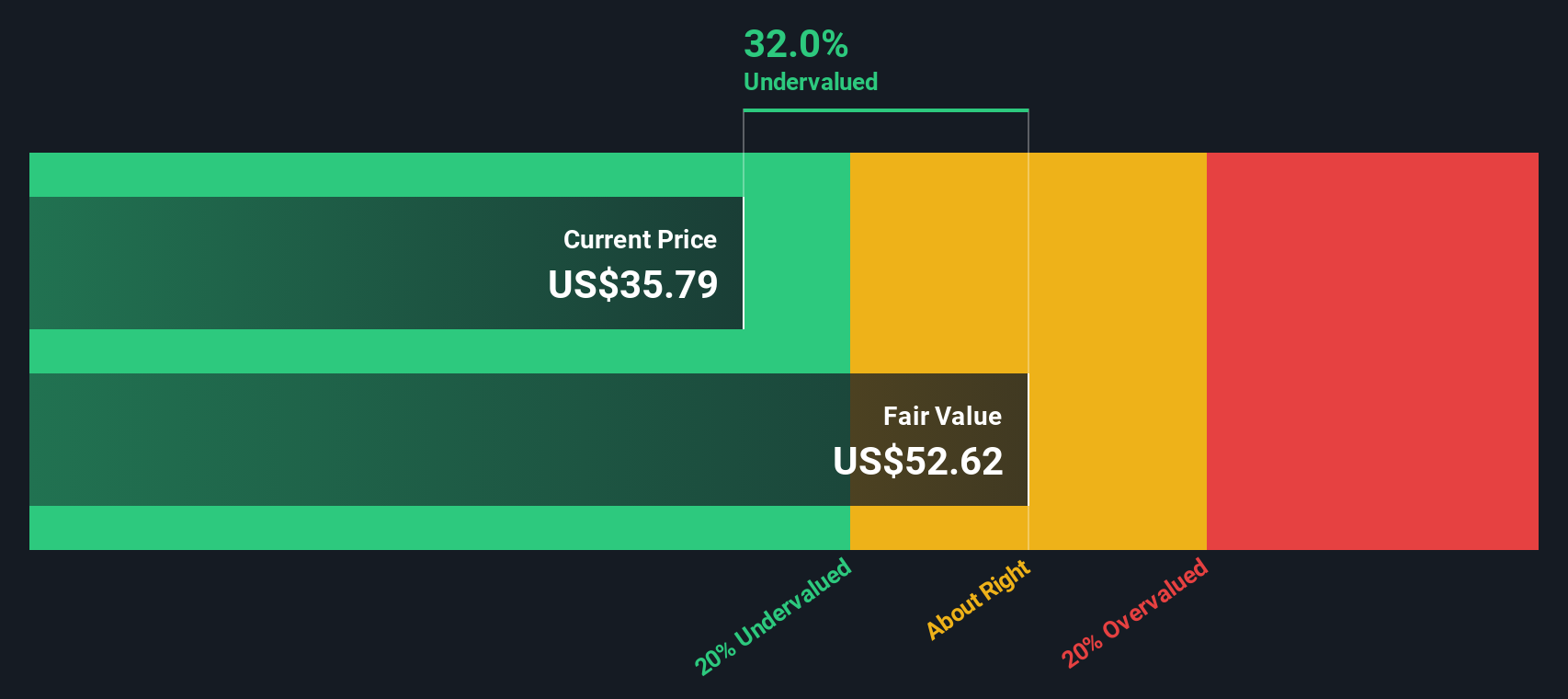

SmartStop Self Storage REIT, a small-cap player in the self-storage sector, has shown promising growth potential with recent business expansions. Notably, they acquired a new facility in Winter Garden, Florida, enhancing their presence in high-growth areas. Their Q3 2025 earnings reported US$70.43 million revenue and a net income of US$5.23 million compared to a loss last year. This financial turnaround is complemented by insider confidence through share purchases earlier this year, indicating belief in future prospects and stability within the company’s operations.

Next Steps

- Unlock our comprehensive list of 78 Undervalued US Small Caps With Insider Buying by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOB

Live Oak Bancshares

Operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States.

High growth potential and good value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.