- United States

- /

- Banks

- /

- NYSE:KEY

US Exchange: Open Lending And 2 Other Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility marked by the Federal Reserve's decision to maintain interest rates and investor focus on major tech earnings, identifying undervalued stocks becomes crucial for those seeking potential opportunities. In this environment, a good stock is typically characterized by strong fundamentals and resilience in its financial performance, making it potentially appealing when trading below estimated value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Berkshire Hills Bancorp (NYSE:BHLB) | $28.57 | $56.67 | 49.6% |

| First National (NasdaqCM:FXNC) | $24.98 | $48.64 | 48.6% |

| Array Technologies (NasdaqGM:ARRY) | $7.15 | $14.24 | 49.8% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $112.64 | $219.14 | 48.6% |

| Privia Health Group (NasdaqGS:PRVA) | $22.51 | $44.59 | 49.5% |

| Bilibili (NasdaqGS:BILI) | $16.78 | $33.06 | 49.2% |

| Verra Mobility (NasdaqCM:VRRM) | $26.39 | $51.91 | 49.2% |

| BeiGene (NasdaqGS:ONC) | $226.71 | $438.50 | 48.3% |

| Equifax (NYSE:EFX) | $271.18 | $532.03 | 49% |

| Similarweb (NYSE:SMWB) | $16.51 | $31.96 | 48.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Open Lending (NasdaqGM:LPRO)

Overview: Open Lending Corporation offers lending enablement and risk analytics solutions to financial institutions and automakers' finance companies in the U.S., with a market cap of approximately $751.91 million.

Operations: The company's revenue segment includes Internet Information Providers, generating $95.89 million.

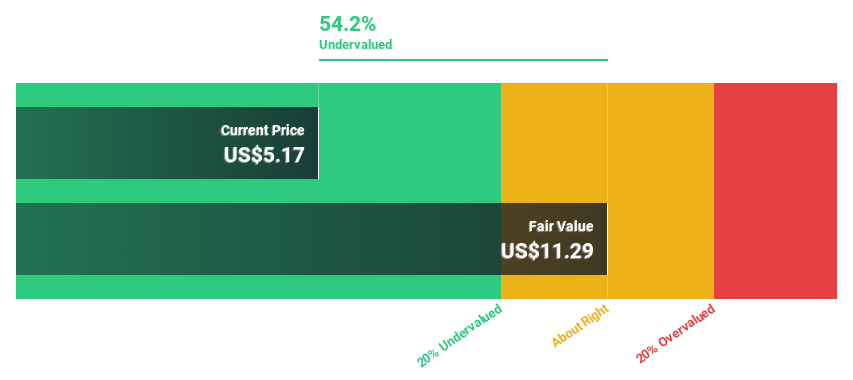

Estimated Discount To Fair Value: 43.8%

Open Lending is trading at US$6.3, significantly below its estimated fair value of US$11.22, suggesting it may be undervalued based on cash flows. Despite recent declines in revenue and net income, earnings are forecast to grow 67.5% annually, outpacing the broader market's growth expectations. Recent strategic partnerships with automotive finance companies could enhance future revenue streams by expanding access to near- and non-prime consumers through innovative lending solutions.

- The growth report we've compiled suggests that Open Lending's future prospects could be on the up.

- Take a closer look at Open Lending's balance sheet health here in our report.

CyberArk Software (NasdaqGS:CYBR)

Overview: CyberArk Software Ltd. develops, markets, and sells software-based identity security solutions and services globally, with a market cap of approximately $18.51 billion.

Operations: The company's revenue primarily comes from its Security Software & Services segment, which generated $909.46 million.

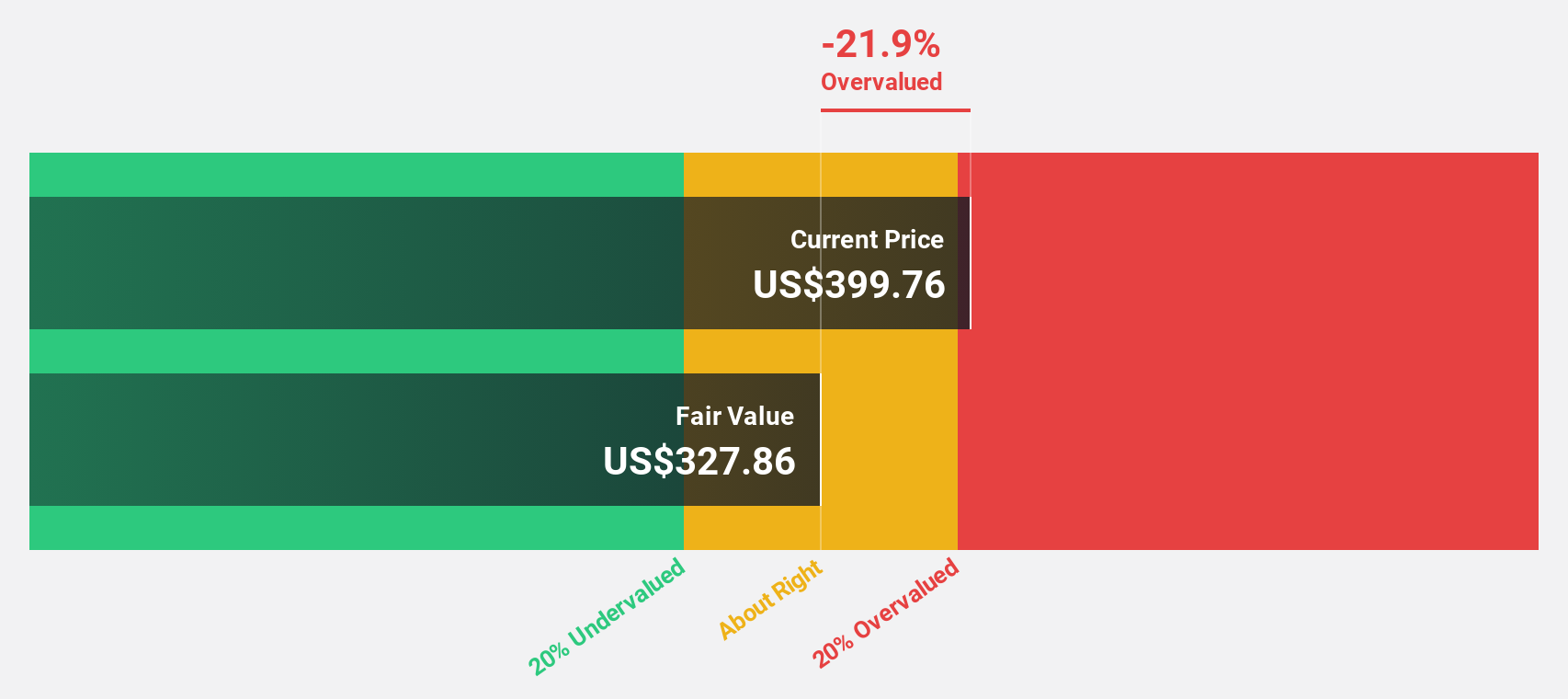

Estimated Discount To Fair Value: 15.6%

CyberArk Software is trading at US$368.52, below its estimated fair value of US$436.79, indicating potential undervaluation based on cash flows. The company has transitioned to profitability and forecasts suggest earnings growth of 32.7% annually, surpassing the broader market's expectations. Recent strategic integrations with Microsoft Defender and partnerships like Wiz enhance CyberArk’s identity security offerings, potentially strengthening its revenue base amid a competitive cybersecurity landscape despite recent shareholder dilution concerns.

- Our growth report here indicates CyberArk Software may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of CyberArk Software stock in this financial health report.

KeyCorp (NYSE:KEY)

Overview: KeyCorp is the holding company for KeyBank National Association, offering a range of retail and commercial banking products and services in the United States, with a market cap of approximately $19.53 billion.

Operations: KeyBank National Association's revenue segments include various retail and commercial banking products and services in the United States.

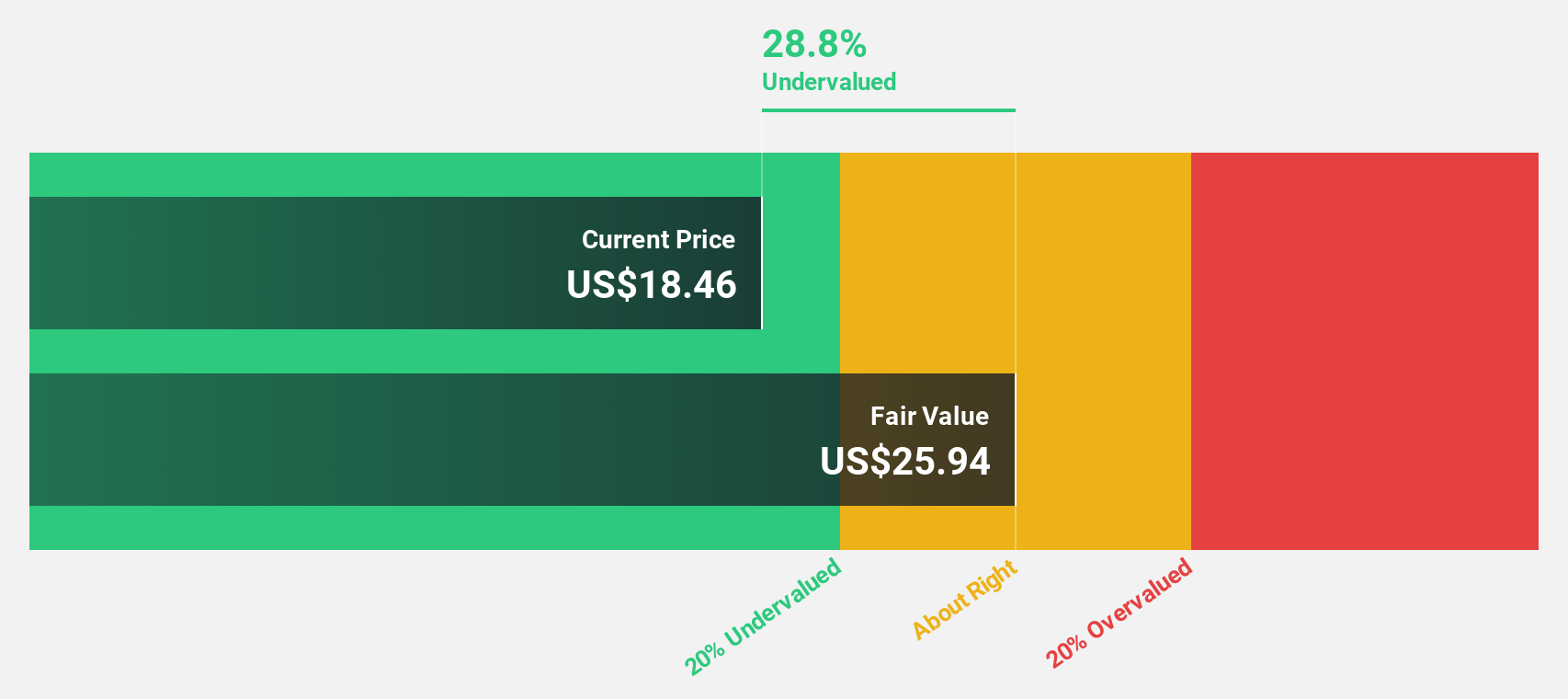

Estimated Discount To Fair Value: 37.4%

KeyCorp is trading at US$17.67, significantly below its estimated fair value of US$28.22, highlighting potential undervaluation based on cash flows. Despite a challenging year with a net loss of US$161 million and increased loan charge-offs, KeyCorp's revenue growth is forecasted to outpace the broader U.S. market at 14.6% annually. The company is actively seeking bolt-on acquisitions to enhance its business structure while aiming for profitability within three years, though dividend sustainability remains uncertain due to current earnings coverage issues.

- Insights from our recent growth report point to a promising forecast for KeyCorp's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of KeyCorp.

Summing It All Up

- Gain an insight into the universe of 166 Undervalued US Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KeyCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEY

KeyCorp

Operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives