- United States

- /

- Banks

- /

- NasdaqGM:HIFS

Discovering Undiscovered Gems in United States for January 2025

Reviewed by Simply Wall St

The United States market has recently experienced a notable upswing, climbing by 3.8% over the past week and achieving a 24% increase over the last year, with earnings forecasted to grow by 15% annually. In such a dynamic environment, identifying stocks that possess strong growth potential and resilience can be key to uncovering undiscovered gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Hingham Institution for Savings (NasdaqGM:HIFS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hingham Institution for Savings offers a range of financial products and services to individuals and small businesses in the United States, with a market capitalization of $527.18 million.

Operations: Hingham Institution for Savings generates revenue primarily from its financial services segment, totaling $65.53 million. The company's net profit margin is a key indicator of its profitability.

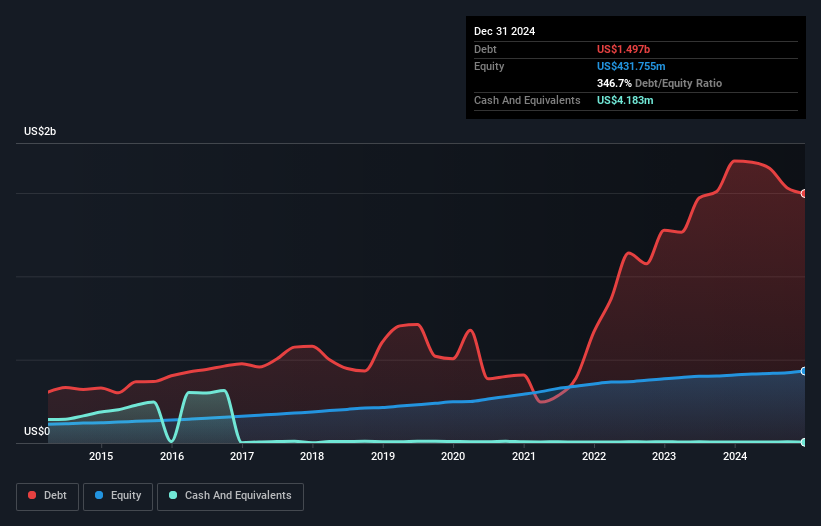

Hingham Institution for Savings, a financial institution with total assets of US$4.5 billion and equity of US$431.8 million, has shown resilience despite earnings declining by 13.2% annually over the past five years. Notably, its bad loans are at an impressively low 0%, supported by a substantial allowance for bad loans at 1661%. The bank's deposits stand at US$2.5 billion against loans totaling US$3.9 billion, highlighting its robust balance sheet structure with low-risk funding sources comprising 62% of liabilities. Recent earnings growth of 6.9% outpaced the industry average, reflecting strong operational performance in challenging times.

- Click here and access our complete health analysis report to understand the dynamics of Hingham Institution for Savings.

Understand Hingham Institution for Savings' track record by examining our Past report.

Guaranty Bancshares (NYSE:GNTY)

Simply Wall St Value Rating: ★★★★★★

Overview: Guaranty Bancshares, Inc. is the bank holding company for Guaranty Bank & Trust, N.A., with a market cap of $403.27 million.

Operations: Guaranty Bancshares generates revenue primarily through interest income from loans and investments, alongside non-interest income such as service charges and fees. The company focuses on managing its cost of funds to optimize net interest margins, which have shown variability in recent periods.

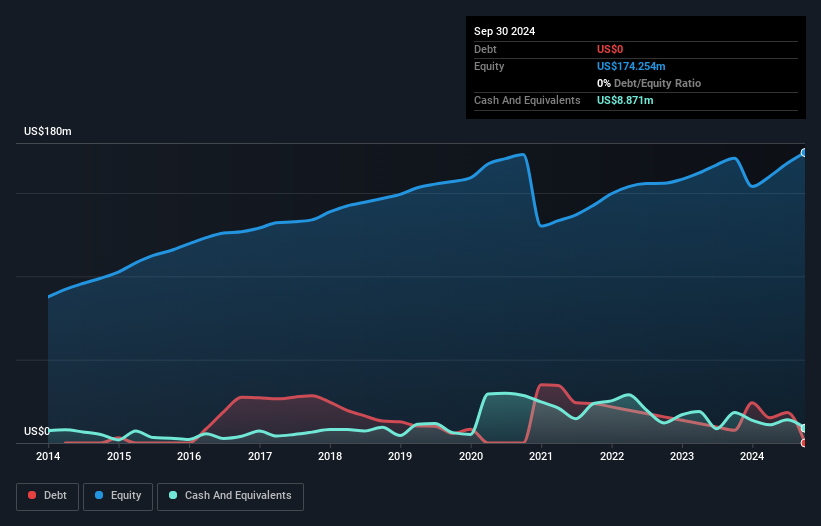

Guaranty Bancshares, with assets totaling US$3.1 billion and equity of US$319.1 million, showcases a robust financial position in the banking sector. The company has total deposits of US$2.7 billion and loans amounting to US$2.1 billion, demonstrating a solid loan-to-deposit ratio that supports its lending activities effectively. It maintains an appropriate bad loans ratio at 0.2% and holds a sufficient allowance for bad loans at 560%, indicating prudent risk management practices. Despite significant insider selling recently, the bank's earnings have grown by 5% over the past year, surpassing industry trends which saw a -10.6% change in earnings growth within the same period.

Natural Grocers by Vitamin Cottage (NYSE:NGVC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Natural Grocers by Vitamin Cottage, Inc. operates retail stores offering natural and organic groceries and dietary supplements across the United States, with a market cap of $924.82 million.

Operations: Natural Grocers generates revenue primarily from its natural and organic retail stores, amounting to $1.24 billion. The company focuses on selling groceries and dietary supplements across the United States.

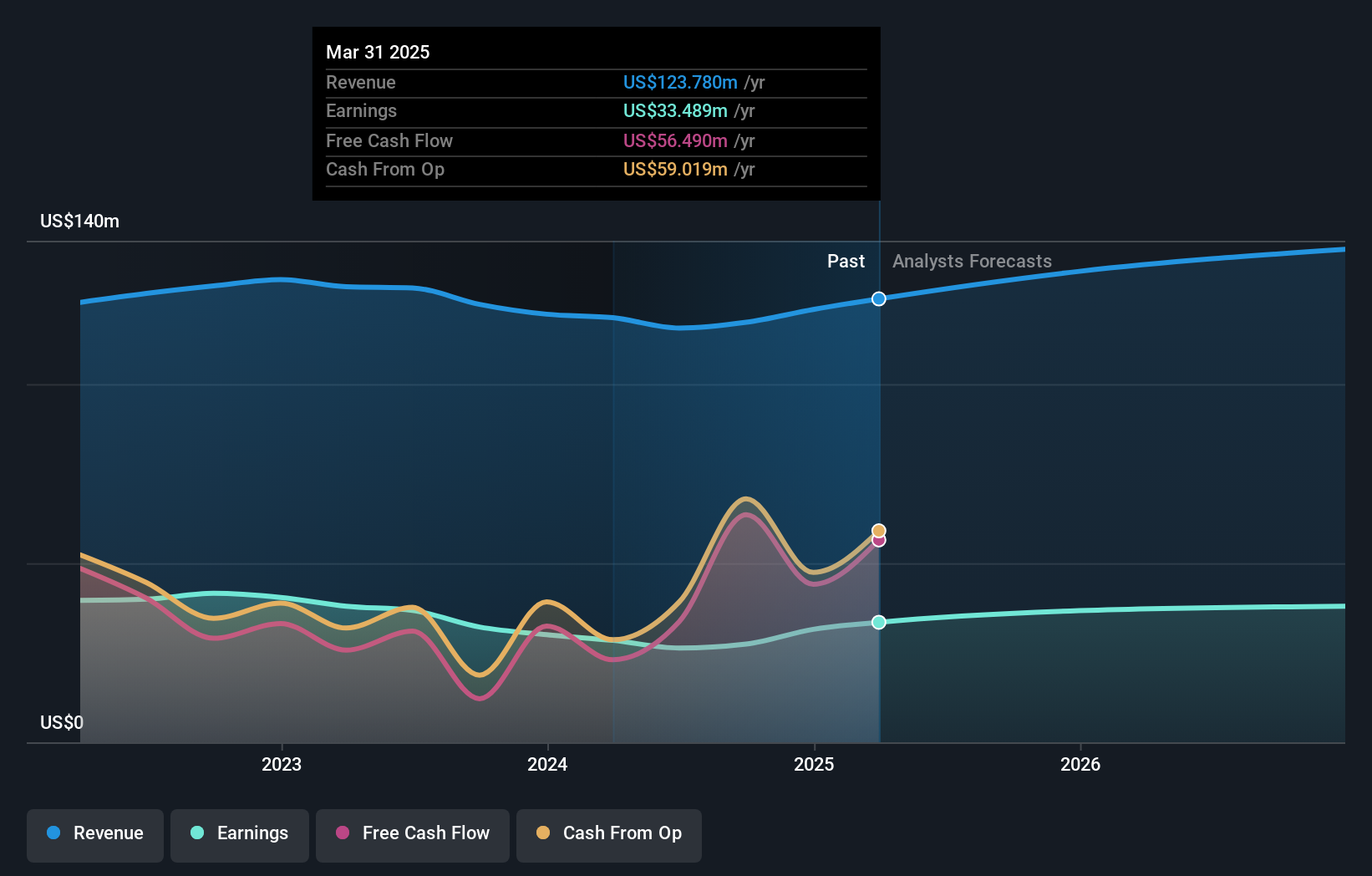

Natural Grocers, a nimble player in the organic retail sector, has been making strides with its debt-free status and impressive earnings growth of 46% over the past year, outpacing the industry average of 10.5%. Recently, it expanded its product lineup with eco-friendly coffee pods and organic pasta offerings. Despite significant insider selling recently, it trades at 29% below estimated fair value. The company reported a net income increase to US$33.94 million for fiscal year 2024 from US$23.24 million previously and plans to open four to six new stores this year while maintaining positive free cash flow.

Seize The Opportunity

- Access the full spectrum of 256 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hingham Institution for Savings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HIFS

Hingham Institution for Savings

Provides various financial products and services to individuals and small businesses in the United States.

Excellent balance sheet with proven track record.