- United States

- /

- Biotech

- /

- NasdaqGS:GILD

Exploring High Growth Tech Stocks in January 2025

Reviewed by Simply Wall St

The United States market has experienced a notable upswing, climbing by 3.8% over the past week and achieving a 24% increase over the last year, with earnings forecasted to grow by 15% annually. In this favorable environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and robust financial health to capitalize on these positive market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 62.05% | 20.47% | ★★★★★★ |

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 21.46% | 55.24% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.39% | 56.66% | ★★★★★★ |

| Blueprint Medicines | 23.25% | 55.27% | ★★★★★★ |

| Travere Therapeutics | 30.02% | 61.89% | ★★★★★★ |

Click here to see the full list of 229 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Gilead Sciences (NasdaqGS:GILD)

Simply Wall St Growth Rating: ★★★★☆☆

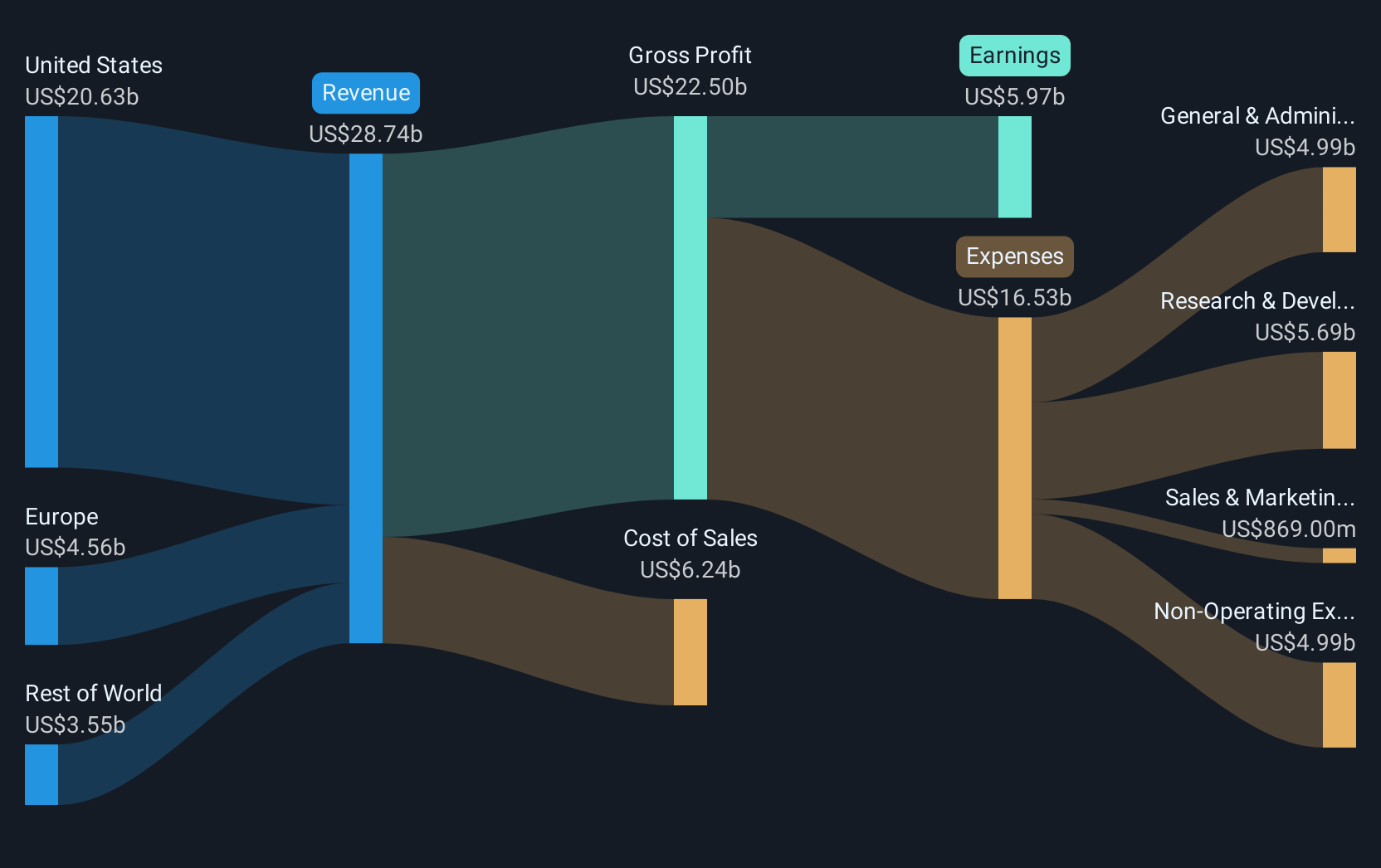

Overview: Gilead Sciences, Inc. is a biopharmaceutical company that focuses on discovering, developing, and commercializing medicines for unmet medical needs across the United States, Europe, and internationally with a market cap of approximately $114.46 billion.

Operations: Gilead Sciences generates revenue primarily from the discovery, development, and commercialization of innovative medicines, totaling $28.30 billion. The company's operations focus on addressing unmet medical needs across various regions globally.

Gilead Sciences, a biopharmaceutical firm, is intensifying its strategic focus through recent alliances and acquisition pursuits. With an annualized revenue growth of 2.8% and earnings expansion at 31.1%, the company's commitment to innovation is underscored by substantial R&D investments, totaling $5 billion last year alone—equating to about 20% of its revenue. Recent strategic moves include a partnership with LEO Pharma to develop treatments for inflammatory diseases and acquiring options for novel therapies from Terray Therapeutics, highlighting Gilead’s proactive approach in expanding its therapeutic pipeline beyond its core areas. These initiatives are pivotal as Gilead aims to fortify its market position by enhancing treatment portfolios and mitigating upcoming patent expirations.

BeiGene (NasdaqGS:ONC)

Simply Wall St Growth Rating: ★★★★☆☆

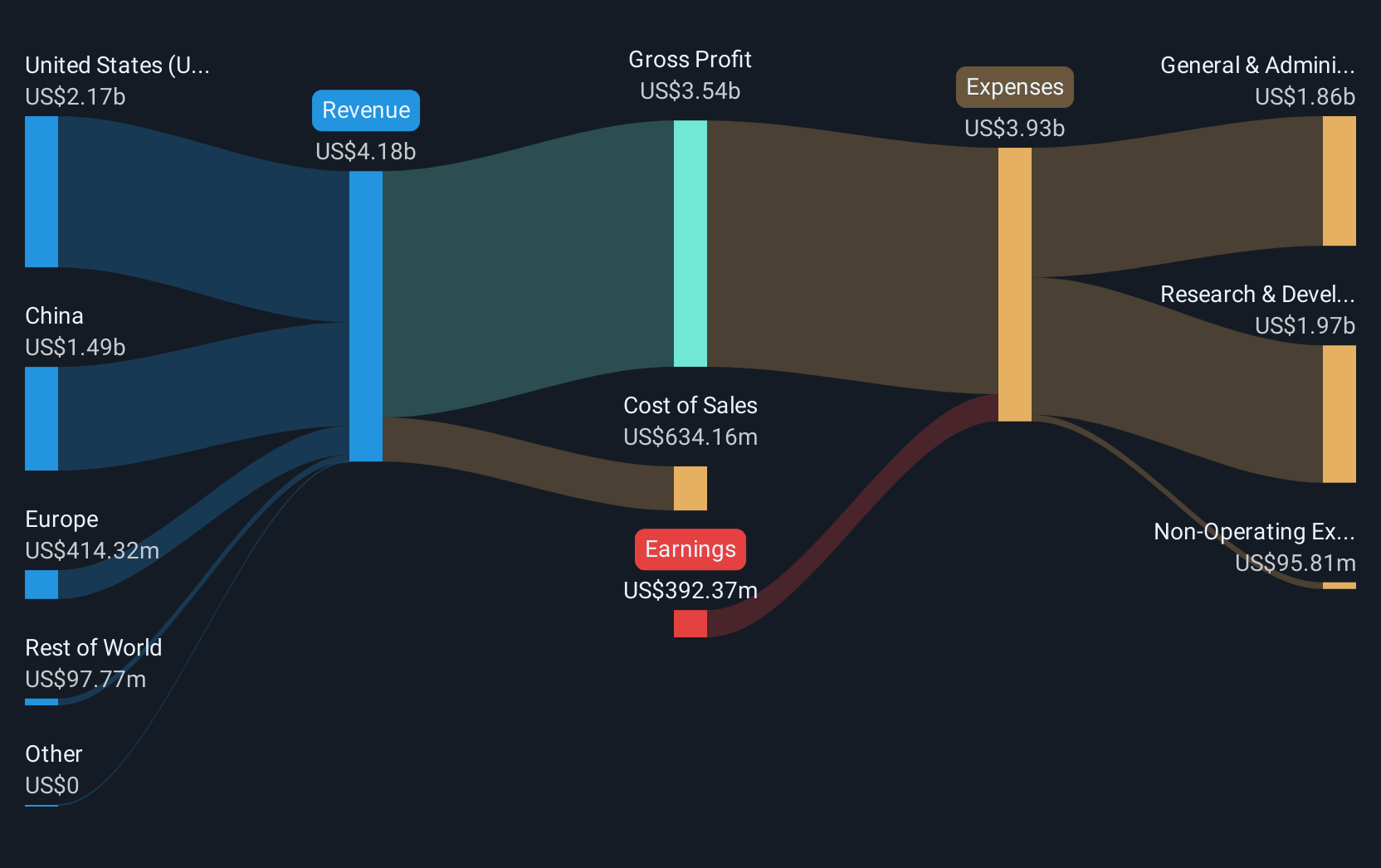

Overview: BeiGene, Ltd. is an oncology company focused on discovering and developing cancer treatments globally, with a market cap of $22.39 billion.

Operations: The company generates revenue primarily from pharmaceutical products, totaling CN¥23.51 billion. Its focus on oncology treatments positions it as a key player in the global cancer treatment market.

BeiGene, amid its strategic shifts and clinical advancements, projects a positive operating income for 2025. This outlook is bolstered by recent executive appointments enhancing governance and operational focus in Europe, pivotal for expanding its market reach. The company's R&D efforts are notably robust, with $400 million allocated to a new credit facility supporting ongoing projects and innovations. These strategic maneuvers underscore BeiGene's commitment to strengthening its position in the global oncology market while navigating through regulatory landscapes effectively.

- Delve into the full analysis health report here for a deeper understanding of BeiGene.

Gain insights into BeiGene's historical performance by reviewing our past performance report.

Dynatrace (NYSE:DT)

Simply Wall St Growth Rating: ★★★★☆☆

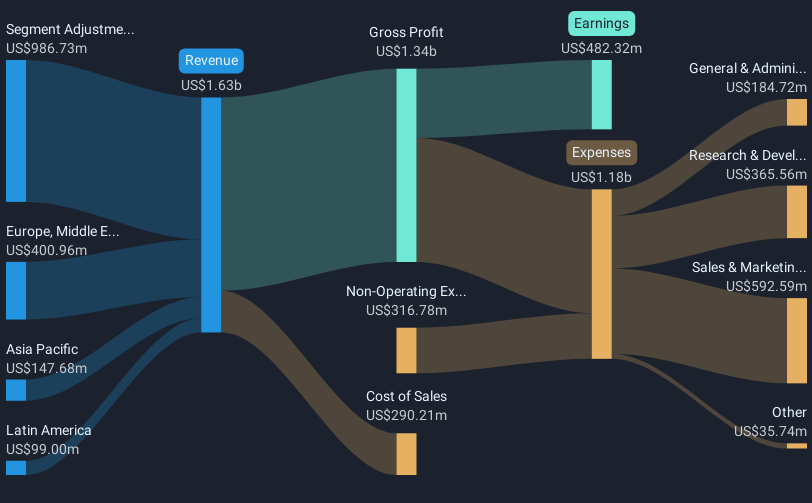

Overview: Dynatrace, Inc. offers a security platform for multicloud environments across various regions including North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America with a market capitalization of approximately $15.31 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $1.56 billion. Its operations span multiple regions, focusing on providing a security platform for multicloud environments.

Dynatrace, with a strategic focus on enhancing IT performance through advanced observability and AIOps, has recently fortified its market presence through key partnerships, such as with Pyramid Consulting and Visa Cash App Racing Bulls. These collaborations leverage Dynatrace's AI-driven analytics to transform data handling in sectors from consulting to Formula 1 racing, indicating a robust application of its technology in diverse fields. Financially, the company is on an upward trajectory with reported revenue growth of 13.1% annually and an impressive 20.7% expected annual earnings growth. This financial momentum is complemented by significant R&D investments aimed at continuous innovation in real-time data analytics and cloud services, positioning Dynatrace well within the high-growth tech landscape for future technological advancements and market expansion.

- Take a closer look at Dynatrace's potential here in our health report.

Gain insights into Dynatrace's past trends and performance with our Past report.

Summing It All Up

- Dive into all 229 of the US High Growth Tech and AI Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Undervalued moderate and pays a dividend.