- United States

- /

- Banks

- /

- NYSE:FBK

FB Financial (FBK): Taking Stock of Current Valuation After Recent Steady Gains

Reviewed by Kshitija Bhandaru

FB Financial (FBK) shares saw a mild uptick in recent trading, moving higher by just under 1% today. With no specific news event driving the price, investors seem to be revaluating the stock in light of its multi-month performance.

See our latest analysis for FB Financial.

FB Financial’s share price has performed strongly this year, gaining over 11% year-to-date and rebounding 19.9% in the past three months. Long-term investors have seen a solid 117% five-year total shareholder return. Recent price momentum suggests growing market confidence in the bank’s ability to deliver, even as short-term swings continue.

If you’re curious about where else momentum is building, this might be the perfect time to discover fast growing stocks with high insider ownership.

But with the stock up sharply this year and trading not far from analyst targets, the big question is whether the current price offers value or if the market has already taken all future growth potential into account.

Most Popular Narrative: 7.9% Undervalued

FB Financial ended last session at $56.31, while the most widely followed narrative points to a fair value estimate of $61.17. This suggests market participants see more upside ahead and are pricing in strong expectations for future growth and profitability.

The planned combination with Southern States Bank is expected to enhance scale and market opportunities, potentially benefiting revenue growth through expanded market presence and improved margin stabilization. FB Financial's ability to adjust cost structures, such as repricing certificates of deposit at lower rates, indicates management's focus on improving net margins by reducing the cost of funds.

Want to know why analysts are so bullish? A few surprising growth drivers have been baked into their forecast, plus a major shift in future profitability expectations. The blueprint for this valuation is built around numbers that defy the recent industry trends. Ready for the details everyone is buzzing about?

Result: Fair Value of $61.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration challenges from the Southern States Bank merger and ongoing competition for deposits could quickly alter FB Financial’s bullish outlook.

Find out about the key risks to this FB Financial narrative.

Another View: What Do the Numbers Say?

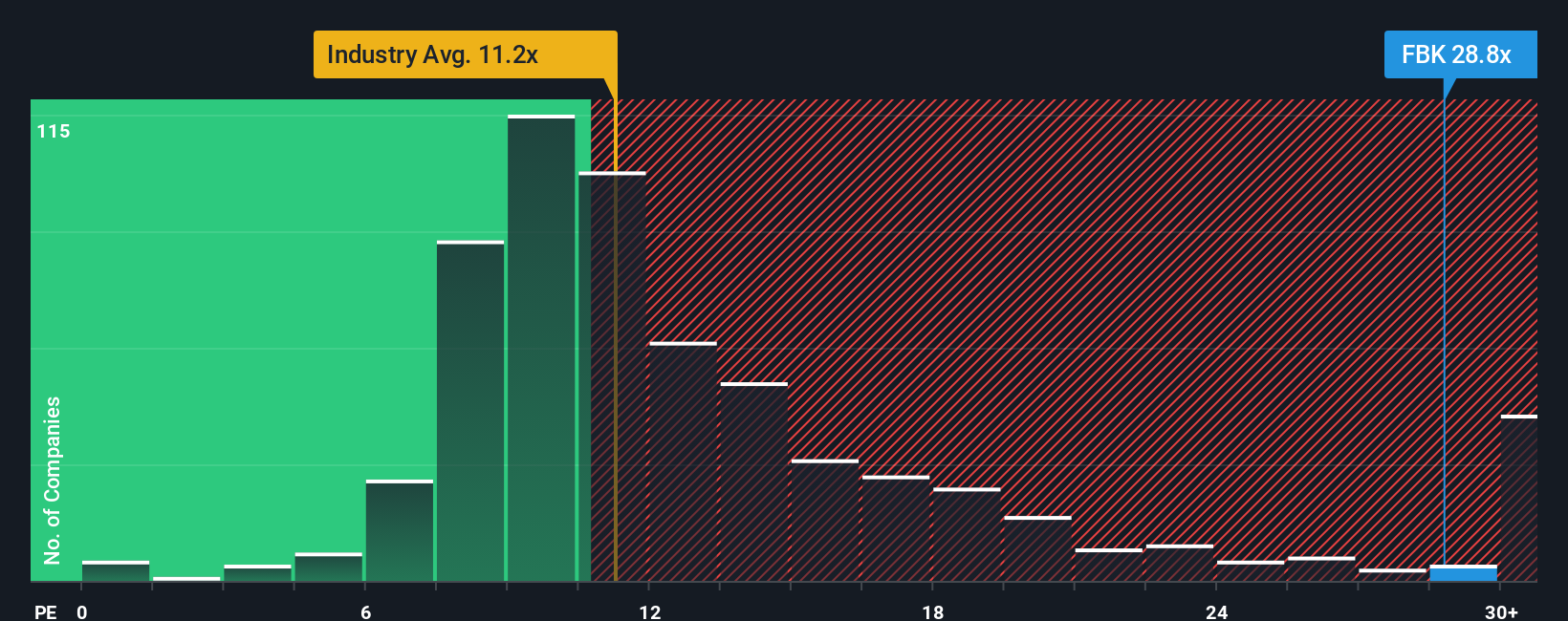

Taking a look at the market’s favored valuation ratio, FB Financial currently trades at 33.6 times earnings. This is much higher than both the industry average of 11.3 times and its peer average of 13.7 times. Even compared to its fair ratio of 21.3 times, the current price stands out as expensive. That could mean limited upside if the market changes its mind, or it could signal investors believe growth will outpace expectations. Is the premium justified, or is the risk now front and center?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FB Financial Narrative

If you see the story playing out differently, or want to do your own digging, you can build your perspective in just a few minutes. Do it your way.

A great starting point for your FB Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Reaching smarter decisions is easier when you compare a range of strategies side by side. Let these proven, ready-to-use stock lists push your ideas further. Avoid missing out on the next surge by staying informed.

- Grow your income stream with these 18 dividend stocks with yields > 3%, offering yields above 3% and remarkable consistency in payouts, ideal for building long-term wealth.

- Spot hidden tech disruptors by checking out these 25 AI penny stocks, which are harnessing artificial intelligence to accelerate innovation across major industries.

- Target tomorrow’s potential winners by searching through these 881 undervalued stocks based on cash flows, trading below intrinsic value, before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBK

FB Financial

Operates as a bank holding company for FirstBank that provides a suite of commercial and consumer banking services.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives