- United States

- /

- Software

- /

- NYSE:QTWO

3 Companies That May Be Trading At A Discount For Value Investors

Reviewed by Simply Wall St

As the U.S. markets experience a pullback from record highs, with tech stocks leading the decline, investors are closely watching economic indicators like inflation and potential Federal Reserve actions that could influence future market dynamics. In this environment, identifying undervalued stocks becomes crucial for value investors seeking opportunities amidst broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $6.86 | $13.24 | 48.2% |

| SolarEdge Technologies (SEDG) | $33.82 | $67.55 | 49.9% |

| Peapack-Gladstone Financial (PGC) | $29.01 | $56.54 | 48.7% |

| Northwest Bancshares (NWBI) | $12.65 | $24.41 | 48.2% |

| Niagen Bioscience (NAGE) | $9.90 | $18.87 | 47.5% |

| Lyft (LYFT) | $16.22 | $31.03 | 47.7% |

| Investar Holding (ISTR) | $23.44 | $45.84 | 48.9% |

| Fiverr International (FVRR) | $23.55 | $45.47 | 48.2% |

| Excelerate Energy (EE) | $24.42 | $46.63 | 47.6% |

| Corsair Gaming (CRSR) | $8.93 | $17.80 | 49.8% |

Underneath we present a selection of stocks filtered out by our screen.

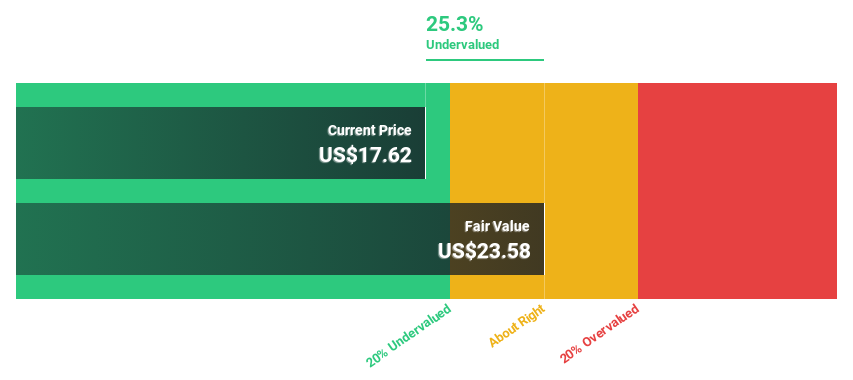

SolarEdge Technologies (SEDG)

Overview: SolarEdge Technologies, Inc. designs, develops, manufactures, and sells DC optimized inverter systems for solar photovoltaic installations globally and has a market cap of approximately $2.01 billion.

Operations: SolarEdge Technologies generates revenue through the design, development, manufacture, and sale of DC optimized inverter systems for solar photovoltaic installations across various international markets including the United States and Europe.

Estimated Discount To Fair Value: 49.9%

SolarEdge Technologies is trading at US$33.82, significantly below its estimated fair value of US$67.55, suggesting it may be undervalued based on cash flows. Despite recent net losses, the company has shown revenue growth and forecasts indicate profitability within three years with revenues expected to grow faster than the US market average. Recent strategic partnerships and expansion in manufacturing highlight efforts to strengthen its position in renewable energy markets while supporting domestic content requirements.

- Upon reviewing our latest growth report, SolarEdge Technologies' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of SolarEdge Technologies stock in this financial health report.

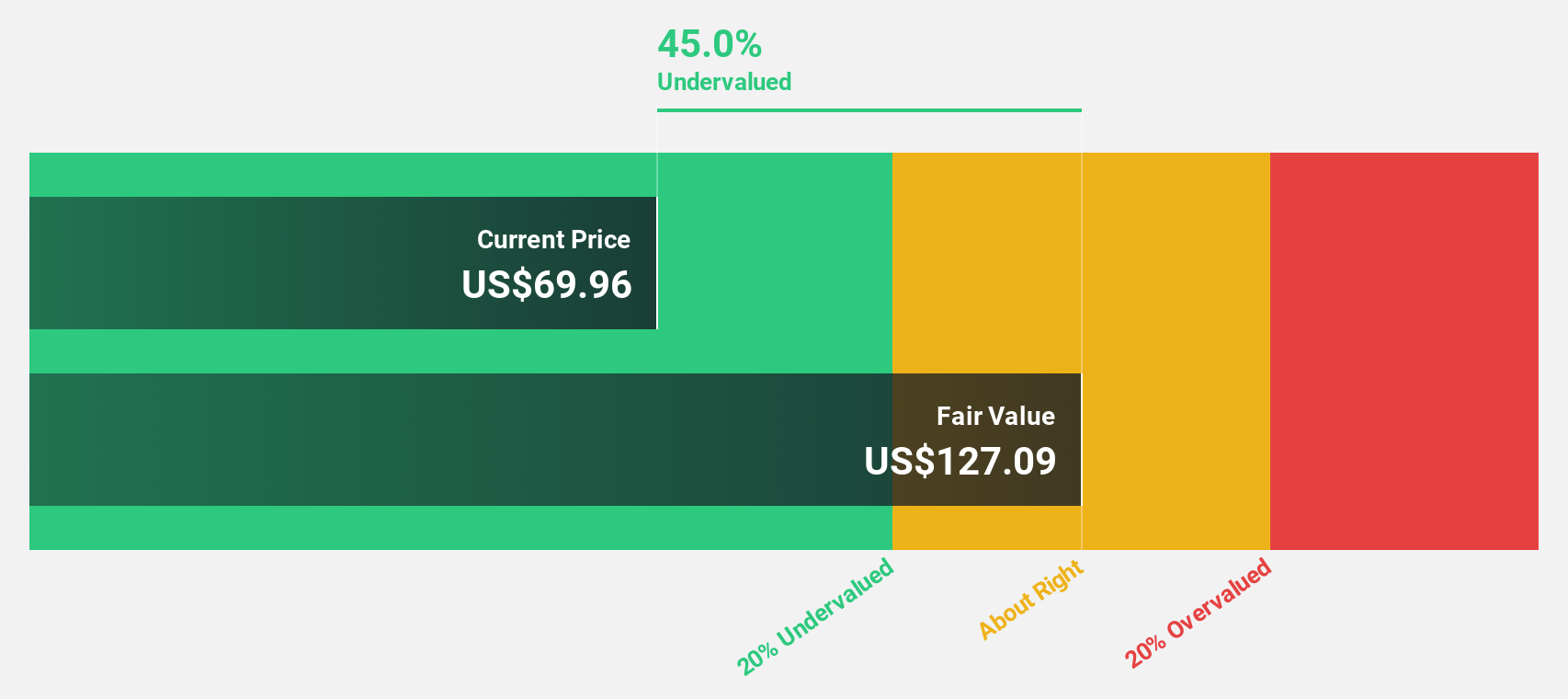

Customers Bancorp (CUBI)

Overview: Customers Bancorp, Inc. is the bank holding company for Customers Bank, offering a range of banking products and services, with a market cap of $2.27 billion.

Operations: The company generates revenue through its Customers Bank Business Banking segment, which reported $596.46 million.

Estimated Discount To Fair Value: 46.5%

Customers Bancorp is trading at US$71.69, well below its estimated fair value of US$133.95, indicating potential undervaluation based on cash flows. With earnings projected to grow significantly faster than the US market, the company shows strong growth prospects despite a recent decline in profit margins. Recent leadership transitions and strategic focus on technological advancements and market expansion are poised to drive future performance while maintaining its innovative banking approach.

- The growth report we've compiled suggests that Customers Bancorp's future prospects could be on the up.

- Get an in-depth perspective on Customers Bancorp's balance sheet by reading our health report here.

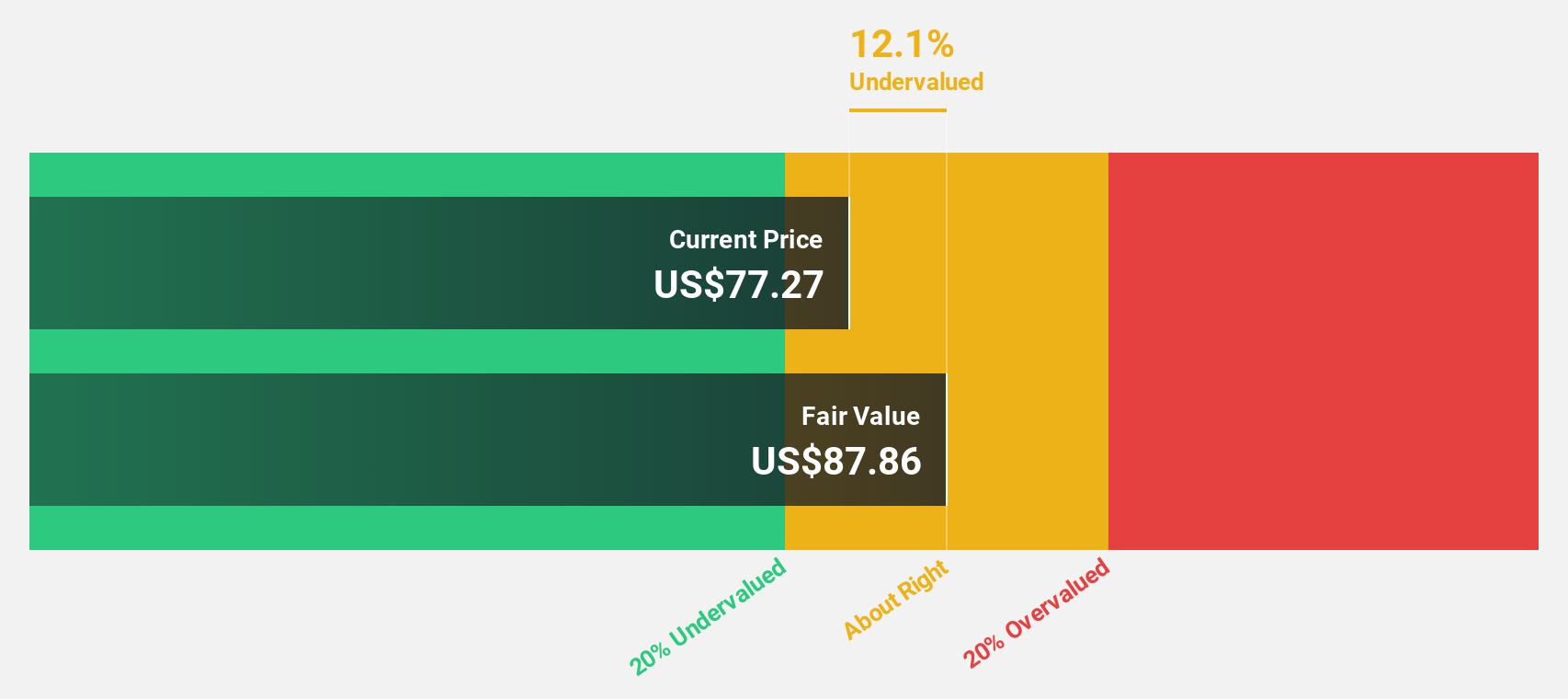

Q2 Holdings (QTWO)

Overview: Q2 Holdings, Inc. offers digital solutions to financial institutions, FinTechs, and alternative finance companies in the United States with a market cap of approximately $4.92 billion.

Operations: The company's revenue is primarily derived from the sale, implementation, and support of its digital solutions, totaling $742.95 million.

Estimated Discount To Fair Value: 10.5%

Q2 Holdings, trading at US$78.73, is slightly undervalued against its fair value of US$87.98 based on cash flows. The company recently became profitable and forecasts suggest substantial earnings growth over the next three years, outpacing the broader US market. Recent integrations with partners like Open Payment Network and Finzly enhance its digital banking platform capabilities, potentially boosting revenue streams despite insider selling concerns in recent months.

- Insights from our recent growth report point to a promising forecast for Q2 Holdings' business outlook.

- Dive into the specifics of Q2 Holdings here with our thorough financial health report.

Taking Advantage

- Discover the full array of 194 Undervalued US Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q2 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QTWO

Q2 Holdings

Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives