- United States

- /

- Banks

- /

- NYSE:CFG

Does Citizens Edge Signal a New Digital Era for Citizens Financial Group’s (CFG) Commercial Strategy?

Reviewed by Sasha Jovanovic

- Earlier this month, Citizens Financial Group introduced Citizens Edge™, a new commercial credit card designed in partnership with Mastercard to serve the unique needs of middle market companies, featuring flexible limits, cash back rewards, and integrated digital management tools.

- This product launch is part of a broader push by Citizens to close technology gaps for middle market clients, emphasizing its commitment to innovation and digital transformation in the commercial banking segment.

- We'll explore how Citizens Edge marks a step forward in the company's growth strategy and influences its investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Citizens Financial Group Investment Narrative Recap

To own shares of Citizens Financial Group today, you need confidence in its ability to execute a successful digital transformation, grow in high-potential markets, and manage credit risk, especially given its exposure to commercial real estate. The recent launch of Citizens Edge™, a commercial credit card for middle market companies, supports the company's digital and fee-based revenue ambitions but does not materially shift the short-term focus or alleviate core risks related to commercial real estate and competitive pressure from larger banks and fintechs.

Of the latest announcements, the appointment of Ted Swimmer as Head of Commercial Banking stands out. With extensive experience building out capital markets businesses, Swimmer’s leadership is well-timed as Citizens emphasizes technology-driven growth and asset quality while broadening its suite of client offerings.

However, investors should not overlook that, in contrast, Citizens' commercial real estate exposure remains a concern if market values were to weaken or...

Read the full narrative on Citizens Financial Group (it's free!)

Citizens Financial Group's narrative projects $10.3 billion in revenue and $2.8 billion in earnings by 2028. This requires 12.6% yearly revenue growth and a $1.3 billion increase in earnings from the current $1.5 billion level.

Uncover how Citizens Financial Group's forecasts yield a $58.60 fair value, a 13% upside to its current price.

Exploring Other Perspectives

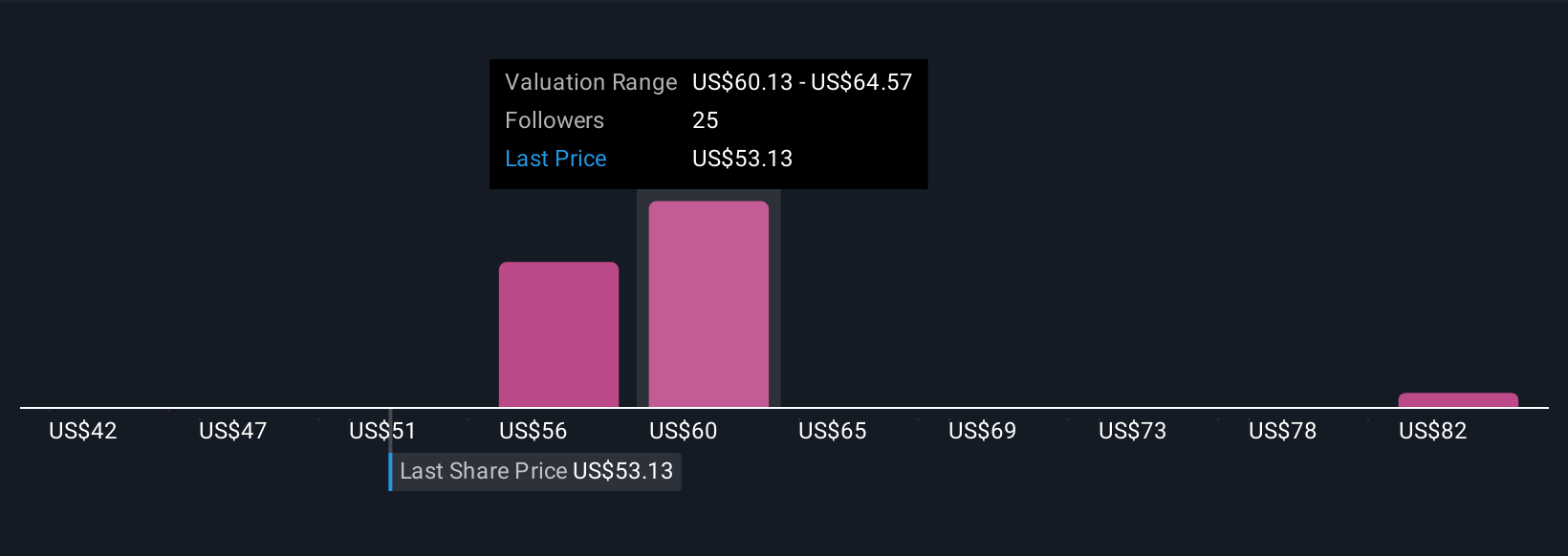

Four members of the Simply Wall St Community valued Citizens Financial Group between US$42.41 and US$86.72 per share. Some see digital innovation as a revenue driver, while others focus on credit risks, reminding you performance expectations are anything but uniform.

Explore 4 other fair value estimates on Citizens Financial Group - why the stock might be worth 18% less than the current price!

Build Your Own Citizens Financial Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Citizens Financial Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Citizens Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Citizens Financial Group's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFG

Citizens Financial Group

Operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives