- United States

- /

- Banks

- /

- NYSE:CADE

Is Now the Right Moment to Revisit Cadence Bank After Recent Share Price Dip?

Reviewed by Bailey Pemberton

Trying to decide what to do with Cadence Bank stock? You are not alone. Investors have been keeping a close eye on this bank, especially after a stretch of volatility shaking up the regional banking sector. Recently, Cadence Bank's share price dipped by 1.1% over the past week and is down more substantially at 5.1% over the last month. Despite these dips, the stock remains up 5.1% year-to-date, and has seen gains of 7.9% in the past year, with a notable 80.9% climb across the last five years. This mix of short-term uncertainty and long-term growth potential is definitely turning heads.

What has been driving sentiment? Alongside broader market pressures, news of continued expansion in the bank's lending services and its deepening commitment to digital transformation have caught the attention of analysts. These developments signal efforts to strengthen the bank's competitive position. While these headlines did not immediately move the share price upward, they do provide important context to how the market is evaluating Cadence Bank's prospects, especially for investors taking a long-term view.

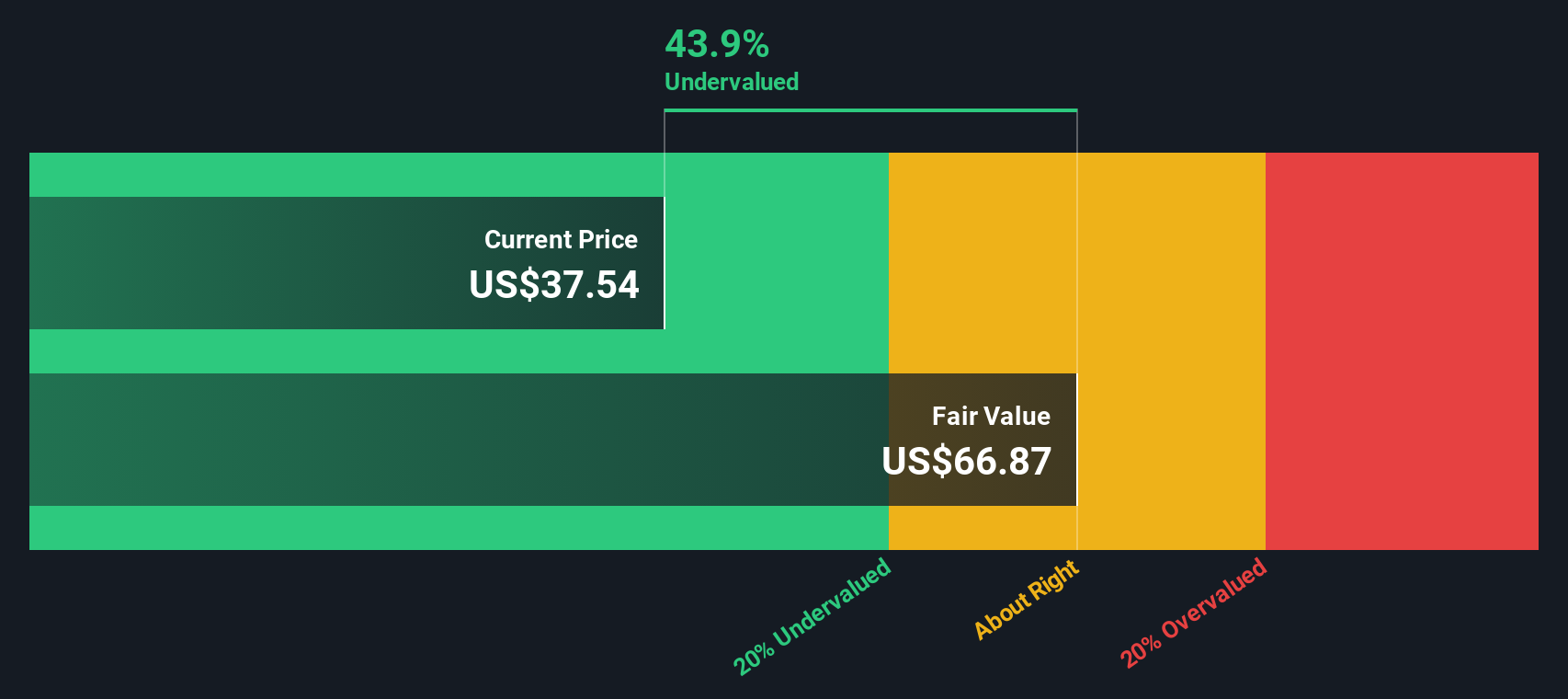

Now, what about valuation? According to our multi-point valuation review, Cadence Bank scores a 3 out of 6, indicating it is undervalued in key areas but has not met every criterion yet. Understanding how that score is determined, and what it really means for your investment approach, is worth a closer look. We will walk through each valuation perspective and, at the end, consider an even more insightful way to judge whether Cadence Bank is a true bargain.

Why Cadence Bank is lagging behind its peers

Approach 1: Cadence Bank Excess Returns Analysis

The Excess Returns valuation model focuses on whether Cadence Bank is generating returns above the cost of its equity. In simple terms, it measures how effectively the bank is using shareholders' funds to create value that exceeds what investors require to compensate for risk. An average return on equity of 10.29% indicates the bank is efficiently producing profits on the money invested by shareholders.

Key figures from this approach include a Book Value per share of $31.75 and a Stable EPS (Earnings Per Share) estimate of $3.57, as determined by a consensus of 10 analysts. The cost of equity, or what shareholders demand for their investment, stands at $2.35 per share. The bank’s excess return, which indicates profits above this hurdle, is $1.22 per share. Looking ahead, analysts also expect the stable Book Value to rise to $34.70 per share.

The Excess Returns model calculates an intrinsic value that signals Cadence Bank stock is 47.7% undervalued relative to recent share prices. This deep discount suggests current market pricing may not fully reflect the long-term return potential generated by the bank’s prudent and profitable capital deployment.

Result: UNDERVALUED

Our Excess Returns analysis suggests Cadence Bank is undervalued by 47.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

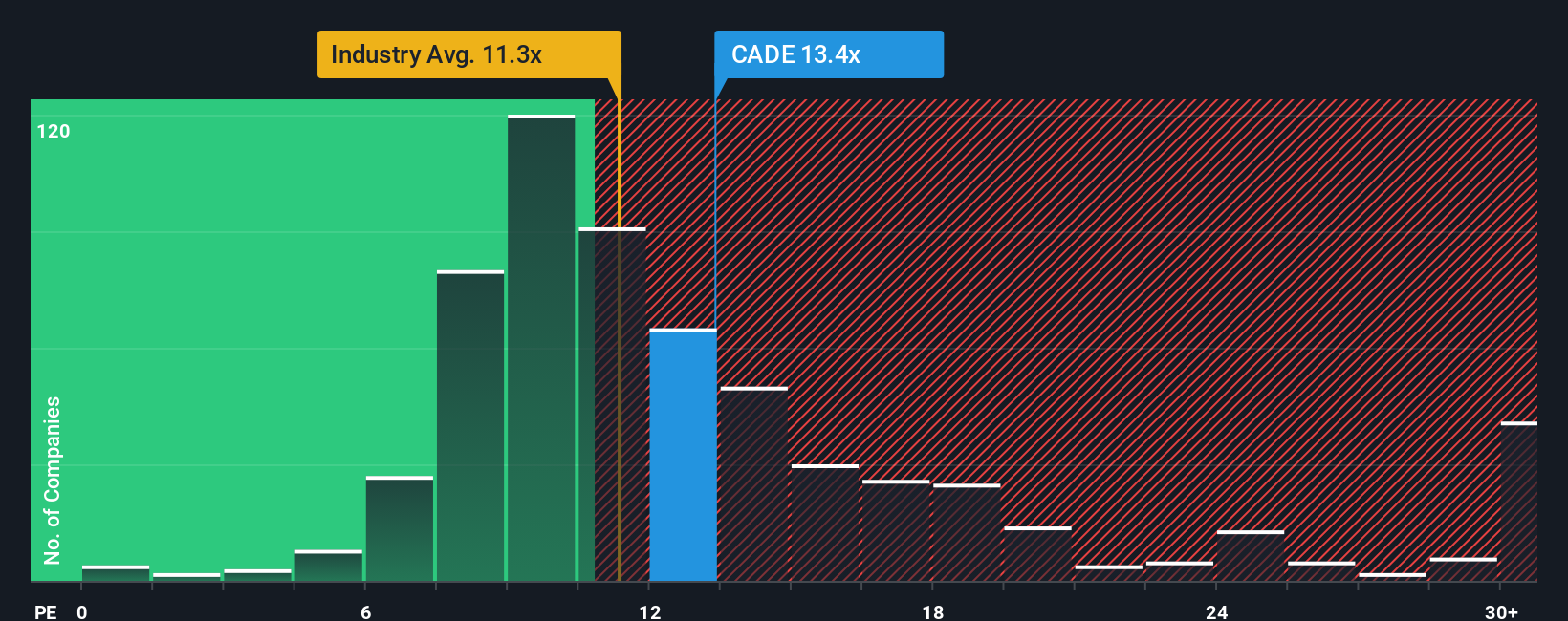

Approach 2: Cadence Bank Price vs Earnings

The Price-to-Earnings (PE) ratio is often the preferred valuation tool for profitable companies like Cadence Bank because it directly relates a company's share price with its earnings power. By demonstrating how much investors are willing to pay for each dollar of earnings, the PE ratio not only reflects current profitability but also sets expectations about future growth and risks.

Growth prospects and perceived risks heavily influence what constitutes a “normal” or “fair” PE ratio. In fast-growing or stable sectors, investors typically pay a premium, resulting in higher PE multiples. In more uncertain environments, lower ratios are often justified.

Currently, Cadence Bank trades at a PE ratio of 12.7x. This is higher than the industry average of 11.2x and above the peer average of 11.5x, suggesting the market is assigning a modest premium, perhaps due to specific strengths or momentum. However, the Simply Wall St Fair Ratio, a measure that takes into account Cadence Bank’s unique growth outlook, risk profile, profit margins, industry dynamics, and market capitalization, stands at 14.3x.

The Fair Ratio is a more comprehensive benchmark than simple peer or industry comparisons because it captures not just where the company stands now, but where it could be headed based on multiple performance drivers. By factoring in expected earnings growth, risk levels, and sector context, it gives investors a more complete snapshot of relative value.

With Cadence Bank’s current PE of 12.7x sitting below the Fair Ratio of 14.3x, this suggests the stock is undervalued based on a deeper, multi-faceted assessment of its potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cadence Bank Narrative

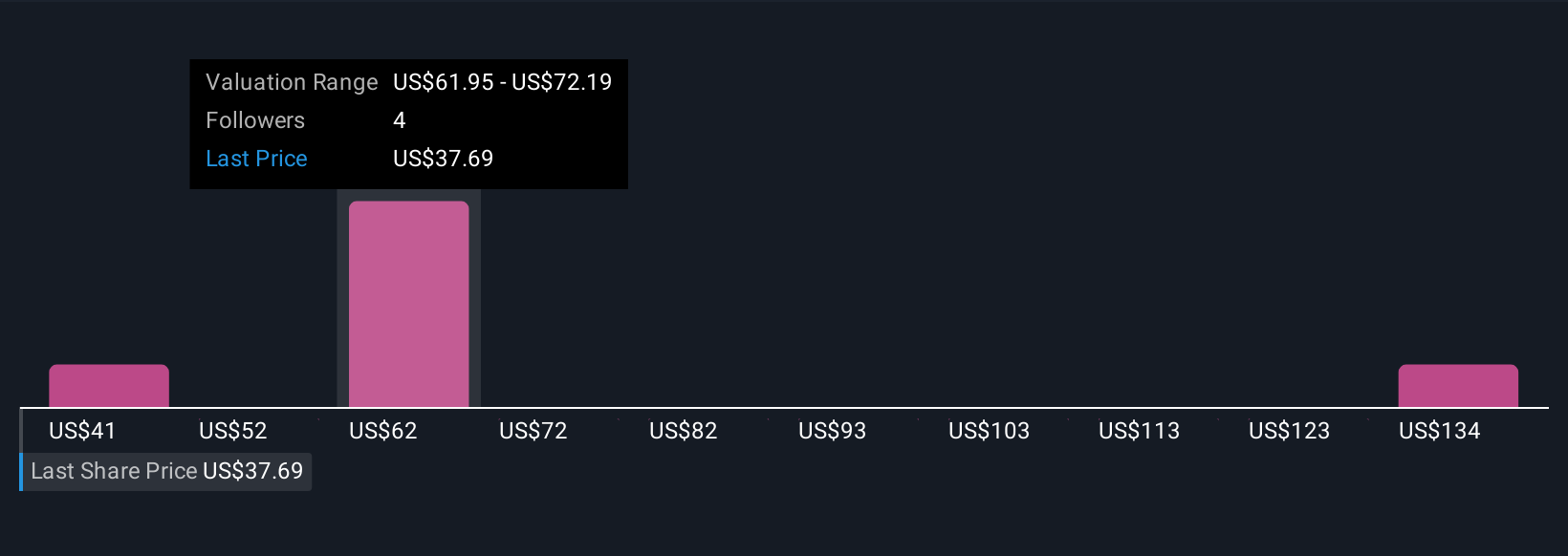

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, smart tool that lets you connect your perspective on a company, like Cadence Bank, to the underlying numbers. It ties together your story about its future, the financial forecasts you believe in, and your estimate of fair value.

This means you can take what you know about a company's strategy, leadership, risks, and market position, link it to assumptions about future revenue, earnings, and profit margins, and see whether the stock looks undervalued or overvalued compared to its current price. Narratives are available right on Simply Wall St’s Community page, making it easy for investors of any experience level to build, share, and follow them. Millions already do.

Because Narratives update each time new data or news arrives, you always have a live, relevant view to help decide if now is a good time to buy, hold, or sell. For example, one Cadence Bank Narrative might be bullish, banking on strong Sunbelt growth and digital advances with a fair value estimate of $42.27. Another could be more cautious, focusing on regional risks and a lower fair value around $37.00. Ultimately, Narratives allow you to easily compare and understand where your outlook sits in relation to others'.

Do you think there's more to the story for Cadence Bank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CADE

Cadence Bank

Provides commercial banking and financial services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)