- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

3 Reliable Dividend Stocks Offering Yields Up To 5.2%

Reviewed by Simply Wall St

As the U.S. market navigates mixed signals with stocks showing varied movements and rising Treasury yields following a credit rating downgrade, investors are keeping a close eye on stable income opportunities. In such an environment, reliable dividend stocks can offer a steady stream of income and potential resilience against market volatility, making them an attractive consideration for those seeking to balance risk and reward.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.76% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.81% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.19% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.13% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.81% | ★★★★★★ |

| Credicorp (NYSE:BAP) | 5.25% | ★★★★★☆ |

| Valley National Bancorp (NasdaqGS:VLY) | 4.80% | ★★★★★☆ |

| Douglas Dynamics (NYSE:PLOW) | 4.09% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 3.83% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 8.63% | ★★★★★☆ |

Click here to see the full list of 141 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

John B. Sanfilippo & Son (NasdaqGS:JBSS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: John B. Sanfilippo & Son, Inc., operating through its subsidiary JBSS Ventures, LLC, processes and distributes tree nuts and peanuts in the United States with a market cap of $749.97 million.

Operations: The company's revenue primarily comes from selling various nut and nut-related products, totaling $1.11 billion.

Dividend Yield: 4.9%

John B. Sanfilippo & Son offers a dividend yield of 4.86%, ranking in the top 25% of US dividend payers, yet its dividends are not covered by free cash flow and have been volatile over the past decade. Despite a low payout ratio of 17.9%, indicating coverage by earnings, recent earnings showed mixed results with increased quarterly net income but decreased nine-month figures. The stock trades at 28.7% below estimated fair value, suggesting potential undervaluation.

- Click here to discover the nuances of John B. Sanfilippo & Son with our detailed analytical dividend report.

- The valuation report we've compiled suggests that John B. Sanfilippo & Son's current price could be quite moderate.

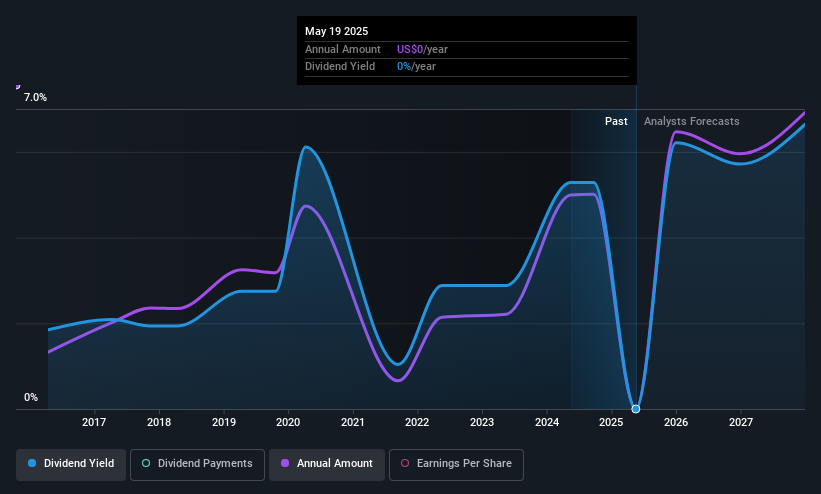

Credicorp (NYSE:BAP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Credicorp Ltd. operates in financial, insurance, and health services primarily in Peru and internationally, with a market cap of $16.41 billion.

Operations: Credicorp Ltd.'s revenue segments include Universal Banking - Banco De Crédito Del Perú (PEN 13.40 billion), Microfinance - Mibanco (PEN 1.55 billion), Insurance and Pension Funds - Pacífico Seguros and Subsidiaries (PEN 1.24 billion), Investment Management and Advisory (PEN 988 million), Universal Banking - Banco De Crédito De Bolivia (PEN 288 million), Microfinance - Mibanco Colombia including Edyficar S.A.S. (PEN 298 million), and Insurance and Pension Funds - Prima AFP (PEN 367 million).

Dividend Yield: 5.3%

Credicorp's dividend yield of 5.25% places it in the top 25% of US dividend payers, with a payout ratio of 55.1%, indicating dividends are covered by earnings and forecasted to remain so in three years (45.9%). Despite this, its dividend history has been unreliable and volatile over the past decade. Credicorp is trading at 33.4% below estimated fair value, though it faces challenges with high non-performing loans at 5.2%. Recent earnings show growth with net income rising to PEN 1,777.7 million for Q1 2025 from PEN 1,511.66 million a year ago, alongside a declared cash dividend aligning with its financial performance for the previous year.

- Take a closer look at Credicorp's potential here in our dividend report.

- Our expertly prepared valuation report Credicorp implies its share price may be lower than expected.

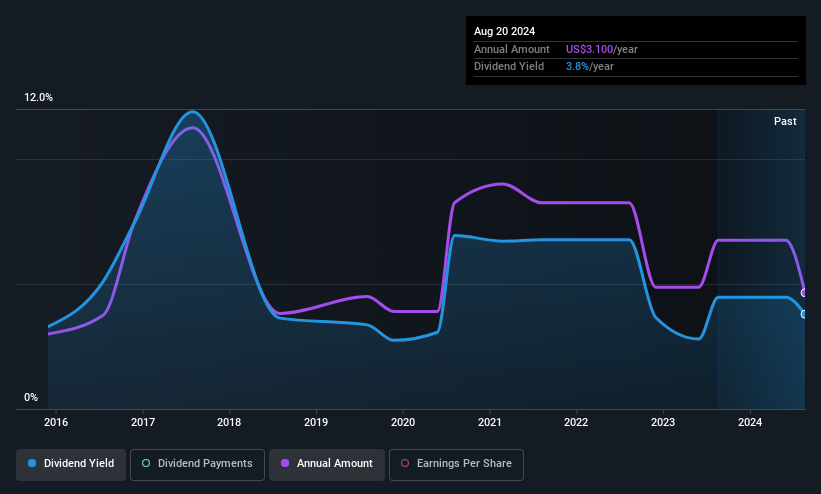

CareTrust REIT (NYSE:CTRE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CareTrust REIT is a self-administered, publicly-traded real estate investment trust focused on owning, acquiring, developing and leasing seniors housing and healthcare-related properties, with a market cap of approximately $5.59 billion.

Operations: CareTrust REIT generates its revenue primarily from investments in healthcare-related real estate assets, totaling $329.84 million.

Dividend Yield: 4.6%

CareTrust REIT's dividend, recently increased to $0.335 per share, has shown stability and growth over the past decade but is not well-covered by earnings due to a high payout ratio of 582.6%. Despite trading at 67.8% below estimated fair value, shareholders experienced significant dilution in the past year. Recent earnings guidance was raised following acquisitions, with Q1 net income rising to US$65.8 million from US$28.75 million a year ago, reflecting robust revenue growth and strategic expansion efforts in the U.S and U.K markets.

- Click to explore a detailed breakdown of our findings in CareTrust REIT's dividend report.

- Upon reviewing our latest valuation report, CareTrust REIT's share price might be too pessimistic.

Key Takeaways

- Gain an insight into the universe of 141 Top US Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of seniors housing and healthcare-related properties.

High growth potential with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives