- United States

- /

- Oil and Gas

- /

- NYSE:VLO

3 US Dividend Stocks To Consider With At Least 3% Yield

Reviewed by Simply Wall St

With the Federal Reserve maintaining its key interest rate amid persistent inflation and market volatility, investors are increasingly focusing on stable income-generating opportunities. In such an environment, dividend stocks with yields of at least 3% can offer a reliable income stream while potentially providing some cushion against market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.21% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.59% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.67% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.01% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.83% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.69% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.72% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.84% | ★★★★★★ |

Click here to see the full list of 136 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

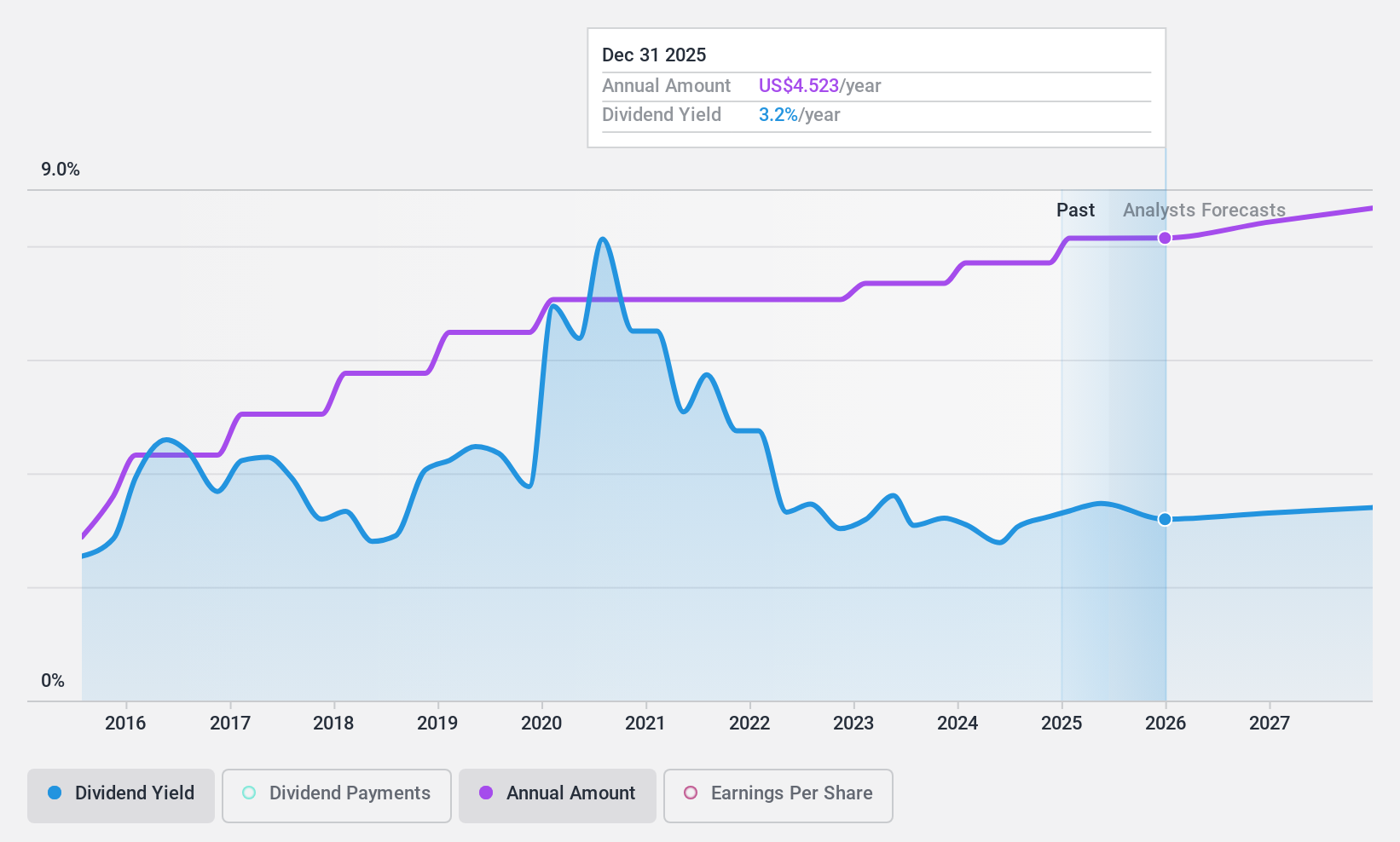

ConnectOne Bancorp (NasdaqGS:CNOB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ConnectOne Bancorp, Inc. is a bank holding company for ConnectOne Bank, offering commercial banking products and services to small and mid-sized businesses, local professionals, and individuals in the New York Metropolitan area and South Florida market, with a market cap of $907.19 million.

Operations: ConnectOne Bancorp, Inc. generates its revenue primarily from its Community Banking segment, which accounts for $248.64 million.

Dividend Yield: 3%

ConnectOne Bancorp offers a stable dividend profile with a current yield of 3.02%, although this is lower than the top quartile of US dividend payers. The company's dividends are well covered by earnings, with a payout ratio of 40.9% and forecasted to decrease to 25.7% in three years, indicating sustainability. Recent activities include completing a share buyback program worth US$58.74 million and filing for shelf registration, which may impact future capital structure decisions.

- Dive into the specifics of ConnectOne Bancorp here with our thorough dividend report.

- The analysis detailed in our ConnectOne Bancorp valuation report hints at an deflated share price compared to its estimated value.

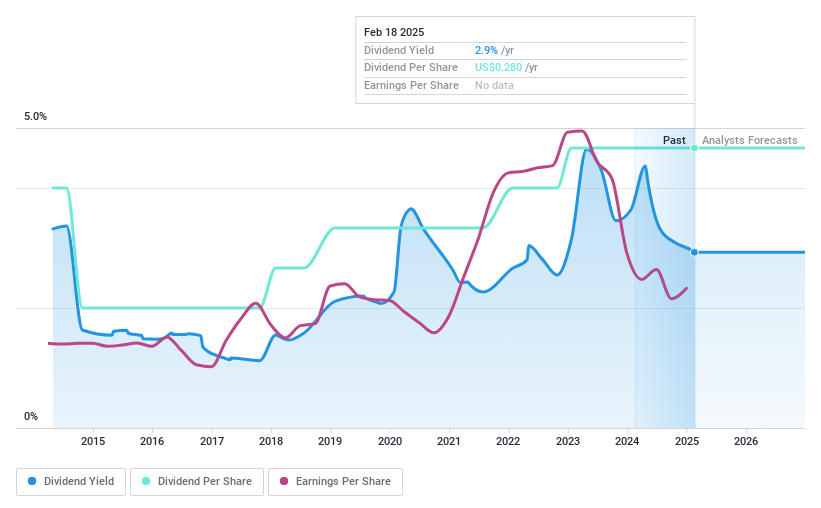

Western New England Bancorp (NasdaqGS:WNEB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Western New England Bancorp, Inc. is the holding company for Westfield Bank, offering a variety of commercial and retail banking products and services to individuals and businesses, with a market cap of $184.69 million.

Operations: Western New England Bancorp, Inc. generates revenue through its subsidiary, Westfield Bank, by providing a diverse array of banking products and services tailored to both individual and business clients.

Dividend Yield: 3%

Western New England Bancorp's dividend yield of 3.01% is below the top quartile of US dividend payers and has been volatile over the past decade. Despite this, dividends are currently covered by earnings with a payout ratio of 54.2%, expected to improve to 40.4% in three years, suggesting future sustainability. Recent financials show improved net income and stable earnings per share, alongside a continued share buyback program totaling US$4.4 million, indicating shareholder value efforts.

- Click here to discover the nuances of Western New England Bancorp with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Western New England Bancorp's share price might be too optimistic.

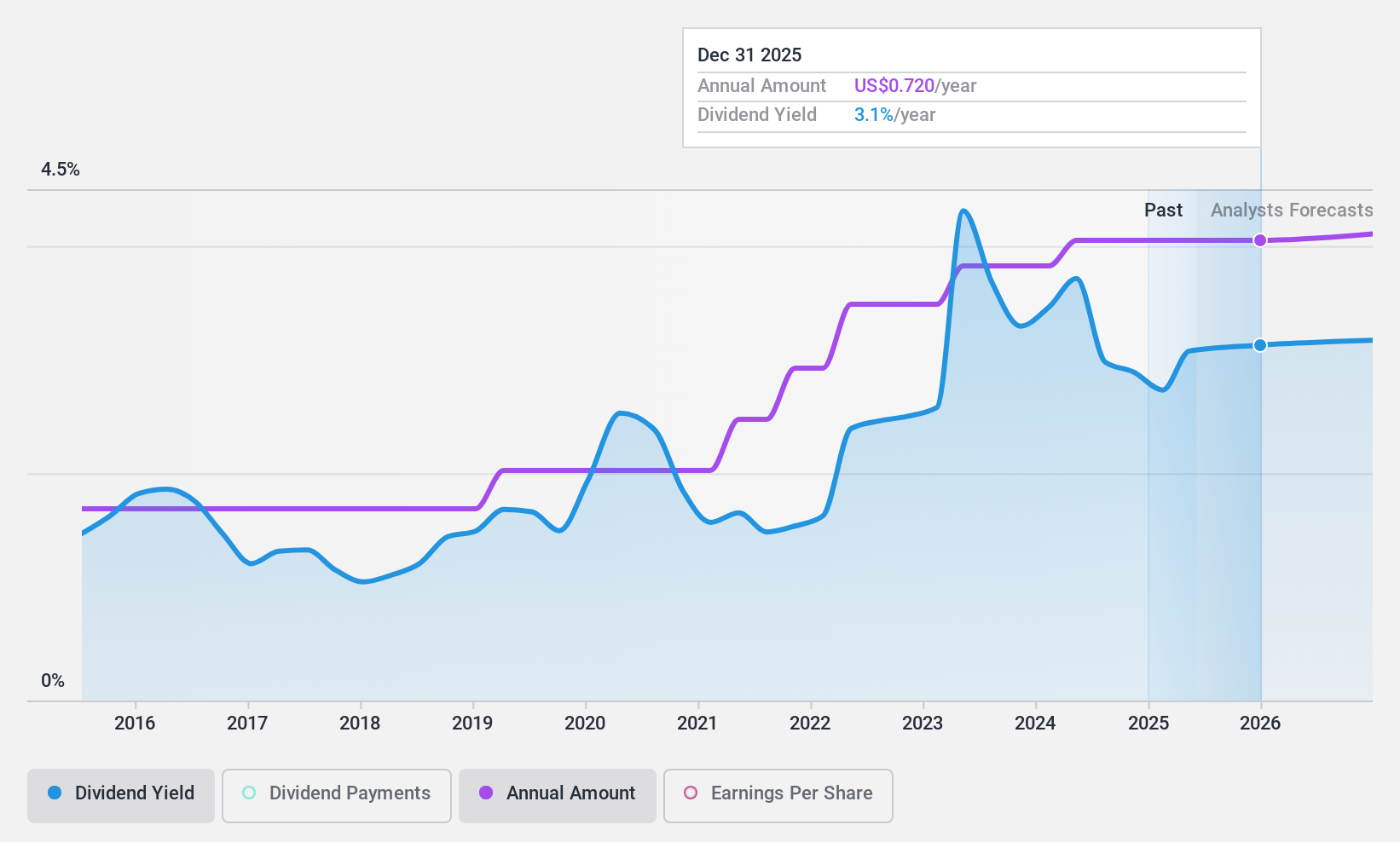

Valero Energy (NYSE:VLO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Valero Energy Corporation is involved in the manufacturing, marketing, and selling of petroleum-based and low-carbon liquid transportation fuels and petrochemical products across various regions including the United States, Canada, and internationally, with a market cap of approximately $43.73 billion.

Operations: Valero Energy's revenue segments include Ethanol at $4.70 billion, Renewable Diesel at $5.45 billion, and Refining (excluding Renewable Diesel) at $128.08 billion.

Dividend Yield: 3.1%

Valero Energy's recent dividend increase to US$1.13 per share highlights its commitment to returning value to shareholders, despite a lower net profit margin of 2.9% compared to last year. Trading at a significant discount to estimated fair value, Valero offers a stable dividend yield of 3.07%, covered by both earnings and cash flows with payout ratios of 37.5% and 22.6%, respectively, ensuring sustainability amidst executive changes and upcoming earnings reports.

- Click to explore a detailed breakdown of our findings in Valero Energy's dividend report.

- According our valuation report, there's an indication that Valero Energy's share price might be on the cheaper side.

Seize The Opportunity

- Embark on your investment journey to our 136 Top US Dividend Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives